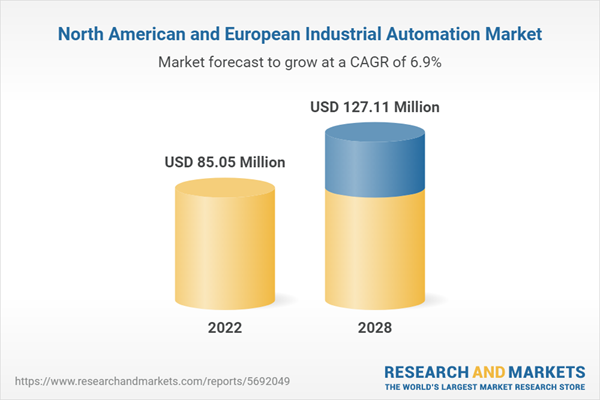

The North America and Europe industrial automation market is expected to grow to US$ 127.11 billion by 2028; it is estimated to grow at a CAGR of 6.9% from 2022 to 2028.

The growing demand for automation in the construction sector is one of the major factors expected to generate huge opportunities for industrial automation market players during the forecast period. Construction is one of the most manual-intensive industries, with physical labor being the primary source of productivity. Although robots are yet to play a substantial role in commercial construction, refurbishment, or deconstruction, the rising automation across industries is experiencing a surge in investment in automated solutions such as robots.

Several types of robots are being extensively adopted across the construction industry for 3D printing, demolition, and remote-controlled or autonomous vehicles. Since automation across the construction industry is in a nascent stage, it is expected to propel over the coming years, thereby catalyzing the industrial automation market size.

As per a global survey commissioned by ABB, in 2020, of 1,900 large and small construction businesses in Europe, the US and China, 81% of respondents planned to introduce or increase the use of robotics and automation within the next decade. These factors further fuel the adoption of robots across the construction industry, which is expected to subsequently contribute to the industrial automation market size.

Further, the higher initial investment for industrial automation is one of the restraining factors hampering the industrial automation market growth. The overall installation cost for automated machinery and solutions, including material and labor costs, is significantly higher than traditional solutions across industries. The integration or uptake of such technologies also requires skilled laborers to operate the same. Thus, the adoption of industrial automation is slow across developing and underdeveloped countries. The installation of such technologies further increases the cost of training and support, thereby increasing the operational cost. Thus, such factors are restraining the uptake of industrial automation among developing and underdeveloped countries, limiting the industrial automation market growth.

Automotive assembly automation involves streamlining repetitive processes, such as material handling, welding, and assembling auto body components. Automotive manufacturers can save on rework, labor costs, and improve quality and repeatability with vision, robotics, and software integration. Europe is home to many prominent car manufacturers, including BMW, Volkswagen, Renault, and Peugeot, with over 200 production and assembly plants established in the region, which produced more than 15 million automobiles in 2019. Thus, the robust automotive industry is expected to influence the adoption of automated solution across the European industrial automation market.

As Europe is one of the early adopters of robotics systems across manufacturing facilities, the ongoing developments in IoT-based technologies are further propelling its adoption in the region. European Commission sanctioned a budget of US$ 780 million for R&D in robotics and other technologies such as AI and Cobots for the period from 2018 to 2020. Germany, the UK, and France are among the few countries at the forefront of the Europe industrial automation market. The European Commission is primarily focusing on R&D funding to reinforce the competitiveness of its manufacturing sector and continue its global technological leadership. ABB Ltd; Hitachi, Ltd.; OMRON Corporation; Siemens; and Emerson Electric Co. are among the key industrial automation market players operating in the Europe industrial automation market.

Germany is the fifth largest industrial automation market specifically for industrial robots owing to the advancing digitalization across manufacturing sector. Germany has a robot density of over 300 per 10,000 workers positioning it as one of the major adopters of industrial robots. Factors such as robust infrastructure, presence of several original equipment manufacturers (OEMs), research and development (R&D) capabilities and political and industrial stability positions Germany as Europe’s robotic hub. Food & beverages is one of the biggest industries in Germany. According to Germany Trade & Invest, R&D and innovation expenditure in the German food & beverage industry reached EUR 3 billion in 2019. High investment in the food & beverages industry drives the scope for industrial automation to a great extent. The German airport authorities have been investing significant amounts toward the renovation of the major airports with advanced technologies. For instance, in February 2018, Munich Airport along with Lufthansa tested humanoid robot in Terminal 2 of the airport for passenger guidance. In April 2019, Frankfurt Airport deployed FRAnny, a robotics head which use AI to assist passenger with information at airport.

The North America and Europe industrial automation market is segmented into component, system, and end user. Based on component, the North America and Europe industrial automation market is categorized into hardware and software. Based on system, the North America and Europe industrial automation market is segmented into supervisory control and data acquisition, distributed control system, programmable logic control, and others. Based on end user, the North America and Europe industrial automation market is segmented into oil & gas, automotive, food & beverage, chemical & materials, aerospace & defense, and others.

The growing demand for automation in the construction sector is one of the major factors expected to generate huge opportunities for industrial automation market players during the forecast period. Construction is one of the most manual-intensive industries, with physical labor being the primary source of productivity. Although robots are yet to play a substantial role in commercial construction, refurbishment, or deconstruction, the rising automation across industries is experiencing a surge in investment in automated solutions such as robots.

Several types of robots are being extensively adopted across the construction industry for 3D printing, demolition, and remote-controlled or autonomous vehicles. Since automation across the construction industry is in a nascent stage, it is expected to propel over the coming years, thereby catalyzing the industrial automation market size.

As per a global survey commissioned by ABB, in 2020, of 1,900 large and small construction businesses in Europe, the US and China, 81% of respondents planned to introduce or increase the use of robotics and automation within the next decade. These factors further fuel the adoption of robots across the construction industry, which is expected to subsequently contribute to the industrial automation market size.

Further, the higher initial investment for industrial automation is one of the restraining factors hampering the industrial automation market growth. The overall installation cost for automated machinery and solutions, including material and labor costs, is significantly higher than traditional solutions across industries. The integration or uptake of such technologies also requires skilled laborers to operate the same. Thus, the adoption of industrial automation is slow across developing and underdeveloped countries. The installation of such technologies further increases the cost of training and support, thereby increasing the operational cost. Thus, such factors are restraining the uptake of industrial automation among developing and underdeveloped countries, limiting the industrial automation market growth.

Automotive assembly automation involves streamlining repetitive processes, such as material handling, welding, and assembling auto body components. Automotive manufacturers can save on rework, labor costs, and improve quality and repeatability with vision, robotics, and software integration. Europe is home to many prominent car manufacturers, including BMW, Volkswagen, Renault, and Peugeot, with over 200 production and assembly plants established in the region, which produced more than 15 million automobiles in 2019. Thus, the robust automotive industry is expected to influence the adoption of automated solution across the European industrial automation market.

As Europe is one of the early adopters of robotics systems across manufacturing facilities, the ongoing developments in IoT-based technologies are further propelling its adoption in the region. European Commission sanctioned a budget of US$ 780 million for R&D in robotics and other technologies such as AI and Cobots for the period from 2018 to 2020. Germany, the UK, and France are among the few countries at the forefront of the Europe industrial automation market. The European Commission is primarily focusing on R&D funding to reinforce the competitiveness of its manufacturing sector and continue its global technological leadership. ABB Ltd; Hitachi, Ltd.; OMRON Corporation; Siemens; and Emerson Electric Co. are among the key industrial automation market players operating in the Europe industrial automation market.

Germany is the fifth largest industrial automation market specifically for industrial robots owing to the advancing digitalization across manufacturing sector. Germany has a robot density of over 300 per 10,000 workers positioning it as one of the major adopters of industrial robots. Factors such as robust infrastructure, presence of several original equipment manufacturers (OEMs), research and development (R&D) capabilities and political and industrial stability positions Germany as Europe’s robotic hub. Food & beverages is one of the biggest industries in Germany. According to Germany Trade & Invest, R&D and innovation expenditure in the German food & beverage industry reached EUR 3 billion in 2019. High investment in the food & beverages industry drives the scope for industrial automation to a great extent. The German airport authorities have been investing significant amounts toward the renovation of the major airports with advanced technologies. For instance, in February 2018, Munich Airport along with Lufthansa tested humanoid robot in Terminal 2 of the airport for passenger guidance. In April 2019, Frankfurt Airport deployed FRAnny, a robotics head which use AI to assist passenger with information at airport.

The North America and Europe industrial automation market is segmented into component, system, and end user. Based on component, the North America and Europe industrial automation market is categorized into hardware and software. Based on system, the North America and Europe industrial automation market is segmented into supervisory control and data acquisition, distributed control system, programmable logic control, and others. Based on end user, the North America and Europe industrial automation market is segmented into oil & gas, automotive, food & beverage, chemical & materials, aerospace & defense, and others.

Impact of COVID-19 Pandemic on North America and Europe Industrial Automation Market

With favorable government policies to boost innovation and reinforce infrastructure capabilities, North America has the highest acceptance and development rate of emerging technologies. Therefore, any impact on industries is projected to have a negative influence on the region's economic development. Unfortunately, the automotive industry was highly impacted by the outbreak of COVID-19. For instance, Mexico - which is more reliant on exports to the US - saw a 90% drop in auto shipments, thereby negatively impacting the industrial automation market across the region. However, the procurement of robots across the other industries in the region experienced a substantial rise in Q1 of 2021. According to the Association for Advancing Automation from Q1 of 2021, procurement of robotics was 86% higher by metal manufacturers; 72% higher by life sciences, pharmaceuticals, and biomed manufacturers; 32% higher by food and consumer goods manufacturers; and 12% higher by other nonautomotive manufacturers compared to Q1 of 2020 in North America. Thus, this rise in robot adoption has helped to revive the sales volume of industrial automation solution across the North America region in 2021.Table of Contents

1. Introduction

3. Research Methodology

4. North America and Europe Industrial Automation Market Landscape

5. North America and Europe Industrial Automation Market - Key Industry Dynamics

6. North America and Europe Industrial Automation Market - Key Market Dynamics

7. North America and Europe Industrial Automation Market Analysis - By Component

8. North America and Europe Industrial Automation Market Analysis - By System

9. North America and Europe Industrial Automation Market Analysis - By End User

10. North America and Europe Industrial Automation Market - Geographic Analysis

11. Impact of COVID-19 Pandemic on Industrial Automation Market

12. Industry Landscape

13. Company Profiles

14. Appendix

List of Tables

List of Figures

Companies Mentioned

- ABB Ltd.

- Bosch Rexroth AG

- Emerson Electric Co.

- Hitachi Ltd.

- Honeywell International, Inc.

- Mitsubishi Electric Corporation

- Omron Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 231 |

| Published | November 2022 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 85.05 Million |

| Forecasted Market Value ( USD | $ 127.11 Million |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Europe, North America |

| No. of Companies Mentioned | 10 |