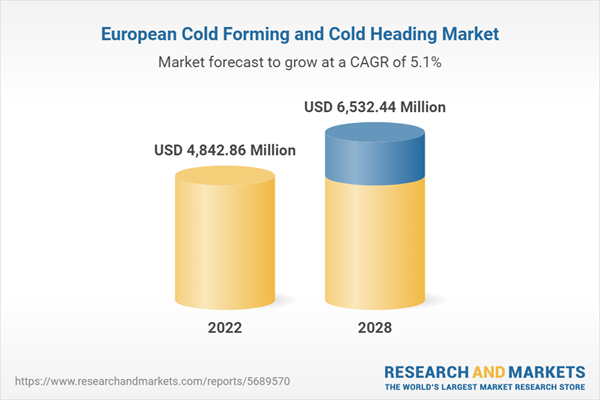

The cold forming and cold heading in Europe is expected to grow from US$ 4,842.86 million in 2022 to US$ 6,532.44 million by 2028. It is estimated to grow at a CAGR of 5.1% from 2022 to 2028.

The automobile industry widely uses parts molded by cold heading machines. The main metals used for cold heading include copper-based (Cu) metal alloys, pure copper, brass, phosphor bronze, stainless steel, and aluminum. Headers manufactured by cold heading machines are terminals and pins used in various automotive control units, engine control units (ECUs), pressure sensors, and other in-vehicle sensors. Technological advancements, climate change-related policies, and changing consumer tastes are driving the demand for eco-friendly, fuel-efficient, intelligent vehicles and innovations in electric and hybrid vehicles. Europe continue to invest in innovation and development of advanced, energy-efficient, and more environment-friendly vehicles. As a result, automakers in Europe is investing in expanding production facilities, which is expected to increase the demand for cold heading machines. Therefore, all these market trends and increased investment in the automotive industry are boosting the demand for cold forming and cold heading processes.

The automobile industry widely uses parts molded by cold heading machines. The main metals used for cold heading include copper-based (Cu) metal alloys, pure copper, brass, phosphor bronze, stainless steel, and aluminum. Headers manufactured by cold heading machines are terminals and pins used in various automotive control units, engine control units (ECUs), pressure sensors, and other in-vehicle sensors. Technological advancements, climate change-related policies, and changing consumer tastes are driving the demand for eco-friendly, fuel-efficient, intelligent vehicles and innovations in electric and hybrid vehicles. Europe continue to invest in innovation and development of advanced, energy-efficient, and more environment-friendly vehicles. As a result, automakers in Europe is investing in expanding production facilities, which is expected to increase the demand for cold heading machines. Therefore, all these market trends and increased investment in the automotive industry are boosting the demand for cold forming and cold heading processes.

Market Overview

Based on country, the Europe cold forming and cold heading market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. Leonardo S.p.A., Rheinmetall GmbH, SAAB AB, Airbus, Bae Systems, and Dassault are a few of the major aerospace & defense companies operating in the region. The increasing manufacturing capacities and rise in the number of contracts among mentioned companies are expected to contribute to the market growth. For instance, in April 2022, Leonardo S.p.A. received a US$ 29 million contract from the US department of defense to supply seven AW119Kx helicopters. Similarly, in September 2021, Airbus received a contract from the Indian Ministry of Defense (MoD) to supply 56 C-295MW transport aircraft for the Indian Air Force. These contracts will increase the aircraft manufacturing activities across the region, thereby contributing to the rise in demand for cold forming and cold heading solutions. Thus, these factors are offering lucrative opportunities to the key players operating in the Europe cold forming and cold heading market. The automotive industry of Europe is one of the major industries contributing to the region’s GDP. A few of the major automotive companies operating in the region include BMW Group, Ferrari, Honda Motor Europe, Ford of Europe, Hyundai Motor Europe, and Iveco Group. The rising adoption of personal vehicles by the European population owing to an increase in their purchasing power is expected to contribute to the growing volume of vehicles manufactured in the region. Moreover, automobile manufacturers are increasingly investing in developing automotive manufacturing plants across the region. For instance, in July 2022, Volvo Group announced an investment of US$ 1.23 billion to open an electric vehicle manufacturing plant in Slovakia. These factors are expected to increase electric vehicle production in the region, thereby offering growth opportunities to the cold forming and cold heading market players.Europe Cold Forming and Cold Heading Market Segmentation

The Europe cold forming and cold heading market is segmented into material, industry, and country.- Based on material, the Europe cold forming and cold heading market is segmented into aluminum, alloy steel, stainless steel, and others. The alloy steel segment registered the largest market share in 2022.

- Based on industry, the Europe cold forming and cold heading market is segmented into aerospace and defense, automotive, industrial equipment and machinery, and others. The automotive segment held the largest market share in 2022.

- Based on country, the Europe cold forming and cold heading market is segmented into Germany, France, Italy, the UK, Russia, and the rest of Europe. Germany dominated the market share in 2022.

Table of Contents

1. Introduction

3. Research Methodology

4. Europe Cold Forming and Cold Heading Market Landscape

5. Europe Cold Forming and Cold Heading Market - Key Industry Dynamics

6. Cold Forming and Cold Heading Market - Europe Analysis

7. Europe Cold Forming and Cold Heading Market Analysis - By Type

8. Europe Cold Forming and Cold Heading Market Analysis - By Industry

9. Europe Cold Forming and Cold Heading Market - Country Analysis

10. Industry Landscape

11. Company Profiles

12. Appendix

List of Tables

List of Figures

Companies Mentioned

- Altra Industrial Motion Corp

- Bharat Forge

- Cold Formed Products

- Deringer-Ney Inc

- Fukui Byora Co., Ltd.

- KALYANI FORGE

- STANLEY

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 101 |

| Published | October 2022 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 4842.86 Million |

| Forecasted Market Value ( USD | $ 6532.44 Million |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 7 |