Speak directly to the analyst to clarify any post sales queries you may have.

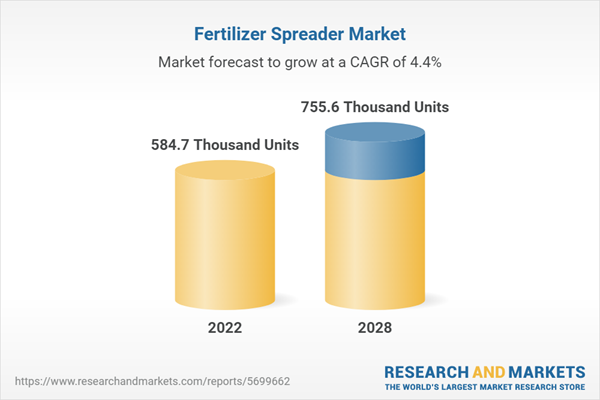

The global fertilizer spreader market is expected to grow at a CAGR of 4.3% during 2022-2028.

For several governments, food self-sufficiency is the key agenda due to the decline in arable land in the name of urbanization, exploitation of natural resources, and a massive shift in food production and the global consumption pattern. Therefore, it has become imperative for governments to adopt efficient and sustainable farming practices to ensure food security and safety. Increasing focus on farm mechanization in developing countries is increasing the demand for fertilizer spreaders as they will help increase output yield, thereby contributing to the growth of the fertilizer spreader market. Moreover, the growing concept of precision farming will increase the demand for technologically advanced fertilizer spreaders in developed countries.

Precision farming is a management concept under which the plantation of crops takes place as per soil specification. The increasing adoption of precision farming is set to become the most valuable driver for fertilizer spreader sales. Through calibrating systems to control fertilizer quantity and mass flow controls to track the amount of fertilizer needed per subplot, precision fertilizer spreaders will aid in increasing agricultural yields and productivity. These spreaders will also assist in soil mapping, using satellite technology to direct fertilizer application and software programs that analyze soil nutrients to decide fertilizer application. Some well-known manufacturers of precision products in the fertilizer spreader market include KUHN, AMAZONE, BBI, and Sulky.

The fertilizer spreader market witnessed a recovery in 2021 after the decline in 2019 and 2020. India, China, and the US are the leading markets with the highest sales. In contrast, China witnessed a tremendous increase in the sale of fertilizer spreaders in the segment of mounted spreaders. The country is characterized by many small and medium-scale farmers with an average land holding size of 1.15 ha. Further, Turkey emerged as a rapidly-growing market in 2021. The fertilizer spreader market in Turkey emerged as the second fastest-growing market globally.

Further, increasing the number of technologically advanced fertilizer spreaders and implements is the solution to save money and time and increase yields. The governments are keen on increasing the farm mechanization rate among farmers, boosting the demand and sales of new equipment in the global fertilizer spreader market. The mechanization of farms is deemed necessary for the agriculture sector as it has the potential to improve food production and reduce the labor shortage.

Geographically, U.S. fertilizer spreader sales grew by approximately 10.3%, and the mounted type of spreader segment enjoyed high growth compared to 2020. The factors for the steady growth of the mounted type segment of fertilizer spreaders were good business turnover among hobby and livestock farmers. The MEA and Latin America still have negligible farm mechanization, and vendors can explore these regions with a portfolio of mounted and trailed spreaders suitable for the specific regions. The fertilizer spreader market is currently in the growth stage, and manufacturers are looking for capacity augmentation in the countries.

MARKET TRENDS & OPPURTUINITES

Development of Smart and Autonomous Spreader

A new frontier of innovation is emerging in the global fertilizer spreader market as agriculture meets digital technologies, opening various paths to a smart agricultural future. Fertilizer spreader manufacturers have become very competitive, and companies constantly strive to innovate and ensure product differentiation at affordable prices. Currently, fertilizer spreader has state-of-the-art technology developed by farm equipment manufacturers to collect and use for analysis and real applications. GPS technology on fertilizer spreaders and other equipment helps farmers with field mapping, soil sampling, and crop scouting. It also allows them to work during low visibility field conditions such as rain, dust, and fog with maximum efficiency.

Increasing Farm Mechanization

Prominent and emerging countries across the globe are witnessing a high rate of farm mechanization; however, the level of mechanization varies among geographical regions. In agricultural countries such as India, China, and the US, there is a need to implement advanced technology to increase production and net incomes due to high growth in the countries. These countries are also adopting farm mechanization at a faster rate. Fertilizer spreaders used on the farm generally account for some of the significant parts of mechanization in the country. In 2021, China and India were the largest fertilizer spreader market in terms of sales in APAC. According to the World Bank, more than 50% of the population will migrate to cities by 2050. This migration will drastically affect the workforce engaged in the agriculture sector, further boosting the contribution of farm mechanization.

SEGMENTATION INSIGHTS

INSIGHTS BY MOUNTING TYPE:

The mounted fertilizer spreader segment generated the highest sales in almost all regions worldwide, and the segment witnessed shipments of 299 thousand units in 2022. This segment mainly includes fertilizer spreaders mounted on a truck or tractor.

Granular fertilizers are often dispersed using these spreaders, sometimes referred to as rotating or centrifugal spreaders. The future growth of this market will be positively impacted by the consolidation of farmland, as these spreaders are primarily used on large farms. In addition, the manufacturers are releasing newly mounted spreaders with enhanced features, including GPS speed sensors to maintain the proper speed, balanced fertilizer distribution, and pressure-based nozzle control systems to guarantee a consistent pattern in fertilizer spreading.

Segmentation by Mounting

- Mounted

- Trailed

- Self-propelled

INSIGHTS BY FERTILIZER TYPE:

Solid fertilizer dominates the industry and witnessed shipments of 461 thousand units in 2022. Factors such as being an inexpensive option, demanding virtually no supplies and little equipment, and being more cost-efficient compared to liquid fertilizer are boosting the industry share of solid fertilizer in the global fertilizer market.

The liquid fertilizer spreader market is expected to grow at a CAGR of 3.9% during the forecast period. Many farmers are turning to liquid fertilizers due to the increase in cropland and the growing need to increase crop production because plants can absorb these nutrients and provide results more quickly.

Segmentation by Fertilizer

- Solid

- Liquid

GEOGRAPHICAL ANALYSIS

North America accounts for almost 24.5% of the global fertilizer spreader market in terms of volume. The region represents a high level of farm mechanization. The farmers in the region, both from the US and Canada, are wealthy and have sufficient money to invest in agricultural machinery such as fertilizer spreaders, tractors, cultivators, etc. In addition, the farmers in the region also benefit from easy credit loans for purchasing agricultural machinery. The US and the Netherlands are key exporters of agricultural products to developing countries such as China, where the food demand is relatively high due to the high population.

The APAC region is expected to witness the fastest growth in the global fertilizer spreader market and is expected to grow at a CAGR of 4.62% during the forecast period. Farm mechanization in the region is advancing steadily. The increasing demand for farm machinery, such as fertilizer spreaders, is mainly to improve per unit yield in the region and mitigate the declining farming population. In the last few years, governments of these countries have increased their support to farmers by offering subsidies and incentives for purchasing fertilizer spreaders and other agricultural equipment and increasing regulations to facilitate the development and modernization of the farming industry.

Segmentation by Geography

- North America

- US

- Canada

- Europe

- Germany

- France

- Italy

- Russia

- Spain

- APAC

- India

- China

- New Zealand

- Australia

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Turkey

- South Africa

VENDOR LANDSCAPE

The global fertilizer spreader market is moderately fragmented, with many local and international players. As consumers expect constant advancements and upgrades in agricultural equipment, the increasingly changing economic environment may hamper vendor growth. The current situation pushes vendors to adjust and improve their value proposition to attain a good business presence. The industry will likely witness growing consolidation due to the intensely competitive environment. These factors make it imperative for vendors to distinguish their products and service offerings through a clear and unique value proposition, or else they will not survive the highly competitive fertilizer spreader market.

AGCO Corp., Deere & Co., CNH Industrial, Kubota, and Adams Fertilizer Equipment are among the major vendors in the global fertilizer spreader market. The competition among these leading players on the global stage is high. Several players offer various agricultural equipment to achieve economies of scale. Other players in the industry are Salford Group, Kuhn Group, etc. The acquisition strategy was followed by most of the players on the path to becoming market leaders.

Key Company Profiles

- AGCO Corporation

- CNH Industrial

- Deere & Company

- Kuhn Group

- Amazone Werke

Other Prominent Vendors

- Adams Fertilizer Equipment

- Eurospand Cavallo

- CEA AGRIMIX

- Montag Mfg

- Salford Group

- Cleris

- Takakita

- Enorossi

- Vervaet

- Kuxmann

WHY SHOULD YOU BUY THIS REPORT?

This report is among the few in the market that offer outlook and opportunity analyses forecast in terms of:

- Market Size & Forecast Volume 2020-2028 (Units)

- Segmentation by Mounting type

- Segmentation by Fertilizer type

- Segmentation by Geography

- Major current and upcoming projects and investments

- Competitive intelligence about the economic scenario, advantages and benefits of fertilizer spreaders, market dynamics, and shares

- Latest and innovative technologies

- Import and export analysis

- COVID-19 impact analysis

- Company profiles of major and other prominent vendors

- Market shares of major vendors

KEY QUESTIONS ANSWERED

1. How big is the fertilizer spreader market?

2. What is the growth rate of the fertilizer spreader market?

3. What are the significant trends in the global fertilizer spreader market?

4. Who are the key players in the global fertilizer spreader market?

5. Which region has the most significant global fertilizer spreader market share?

Table of Contents

Companies Mentioned

- AGCO Corporation

- CNH Industrial

- Deere & Company

- Kuhn Group

- Amazone Werke

- Adams Fertilizer Equipment

- Eurospand Cavallo

- CEA AGRIMIX

- Montag Mfg

- Salford Group

- Cleris

- Takakita

- Enorossi

- Vervaet

- Kuxmann

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 199 |

| Published | December 2022 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value in 2022 | 584.7 Thousand Units |

| Forecasted Market Value by 2028 | 755.6 Thousand Units |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |