Game developers are continuously introducing fresh themes, mechanics, and genres, attracting new players, which is supporting the board games market growth. The introduction of strategy-based, cooperative, and immersive games diversifies options for players, appealing to different interests. These innovations cater to various age groups, ensuring broad games appeal across demographics. Interactive storytelling and unique designs make games more engaging. The rise of modular, customizable, and thematic games offers more replay value, keeping players engaged.

Companies are experimenting with hybrid gaming experiences, blending traditional and digital elements to reach a wider audience. Board games that incorporate current trends and popular culture attract attention and foster engagement. Expansion of niche categories like solo board games, appeals to specific player preferences. Gamers are drawn to novel experiences, including limited edition releases, fostering collector-driven demand.

The increasing demand for family entertainment is substantially driving the market in the United States. Board games offer a screen-free activity that families can enjoy together, strengthening social bonds. As more families seek quality time, board games are becoming a preferred choice for shared fun and learning. Parents are drawn to educational games that increase children’s cognitive skills while offering entertainment. The variety of game genres available ensures something for all ages and interests. Cooperative gaming and family-friendly themes encourage diversity and appeal to a wide range of players. As families prioritize engaging, interactive pastimes, board games fill a unique niche.

Events like family game nights are gaining traction, contributing to sustained demand. Furthermore, board games serve as an alternative to digital distractions, encouraging face-to-face interaction. To cater this demand, in October 2024, Hasbro and Top Trumps USA launched “Monopoly: Queens Edition” in New York at Queens Centre Mall, celebrating local landmarks. The game featured iconic places like parks, streets, and cultural sites across Queens. Special game pieces and spaces represented the borough’s unique identity. The edition was well-received by residents, local leaders, and collectors, highlighting the community’s pride.

Board Games Market Trends:

Increasing number of social gaming events

The revival of social gaming is positively influencing the market. The rising number of individuals seeking face-to-face interactions as an alternative to digital communication, often resort to these social gaming events. Apart from this, another factor increasing the demand for board games is the rising number of tournaments and conventions across the globe, which contribute toward the creation of a potent gaming community of enthusiasts. For instance, as per GEN CON, one of the leading annual tabletop gaming conventions, number of people participating in its event, which marked its 20th anniversary in Indianapolis, was 70,000 in 2023.Players in these types of events socialize, try new games, make, and share strategies giving participants an exhilarating experience. This direct interaction between individuals at these events builds brand loyalty among customers which leads to a longer retention rate. The board games market value is experiencing significant growth, driven by these factors, and is projected to reach substantial figures as user engagement and participation in such events continue to rise.

Educational and cognitive benefits offered by games

Board games' cognitive and educational advantages are major drivers of market expansion. Parents and educators find these games intriguing because they enhance critical thinking, problem-solving, and decision-making abilities. Many games incorporate learning elements, making education enjoyable and interactive for children. Games focused on strategy, math, and language development help enhance cognitive abilities in players of all ages. A report published by THE CITY OF ASHIVILLE, titled “WELLNESS WEDNESDAY- 5 MENTAL BENEFITS OF BOARD GAMES”, stated that according to a study conducted in 2013, found that the risk of dementia was reduced to 15% among people who engage in board games as compared to non-players.These games also encourage memory retention, focus, and attention to detail, which are essential developmental skills. Collaborative games promote teamwork and communication, helping players develop interpersonal and social skills effectively. Games with challenges and problem-solving tasks foster creativity and analytical thinking in a fun setting. Apart from children, adults are also adopting board games to work toward the development of their cognitive development and improve their mental stimulation.

Growing number of e-commerce platforms

Online platforms offer unmatched convenience, enabling customers to explore and purchase games from anywhere around the world. E-commerce platforms enable independent and niche game developers to efficiently access a larger audience. A huge selection of games that appeal to a range of age groups and tastes may be found in digital markets. In-depth product descriptions, ratings, and reviews help customers make well-informed decisions when making purchases. These platforms often provide discounts and exclusive deals, making board games more affordable and appealing. Faster delivery services offered by online retailers ensure that customers receive products promptly, enhancing satisfaction.The global accessibility of e-commerce bridges geographical limitations, expanding market reach for board game manufacturers. The International Trade Administration noticed a substantial upward trend in the global e-commerce retail sales- of 8% in between 2019-2020. Apart from this, the data published on the website of The research shows that the global e-commerce market reached USD 21.1 Trillion in 2023 and is projected to reach USD 183.8 Trillion by 2032, exhibiting a growth rate of 27.16% during 2024-2032.

Rise of Board Game Cafes and Themed Tabletop Games

Board game cafes provide a unique social environment where players can gather, explore a variety of games, and enjoy curated experiences in a relaxed setting. These venues cater to both casual players and enthusiasts, offering access to a diverse selection of games without the need for ownership. For instance, the Space at Kaleidoscope, Myrtle Beach's first board game cafe, opens on February 8, 2025, at 519 Broadway St. A January 18 meet-and-greet offers discounted memberships and details. The cafe features board games, snacks, and community events. Apart from this, the rise of themed tabletop games, inspired by popular franchises, historical events, and fantasy worlds, has significantly enhanced user interest.These games often feature immersive storytelling and visually appealing components, attracting a broader demographic, including younger audiences and families. The combination of engaging themes and accessible social spaces is expanding the reach of board gaming beyond traditional markets, creating a vibrant community and driving consistent market growth. Such innovations contribute to the increasing value and demand for board games globally.

Board Games Industry Segmentation:

The research provides an analysis of the key trends in each segment of the global board games market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, game type, age group, and distribution channel.Analysis by Product Type:

- Tabletop Games

- Card and Dice Games

- Collectible Card Games

- Miniature Games

- RPG Games

In card and dice games, holds a notable board games market share, as they are the primary game elements in place of a board. Games in this category include deck of cards which consists certain rules in regard to ranking and combination of these cards. Mostly played games in this category include poker, bridge, Yahtzee and farkle.

Collectible card games refer to gameplay mechanism which require players to collect and trade cards in order to build a personalized deck. These games are gaining traction on account of the loyal following and continuous release of new cards. THE NEW YORK TIMES stated that one of the most renowned CCG named “MAGIC: THE GATHERING”, collected a massive revenue of approximately $1.1 billion in the year 2022. The report also states that this game held 18% of the overall revenue of Habro in the previous year.

Miniature games are distinctive on account of their detailed models and figures which represent characters of units in the game. This game is particularly adopted by individuals who enjoy the artistic aspect of gaming as they often spend a substantial amount of time painting and customizing their miniatures. The game requires some strategy and tactics which is appealing to a large audience which appreciates war-gaming and role-playing situations.

Role-playing games (RPGs) are another type of subsegment available in the market. These games contain character development and storytelling which offer an extremely immersive experience. Individuals who are more into creative problem-solving or narrative-driven games are the target audience.

Analysis by Game Type:

- Strategy and War Games

- Educational Games

- Fantasy Games

- Sport Games

- Others

Educational games provide double benefits, including entertainment and learning. They are meant to teach or inculcate certain skills or concepts among the players. These games target young individuals learning arithmetic as well as adults who are interested in science or history. The increasing trend of game-based learning is leading to a major adoption of the educational games, thus creating a positive market forecast. According to The research, the global game-based learning market is projected to reach US$ 71.7 Billion by 2032, expanding at a growth rate of 15.8% during 2024-2032.

Fantasy games hold a major part of the market catering to individuals indulging in immersive storytelling and deep imaginative settings. These games include detailed characters, elaborate narratives, and a complicated world-building that allows creativity and strategic thinking. One of the most popular games is Dungeons & Dragons.

Sports games apprehend the competitive nature and excitement of athletic events in a tabletop format which is exciting for a major portion of sports enthusiasts. They include a wide variety of games like basketball, soccer, and football which allows the players to plan plays, manage teams, and enjoy the thrill of sport strategy. Their popularity can also be accredited due to their ability to make individuals learn about rules and strategies of numerous sports.

Analysis by Age Group:

- 0-2 Years

- 2-5 Years

- 5-12 Years

- Above 12 Years

This group is particularly attracted to games that are simple yet intellectually stimulating, fostering a sense of achievement. This age group's extensive selection of games contributes to the market's expansion. Additionally, board games are often used as social tools, allowing children to connect and collaborate. The segment benefits from a growing preference for non-digital entertainment, as parents look for alternatives to screen time. Toy and game manufacturers focus on this age group to develop games that blend fun and learning.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

The growing number of dedicated board game cafes and events at these stores enhance market visibility. Collectors and enthusiasts prioritize specialty stores due to their focus on niche and premium board game offerings. Local and independent game stores provide more customized and unique experiences compared to large retail chains. Specialty stores also have the advantage of hosting game nights, which engage customers directly with products. These stores allow customers to explore games before purchasing, fostering stronger product connections.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The limited edition featured customized game pieces like basketballs, sneakers, rings, and jersey tokens. The board highlighted milestones from James's life, with “Bron Bucks” replacing traditional money. The launch included a life-sized game experience for I Promise School students in Akron, Ohio. Moreover, the well-established retail infrastructure, making games widely accessible. North America's varied consumer needs are met by specialized board game websites and online commerce platforms. upliftment is a major factor driving the market growth. Other than this, key players are undertaking strategic marketing steps in order to expand their presence globally and cater to a wider audience.

Key Regional Takeaways:

United States Board Games Market Analysis

The growth of tabletop gaming communities and growing demand for family-friendly entertainment are driving the board game market in the US. Monopoly, Scrabble, and Catan are the most popular board games, with more than 50% of American homes owning at least one. Most of millennials say that playing board games is their favorite pastime, making them important contributors. The market is also being fueled by the growing trend of game cafes. Educational board games for kids and teens have gained popularity as parents want activities that are screen-free and can help build skills.Moreover, the holiday season accounts for a large portion of sales, as most annual board game purchases happen in November and December. Additionally, the extensive availability of board games through both online platforms and retail outlets enhances accessibility. Popular culture, fueled by nostalgia and innovative game releases, further contributes to sustained board games market growth.

Asia Pacific Board Games Market Analysis

The market in the Asia-Pacific region is gradually growing due to the growing trend of international games. The market is dominated by countries like China, Japan, and India, wherein, China alone generates USD 1.1 Billion from selling board games in 2023, according to industry reports. Board games with themes from anime and manga are most popular, especially in Japan. Urban social gaming culture is gaining momentum, and board game cafes are becoming popular, especially in cities like Bangalore, Tokyo, and Beijing. In addition, international board games are now easily accessible with the help of online shopping platforms.In the region, e-commerce accounts for more than 50% of all purchases. Festivals and family gatherings are also encouraging demand as cultural theme-based games are enjoyed by the local audience. In addition, the sector is growing as disposable income in APAC countries is rising. Industry studies predict that by 2033, the disposable income per capita in 18 Asia-Pacific megacities will have increased by more than 50%.

Europe Board Games Market Analysis

The board game market in Europe is thriving due to its strong family-oriented customs and rich tabletop gaming legacy. According to an industry report, nearly half of the German households, own strategy board games like Catan and Carcassonne, driving a significant market share. Thirty percent of European individuals said they prefer environmentally friendly board games, which indicates that there is a growing demand for responsibly created and eco-friendly products. More than 150,000 people attend board game conferences each year, such as the Essen Spiel in Germany, which assist in driving sales. Appealing to European audiences with its problem-solving aspect, cooperative and collaborative games attract a wider base of audience.Educational board games are gaining traction in the UK and France, especially in educational institutions. The increasing disposable incomes, coupled with an increased emphasis on leisure activities are growing the demand for indoor entertainment solutions like board games. The distribution landscape in the region is being propelled by the rise of the internet and social media. According to reports, more than 60% of board game sales in the region are contributed by retail giants such as Sainsbury's, Target, Carrefour, Metro, Costco, etc.

Latin America Board Games Market Analysis

Latin America's board game business is driven by an increasing middle class and by the interest of the people in engaging in social and family activities. The biggest markets for board games in the region are Mexico and Brazil. According to the 2020 Kids Insights LatAm Industry Report, arts & crafts and board games are more popular among older age groups, which increased by 60% from Q2 to February 2021. New strategic games and classic games like Lotería are also gaining traction due to the growing trend of historical games. With over 10% of schools within the region using games to learn, board games are being integrated into learning environments.Rising awareness among individuals and community engagement are also bolstering the board games industry growth. Events such as the Mexico City Board Game Festival are further increasing the market growth. E-commerce platforms have witnessed an increased sale of over 30%. They also offer convenient access to both local and international games, especially during holiday season. According to the statistics by Kidscorp, more than 72% Latin American children search for new games and toys online before buying them.

Middle East and Africa Board Games Market Analysis

Board games are gaining traction in the Middle East and Africa region due to expanding urbanization. Local themes and cultural elements incorporated into games attract regional audiences and enhance appeal. Board game cafes and gaming hubs are emerging in cities, promoting engagement and market visibility. Younger populations seeking alternatives to digital gaming are progressively attracted to board games. The region’s interest in family-friendly activities and group entertainment contributes to sustained demand.Although contemporary board games are gaining traction school and youth programs and NGOs, the traditional Mancala games are still popular in the Africa Region. Accessibility has improved as a result of the growth of online shopping channels, especially in urban and suburban locations. As per an industry report smartphone penetration in the Sub-Saharan Africa reached 50% in 2023.

Competitive Landscape:

Key players are innovating by creating new and exciting game concepts to capture customer interest. Their research and development (R&D) efforts focus on producing games with unique mechanics and engaging themes. Market leaders are dominating through their strong brand presence and diverse portfolios. These companies make significant marketing investments in an effort to expand their audience and boost brand recognition. They also focus on collaborations with popular franchises to create games that attract fans. Distribution strategies by key players ensure games reaches the global audience, both online and offline. By tapping into different age groups and interests, these companies expand the market’s reach.They also support niche markets by offering specialized games that appeal to collectors and enthusiasts. For instance, in August 2024, the Royal Horticultural Society (RHS) announced a partnership with Gibsons Games Ltd. for puzzles and games. This collaboration planned to introduce RHS-themed products, launching at retail in January 2025. The range included puzzles, card games, and a gardening-inspired board game. Many key players are embracing digital versions of their games, extending their reach into the online gaming market. The development of educational and family-friendly games further strengthens the appeal of board games.

The report provides a comprehensive analysis of the competitive landscape in the board games market with detailed profiles of all major companies, including:

- Buffalo Games

- Cartamundi Asia Pacific

- Clementoni Spa

- CMON Limited

- Franckh-Kosmos Verlags-GmbH and Co. KG

- Fremont Die Consumer Products Inc.

- Gibsons Games Ltd.

- Goliath Games

- Hasbro Inc.

- Mattel Inc.

- Mindware Inc.

- PD Verlag GmbH and Co. KG

- The Walt Disney Co.

Key Questions Answered in This Report

- What is board games?

- How big is the global board games market?

- What is the expected growth rate of the global board games market during 2025-2033?

- What are the key factors driving the global board games market?

- What is the leading segment of the global board games market based on age group?

- What is the leading segment of the global board games market based on distribution channel?

- What are the key regions in the global board games market?

- Who are the key players/companies in the global board games market?

Table of Contents

Companies Mentioned

- Buffalo Games

- Cartamundi Asia Pacific

- Clementoni Spa

- CMON Limited

- Franckh-Kosmos Verlags-GmbH and Co. KG

- Fremont Die Consumer Products Inc.

- Gibsons Games Ltd.

- Goliath Games

- Hasbro Inc.

- Mattel Inc.

- Mindware Inc.

- PD Verlag GmbH and Co. KG

- The Walt Disney Co

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | June 2025 |

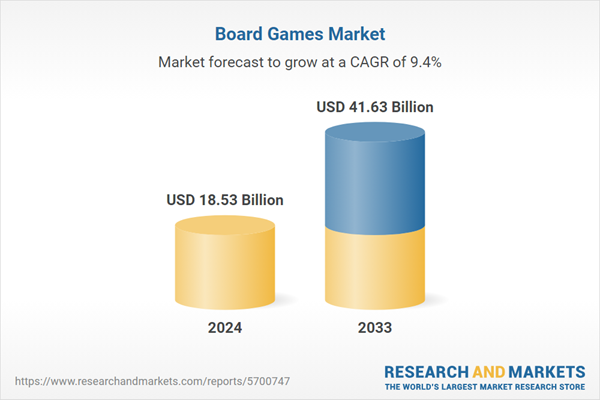

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 18.53 Billion |

| Forecasted Market Value ( USD | $ 41.63 Billion |

| Compound Annual Growth Rate | 9.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |