Speak directly to the analyst to clarify any post sales queries you may have.

KEY HIGHLIGHTS

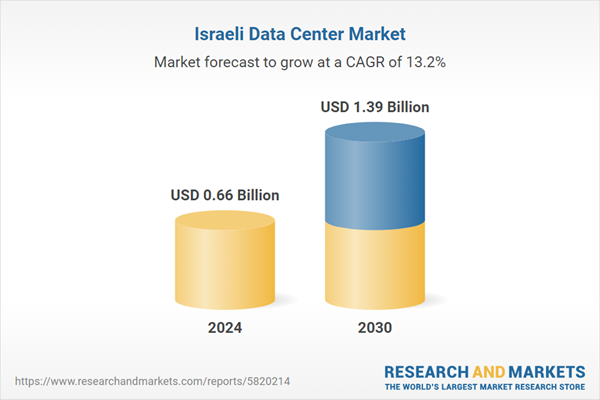

- The growth of the Israel data center market is expected to continue, driven by demand for cloud services, AI applications, and digital transformation. However, the future trajectory of this growth may depend on the duration and intensity of the conflict.

- The Israeli government has been actively promoting the data center industry. It has established an ambitious target to achieve between 600 to 700 MW of data center capacity by 2030. This initiative is part of a broader strategy to enhance the country’s technological infrastructure, attract foreign investment, and meet the growing demand for digital services.

- The physical security of data centers in Israel has long been a significant concern. The strategic importance of underground data centers has increased in response to ongoing conflicts, including the recent war in Israel. Located well below the surface, these data centers are protected from bombs, missile strikes, and other physical threats.

- In terms of area, Tel Aviv and Petah Tikva are the prominent locations for data center investments in the Israel data center market. Jerusalem, Rosh Haayin, Tirat Carmel, and Raanana are the emerging locations that attract data center developments.

WHY SHOULD YOU BUY THIS RESEARCH?

- Market size available in the investment, area, power capacity, and Israel colocation market revenue.

- An assessment of the data center investment in Israel by colocation, hyperscale, and enterprise operators.

- Data center investments in the area (square feet) and power capacity (MW) across cities in the country.

- A detailed study of the existing Israel data center market landscape, an in-depth industry analysis, and insightful predictions about the Israel data center market size during the forecast period.

- Snapshot of existing and upcoming third-party data center facilities in Israel

- Facilities Covered (Existing): 28

- Facilities Identified (Upcoming): 27

- Coverage: 10+ Cities

- Existing vs. Upcoming (Data Center Area)

- Existing vs. Upcoming (IT Load Capacity)

- Data center colocation market in Israel

- Colocation Market Revenue & Forecast (2021-2030)

- Wholesale vs. Retail Colocation Revenue (2021-2030)

- Retail Colocation Pricing

- Wholesale Colocation Pricing

- The Israel data center landscape market investments are classified into IT, power, cooling, and general construction services with sizing and forecast.

- A comprehensive analysis of the latest trends, growth rate, potential opportunities, growth restraints, and prospects for the market.

- Business overview and product offerings of prominent IT infrastructure providers, construction contractors, support infrastructure providers, and investors operating in the industry.

- A transparent research methodology and the analysis of the demand and supply aspects of the market.

VENDOR LANDSCAPE

- The Israel data center market is predominantly led by local operators such as Adgar Investments and Development, MedOne, Bezeq International, and Bynet Data Communications, as well as global players such as EdgeConneX, Compass Datacenters, Global Technical Realty, and Serverfarm. These companies have strengthened their operations to support the increasing demand driven by digital transformation initiatives across the country.

- All three major global cloud service providers Amazon Web Services (AWS), Google, and Microsoft have dedicated cloud regions in the country, each with three availability zones. They are capitalizing on the growing cloud adoption and the expanding digital economy. In addition, Oracle Cloud is actively increasing its presence in the Israel data center market. It plans to launch a new cloud region in Tel Aviv, with existing operations in Jerusalem, which currently has one availability zone.

- New entrants in the Israel data center market include Techtonic, Anan, Mega Data Centers, NED, and others. Further, Kardan Israel and Geva Real Estate have launched separate business entities named Serverz Data Center and MultiDC - Data Center Campus which are also making significant investments in the market.

- Mega Data Centers, one of the new entrants into the Israel data center market has planned to develop six data center facilities with a cumulative power capacity of over 489 MW. The first data center, MDCIL-1 Modiin is currently under development which will offer 32 MW power capacity by Q2 2025.

EXISTING VS. UPCOMING DATA CENTERS

- Existing Facilities in the Region (Area and Power Capacity)

- Tel Aviv

- Other Cities

- List of Upcoming Facilities in the Region (Area and Power Capacity)

- Tel Aviv

- Other Cities

IT Infrastructure Providers

- Broadcom

- Cisco

- Dell Technologies

- Fujitsu

- Hewlett Packard Enterprise

- Hitachi Vantara

- IBM

- Lenovo

- NetApp

Data Center Construction Contractors & Sub-Contractors

- Ashtrom Group

- Auerbach Halevy Architects

- Electra Group

- M+W Group

- Mercury

- Margolin Bros. Engineering & Consulting

- MiCiM

- Saan Zahav

- Skorka Architects

- Yeda Engineering

Support Infrastructure Providers

- ABB

- Caterpillar

- Cummins

- Delta Electronics

- Eaton

- ETAP

- HITEC Power Protection

- Johnson Controls

- Keysight Technologies

- Legrand

- Mitsubishi Electric

- Rittal

- Rolls-Royce

- Schneider Electric

- Siemens

- STULZ

- Vertiv

Data Center Investors

- Adgar Investments & Development

- Amazon Web Services

- Bezeq International

- Bynet Data Communications

- Compass Datacenters

- EdgeConneX

- Global Technical Realty

- MedOne

- Microsoft

- Oracle

- Serverfarm

New Entrants

- Anan

- Mega Data Centers

- MultiDC - Data Center Campus

- NED

- Serverz Data Center

- Techtonic

The report includes the investment in the following areas:

- IT Infrastructure

- Server Infrastructure

- Storage Infrastructure

- Network Infrastructure

- Electrical Infrastructure

- UPS Systems

- Generators

- Transfer Switches & Switchgears

- PDUs

- Other Electrical Infrastructure

- Mechanical Infrastructure

- Cooling Systems

- Rack Cabinets

- Other Mechanical Infrastructure

- Cooling Systems

- CRAC and CRAH Units

- Chillers Units

- Cooling Towers, Condensers and Dry Coolers

- Other Cooling Units

- General Construction

- Core & Shell Development

- Installation & Commissioning Services

- Building & Engineering Design

- Fire Detection & Suppression Systems

- Physical Security

- Data Center Infrastructure Management (DCIM)

- Tier Standard

- Tier I & II

- Tier III

- Tier IV

KEY QUESTIONS ANSWERED

1. How big is the Israel data center market?2. What factors are driving the Israel data center market?

3. What is the growth rate of the Israel data center market?

4. How much MW of power capacity will be added across Israel during 2025-2030?

Table of Contents

Companies Mentioned

The companies mentioned in this Israel Data Center market report include:- Broadcom

- Cisco

- Dell Technologies

- Fujitsu

- Hewlett Packard Enterprise

- Hitachi Vantara

- IBM

- Lenovo

- NetApp

- Ashtrom Group

- Auerbach Halevy Architects

- Electra Group

- M+W Group

- Mercury

- Margolin Bros. Engineering & Consulting

- MiCiM

- Saan Zahav

- Skorka Architects

- Yeda Engineering

- ABB

- Caterpillar

- Cummins

- Delta Electronics

- Eaton

- ETAP

- HITEC Power Protection

- Johnson Controls

- Keysight Technologies

- Legrand

- Mitsubishi Electric

- Rittal

- Rolls-Royce

- Schneider Electric

- Siemens

- STULZ

- Vertiv

- Adgar Investments & Development

- Amazon Web Services

- Bezeq International

- Bynet Data Communications

- Compass Datacenters

- EdgeConneX

- Global Technical Realty

- MedOne

- Microsoft

- Oracle

- Serverfarm

- Anan

- Mega Data Centers

- MultiDC - Data Center Campus

- NED

- Serverz Data Center

- Techtonic

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 110 |

| Published | February 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 0.66 Billion |

| Forecasted Market Value ( USD | $ 1.39 Billion |

| Compound Annual Growth Rate | 13.2% |

| Regions Covered | Israel |

| No. of Companies Mentioned | 54 |