Edge banding is a finish carpentry method. In this method, a short strip of material is used to make durable and aesthetic trim edges of furniture. Edge banding is made of different materials, such as plastic, metal, and wood. Edge band materials have gained momentum in the market over the last decade with increasing growth in the building & construction sector. It offers many benefits in furnishing and is predominantly used to prevent water absorption and humidity on wooden surfaces to protect them. It is also used to provide wood veneers with a smooth aesthetic finish as it conceals the rugged natural texture of solid wood. It is also used on non-wood surfaces to give the appearance of natural wood.

The US edge banding materials market growth is attributed to increased demand for furniture due to the rising housing & construction sector and the increased need for user-friendly and sustainable edge banding materials. The rapidly growing residential sector is also increasing the demand for edge banding materials. During the forecast period, the rising demand for sustainable and user-friendly edge banding materials is expected to influence the overall growth of the US edge banding materials market.

The residential construction sector is expanding despite ongoing supply chain challenges, including the shortage of building materials, rising prices, and expensive land. The US government is also focusing on providing affordable housing. As part of the BBB plan, the government allocated an investment of US$ 150 billion on affordable housing provisions for the construction and rehabilitation of over 1 million affordable homes across the country. This increased government investment is expected to increase the demand for residential furniture, which is expected to boost the US edge banding market growth.

Moreover, changing consumer preferences, inclination toward a luxurious lifestyle, increasing income levels of consumers, and a growing number of commercial spaces are also boosting demand for wood-based edge banding materials. In modern furniture manufacturing, edge banding quality is one of the key criteria for evaluating the quality of the entire furniture item. Thus, furniture manufacturers use wood-based edge banding to get an aesthetic and natural finish. These factors are driving the growth of the US edge banding materials market.

A few key players operating in the US edge banding materials market are Product Resources, Inc.; EdgeCo Incorporated; Surteco USA Inc.; Charter Industries, LLC; JSO Wood Product; Product Resources, Inc.; Sauers & Company Veneers; EdgeCo Incorporated; Edgebanding Services, Inc. (ESI); and REHAU Incorporated. Players operating in the market are highly focused on developing high-quality and innovative product offerings to fulfill customers' requirements.

The overall US edge banding materials market size has been derived using both primary and secondary sources. Exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the market. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain more analytical insights into the topic. The participants of this process include industry experts, such as VPs, business development managers, market intelligence managers, and national sales managers - along with external consultants, such as valuation experts, research analysts, and key opinion leaders - specializing in the US edge banding materials market.

Table of Contents

Companies Mentioned

- Product Resources, Inc.

- EdgeCo Incorporated

- Surteco USA Inc.

- A Charter Industries, LLC.

- JSO Wood Product

- Product Resources, Inc.

- Sauers & Company Veneers

- EdgeCo Incorporated

- Edgebanding Services, Inc. (ESI)

- REHAU

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 101 |

| Published | October 2022 |

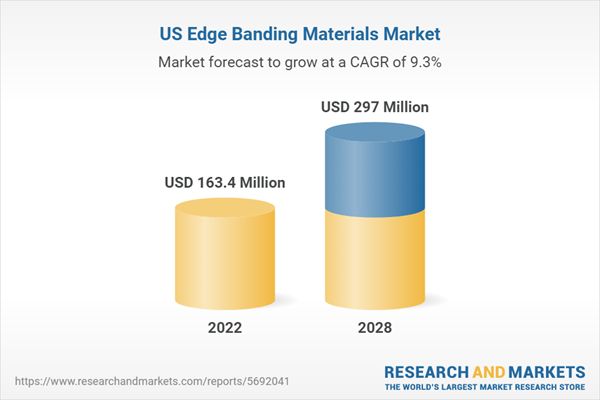

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 163.4 Million |

| Forecasted Market Value ( USD | $ 297 Million |

| Compound Annual Growth Rate | 9.3% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |

![US Edge Banding Materials Market Forecast to 2028 - COVID-19 Impact and Country Analysis By Material [Plastic, Wood, Metal, and Others] and End Use- Product Image](http://www.researchandmarkets.com/product_images/12371/12371694_115px_jpg/us_edge_banding_materials_market.jpg)