ICT Investment in Government Market Analysis:

- Major Market Drivers: The rising need for improved public service delivery and enhanced cybersecurity represents the major driver of the market. Governments are increasingly adopting digital solutions to streamline operations, reduce costs, and enhance citizen engagement. Regulatory compliance requirements mandate the implementation of advanced ICT systems for data management and security.

- Key Market Trends: The widespread adoption of cloud computing and AI technologies represents the key trend in the market. Cloud services offer scalability, cost-efficiency, and improved collaboration, driving their integration into government operations. Artificial Intelligence (AI) and machine learning (ML) are being leveraged for predictive analytics, enhancing decision-making and resource allocation.

- Geographical Trends: North America accounts for the largest region in the market. The increasing need for enhanced cybersecurity, improved public service efficiency, and digital transformation initiatives are creating a positive ICT investment in government market outlook across the region.

- Competitive Landscape: Some of the major market players in the ICT investment in government industry include Amazon Web Services Inc. (Amazon.com Inc.), Avaya Holdings Corp., Capgemini SE, Huawei Technologies Co. Ltd., and Nokia Corporation, among many others.

- Challenges and Opportunities: The market faces several challenges including budget constraints, which limit the ability to adopt and implement advanced technologies. However, the market also faces several opportunities such as the growing demand for digital transformation and e-governance solutions offer a vast potential for innovation and efficiency improvements.

ICT Investment in Government Market Trends:

Increasing Digital Transformation Initiatives

The push for digital transformation is another significant driver of the market growth. Governments are embracing modern technologies like cloud computing, artificial intelligence (AI), and the Internet of Things (IoT) to enhance operational efficiency and innovation. For instance, in August 2024, Tech giant Google announced partnering with the state government of Andhra Pradesh in India to provide Artificial Intelligence (AI) applications in sectors like agriculture, healthcare, sustainability, skill development, and startup ecosystems. A Memorandum of Understanding (MoU) is slated for signing between the state government and Google under the initiative "AI for Andhra Pradesh, Powered by Google".This comprehensive partnership intends to encompass AI applications in agriculture, healthcare, and sustainability, as well as skill development, startup ecosystems, AI workforce cultivation, MSME support through digital credit, and Al-driven governance. These technologies enable better data management, predictive analytics, and automation, which leads to cost savings and more effective governance, thus boosting the ICT investment in government market growth.

Growing Cybersecurity Concerns

With the rise of cyber threats and the increasing volume of sensitive data handled by government agencies, cybersecurity has become a top priority. According to industry reports, there were 2,365 cyberattacks in 2023 with 343,338,964 victims. 2023 saw a 72% increase in data breaches since 2021, which held the previous record. A data breach costs $4.45 million on average. Email is the most common vector for malware, with around 35% of malware delivered via email in 2023. Investments in advanced cybersecurity measures, such as threat detection, data encryption, and secure communication channels, are essential to protect government infrastructure and maintain public trust.For instance, in August 2024, Stellar Cyber introduced Multi-Layer AI, incorporating four distinct technologies, including machine learning (ML), graph ML, generative AI, and hyper-automation, into a single unified platform that reduces threat detection and response time. According to the ICT investment in government market forecast, robust cybersecurity frameworks will be pivotal in helping to prevent data breaches and ensure the integrity and confidentiality of government data, which is further expected to drive the market growth.

Rising Regulatory Compliance

Regulatory requirements necessitate the adoption of ICT systems to ensure compliance with data protection and privacy laws. Governments must implement secure and compliant ICT infrastructures to handle citizens' data responsibly. For instance, with under six months to go until the European Union Digital Operational Resilience Act (DORA) becomes applicable on 17 January 2025, DORA implementation projects are running full steam ahead.DORA lays down uniform requirements concerning information and communication technology (ICT) supporting the business processes of most regulated entities in the financial sector. It also extends the powers of the financial services’ supervisory authorities to ICT service providers deemed to be “critical” by the authorities. This drive toward regulatory adherence encourages investments in updated ICT solutions that meet legal standards and protect sensitive information.

ICT Investment in Government Market Segmentation:

The research provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on solution and technology.Breakup by Solution:

- Devices

- Software

- IT Services

- Data Center Systems

- Communication Service.

IT services accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the solution. This includes devices, software, IT services, data center systems, and communication services. According to the ICT investment in government market report, IT services represented the largest segment.The demand for IT services in the market is driven by the push for online services and citizen engagement necessitates robust ICT systems, enhancing accessibility and transparency. The shift to cloud solutions offers scalability and cost-effectiveness, making it attractive for government agencies. The rising concerns over cyber threats compel governments to invest in secure ICT infrastructures to protect sensitive data and systems.

These technologies are being integrated to enhance decision-making and streamline operations, further driving ICT investments in the public sector. Governments are increasingly adopting digital technologies to improve service delivery and operational efficiency, which is leading to higher ICT investments, thereby driving the ICT investment in government demand.

Breakup by Technology:

- IoT

- Big Data

- Cloud Computing

- Content Management

- Securit.

IoT holds the largest share of the industry

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes IoT, big data, cloud computing, content management, and security. According to the report, IoT accounted for the largest market share.The demand for IoT technology in the market is driven by several key factors IoT technologies automate processes, reduce manual intervention, and provide actionable data to streamline government operations and decision-making. IoT sensors and devices enable real-time monitoring and optimization of government infrastructure, such as transportation networks, utilities, and public facilities, leading to enhanced efficiency and cost savings. IoT devices with robust security features help safeguard government systems and data against cyber threats, a growing concern in the digital age. IoT-enabled services and applications enhance citizen engagement and improve access to government information and services.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Afric.

North America leads the market, accounting for the largest ICT investment in government market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for ICT investment in government.The market in North America is driven by several factors including governments increasingly adopting digital solutions to enhance efficiency and service delivery, leading to significant ICT investments. The shift towards cloud services enables scalable and cost-effective solutions, crucial for modernizing government IT infrastructures. The rising cyber threats necessitate investments in secure ICT systems to protect sensitive government data. The increasing integration of IoT, big data, and AI technologies is enhancing operational capabilities and improving public services. Governments are investing in ICT to meet compliance requirements and improve transparency and accountability in operations.

For instance, in April 2024, the Biden-Harris Administration announced that the U.S. Department of Commerce and Intel Corporation have reached a non-binding preliminary memorandum of terms (PMT) to provide up to $8.5 billion in direct funding under the CHIPS and Science Act to strengthen the U.S. supply chain and re-establish American leadership in semiconductor manufacturing. Leading-edge logic chips are essential to the world’s most advanced technologies like Artificial Intelligence (AI), and this proposed funding would help ensure more of those chips are developed and made domestically.

Competitive Landscape:

- The ICT investment in government market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the ICT investment in government industry include Amazon Web Services Inc. (Amazon.com Inc.), Avaya Holdings Corp., Capgemini SE, Huawei Technologies Co. Ltd., and Nokia Corporation.

- The market for ICT investment in the government is highly competitive, featuring major players such as IBM, Microsoft, Cisco Systems, and Oracle. These companies offer advanced solutions in cloud computing, cybersecurity, and AI to meet government needs. Emerging players like Amazon Web Services (AWS) and Google Cloud are also gaining traction with their scalable and innovative technologies. The market is characterized by strategic partnerships, continuous innovation, and a focus on secure, efficient, and compliant ICT infrastructures to support digital government initiatives. For instance, in July 2024, Huawei Technologies (Mauritius) Co., Ltd. announced its plan to provide 4,000 ICT courses and classes over the next four years at a DigiTalent 3.0 Launch Ceremony in Port Louis, Mauritius. These training opportunities will be provided by the Huawei ICT Academy, Huawei's Seeds for the Future program, training for government civil servants, SME digital transformation training, and digital literacy initiatives.

Key Questions Answered in This Report

- How big is the global ICT investment in government market?

- What is the expected growth rate of the global ICT investment in government market during 2025-2033?

- What are the key factors driving the global ICT investment in government market?

- What has been the impact of COVID-19 on the global ICT investment in government market?

- What is the breakup of the global ICT investment in government market based on the solution?

- What is the breakup of the global ICT investment in government market based on the technology?

- What are the key regions in the global ICT investment in government market?

- Who are the key players/companies in the global ICT investment in government market?

Table of Contents

Companies Mentioned

- Amazon Web Services Inc. (Amazon.com Inc.)

- Avaya Holdings Corp.

- Capgemini SE

- Huawei Technologies Co. Ltd.

- Nokia Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 143 |

| Published | June 2025 |

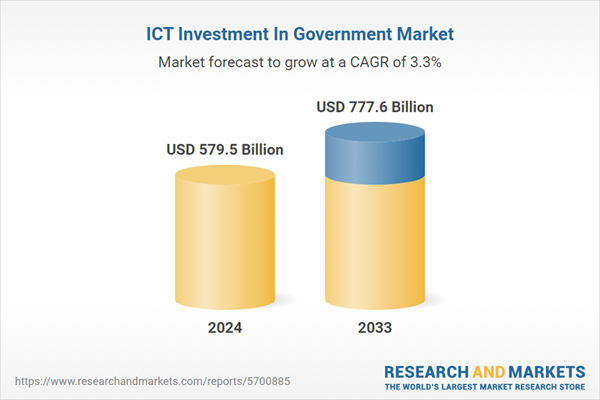

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 579.5 Billion |

| Forecasted Market Value ( USD | $ 777.6 Billion |

| Compound Annual Growth Rate | 3.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 5 |