Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Growing Demand for Protein & Food Security

As the global population surges toward 10 billion by 2050, securing an affordable and nutritious protein supply has become imperative. Interestingly, over 2 billion people worldwide already incorporated insects into their diets, highlighting both cultural acceptance and real-world feasibility of insects as a mainstream protein alternative.From a nutritional standpoint, insects are powerhouses: some species provide up to 80% protein by dry weight, while cricket flour alone delivers around 65% protein content. Beyond protein, they offer complete essential amino acid profiles, plus high levels of iron, zinc, and B vitamins putting them on par with, or even ahead of, many conventional protein sources in nutrient density.

Insect farming also significantly reduces resource use. It requires between 8 and 14 times less land and 50 to 90% less water compared to cattle production. And when it comes to greenhouse gas emissions, insect protein generates roughly 100 times fewer emissions than beef, making it a potent tool in climate-smart agriculture.

Altogether, these strengths nutritional richness, environmental efficiency, and cultural familiarity position insects as a strategic resource for enhancing food security. By embedding insect protein into global food systems spanning human food, animal feed, and nutritional supplements we can tackle protein scarcity while easing ecological stress.

Key Market Challenges

Consumer Acceptance & Perception

One of the most persistent challenges facing the insect farming industry is the widespread psychological aversion, particularly in Western and urban markets, toward consuming insects. Many consumers associate insects with filth, disease, or fear, making them hesitant to accept even well-processed insect-based products. The idea of eating bugs - even in powdered or concealed forms - often triggers a "disgust response," which can be deeply rooted in cultural norms and lack of exposure. Unlike regions in Asia, Africa, and Latin America where insects are traditionally consumed, Western markets lack a historical or culinary context for edible insects. This cultural disconnect is exacerbated by limited public awareness about the nutritional and environmental benefits of insect protein. As a result, the industry must overcome a complex set of perception-related barriers before it can achieve broad-based consumer acceptance.To combat this challenge, companies and industry stakeholders must invest in robust consumer education campaigns, product transparency, and appealing product formats. Instead of selling whole insects, brands are increasingly turning to more palatable forms like protein powders, energy bars, and snacks that disguise the insect origin. Celebrity endorsements, scientific backing, and eco-friendly branding are also being used to reframe insect protein as a premium, sustainable alternative. However, changing consumer attitudes takes time and consistency, especially when it involves disrupting established food habits. Moreover, regulatory labeling requirements that mandate highlighting insect content can inadvertently reinforce aversion rather than build trust. Therefore, while consumer perception is gradually evolving, it remains a critical bottleneck that must be strategically addressed for insect farming to realize its full potential in global food systems.

Key Market Trends

Product Diversification & Circular Economy

The insect farming market is rapidly evolving beyond its initial focus on animal feed to embrace a broad spectrum of high-value products, a trend known as product diversification. While black soldier fly larvae and crickets remain central to the feed industry, producers are increasingly venturing into human nutrition, pet food, organic fertilizers (like frass), cosmetics, and even pharmaceuticals.Insect protein is now being incorporated into protein bars, baked goods, meat substitutes, and dietary supplements. At the same time, companies are exploring insect-derived oils and chitin for use in cosmetics, medical materials, and bioplastics. This strategic diversification allows insect farmers to tap into multiple industries, mitigating risk and enhancing profitability. As awareness grows around the health and sustainability benefits of insect-based products, producers are innovating new formulations and delivery formats to attract environmentally conscious consumers across diverse markets.

In parallel, the circular economy model is gaining strong momentum within the insect farming industry. Insects are uniquely capable of converting organic waste - such as food scraps, brewery by-products, and agricultural residues - into high-protein biomass and nutrient-rich fertilizer. This approach helps close the loop between food production, waste management, and soil health, minimizing environmental impact while maximizing resource efficiency. For instance, insect frass is increasingly used as an organic fertilizer that enriches soil without synthetic inputs. Many insect farms are now co-located with food processors or breweries to source consistent waste streams, reinforcing a zero-waste production cycle. This synergy between sustainability and profitability is positioning insect farming as a model for regenerative agriculture, attracting investments from both agri-tech innovators and circular economy advocates.

Key Market Players

- Viscon Group

- Bühler Insect Technology Solutions

- Protenga Pte. Ltd.

- nextProtein SAS

- NextAlim SAS

- AgriProtein Holdings UK Ltd

- Ÿnsect SAS

- Thai Union Group

- Deli Bugs Ltd.

- EntoCube Ltd.

Report Scope:

In this report, global insect farming market has been segmented into following categories, in addition to the industry trends which have also been detailed below:Insect Farming Market, By Insect:

- Silkworms

- Honeybees

- Waxworms

- Lac Insects

- Cochineal

- Crickets

- Others

Insect Farming Market, By Product:

- Whole Insect

- Insect Protein

- Insect Oil

- Others

Insect Farming Market, By Application:

- Silk

- Lac

- Honey

- Animal Feed

- Food Colorant

- Insect Protein Bars & Protein Shakes

- Insect Baked Products & Snacks

- Others

Insect Farming Market, By Region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Singapore

- Thailand

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in global insect farming market.Available Customizations:

With the given market data, the publisher offers customizations according to a company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Viscon Group

- Bühler Insect Technology Solutions

- Protenga Pte. Ltd.

- nextProtein SAS

- NextAlim SAS

- AgriProtein Holdings UK Ltd

- Ÿnsect SAS

- Thai Union Group

- Deli Bugs Ltd.

- EntoCube Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | August 2025 |

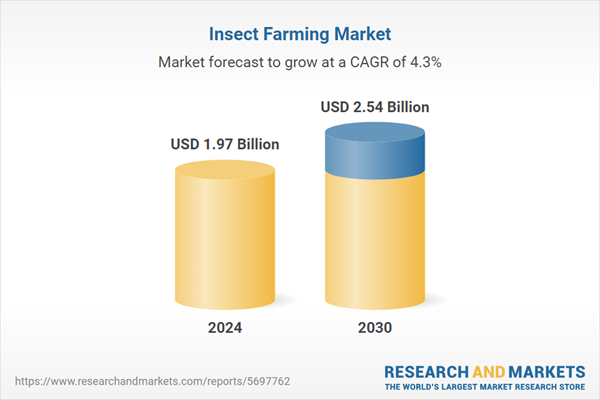

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.97 Billion |

| Forecasted Market Value ( USD | $ 2.54 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |