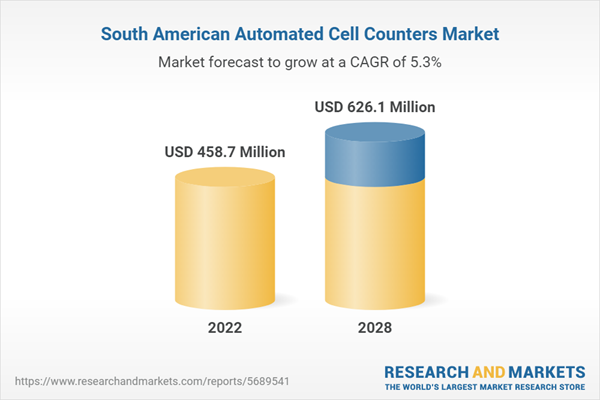

The automated cell counters market in South America is expected to grow from US$ 458.70 million in 2022 to US$ 626.10 million by 2028; it is estimated to grow at a CAGR of 5.3% from 2022 to 2028.

The biotechnology & biopharmaceutical industry is focusing on the discovery and development of drugs to treat various diseases. Cell and molecular biology have become crucial parts of the modern drug discovery process. Monitoring the interaction of cells and internal cellular activity provides critical information on cell health, changes in disease states, and the response of targets to potential therapeutic compounds. The ability to visualize biological activities at a cellular level has been a major element in drug discovery. Further, the addition of automation and high-volume screening methods allowed the testing of many compounds. For instance, monitoring the effect of various compounds against a specific type of cancer is executed on a cellular level. Automated Cell Counters are used to monitor the changes in cancer cell characteristics at every stage of cancer. There are webinars held to create awareness about the techniques that are used for cell imaging and cell counting by various institutes. For instance, the ATA Scientific Instruments, in October 2020, held four new webinars that were specifically focused on cell counting and imaging for drug discovery. Thus, the increase in the discovery and development of drugs is boosting the demand for automated cell counters.

Eppendorf; Thermo Fisher Scientific Inc.; Countstar Inc.; Bio-Rad Laboratories, Inc.; F. Hoffman-La Roche Ltd; Beckman Coulter, Inc. (Danaher); Nanoentek; Olympus Corporation; MERCK KGaA; Sysmex Corporation; Agilent Technologies, Inc.; Abbott; and Nexcelom Bioscience LLC. are the leading companies operating in the South America automated cell counters market.

The biotechnology & biopharmaceutical industry is focusing on the discovery and development of drugs to treat various diseases. Cell and molecular biology have become crucial parts of the modern drug discovery process. Monitoring the interaction of cells and internal cellular activity provides critical information on cell health, changes in disease states, and the response of targets to potential therapeutic compounds. The ability to visualize biological activities at a cellular level has been a major element in drug discovery. Further, the addition of automation and high-volume screening methods allowed the testing of many compounds. For instance, monitoring the effect of various compounds against a specific type of cancer is executed on a cellular level. Automated Cell Counters are used to monitor the changes in cancer cell characteristics at every stage of cancer. There are webinars held to create awareness about the techniques that are used for cell imaging and cell counting by various institutes. For instance, the ATA Scientific Instruments, in October 2020, held four new webinars that were specifically focused on cell counting and imaging for drug discovery. Thus, the increase in the discovery and development of drugs is boosting the demand for automated cell counters.

Market Overview

In South America, the market growth is attributed to developments of a wide range of automated cell counters applications in the field of pharmaceutical, biotechnology, medical research, and diagnostic labs in Brazil and the rising incidence of patients suffering from chronic and infectious diseases.South America Automated cell counters Market Segmentation

The South America automated cell counters market is segmented on the basis of type, end user, and country. Based on type, the market is segmented into hemocytometer, flow cytometers, electrical impedance coulter counters, and spectrophotometers. The spectrophotometers segment held the largest market share in 2022. Based on end user, the market is categorized into hospitals, research laboratories, diagnostics centers, and others. The hospitals segment held the largest market share in 2022. Based on country, the market is segmented into Brazil, Argentina, and the Rest of South America. Brazil dominated the market share in 2022.Eppendorf; Thermo Fisher Scientific Inc.; Countstar Inc.; Bio-Rad Laboratories, Inc.; F. Hoffman-La Roche Ltd; Beckman Coulter, Inc. (Danaher); Nanoentek; Olympus Corporation; MERCK KGaA; Sysmex Corporation; Agilent Technologies, Inc.; Abbott; and Nexcelom Bioscience LLC. are the leading companies operating in the South America automated cell counters market.

Table of Contents

1. Introduction

3. Research Methodology

4. SAM Automated Cell Counters Market - Market Landscape

5. SAM Automated Cell Counters Market - Key Market Dynamics

6. Automated Cell Counters Market - SAM Analysis

7. SAM Automated Cell Counter Market - by Type

8. SAM Automated Cell Counter Market - by End User

9. SAM Automated Cell Counters Market - By Country Analysis

10. Automated Cell Counters Market - Industry Landscape

11. COMPANY PROFILES

12. Appendix

List of Tables

List of Figures

Companies Mentioned

- Eppendorf

- Thermo Fisher Scientific Inc.

- Countstar Inc.

- Bio-Rad Laboratories, Inc.

- F. Hoffman-La Roche Ltd

- Beckman Coulter, Inc. (Danaher)

- Nanoentek

- Olympus Corporation

- MERCK KGaA

- Sysmex Corporation

- Agilent Technologies, Inc.

- Abbott

- Nexcelom Bioscience LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | October 2022 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 458.7 Million |

| Forecasted Market Value ( USD | $ 626.1 Million |

| Compound Annual Growth Rate | 5.3% |

| No. of Companies Mentioned | 13 |