Air barrier is a material designed and constructed to control airflow between a conditioned space and an unconditioned space. These systems should be impermeable to airflow, continuous over the entire building enclosure, able to withstand the forces that may act on them during and after construction, and durable over the expected lifetime of the building. Various advantages of air barriers are resulting in their greater adoption in residential, commercial, and industrial sectors in the US. In residential and commercial buildings, air leakage is a major source of energy waste. As per the US Energy Information Administration, buildings consumed about 40% of the total energy used in the US in 2016. Making buildings tighter through the proper use of continuous air barriers can help significantly reduce this energy usage. The International Energy Conservation Code (IECC), the DOE Zero Energy Ready Home program, and several state energy codes now require the use of air barriers. The strong growth in the residential construction sector in the US is also driving the demand for air barriers. The popularity of fluid-applied air barriers is rapidly increasing, owing to their various advantages such as versatility, ease of application, and effectiveness even on irregular substrates. Hence, the use of fluid-applied air barriers is increasing. This is expected to boost the US air barrier market growth. Further, players’ focus on performance improvement of the product is enabling them to launch new and innovative air barriers for their customers. For instance, in October 2020, GCP Applied Technologies added two new products to its air barrier portfolio - PERM-A-BARRIER VPL 50RS and PERM-A-BARRIER VPS 30 membranes. These new air barriers are specifically designed to offer superior protection against the damaging effects of air and liquid water ingress on building structures. This will offer lucrative opportunities for the growth of the air barrier market in the country.

Based on type, the US air barrier market is segmented into vapor permeable and vapor impermeable. The vapor permeable segment held a larger market share in 2021. The use of vapor-permeable air barriers in imparting superior moisture protection for homes has grown significantly. In this regard, permeable air barriers have grown in importance. Moreover, a permeable air barrier combats moisture inflation in extreme cold and mixed climates. These are the factors driving the segment’s growth in the forecast period.

The growing construction activities in residential, commercial, and industrial sectors are propelling the growth of the air barrier market in the US. Air leakage in homes can increase heating and cooling costs, cause moisture damage in walls, allow pollutants and debris to collect in wall interiors, and provide openings for insects and rodents to enter. To avoid this, air barriers are highly used in residential construction. Moreover, factors such as high disposable income and shift in consumer lifestyle attract consumers to invest in modern and eco-friendly construction. Residential building construction is the largest US construction market segment. The market for this segment is driven by an increase in government spending on residential construction and a rise in demand for new homes and building improvements. Further, high investments in research and development to produce innovative barriers and insulations, such as cellulose and OSB material barriers, will augment the increase in air barrier sales.

The key players operating in the US air barrier market include BASF SE, Dow Inc, 3M, W. R. Meadows Inc, GCP Applied Technologies Inc, CertainTeed LLC, Tamarack Materials Inc, VaproShield LLC, TK Products Construction Coating, Henry Co, Carlisle Companies Inc, and General Electric Co. Players operating in the US air barrier market are focusing on providing high-quality products to fulfill customer demand. They are also focusing on strategies such as investments in research and development activities and new product launches.

The overall US air barrier market size has been derived using both primary and secondary sources. To begin the research process, exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information about the market. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain analytical insights into the topic. Participants in this process include industry experts, such as VPs, business development managers, market intelligence managers, and national sales managers, along with external consultants, such as valuation experts, research analysts, and key opinion leaders specializing in the US air barrier market.

Table of Contents

Companies Mentioned

- BASF SE

- Dow Inc

- 3M Co

- W. R. Meadows Inc

- GCP Applied Technologies Inc

- CertainTeed LLC

- Tamarack Materials Inc

- VaproShield LLC

- TK Products Construction Coating

- Henry Co

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 107 |

| Published | October 2022 |

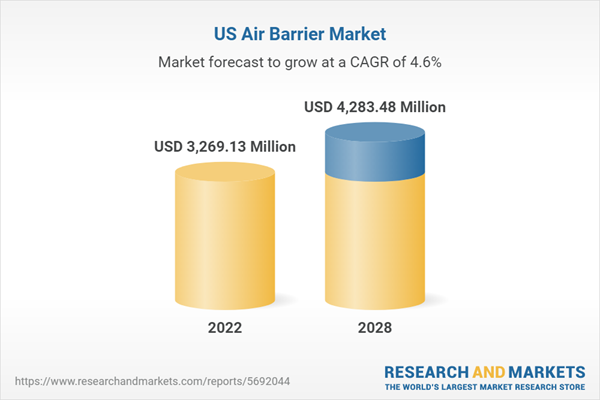

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 3269.13 Million |

| Forecasted Market Value ( USD | $ 4283.48 Million |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |