Speak directly to the analyst to clarify any post sales queries you may have.

The New Zealand elevator market by the installed base is expected to reach 18,462 units by 2028. Green star-rated building, One Queen Street in Auckland, will be redeveloped and comprises 14,300 sqm commercial space with an investment of USD 174 million. In its second stage, a commercial bay will comprise luxurious hotels, office space, and retail space with an investment of USD 1 billion and is anticipated to be finished by 2023. This redevelopment will give support to the New Zealand elevator and escalator market.

Escalators used in the public transit sector accounted for the largest share of around 38.5% in 2021 due to increasing public transit projects in the pipeline. The New Zealand escalators market by the installed base is expected to reach 5,213 units by 2028.

KEY HIGHLIGHTS

a) The Artificial Intelligence Forum of New Zealand (AIFNZ) aims to increase New Zealanders' knowledge of artificial intelligence (AI) and its capabilities. The swift development of AI technologies presents significant opportunities and difficulties. The University of Auckland will get millions of dollars from the New Zealand government to better investigate and embrace the power of artificial intelligence (AI). In 2019, about NZ$ 4 million was committed to this field of study.b) The Emissions Reduction Plan outlines the steps that will be taken to satisfy the first emissions budget (2022-2025), and it puts us on the right track to comply with the second and third emissions budgets (2026- 2030). This will make it possible to transition to a low-emission future feasibly and cheaply. Every action and initiative the Building for Climate Change program takes will be in collaboration with the building and construction industry to ensure everything is implemented correctly.

c) Currently, 20% of New Zealand's carbon emissions are attributable to the built environment. The council is recommending that the Building Code be modified in three stages, with the use of fossil fuels being completely phased out by 2030 and restricted to new construction by 2026. There are currently more than 3000 green construction projects underway around the nation. These include 170 newly certified Green Star buildings, with another 70 undergoing evaluation.

d) Wellington has 152 personal cable cars, also known as incline lifts. In the past, the city's hills were home to over 300 personal cable cars, but regulations were implemented in 2005. The demand for cable cars and inclined elevators has increased due to their ability to increase a property's worth and the fact that accessible locations in Wellington are getting more challenging to obtain. Depending on the terrain, installing one can cost between USD 150,000 and USD 200,000 in addition to ongoing maintenance expenses.

e) The cost of numerous essential commodities for construction projects, including steel and timber, has skyrocketed. In contrast, the COVID-19 pandemic's impact on the supply chain for materials and labor can be traced as the problem's origin. New obstacles, such as geopolitical risks like the Ukraine War, continue to pressure prices at a time when demand is rising due to government-led infrastructure projects. The cost of building new homes rose by 18% in the March 2022 quarter compared to the March 2021 quarter, the fastest growth ever observed since the survey launched in 1985, according to the most recent Stats NZ Consumer Price Index.

SEGMENTATION ANALYSIS

Elevator Market Segmentation by

Machine Type

- Hydraulic and Pneumatic

- Machine Room Traction

- Machine Room Less Traction

- Others

- Climbing

- Elevators

- Industrial Elevators

Carriage Type

- Passenger

- Freight

Capacity

- 2-15 Persons

- 16-24 Persons

- 25-33 Persons

- 34 Persons and Above

End-User

- Commercial

- Residential

- Industrial

- Others

- Public Transit

- Institutional

- Infrastructural

Escalator Market Segmentation by

Product Type

- Parallel

- Multi Parallel

- Walkway

- Crisscross

End-User

- Public Transit

- Commercial

- Others

- Institutional Sector

- Infrastructure

- Industrial

A Rise In Residential And Commercial Building Activity Is Expected To Drive The New Zealand elevator and escalator market

1. Canterbury authorities have experienced an increase in new dwelling building authorizations in 2022 compared to 2021 after a relatively stagnant growth in new dwelling permits across most communities. With 23.1 new permits given per 1,000 residents in the Selwyn District in 2021-2022, it continues to have the highest proportion, followed by the Mackenzie District with 15. The lowest rate was three per 1,000 inhabitants in Waimate District.2. Auckland Council has financed around USD 257 million for a high-rise mixed-use residential project around Aotea train station. The development comprises nine levels of commercial space, a public plaza, and 60 apartments. After the completion of the City rail link in 2024, construction of Aotea Central will commence.

3. An agreement between New Zealand’s SkyCity Entertainment Group and the Government of New Zealand was established to complete the extended project of the New Zealand International Convention center (NZICC). This project is still under planning and is anticipated to be completed in 2024. The development is worth USD 427 million.

4. With an investment of USD 142 million from Australian developers, Ninety-four feet are commencing the construction of a hotel & luxury apartment tower in Auckland, Wellington, and Queenstown. Initial decommissioning was completed, and IconCoPty Ltd (NZ) signed a contract to deliver 41 levels, 225 rooms hotel Indigo Auckland and mixed-use development. Such development plans will propel the growth of the New Zealand elevator and escalator market.

Governments Effort To Expand Infrastructure Across Nation To Increase The Demand For New Installations

1. The increasing population drives the plan of shifting the Port of Auckland to Northland, where there is an addition of 77ha of prime waterfront land for public and a new cruise terminal. It is estimated to value around ~USD 6 billion to shift the port and is anticipated to be finished by 2036.2. Enabling works of the Auckland Airport Transport hub began in June 2022. The development is worth USD 189 million, transforming how people commute directly to the airport. This project is under construction and is expected to be finished by 2027.

3. One of New Zealand’s most significant transportation projects, the Karangahape Station, is a part of CRL with an investment of USD 2.5billion. This was a 3.45km underground twin tunnel rail line below Auckland City Center. This project is still under construction and is scheduled for completion in 2024.

Regulations For Maintenance of Elevators And Escalators In New Zealand By Building Act To Create Demand

1. Maintenance and modernization in the New Zealand elevator and escalator market accounted for 69.7% and 30.3%, respectively, for 2021.2. Since there has been a 40% increase in accidents in New Zealand from 2011 to 2016. In the year 2015, the country implemented the Building Act. The Building Act acknowledges the value of elevators to the built environment and the possible risk to life safety they may present. Checks are therefore necessary during the design stage, throughout construction, and after it is finished. The Building Act mandates routine inspections and maintenance to ensure the elevator maintains its approved standard.

REGIONAL ANALYSIS

1. Auckland has always been the largest market for construction and building, contributing around 40% to the total national construction value and 42% of new dwellings approved in 2021.2. All Canterbury authorities have experienced an increase in new dwelling building authorizations in 2022 compared to 2021 after a relatively stagnant increase in new dwelling permits across most communities.

VENDOR LANDSCAPE

a) The key players in the New Zealand elevator and escalator market are KONE, Otis, Hyundai Elevator, TK Elevator, Mitsubishi Electric, Hitachi, Schindler, and Fujitec.b) The top 4 prominent vendors, including TK Elevator, Otis, KONE, and Schindler, account for 31% of the market share in New Zealand.

c) The newest addition to Auckland is Commercial Bay, situated in the city's core business center. Using its transit management system Schindler PORT, Schindler provided 20 escalators and 26 elevators to connect horizontal and vertical transportation while optimizing passenger itineraries.

d) In November 2019, KONE introduced the built-in connectivity series as a standard in New Zealand. Additional software services, anti-fingerprint, anti-finger scratch, and anti-microbial surfaces, are available in the DX Class Elevator series.

e) The TK Elevator in New Zealand opened the first walks by Thyssenkrupp, creating opportunities by providing modular space-saving concepts, simplified planning, integration and operation, and innovation, especially in the digital era and space.

Key Vendors

- Hyundai

- TK Elevator

- Schindler

- Hitachi

- KONE

- Otis

Other Prominent Vendors

- Blue Star Elevators

- Kleemann

- Vestner

- Stannah Lifts

- Access Automation

- Power Glide Elevators

KEY QUESTIONS ANSWERED

1. How big is the New Zealand elevator and escalator market?2. What is the number of installed bases in the New Zealand elevators and escalators market in 2021?

3. Who are the key companies in the New Zealand elevator and escalator market?

4. What will be the growth rate of the New Zealand elevator and escalator market?

5. What are the key drivers for the New Zealand elevator and escalator market?

Table of Contents

Companies Mentioned

- P&G

- Edgewell

- BIC

- Harry’s

- Alleyoop

- All Girls Shave Club

- BeBodywise

- Bombay Shaving Company

- Carmesi

- Dorco

- Edwin Jagger

- Estrid

- Feather

- FFS Beauty

- Grüum

- Hanni

- HAPPY LEGS CLUB

- Jillrazor

- Jungle Culture

- Kai

- Kitsch

- LetsShave

- Make My Shave

- NUDDY

- OSCAR RAZOR

- Ouishave

- Parker Safety Razor

- Push

- PRESERVE

- Pure Silk

- Redroom Technology

- Shiseido Company

- Sirona Hygiene Private Limited

- Sterling Shave Club

- ShaveMOB

- Super-Max

- THE WOMEN'S SHAVE CLUB

- Tweezerman International

- The Shave Union

- Women’s India Personal Care

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

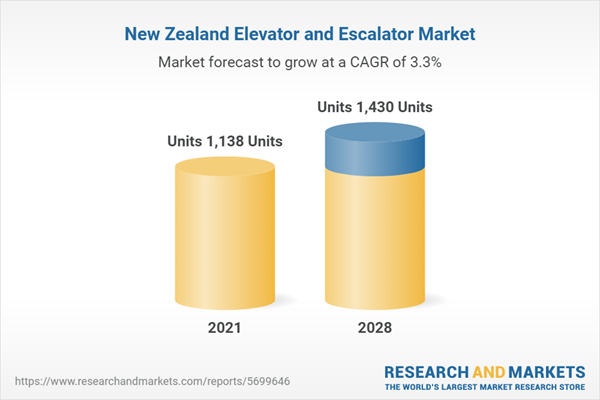

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 106 |

| Published | December 2022 |

| Forecast Period | 2021 - 2028 |

| Estimated Market Value ( Units | Units 1138 Units |

| Forecasted Market Value ( Units | Units 1430 Units |

| Compound Annual Growth Rate | 3.3% |

| Regions Covered | New Zealand |

| No. of Companies Mentioned | 40 |