Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

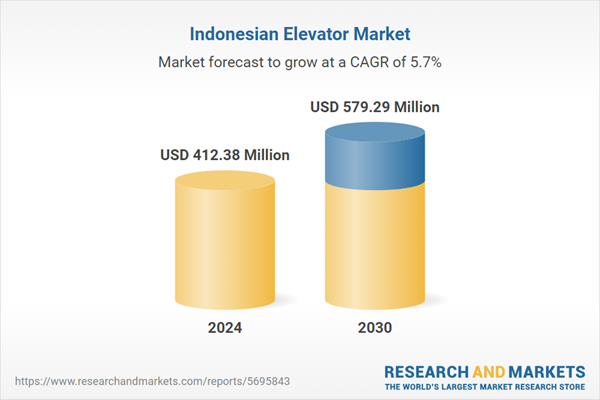

The Indonesia elevator market is driven by urbanization, increasing infrastructure investments, and rapid commercial and residential development. Government initiatives promoting sustainable urban mobility and modernization of buildings further boost demand. Technological advancements in elevator systems, including energy efficiency and smart features, also play a crucial role. Demographic shifts towards urban living and high-rise buildings create a continuous need for reliable vertical transportation solutions, propelling market growth. Additionally, rising safety standards and regulations contribute to the market's expansion as stakeholders prioritize safer and more efficient elevator solutions.

Key Market Drivers

The Indonesia elevator market is shaped by several key drivers that collectively contribute to its growth and evolution. Urbanization stands out as a primary driver, with Indonesia experiencing rapid urban growth and increasing population density in cities. As more people migrate to urban areas for better opportunities, the demand for high-rise residential and commercial buildings escalates, thereby boosting the need for efficient vertical transportation solutions like elevators.Infrastructure development initiatives by the Indonesian government also play a crucial role. Significant investments in infrastructure projects, including transportation networks and smart cities, necessitate modernized buildings equipped with advanced elevator systems. These projects not only drive the construction sector but also stimulate demand for elevators that meet modern safety, energy efficiency, and sustainability standards.

The Indonesian government invested USD 400 billion in infrastructure development between 2020 and 2024, focusing on improving transportation, energy, and digital infrastructure.

Key Market Challenges

While the Indonesia elevator market presents significant opportunities, it also faces several key challenges that influence its dynamics and growth trajectory. One of the primary challenges is the infrastructure deficit in many urban areas. Despite ongoing investments, infrastructure development often lags behind rapid urbanization, leading to congestion, inadequate building facilities, and delays in elevator installations. This mismatch between demand and infrastructure readiness poses logistical challenges for elevator manufacturers and construction companies, impacting project timelines and market growth.Moreover, economic uncertainties and fluctuating market conditions can hinder investment in large-scale construction projects, affecting the demand for elevators. Economic downturns or policy changes may lead to reduced construction activity, postponement of building projects, or budget constraints, impacting the overall demand for elevator installations and upgrades.

Technological complexities also present challenges. While technological advancements drive innovation in elevator systems, integrating new technologies into existing buildings can be costly and technically challenging. Retrofitting older buildings with modern elevator solutions that meet current safety and efficiency standards requires careful planning and investment, often posing logistical and financial challenges for building owners and operators.

Regulatory compliance and safety standards are critical but can also be challenging to navigate. Strict regulatory requirements govern elevator installation, maintenance, and operation in Indonesia, ensuring safety and reliability. However, compliance with these standards requires expertise, resources, and ongoing training for industry professionals, adding complexity and costs to elevator projects.

Market competition intensifies as more international and local players enter the Indonesia elevator market. Competition based on price, technology, and service offerings can pressure margins and drive consolidation among market players. Differentiating through innovation, quality, and customer service becomes crucial for sustaining market share and profitability in a competitive environment.

Environmental considerations and sustainability goals present both opportunities and challenges. While there is increasing demand for energy-efficient elevator solutions, meeting these demands requires investment in research and development of eco-friendly technologies. Balancing environmental stewardship with cost-effectiveness and performance remains a challenge for elevator manufacturers and stakeholders in the market.

The Indonesia elevator market is poised for growth driven by urbanization, infrastructure investments, and technological advancements, it must navigate challenges such as infrastructure deficits, economic uncertainties, technological complexities, regulatory compliance, market competition, and sustainability imperatives. Addressing these challenges requires strategic planning, collaboration among stakeholders, and continuous innovation to capitalize on growth opportunities and ensure sustainable development of the elevator market in Indonesia.

Key Market Trends

The Indonesia elevator market is witnessing several key trends that are shaping its evolution and growth trajectory. Urbanization remains a dominant trend, driven by population migration to urban areas in search of better opportunities. This demographic shift fuels the construction of high-rise buildings, condominiums, and commercial complexes, thereby increasing the demand for elevators as essential vertical transportation solutions.Technological advancements play a crucial role in transforming the elevator market. There is a growing emphasis on smart elevators equipped with IoT (Internet of Things) capabilities, cloud connectivity, and predictive maintenance features. These advancements enhance elevator performance, improve energy efficiency, and provide real-time monitoring and diagnostics, thereby reducing downtime and enhancing user experience.

Sustainability is becoming increasingly important in the Indonesia elevator market. With rising environmental awareness and government initiatives promoting green building practices, there is a growing demand for energy-efficient and eco-friendly elevator solutions. Manufacturers are responding by developing elevators with regenerative drives, energy-efficient lighting, and materials that minimize environmental impact throughout their lifecycle.

Safety standards and regulations continue to drive market trends. Indonesian authorities impose stringent regulations on elevator installation, maintenance, and operation to ensure user safety. Manufacturers and service providers are investing in compliance with these standards while also enhancing safety features such as emergency braking systems, anti-collision sensors, and secure communication protocols.

Market customization and specialization are emerging trends as stakeholders seek tailored elevator solutions to meet specific building requirements and user preferences. This trend encompasses custom designs, aesthetic options, and enhanced functionality to cater to diverse architectural styles and user demographics. Additionally, there is a growing demand for space-saving solutions like machine-room-less (MRL) elevators, which optimize building space and installation flexibility.

The service and maintenance segment is also experiencing growth as building owners prioritize reliability and operational efficiency. Preventive maintenance programs, remote monitoring capabilities, and rapid response services are becoming standard offerings to minimize downtime and ensure uninterrupted elevator operation.

The market is witnessing increased competition with the entry of international players and partnerships between global and local firms. This competition fosters innovation, drives product development, and enhances service delivery standards across the industry.

The Indonesia elevator market is characterized by trends such as urbanization, technological innovation, sustainability, regulatory compliance, customization, service excellence, and competitive dynamics. Understanding and adapting to these trends are crucial for stakeholders aiming to capitalize on growth opportunities and meet the evolving needs of the market.

Key Market Players

- PT. KONE Indo Elevator

- PT Berca Schindler Lifts

- TK Elevator Indonesia

- Otis Indonesia

- PT. Mitsubishi Jaya Elevator and Escalator

- PT. Hyundai Elevator Indonesia

- Toshiba Asia Pacific Pte. Ltd.

- PT. Toshiba Elevator and Building Systems Corporation

- PT. Seltech Putera Perkasa

- PT. Hitachi Asia Indonesia

Report Scope:

In this report, the Indonesia Elevator Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Indonesia Elevator Market, By Elevator Door Type:

- Automatic

- Manual

Indonesia Elevator Market, By Elevator Technology:

- Traction

- Machine Room-Less Traction

- Hydraulic

Indonesia Elevator Market, By Service:

- Modernization and Maintenance & Repair

- New Installation

Indonesia Elevator Market, By End User:

- Residential

- Commercial

- Infrastructural

- Institutional

- Others

Indonesia Elevator Market, By Region:

- Central Region

- Eastern Region

- Western Region

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Indonesia Elevator Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- PT. KONE Indo Elevator

- PT Berca Schindler Lifts

- TK Elevator Indonesia

- Otis Indonesia

- PT. Mitsubishi Jaya Elevator and Escalator

- PT. Hyundai Elevator Indonesia

- Toshiba Asia Pacific Pte. Ltd.

- PT. Toshiba Elevator and Building Systems Corporation

- PT. Seltech Putera Perkasa

- PT. Hitachi Asia Indonesia

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 88 |

| Published | September 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 412.38 Million |

| Forecasted Market Value ( USD | $ 579.29 Million |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Indonesia |

| No. of Companies Mentioned | 10 |