Caprolactam refers to a white crystalline organic compound that stands as a vital precursor in the production of nylon 6, a synthetic polymer with widespread industrial applications. It boasts remarkable solubility in water and some organic solvents, and when heated, it undergoes polymerization to yield nylon 6. Its chemical properties highlight its role as a cyclic amide with inherent reactivity, enabling it to partake in various chemical transformations pivotal to industrial processes. The unique working mechanism of caprolactam centers on its capability to undergo ring-opening polymerization, making it instrumental in nylon synthesis.

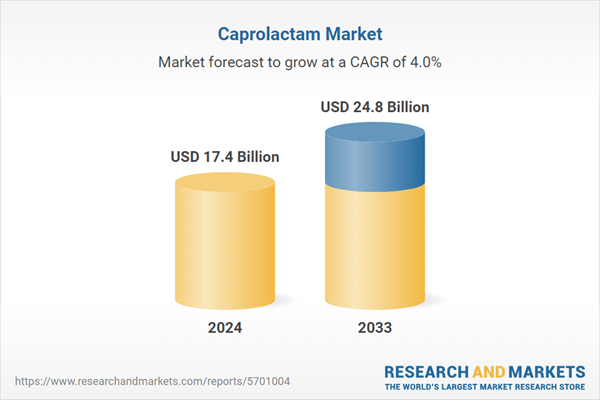

The market for caprolactam globally is primarily propelled by escalating requirements from the textile industry for high-strength, lightweight materials such as nylon-6 fibers. This, in conjunction with the augmenting demand from the automotive sector, is establishing a supportive environment for market expansion. Moreover, the advent of nylon-6 by-products in packaging industries, credited to its superior mechanical properties and resistance to permeation, is fostering the market growth. Further contributing to this upward trend, caprolactam's significance in the electronics sector for the creation of integral components, presents yet another impactful driver. Also, the rapid product utilization in the fabrication of industrial yarns, brushes, and fishing line materials is aiding in the market's positive development. The global commitment towards sustainability is creating lucrative opportunities in the market, initiating the need for bio-based caprolactam.

Caprolactam Market Trends/Drivers:

Considerable growth in the construction industry

The global caprolactam market is experiencing a substantial boost owing to the ongoing infrastructure and construction boom across various regions. Caprolactam, a crucial raw material for engineering plastics like nylon-6, offers exceptional mechanical properties, including high strength, lightweight, and resistance to wear and tear. These attributes make it an ideal choice for manufacturing construction components such as pipes, fittings, and flooring materials. Additionally, the infrastructure development plans undertaken by various governments worldwide further contribute to the market growth. As countries invest in the modernization and expansion of their transportation networks, energy facilities, and industrial infrastructure, the demand for caprolactam-based materials rises. Moreover, the emphasis on environmentally friendly and energy-efficient construction practices is boosting the use of caprolactam-based materials. The construction industry's inclination towards sustainable building materials has led to the adoption of engineering plastics in place of traditional materials, contributing to the growth of the caprolactam market.Rising demand for durable consumer products

The burgeoning demand for consumer goods is a key driver for the caprolactam market, as manufacturers increasingly incorporate engineering plastics in their product offerings. Caprolactam-based materials, particularly nylon-6, possess excellent mechanical properties, such as high tensile strength, impact resistance, and flexibility, making them highly desirable for a wide range of consumer products. Caprolactam-based nylon-6 is used in the production of various components, including automotive interiors, exterior trims, and under-the-hood applications. Furthermore, the sports and leisure sector is witnessing a growing demand for durable and high-performance products. Caprolactam-based materials are widely used in the production of sports equipment such as racquets, skis, and snowboards, owing to their strength and resilience. Additionally, nylon-6 is utilized in the manufacturing of household items like kitchen utensils, electronic appliances, and furniture, as it offers enhanced durability and.Continual advancements in medical applications

The caprolactam market is experiencing significant growth due to the continuous advancements in medical applications. Caprolactam-based polymers, such as medical-grade nylon, are extensively used in the healthcare industry for producing medical devices and surgical instruments. In the medical device sector, caprolactam-based materials find applications in the production of catheters, surgical sutures, and implants, among other critical components. The ability of these materials to withstand rigorous sterilization processes without compromising their properties makes them essential for ensuring patient safety and health. Moreover, the growing demand for drug delivery systems and pharmaceutical packaging further drives the use of caprolactam-based materials in the medical field. The ability of these materials to protect drugs from degradation and maintain their efficacy during storage and transportation is highly valued by pharmaceutical manufacturers.Caprolactam Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global caprolactam market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on source, end-product and application.Breakup by Source:

- Cyclohexane

- Phenol

- Toluene

- Others

Cyclohexane represents the largest market segment

The report has provided a detailed breakup and analysis of the market based on the source. This includes cyclohexane, phenol, toluene and others. According to the report, cyclohexane represented the largest segment.The cyclohexane market segment is largely driven by the demand for nylon 6,6 and nylon 6 fibers, widely utilized in the textile and automotive industries. Additionally, the growth of the adhesive industry, which uses cyclohexane, contributes to this market. As such, cyclohexane remains a vital component in these industries, thereby driving its market segment.

In the case of phenol, it is the demand from end-user industries such as plastics, resins, pharmaceuticals, and cosmetics that propels its market. Technological innovations in production processes have also played a significant role. As a result, the phenol market segment continues to grow, supported by these factors.

On the other hand, toluene's market is driven by growing demand in the production of benzene and xylene, and the expansion of the paint industry which uses toluene as a solvent. Its increasing use in flexible foam applications also aids market growth. Therefore, the toluene market segment is witnessing growth, spurred by these key industry demands.

Breakup by End-Product:

- Nylon 6 Fibers

- Nylon 6 Resins

- Others

Nylon 6 Fibers represents the largest market segment

The report has provided a detailed breakup and analysis of the market based on the end-product. This includes nylon 6 fibers, nylon 6 resins and others. According to the report, nylon 6 fibers represented the largest segment.The nylon 6 fibers market segment is driven by its increasing use in the textile industry, due to its durability and strength. It is also gaining traction in the automotive sector for tire cord manufacturing, as well as in carpets and industrial yarns. As such, the demand for nylon 6 fibers continues to augment, thus driving growth in this market segment.

On the other hand, the augmenting demand for nylon 6 resins is on the rise, given their versatile applications in packaging, textiles, and automotive industries. This is due to their exceptional strength, heat resistance, and chemical resistance properties. Consequently, the nylon 6 resins market segment is set to grow, propelled by these sectoral demands.

Breakup by Application:

- Industrial Yarns

- Engineering Resins and Films

- Textiles and Carpets

- Others

The market for industrial yarns is seeing growth due to an increased demand in industrial applications and a surge for high-strength, durable materials. Technological advancements in yarn manufacturing processes are also bolstering this market segment. Hence, the industrial yarn market is poised for growth, buoyed by these key drivers.

On the other hand, engineering resins and films are in demand due to the growing need for lightweight materials in the automotive and aerospace industries. There is an increased call for high-performance films in packaging, and evolving regulations for improved product safety and durability. Consequently, the engineering resins and films market segment is experiencing upward trends.

The textiles and carpets segment is propelled by a rising demand for home decor products, coupled with increasing urbanization and a growing global population. Advancements in synthetic fiber technology have further stimulated this market. Consequently, the textiles and carpets market segment is set to expand in response to these driving forces.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest caprolactam market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.Asia Pacific is experiencing significant growth, driven by factors such as a burgeoning population, rapid urbanization, and industrialization. The region's growing consumer purchasing power and expanding manufacturing sector are also key factors.

Moreover, the strong growth in industries including textiles, automotive, electronics, and chemicals in the region contribute to this upward trend. Hence, the Asia Pacific market segment continues to expand, benefiting from these unique regional attributes and industry developments.

Furthermore, the Asia Pacific region is characterized by an aggressive adoption of technological advancements, which is propelling various markets forward. Infrastructure development, fueled by both public and private investments, is another driver, creating opportunities for industries like construction, engineering resins, and textiles. The region's proactive policies and initiatives towards sustainability and environment protection are pushing industries towards eco-friendly products and solutions, which influence the market positively.

Competitive Landscape:

The leading companies are allocating substantial resources to R&D to develop new products, improve existing ones, and discover efficient production methods, thereby creating a competitive edge. The key players are expanding their production facilities and upgrading existing ones to increase output, meet rising demand, and reduce operational costs. Additionally, they are also expanding their geographical extent by entering untapped markets or strengthening their presence in existing ones. This could involve marketing efforts, partnership with local firms, or even setting up physical branches or manufacturing units. Furthermore, companies are focusing on producing eco-friendly products and adopting sustainable manufacturing practices to attract environmentally conscious consumers and comply with regulatory norms.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- AdvanSix Inc.

- Alpek S.A.B. de C.V.

- BASF SE

- Capro Corporation

- China Petrochemical Development Corporation

- China Petrochemical Corporation (Sinopec)

- DOMO Chemicals GmbH

- Gujarat State Fertilizers & Chemicals Limited

- Koninklijke DSM N.V.

- LANXESS AG

- Sumitomo Chemical Co., Ltd.

- Toray Industries Inc.

- Ube Industries, Ltd

Key Questions Answered in This Report

1. What is the global caprolactam market growth?2. What are the global caprolactam market drivers?

3. What are the key industry trends in the global caprolactam market?

4. What is the impact of COVID-19 on the global caprolactam market?

5. What is the global caprolactam market breakup by end-product?

6. What is the global caprolactam market breakup by application?

7. What are the major regions in the global caprolactam market?

8. Who are the key companies/players in the global caprolactam market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Caprolactam Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Source

6.1 Cyclohexane

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Phenol

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Toluene

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 Others

6.4.1 Market Trends

6.4.2 Market Forecast

7 Market Breakup by End-Product

7.1 Nylon 6 Fibers

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Nylon 6 Resins

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Others

7.3.1 Market Trends

7.3.2 Market Forecast

8 Market Breakup by Application

8.1 Industrial Yarns

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Engineering Resins and Films

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Textiles and Carpets

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Others

8.4.1 Market Trends

8.4.2 Market Forecast

9 Market Breakup by Region

9.1 North America

9.1.1 United States

9.1.1.1 Market Trends

9.1.1.2 Market Forecast

9.1.2 Canada

9.1.2.1 Market Trends

9.1.2.2 Market Forecast

9.2 Asia Pacific

9.2.1 China

9.2.1.1 Market Trends

9.2.1.2 Market Forecast

9.2.2 Japan

9.2.2.1 Market Trends

9.2.2.2 Market Forecast

9.2.3 India

9.2.3.1 Market Trends

9.2.3.2 Market Forecast

9.2.4 South Korea

9.2.4.1 Market Trends

9.2.4.2 Market Forecast

9.2.5 Australia

9.2.5.1 Market Trends

9.2.5.2 Market Forecast

9.2.6 Indonesia

9.2.6.1 Market Trends

9.2.6.2 Market Forecast

9.2.7 Others

9.2.7.1 Market Trends

9.2.7.2 Market Forecast

9.3 Europe

9.3.1 Germany

9.3.1.1 Market Trends

9.3.1.2 Market Forecast

9.3.2 France

9.3.2.1 Market Trends

9.3.2.2 Market Forecast

9.3.3 United Kingdom

9.3.3.1 Market Trends

9.3.3.2 Market Forecast

9.3.4 Italy

9.3.4.1 Market Trends

9.3.4.2 Market Forecast

9.3.5 Spain

9.3.5.1 Market Trends

9.3.5.2 Market Forecast

9.3.6 Russia

9.3.6.1 Market Trends

9.3.6.2 Market Forecast

9.3.7 Others

9.3.7.1 Market Trends

9.3.7.2 Market Forecast

9.4 Latin America

9.4.1 Brazil

9.4.1.1 Market Trends

9.4.1.2 Market Forecast

9.4.2 Mexico

9.4.2.1 Market Trends

9.4.2.2 Market Forecast

9.4.3 Others

9.4.3.1 Market Trends

9.4.3.2 Market Forecast

9.5 Middle East and Africa

9.5.1 Market Trends

9.5.2 Market Breakup by Country

9.5.3 Market Forecast

10 Imports and Exports

10.1 Import Trends

10.2 Import Breakup by Country

10.3 Export Trends

10.4 Export Breakup by Country

11 SWOT Analysis

11.1 Overview

11.2 Strengths

11.3 Weaknesses

11.4 Opportunities

11.5 Threats

12 Value Chain Analysis

13 Porters Five Forces Analysis

13.1 Overview

13.2 Bargaining Power of Buyers

13.3 Bargaining Power of Suppliers

13.4 Degree of Competition

13.5 Threat of New Entrants

13.6 Threat of Substitutes

14 Price Indicators

15 Competitive Landscape

15.1 Market Structure

15.2 Key Players

15.3 Profiles of Key Players

15.3.1 Advansix Inc.

15.3.1.1 Company Overview

15.3.1.2 Product Portfolio

15.3.1.3 Financials

15.3.1.4 SWOT Analysis

15.3.2 Alpek S.A.B. de C.V.

15.3.2.1 Company Overview

15.3.2.2 Product Portfolio

15.3.2.3 Financials

15.3.3 BASF SE

15.3.3.1 Company Overview

15.3.3.2 Product Portfolio

15.3.3.3 Financials

15.3.3.4 SWOT Analysis

15.3.4 Capro Corporation

15.3.4.1 Company Overview

15.3.4.2 Product Portfolio

15.3.4.3 Financials

15.3.5 China Petrochemical Development Corporation

15.3.5.1 Company Overview

15.3.5.2 Product Portfolio

15.3.5.3 Financials

15.3.5.4 SWOT Analysis

15.3.6 China Petrochemical Corporation (Sinopec)

15.3.6.1 Company Overview

15.3.6.2 Product Portfolio

15.3.6.3 Financials

15.3.6.4 SWOT Analysis

15.3.7 DOMO Chemicals GmbH

15.3.7.1 Company Overview

15.3.7.2 Product Portfolio

15.3.7.3 Financials

15.3.8 Gujarat State Fertilizers & Chemicals Limited

15.3.8.1 Company Overview

15.3.8.2 Product Portfolio

15.3.8.3 Financials

15.3.9 Koninklijke DSM N.V.

15.3.9.1 Company Overview

15.3.9.2 Product Portfolio

15.3.9.3 Financials

15.3.9.4 SWOT Analysis

15.3.10 Lanxess AG

15.3.10.1 Company Overview

15.3.10.2 Product Portfolio

15.3.10.3 Financials

15.3.10.4 SWOT Analysis

15.3.11 Sumitomo Chemical Co., Ltd.

15.3.11.1 Company Overview

15.3.11.2 Product Portfolio

15.3.11.3 Financials

15.3.11.4 SWOT Analysis

15.3.12 Toray Industries Inc.

15.3.12.1 Company Overview

15.3.12.2 Product Portfolio

15.3.12.3 Financials

15.3.12.4 SWOT Analysis

15.3.13 UBE Industries, Ltd.

15.3.13.1 Company Overview

15.3.13.2 Product Portfolio

15.3.13.3 Financials

15.3.13.4 SWOT Analysis

List of Figures

Figure 1: Global: Caprolactam Market: Major Drivers and Challenges

Figure 2: Global: Caprolactam Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Caprolactam Market: Breakup by Source (in %), 2024

Figure 4: Global: Caprolactam Market: Breakup by End-Product (in %), 2024

Figure 5: Global: Caprolactam Market: Breakup by Application (in %), 2024

Figure 6: Global: Caprolactam Market: Breakup by Region (in %), 2024

Figure 7: Global: Caprolactam Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 8: Global: Caprolactam (Cyclohexane) Market: Sales Value (in Million USD), 2019 & 2024

Figure 9: Global: Caprolactam (Cyclohexane) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 10: Global: Caprolactam (Phenol) Market: Sales Value (in Million USD), 2019 & 2024

Figure 11: Global: Caprolactam (Phenol) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 12: Global: Caprolactam (Toluene) Market: Sales Value (in Million USD), 2019 & 2024

Figure 13: Global: Caprolactam (Toluene) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 14: Global: Caprolactam (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 15: Global: Caprolactam (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 16: Global: Caprolactam (Nylon 6 Fibers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 17: Global: Caprolactam (Nylon 6 Fibers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 18: Global: Caprolactam (Nylon 6 Resins) Market: Sales Value (in Million USD), 2019 & 2024

Figure 19: Global: Caprolactam (Nylon 6 Resins) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 20: Global: Caprolactam (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 21: Global: Caprolactam (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 22: Global: Caprolactam (Industrial Yarns) Market: Sales Value (in Million USD), 2019 & 2024

Figure 23: Global: Caprolactam (Industrial Yarns) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 24: Global: Caprolactam (Engineering Resins and Films) Market: Sales Value (in Million USD), 2019 & 2024

Figure 25: Global: Caprolactam (Engineering Resins and Films) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 26: Global: Caprolactam (Textiles and Carpets) Market: Sales Value (in Million USD), 2019 & 2024

Figure 27: Global: Caprolactam (Textiles and Carpets) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 28: Global: Caprolactam (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 29: Global: Caprolactam (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 30: North America: Caprolactam Market: Sales Value (in Million USD), 2019 & 2024

Figure 31: North America: Caprolactam Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 32: United States: Caprolactam Market: Sales Value (in Million USD), 2019 & 2024

Figure 33: United States: Caprolactam Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 34: Canada: Caprolactam Market: Sales Value (in Million USD), 2019 & 2024

Figure 35: Canada: Caprolactam Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 36: Asia Pacific: Caprolactam Market: Sales Value (in Million USD), 2019 & 2024

Figure 37: Asia Pacific: Caprolactam Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 38: China: Caprolactam Market: Sales Value (in Million USD), 2019 & 2024

Figure 39: China: Caprolactam Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 40: Japan: Caprolactam Market: Sales Value (in Million USD), 2019 & 2024

Figure 41: Japan: Caprolactam Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 42: India: Caprolactam Market: Sales Value (in Million USD), 2019 & 2024

Figure 43: India: Caprolactam Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 44: South Korea: Caprolactam Market: Sales Value (in Million USD), 2019 & 2024

Figure 45: South Korea: Caprolactam Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 46: Australia: Caprolactam Market: Sales Value (in Million USD), 2019 & 2024

Figure 47: Australia: Caprolactam Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 48: Indonesia: Caprolactam Market: Sales Value (in Million USD), 2019 & 2024

Figure 49: Indonesia: Caprolactam Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 50: Others: Caprolactam Market: Sales Value (in Million USD), 2019 & 2024

Figure 51: Others: Caprolactam Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 52: Europe: Caprolactam Market: Sales Value (in Million USD), 2019 & 2024

Figure 53: Europe: Caprolactam Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 54: Germany: Caprolactam Market: Sales Value (in Million USD), 2019 & 2024

Figure 55: Germany: Caprolactam Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 56: France: Caprolactam Market: Sales Value (in Million USD), 2019 & 2024

Figure 57: France: Caprolactam Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 58: United Kingdom: Caprolactam Market: Sales Value (in Million USD), 2019 & 2024

Figure 59: United Kingdom: Caprolactam Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 60: Italy: Caprolactam Market: Sales Value (in Million USD), 2019 & 2024

Figure 61: Italy: Caprolactam Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 62: Spain: Caprolactam Market: Sales Value (in Million USD), 2019 & 2024

Figure 63: Spain: Caprolactam Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 64: Russia: Caprolactam Market: Sales Value (in Million USD), 2019 & 2024

Figure 65: Russia: Caprolactam Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 66: Others: Caprolactam Market: Sales Value (in Million USD), 2019 & 2024

Figure 67: Others: Caprolactam Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 68: Latin America: Caprolactam Market: Sales Value (in Million USD), 2019 & 2024

Figure 69: Latin America: Caprolactam Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 70: Brazil: Caprolactam Market: Sales Value (in Million USD), 2019 & 2024

Figure 71: Brazil: Caprolactam Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 72: Mexico: Caprolactam Market: Sales Value (in Million USD), 2019 & 2024

Figure 73: Mexico: Caprolactam Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 74: Others: Caprolactam Market: Sales Value (in Million USD), 2019 & 2024

Figure 75: Others: Caprolactam Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 76: Middle East and Africa: Caprolactam Market: Sales Value (in Million USD), 2019 & 2024

Figure 77: Middle East and Africa: Caprolactam Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 78: Global: Caprolactam Market: Import Trends (in Million USD), 2019-2024

Figure 79: Global: Caprolactam Market: Import Breakup by Country (in %), 2024

Figure 80: Global: Caprolactam Market: Export Trends (in Million USD), 2019-2024

Figure 81: Global: Caprolactam Market: Export Breakup by Country (in %), 2024

Figure 82: Global: Caprolactam Industry: SWOT Analysis

Figure 83: Global: Caprolactam Industry: Value Chain Analysis

Figure 84: Global: Caprolactam Industry: Porter’s Five Forces Analysis

List of Tables

Table 1: Global: Caprolactam Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Caprolactam Market Forecast: Breakup by Source (in Million USD), 2025-2033

Table 3: Global: Caprolactam Market Forecast: Breakup by End-Product (in Million USD), 2025-2033

Table 4: Global: Caprolactam Market Forecast: Breakup by Application (in Million USD), 2025-2033

Table 5: Global: Caprolactam Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 6: Global: Caprolactam: Export Data of Major Countries, 2024

Table 7: Global: Caprolactam: Import Data of Major Countries, 2024

Table 8: Global: Caprolactam Market: Competitive Structure

Table 9: Global: Caprolactam Market: Key Players

Companies Mentioned

- AdvanSix Inc.

- Alpek S.A.B. de C.V.

- BASF SE

- Capro Corporation

- China Petrochemical Development Corporation

- China Petrochemical Corporation (Sinopec)

- DOMO Chemicals GmbH

- Gujarat State Fertilizers & Chemicals Limited

- Koninklijke DSM N.V.

- LANXESS AG

- Sumitomo Chemical Co. Ltd.

- Toray Industries Inc.

- Ube Industries Ltd. etc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 136 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 17.4 Billion |

| Forecasted Market Value ( USD | $ 24.8 Billion |

| Compound Annual Growth Rate | 4.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |