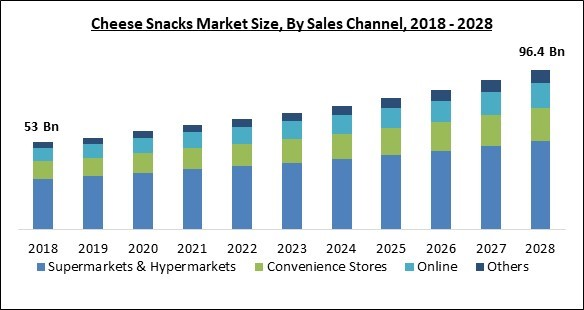

The Global Cheese Snacks Market size is expected to reach $96.4 billion by 2028, rising at a market growth of 6.3% CAGR during the forecast period.

Since cheese gives otherwise bland foods a salty dimension, it has become a must-have for snacks. Customers choose cheese snacks because they are readily available in the market and have good nutritional value. Some of the most common types of cheese used to make cheese snacks are mozzarella, parmesan, and cheddar.

Cheese snacks are becoming more and more popular as more brands become accessible in developing nations. Due to the high demand for western food in these countries, market growth is anticipated. Increasing the number of retail outlets is necessary to fuel the market for cheese snacks. The availability of healthier cheese snacks on the market is growing as a result of the demand for cheese snacks.

One of the main drivers of market growth for cheese-based snacks is the variety of lifestyles of urban consumers. The market is expanding as a result of product manufacturers' efforts to meet consumer demand through brand relocation, brand reinforcement, and brand expansion. Cheese snacks are becoming more popular all over the world due to changes in taste and increased westernization.

Cheese is an example of whole food, meaning it has undergone little to no processing and is as close to its natural state as possible. Depending on the type and quantity of cheese users consume, the nutritional value of cheese can vary greatly. Avoid highly processed varieties because they may be high in sodium and additives.

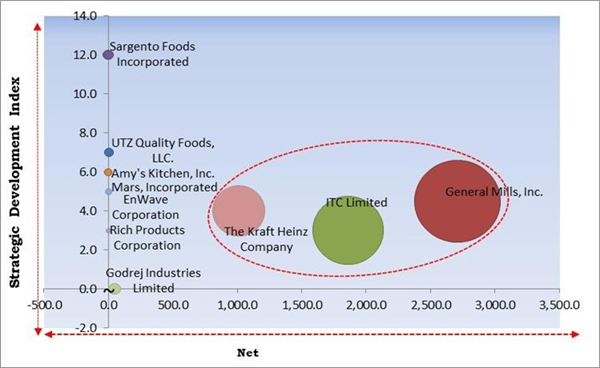

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; General Mills, Inc., ITC Limited, The Kraft Heinz Company are the forerunners in the Cheese Snacks Market. Companies such as UTZ Quality Foods, LLC, Amy's Kitchen, Inc., and Mars Incorporated are some of the key innovators in Cheese Snacks Market.

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Sargento Foods, Inc., Mars, Inc., Utz Brands, Inc. (UTZ Quality Foods, LLC), General Mills, Inc., EnWave Corporation, Amy's Kitchen, Inc., Rich Products Corporation (RE Rich Family Holding Corporation), The Kraft Heinz Company, ITC Limited and Godrej Agrovet Limited (Godrej Industries Limited).

Since cheese gives otherwise bland foods a salty dimension, it has become a must-have for snacks. Customers choose cheese snacks because they are readily available in the market and have good nutritional value. Some of the most common types of cheese used to make cheese snacks are mozzarella, parmesan, and cheddar.

Cheese snacks are becoming more and more popular as more brands become accessible in developing nations. Due to the high demand for western food in these countries, market growth is anticipated. Increasing the number of retail outlets is necessary to fuel the market for cheese snacks. The availability of healthier cheese snacks on the market is growing as a result of the demand for cheese snacks.

One of the main drivers of market growth for cheese-based snacks is the variety of lifestyles of urban consumers. The market is expanding as a result of product manufacturers' efforts to meet consumer demand through brand relocation, brand reinforcement, and brand expansion. Cheese snacks are becoming more popular all over the world due to changes in taste and increased westernization.

Cheese is an example of whole food, meaning it has undergone little to no processing and is as close to its natural state as possible. Depending on the type and quantity of cheese users consume, the nutritional value of cheese can vary greatly. Avoid highly processed varieties because they may be high in sodium and additives.

COVID-19 Impact Analysis

The cheese snacks market has suffered greatly as a result of the widespread COVID-19 across the globe. The COVID-19 outbreak has caused a significant decline in the sales of cheese and cheese snacks. As restaurants, shops, and bakeries have closed, so has the demand for cheese snacks. Cheese manufacturing facilities are reporting lower demand, while milk producers are struggling with excess inventory. Along with this, due to the travel & trade restrictions, the logistical network has been disrupted, which has resulted in losses for the businesses due to lower sales.Market Growth Factors

Rising per capita income of people

One of the most important stimulating ingredients for market development is an increase in the average income of consumers as a result of modernization and a wider base of employed individuals. This is one of the most important factors contributing to the growth of the market. The purchase of cheese-based snacks has seen an increase in popularity among consumers in their mid-thirties to mid-forties. An up-phrase push is anticipated to be delivered to the market as a result of increased funding for generating imaginative class goods in addition to the inventiveness begun by the most important corporations for product branding.Consumption of on-the-go snacks is increasing

The positive expansion of the cheese-based snacks market is being driven by the increase in the consumption of on-the-go snacks. Worldwide demand for cheese-based snacks is anticipated to increase as consumer awareness of the health dangers associated with junk food consumption, including diabetes, heart disease, and other chronic diseases grows. One of the major developments in the market for cheese-based snacks worldwide is an increase in consumer demand for eating habits and a lifestyle centered around cheese.Marketing Restraining Factor

Large population suffering from diseases like lactose intolerance

A large number of people suffer from diseases like lactose intolerance. An individual with lactose intolerance lacks the enzyme necessary to metabolize and digest milk sugar. Consuming dairy products such as milk or cheese may cause bloating, gas, or diarrhea. Individual differences exist in tolerance levels. Some people may be able to consume aged dairy products with little lactose, like hard cheeses and yogurt, while others may react to even a small bit of dairy. A person who has a lactose intolerance may have an adverse reaction to soft, fresh cheeses like mozzarella.Sales Channel Outlook

On the basis of sales channel, the cheese snacks market is fragmented into supermarket & hypermarket, convenience stores, online and others. In 2021, the online segment covered a substantial revenue share in the cheese snacks market. Online sale is one of the most efficient snack-buying options with the fastest growth. The segment growth is expanded by the rising number of internet and smartphone users, particularly in developed nations. Additionally, e-commerce tools like social networking and Google Ads are crucial in influencing consumer decisions.Type Outlook

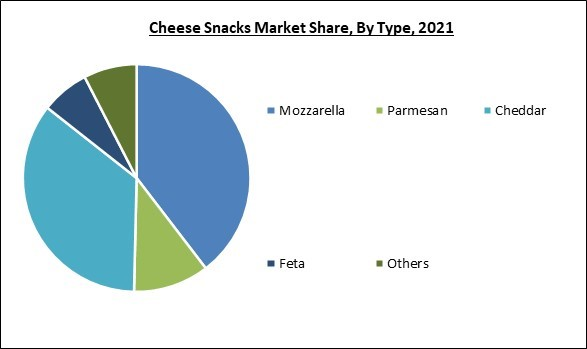

Based on type, the cheese snacks market is segmented into mozzarella, parmesan, cheddar, feta and others. In 2021, the mozzarella segment dominated the cheese snacks market with the largest revenue share. Curd cheese, often known as mozzarella cheese, is capable of being sliced and used in a variety of food preparations. The high calcium and protein content of this cheese contributes to its significant consumption in the food business.Regional Outlook

Region wise, the cheese snacks market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2021, the Asia Pacific region led the largest revenue share in the cheese snacks market by generating the largest revenue share. The need for a healthy snack is increasing quickly in this region as consumers become more health aware and conscious of the foods they must eat and the diets they should follow. The number of consumption occasions has significantly expanded, and the Asia Pacific appears to be the region with the greatest growth.The Cardinal Matrix - Cheese Snacks Market Competition Analysis

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; General Mills, Inc., ITC Limited, The Kraft Heinz Company are the forerunners in the Cheese Snacks Market. Companies such as UTZ Quality Foods, LLC, Amy's Kitchen, Inc., and Mars Incorporated are some of the key innovators in Cheese Snacks Market.

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Sargento Foods, Inc., Mars, Inc., Utz Brands, Inc. (UTZ Quality Foods, LLC), General Mills, Inc., EnWave Corporation, Amy's Kitchen, Inc., Rich Products Corporation (RE Rich Family Holding Corporation), The Kraft Heinz Company, ITC Limited and Godrej Agrovet Limited (Godrej Industries Limited).

Strategies Deployed in Cheese Snacks Market

Partnerships, Collaborations and Agreements:

- Jun-2022: Mars teamed up with Perfect Day, a food technology startup company. Under this collaboration, Mars would launch CO2COA, the company's first animal-free chocolate innovation in the United States. The latest CO2COA chocolate offers customers silky smooth, lactose-free chocolate which is also environment-friendly.

- May-2022: Utz Brands partnered with Grillo's Pickles, a Needham-based company. Under this partnership, Utz would launch new limited-time-only potato chips offering. Furthermore, this partnership would also enable Utz to leverage its own Utz Cheese Balls uniquely.

- Jul-2021: KraftMacaroni & Cheese partnered with Van Leeuwen Ice Cream, a maker of ice cream made from natural ingredients. Under this partnership, KraftMacroni & Cheese would launch a limited edition ice cream. Also, the partnership would turn the comfort of KraftMacaroni & Cheese into the ultimate summer treat with no artificial flavors, preservatives, or dyes.

- May-2021: Utz Brands came into a partnership with Ferrara, a related company of the Ferrero Group. This partnership aimed at developing the latest and exciting snack food variety pack. This partnership combines category leaders with iconic brand portfolios & substantial retail reach abilities with the aim to respond to the increasing customer demand for variety packs.

- Mar-2021: Sargento Foods came into a partnership with Mondelēz International, one of the world's largest snacks companies. This partnership focused on creating the latest snack range, Sargento Balanced Breaks Cheese & Crackers Snacks, that pairs Sargento cheeses with Ritz, Triscuit, and Wheat Thins crackers. The latest range offers four combinations, each containing 7-9g of protein and up to 170 calories per serving.

- May-2020: EnWave signed an agreement with NuWave, an award-winning Cloud Service Provider. Under this agreement, the NuWave would commercially use dehydration technology with aim of shelf-stable baked goods. The REV technology of EnWave enables the gentle, homogenous removal of water from baked goods.

Product Launches and Product Expansions:

- Mar-2022: EnWave Corporation unveiled Moon Cheese. Moon Cheese Crunchy Cheese Sticks would be the first shelf-stable cheese snack product in a stick or puff format made from 100% real cheese.

- May-2021: Sargento Foods introduced Sargento Creamery Sliced & Shredded Cheeses, a new line of real, natural cheeses. The launch adds creamy texture & meltiness to the favorite dishes and the perfect choice for indulgent, cozy, at-home meals or any backyard barbeque.

- Aug-2020: Utz Quality Foods launched Good Health, a member of the Utz Quality Foods family of brands. Under this launch, the company would offer Baked Cheese Puffs & Baked Cheese Fries. The products are made with real cheese, the main ingredient for Organic Valley, the nation’s largest farmer-owned organic cooperative.

- Apr-2020: Amy’s Kitchen launched the latest gluten-free pizzas packed with vegetables. The latest Veggie Crust Pizzas consists of crusts made from organic cauliflower, sweet potato, and broccoli topped with slow-simmered tomato sauce as well as mozzarella cheese.

- Mar-2020: ITC unveiled Mad Angles Cheese Nachos and Bingo, Mad Angles Pizza-aaaah, two latest variants of snacks in its Bingo Brand. This launch aimed at driving demand as well as growing consumer franchises with the launch of innovative & differentiated products.

- Feb-2020: Sargento Foods released Snack Bites. The latest cheese-pairing snack packs would improve as well as compliment flavors for a match made in cheese lover's heaven.

- Jan-2020: Amy’s Kitchen unveiled Vegan Mexican Casserole with Cheeze, Vegan Broccoli & Cheeze Bake, Vegan Chili Mac & Cheeze, and Vegan Tortilla Casserole with Cheeze, a vegan version of the most popular frozen meals at Sprouts Farmers Market as well as natural grocery retailers. This launch focused on fulfilling the rising consumer demand.

- Jan-2020: Rich Products released a new bake-off range. The range features muffins, cookies, shortbreads, buns, and pastries. The launch aimed at entering into the sweet bakes trend. These goods would help wholesale, grocery, food service and out-of-home channel retailers to meet the increasing demand due to the sweet-toothed cravings of UK customers.

Acquisitions and Mergers:

- May-2022: Sargento Foods completed the acquisition of Baker Cheese Factory, a fourth-generation family-owned, cheese manufacturer. This acquisition would enable Sargento to grow its packaged cheese goods due to the high demand for cheese snacks. The acquisition would further enable will Sargento to add its latest products to the existing broad range of sliced, shredded, and snack natural cheese products that it already offers.

- May-2022: General Mills completed the acquisition of TNT Crust, a manufacturer of frozen pizza crusts for food service and retail. This acquisition would complement General Mills’ current frozen baked goods portfolio.

- Nov-2020: Mars, Incorporated is fully acquiring Kind North America the companies announced. Kind is one of the biggest brands in healthy snacks. This is the type of brand that could truly help Mars continue to grow and adapt as a leader in the food space.

Geographical Expansions:

- Nov-2021: General Mills expanded its business by launching Bold Cultr to enter into a new animal-free dairy category. Bold Cultr would develop flavored cream cheeses as well as cheese slices & shreds for further product launches.

Scope of the Study

By Sales Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online

- Others

By Type

- Mozzarella

- Parmesan

- Cheddar

- Feta

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Sargento Foods, Inc.

- Mars, Inc.

- Utz Brands, Inc. (UTZ Quality Foods, LLC)

- General Mills, Inc.

- EnWave Corporation

- Amy's Kitchen, Inc.

- Rich Products Corporation (RE Rich Family Holding Corporation)

- The Kraft Heinz Company

- ITC Limited

- Godrej Agrovet Limited (Godrej Industries Limited)

Unique Offerings

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

Chapter 2. Market Overview

Chapter 3. Competition Analysis - Global

Chapter 4. Global Cheese Snacks Market by Sales Channel

Chapter 5. Global Cheese Snacks Market by Type

Chapter 6. Global Cheese Snacks Market by Region

Chapter 7. Company Profiles

Companies Mentioned

- Sargento Foods, Inc.

- Mars, Inc.

- Utz Brands, Inc. (UTZ Quality Foods, LLC)

- General Mills, Inc.

- EnWave Corporation

- Amy's Kitchen, Inc.

- Rich Products Corporation (RE Rich Family Holding Corporation)

- The Kraft Heinz Company

- ITC Limited

- Godrej Agrovet Limited (Godrej Industries Limited)

Methodology

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | October 2022 |

| Forecast Period | 2021 - 2028 |

| Estimated Market Value ( USD | $ 63542 Million |

| Forecasted Market Value ( USD | $ 96417 Million |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |