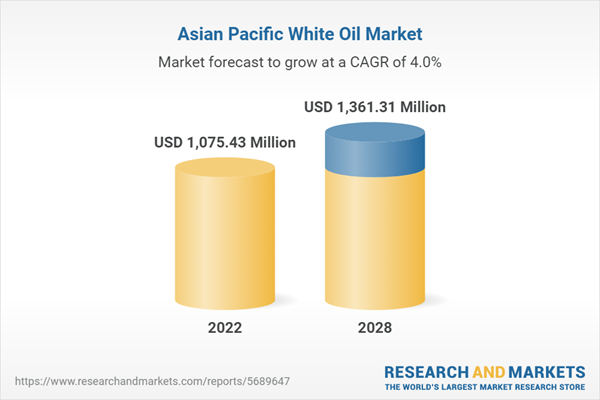

The white oil market in Asia Pacific is expected to grow from US$ 1075.43 million in 2022 to US$ 1361.31 million by 2028. It is estimated to grow at a CAGR of 4.0% from 2022 to 2028.

The growing consumer inclination toward packaged products due to a shift in eating habits and the transformation of lifestyles may have an imperative impact on the demand for white oil. The oil is used in the production of adhesives for food packaging. Technical white oil mineral is permitted as an indirect food additive in a wide variety of food contact materials, including adhesives. It is also used as a defoaming agent component in paper and paperboard packaging. White oil is used in hot melt adhesives, wherein it acts as a diluent for ensuring material transparency when it is used in cosmetics or food packaging. The growing trend such as in food service cups, packaging, and utensils are all produced with white oil. It is used to soften rubber and polymer products. The packaging industry uses white oils typically in the products of polymers, thermoplastic elastomers, polyolefins and polystyrene, these packaging keep foods crisp. Furthermore, increasing focus on clean rooms and hygienic consumable goods packaging is one of the main factors that are likely to encourage the use of white oil adhesives in the food packaging industry.

Asia Pacific White oil market Revenue and Forecast to 2028

The Asia Pacific white oil market is segmented into grade, application, and country. - Based on grade, the market is segmented into food, pharmaceutical, and technical. The pharmaceutical segment registered the largest market share in 2022.

The growing consumer inclination toward packaged products due to a shift in eating habits and the transformation of lifestyles may have an imperative impact on the demand for white oil. The oil is used in the production of adhesives for food packaging. Technical white oil mineral is permitted as an indirect food additive in a wide variety of food contact materials, including adhesives. It is also used as a defoaming agent component in paper and paperboard packaging. White oil is used in hot melt adhesives, wherein it acts as a diluent for ensuring material transparency when it is used in cosmetics or food packaging. The growing trend such as in food service cups, packaging, and utensils are all produced with white oil. It is used to soften rubber and polymer products. The packaging industry uses white oils typically in the products of polymers, thermoplastic elastomers, polyolefins and polystyrene, these packaging keep foods crisp. Furthermore, increasing focus on clean rooms and hygienic consumable goods packaging is one of the main factors that are likely to encourage the use of white oil adhesives in the food packaging industry.

Market Overview

Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific are the key contributors to the white oil market in the Asia Pacific. China, India, and other southeast Asian countries are the key markets in the region. Due to heavy investments from various manufacturers and the rise in government initiatives to support the production of different grades of white oil, the production capacity of the region is expected to increase in the coming years. For instance, Weifang Hongrun Petrochemical Technology Co. has recently awarded a contract to Chevron Lummus Global for the licensing and design of a 500,000-metric ton per year white oil hydro processing unit and a 200,000 t/y food-grade white oil unit in Shandong, China. The most common use of white oils in India is hair oil, a component of cosmetics and personal care products. Three-fourths of the nation's usage of white oil is accounted for by the pharmaceutical and cosmetics industries combined. Additionally, manufacturers are investing in cosmetics production in Japan due to the rising demand for cosmetics created in Japan from consumers in Asia Pacific. Shiseido, one of the major cosmetics manufacturers in the nation, has revealed plans to invest between US$ 387.37 billion and US$ 484.22 billion in a new factory that is expected to be built on the southern main island of Kyushu and set to open around 2021. To increase its national production capacity, the corporation also constructed two additional plants in Tochigi Prefecture in 2019 and Osaka Prefecture in 2021. Such Strategic developments by manufacturers increase the demand for white oil and are further expected to drive the Asia Pacific white oil market.Asia Pacific White oil market Revenue and Forecast to 2028

Asia Pacific White oil market Segmentation

The Asia Pacific white oil market is segmented into grade, application, and country. - Based on grade, the market is segmented into food, pharmaceutical, and technical. The pharmaceutical segment registered the largest market share in 2022.

- Based on application, the market is segmented into personal care and cosmetics, pharmaceutical and healthcare, food industries, plastic processing, agriculture, and others. The personal care and cosmetics segment held a largest market share in 2022.

- Based on country, the market is segmented into Australia, China, India, Japan, South Korea, and rest of APAC. China dominated the market share in 2022.

Table of Contents

1. Introduction

3. Research Methodology

4. APAC White Oil Market Landscape

5. APAC White Oil Market - Key Market Dynamics

6. White Oil - APAC Market Analysis

7. APAC White Oil Market Analysis - By Grade

8. APAC White Oil Market Analysis - By Application

9. APAC White Oil Market - Country Analysis

10. Industry Landscape

11. Company Profiles

12. Appendix

List of Tables

List of Figures

Companies Mentioned

- Calumet Specialty Product Partners.

- Chevron Corporation.

- EXXON Mobil Corporation.

- Petro-Canada Lubricants Inc.

- ATLANTIC OIL.

- APAR.

- Sasol.

- Sonneborn LLC.

- H&R GROUP

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | October 2022 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 1075.43 Million |

| Forecasted Market Value ( USD | $ 1361.31 Million |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 9 |