Automotive natural gas vehicles use an alternative to diesel and gasoline, liquefied natural gas (LNG), or compressed natural gas (CNG). Buses, lift trucks, light and heavy vehicles, motorbikes, automobiles, vans, and locomotives make extensive use of natural gas. Natural gas is a more inexpensive and environmentally beneficial alternative to conventional fuels. Nowadays the penetration of automotive natural gas cars is rising due to their operating advantages. The increasing need for alternative fuels in the transportation field is prompting industry participants to use LNG for their operations. Consequently, the transportation industry is experiencing an increase in the requirement for LNG vehicles.

Natural gas vehicles function similarly to gasoline-powered automobiles. Typically, a natural gas vehicle's fuel tank or cylinder is located near the rear of the vehicle. Using fuel lines high-pressure gas is transferred from the gas tank by the fuel system to the combustion chamber. The fuel is then mixed with air inside the combustion chamber, where it is compressed and ignited with the help of a spark plug. It has been observed that vehicles powered by natural gas have low emissions and high performance.

Prominently, three varieties of NGVs exist namely, dedicated, dual-fuel, and bi-fuels. Dedicated vehicles are exclusively built to operate on natural gas. Bi-fuel vehicles are equipped with two distinct fueling systems that allow them to operate on either gasoline or natural gas. The dual-fuel systems vehicles run on natural gas, while diesel fuel is used to assist the ignition. Traditionally, this design is exclusive to heavy-duty trucks. Under pressure, CNG vehicles retain natural gas in containers where it stays in a gaseous state. Because LNG is kept as a liquid, its energy density is larger than that of CNG, allowing more fuel to be carried onboard a vehicle utilizing LNG. This makes LNG suitable for Class 7 and 8 trucks that require a longer range. Frequently, the choice of fuel is dictated by vehicle application requirements (e.g., energy requirements) and desired driving range.

COVID-19 Impact Analysis

The global economy suffered a significant setback because of the COVID-19 pandemic, which had a detrimental influence on automobile production. The pandemic caused political, social, and economic disruptions in important industries, which impeded growth to some degree. Several production facilities ceased operations as a consequence of the pandemic's effects on the supply chain. The outbreak had a severe influence on the sales of commercial and passenger vehicles, which in turn damaged the requirement for NGVs in the automotive industry. However, post-pandemic, a number of firms have reported an increase in sales of natural gas-powered vehicles, which is anticipated to propel the expansion of the automotive natural gas vehicle market throughout the forecast period.Market Growth Factors

Nations face a growing need for vehicles that emit fewer pollutants

As many nations have become more worried about rising emissions, the spread of vehicles powered by low-emission fuels, such as CNG and LNG, may accelerate. Numerous nations have expressed a goal to reduce pollutants over the next few years, and they are enacting stricter regulations for these vehicles in the coming years. Many nations have already supported the development of alternative fuel vehicles like CNG and LNG in an effort to reduce gasoline import-related emissions and costs. Current automobiles can be easily and affordably converted to LNG or CNG fuel systems.Increasing investment in vehicles with CNG backing

The sale of CNG and LNG automobiles as a less expensive alternative to gasoline/diesel vehicles has expanded dramatically in a number of automotive categories across the nation. Multiple times as many CNG-powered vehicles have been registered in recent years. In addition, the number of gasoline/CNG vehicle registration has also increased. Also, a substantial number of gasoline/hybrid vehicles are being produced to meet the expanding demand of the concerned populace.Marketing Restraining Factor

Increase in electric vehicle demand

Changes in climate are occurring all around the planet. Countries around the world are taking steps to limit their emissions of greenhouse gases including carbon dioxide. Several nations throughout the world are embracing electric vehicles in order to reach their net-zero emission goals, which is growing the global demand for electric vehicles. Unlike conventional gasoline-powered vehicles, electric vehicles run on renewable power and produce no emissions. Eliminating the need for any other sort of engine, an electric vehicle features an electric motor that operates on battery-supplied electric power.Vehicle Type Outlook

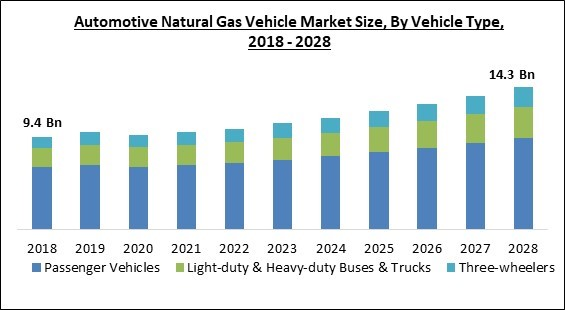

On the basis of vehicle type, the automotive natural gas vehicle market is divided into passenger vehicles, light-duty & heavy-duty buses and trucks, and three-wheelers. The light-duty and heavy-duty segments recorded a substantial revenue share in the automotive natural gas vehicle market in 2021. Light-duty NGVs are automobiles that run on propane, LPG, compressed natural gas, or other compressed fuels. Growth is predicted to be fueled by rising clean fuel demand as well as growing worries about the negative effects of utilizing petroleum goods.Fuel Type Outlook

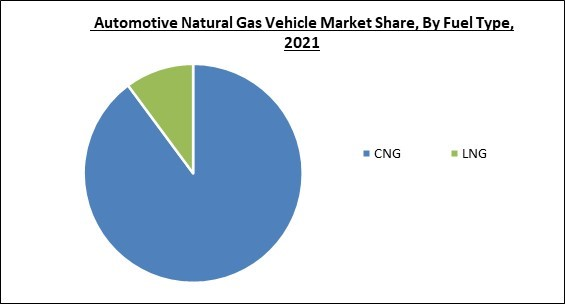

Based on fuel type, the automotive natural gas vehicle market is categorized into CNG and LNG. The CNG segment garnered the highest revenue share in the automotive natural gas vehicle market in 2021. The expansion of this segment can be ascribed to the growing number of government efforts aimed at reducing vehicle emissions and enhancing environmental protection. The non-toxicity of CNG reduces its environmental impact.Regional Outlook

Based on region, the automotive natural gas vehicle market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment procured the maximum revenue share in the automotive natural gas vehicle market in 2021. This expansion is attributable to increased passenger car production and sales in the region. Due to the growth of natural gas facilities in nations like India, China, and Pakistan, this area is the biggest adopter of natural gas vehicles. In India, for instance, the City Gas Distribution (CGD) policy was developed by the Ministry of Petroleum and Natural Gas. In accordance with the policy, the state would extend CNG infrastructure nationwide.The Cardinal Matrix - Automotive Natural Gas Vehicle Market Competition Analysis

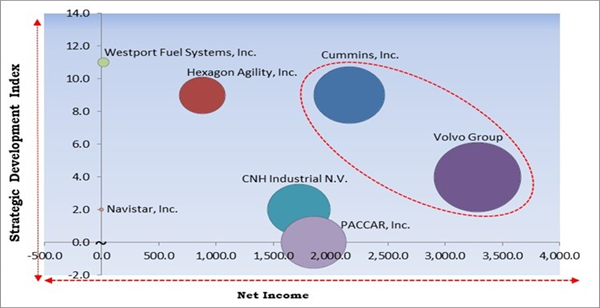

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Cummins, Inc. and Volvo Group are the forerunners in the Automotive Natural Gas Vehicle Market. Companies such as Westport Fuel Systems, Inc., Hexagon Agility, Inc., CNH Industrial N.V. are some of the key innovators in Automotive Natural Gas Vehicle Market.

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Volvo Group, CNH Industrial N.V., Cummins, Inc., Hexagon Agility, Inc. (Hexagon AB), Beijing Foton International Trade Co., Ltd., Clean Energy Fuels Corp., PACCAR, Inc., Navistar, Inc., Quantum Fuel Systems LLC and Westport Fuel Systems, Inc.

Strategies Deployed in Automotive Natural Gas Vehicle Market

Partnerships, Collaborations and Agreements:

- Oct-2022: Volvo partnered with CMB.TECH, a developer and integrator of hydrogen solutions. Through this partnership, the company aimed to advance the dual-fuel hydrogen-powered technologies development for land and sea applications. The partnership will involve small-scale industrialization projects along with some pilot projects, offering them access to hydrogen solutions for decreasing emissions of greenhouse gases.

- Aug-2021: Hexagon Agility collaborated with Power Solutions International, a supplier of emissions-certified power systems and engines in Illinois. With this collaboration, the companies aimed to offer more options for alternate fuel systems to OEMs. Through this, the companies supported the OEMs' requirement for low-emission vehicle products, which consequently allowed their fleet-owning customers to meet sustainability goals and reduce fuel costs.

- Nov-2020: Cummins collaborated with Navistar International, a leading manufacturer and solutions provider for the medium-duty, heavy-duty and severe-service truck segments. Under the collaboration, the companies aimed to design a class 8 truck that would use hydrogen fuel cells. The companies featured cutting-edge fuel cell configurations in the class 8 truck and paved the way for the development of line haul trucks incorporating hydrogen technology. the collaboration also attempted to increase the accessibility of hydrogen-powered vehicles for fleets while lowering fuel costs.

- Aug-2020: Navistar International formed an agreement with Cummins, an American multinational corporation. Following this agreement, Navistar aimed to provide consumers with the most fuel-efficient engines, which also helped in achieving emission reduction goals. The agreement helped the companies in optimizing their R&D investments in concurrent technologies while offering them the flexibility for advanced technology investment.

- Apr-2020: Volvo formed an agreement with Daimler Truck, the world's largest commercial vehicle manufacturer. With this agreement, Volvo and Daimler focused on large-scale production and development of fuel cells to be incorporated in heavy-duty trucks, which demand long-haul uses. The companies assimilated their strengths to unveil series-produced FCVs as well as lower their costs of development.

Product Launches and Product Expansions:

- Sep-2022: Westport Fuel Systems unveiled H2 HPDI, a fuel system developed for heavy-duty vehicles. The H2 HPDI is designed to decrease CO2 emissions to conform to the decarbonization goals of the EU. The hydrogen solution offers increased energy efficiency and is workable with existing manufacturing assets and engines.

- May-2022: Cummins launched a 15-liter hydrogen engine. The product is developed on the fuel-agnostic platform by Cummins, where over the head gasket, different components are found for engines of each fuel type, and below the head gasket, similar components are placed for different fuel types. The company also intends to develop 6.7-liters and 15-liter displacements with hydrogen IC engines.

- Aug-2020: Agility introduced the compressed natural gas fuel system's third generation. The system is roof mountable and can be used with Rear End Loader, Front End Loader, and Automated Side Loader vehicles. The design made the unit lighter thereby promoting its easy service and installation and also strengthened the roof mount systems against visible damage caused by daily use.

Acquisitions and Mergers:

- Aug-2022: Hexagon took over Cryoshelter, a developer of cryogenic tank technology from Austria. Through this acquisition, the company focused on strengthening its attempts of decarbonizing heavy-duty vehicles by incorporating the disruptive technology of Cryoshelter. The acquisition primarily focused on the European market where the limited space available on trucks had increased the demand for energy-efficient and clean cryogenic RLNG/LNG fuels.

- Jan-2022: Cummins acquired Rush Enterprises, an international retailer of commercial vehicles. Following this acquisition, Cummins and Rush focused on increasing the manufacturing of natural gas powertrains producing near-zero emissions. The acquisition incorporated the gas fuel systems by Cummins in vehicles for their commercialization in North America.

- May-2021: Westport Fuel Systems acquired Stako, the LPG fuel storage production subsidiary of Worthington Industries. With this acquisition, Westport aimed to increase its capacity to offer integrated fuel systems. This has further enabled the company to provide innovative solutions to preeminent OEMs.

- Nov-2020: Westport Innovations merged with Fuel Systems Solutions, a leading designer, manufacturer, and supplier of proven, cost-effective alternative fuel components and systems. Through this merger, the companies focused on combining their complementary product portfolios of technology, products, and R&D along with pulling together their clientele and employees. The company so formed was named Westport Fuel Systems.

Scope of the Study

By Vehicle Type

- Passenger Vehicles

- Light-duty & Heavy-duty Buses & Trucks

- Three-wheelers

By Fuel Type

- CNG

- LNG

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Volvo Group

- CNH Industrial N.V.

- Cummins, Inc.

- Hexagon Agility, Inc. (Hexagon AB)

- Beijing Foton International Trade Co., Ltd.

- Clean Energy Fuels Corp.

- PACCAR, Inc.

- Navistar, Inc.

- Quantum Fuel Systems LLC

- Westport Fuel Systems, Inc.

Unique Offerings

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Volvo Group

- CNH Industrial N.V.

- Cummins, Inc.

- Hexagon Agility, Inc. (Hexagon AB)

- Beijing Foton International Trade Co., Ltd.

- Clean Energy Fuels Corp.

- PACCAR, Inc.

- Navistar, Inc.

- Quantum Fuel Systems LLC

- Westport Fuel Systems, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 165 |

| Published | October 2022 |

| Forecast Period | 2021 - 2028 |

| Estimated Market Value ( USD | $ 9836.9 Million |

| Forecasted Market Value ( USD | $ 14334 Million |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |