Microcontroller Socket Market Analysis:

- Major Market Drivers: The increasing adoption of IoT devices is significantly driving the demand for microcontroller sockets. Additionally, the rise in consumer electronics and smart home devices is propelling market growth.

- Key Market Trends: There is a growing trend towards miniaturization and higher efficiency in microcontroller designs. Another key trend is the integration of advanced features like AI and machine learning capabilities within microcontrollers.

- Geographical Trends: The Asia-Pacific region is witnessing substantial growth due to the presence of major electronics manufacturing hubs. North America is also a significant market, driven by advancements in automotive and industrial automation sectors.

- Competitive Landscape: Some of the key market players include Advanced Interconnections, Andon Electronics, Aries Electronics Inc., Johnstech International Corporation, Loranger International Corporation, Microchip Technology, etc.

- Challenges and Opportunities: One of the main challenges is the high cost associated with advanced microcontroller sockets. However, there are significant opportunities in the growing fields of IoT and smart technologies, which require advanced microcontroller solutions.

Microcontroller Socket Market Trends:

Increasing cost reduction

Cost reduction is the primary driving factor of the market growth. Technological advancements assist in meeting the needs of cutting-edge electronic systems. Nonetheless, when an IC manufacturer is given the choice of keeping costs under control and using the most advanced technology. This alternative is primarily focused on cost minimization, as is the microcontroller socket market.Many original equipment manufacturers (OEMs), foundries, system developers, test subcontractors, packaging companies, and chip makers are spending extensively in developing next-generation packaging solutions. These next-generation packaging methods are more cost-effective and give speedier results. Thus, these factors are likely to increase the microcontroller socket market share throughout the microcontroller socket market forecast period.

Rapid technological advancements

The growing demand for advanced technologies to reduce fuel consumption is driving up the demand for low-power embedded systems. To take advantage of these prospects, manufacturers have begun manufacturing powertrain applications. Miniaturized designs are characterized by low power consumption and weight. Such advancements in the microcontroller socket market have helped to increase functionality per chip with high output and input. Furthermore, these chips are accessible in reduced packaging sizes. Besides, the utilization of copper wire has grown, reducing packaging costs while maintaining efficiency. This, in turn, is aiding the market expansion as shown in the microcontroller socket market research report.Advances in IC Packaging

The microcontroller socket market is also expected to benefit from recent advances in IC packaging, which allow it to provide great performance at a cheap cost in a low-profile, low-power design. These developments demonstrate great promise, enticing system developers. OEMs, packaging and testing subcontractors, foundries, fabless chip firms, and chip makers all place a high value on next-generation packaging solutions. As manufacturers seek to produce better, faster, and cheaper results, the use of IC packaging is expanding the microcontroller socket market. This, in turn, will bolster demand for the microcontroller socket, thereby expanding the market according to microcontroller socket market report.Microcontroller Socket Market Segmentation:

The research provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product and application.Breakup by Product:

- DIP

- BGA

- QFP

- SOP

- SOI.

DIP dominates the market

The report has provided a detailed breakup and analysis of the market based on the product. This includes DIP, BGA, QFP, SOP, and SOIC. According to the report, DIP represented the largest segment.The microcontroller socket market outlook is experiencing a boost from dual in line package (DIP) technology due to its enhanced compatibility and user friendly features. DIPs simple design, with two rows of pins arranged in parallel makes it easy to plug into sockets and breadboards making prototyping and testing quick and straightforward. This seamless integration plays a role in microcontroller applications facilitating the development and deployment of various electronic devices.

DIP packages are cost effective and well supported by existing socket and circuit board setups reducing the need, for investments. As microcontroller applications continue to expand into consumer electronics, automotive and industrial sectors, the reliability and user friendliness of DIP technology drive its adoption fueling the growth of the microcontroller socket demand.

Breakup by Application:

- Automotive

- Consumer Electronics

- Industrial

- Medical Devices

- Military and Defens.

Automotive holds the largest share in the market

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive, consumer electronics, industrial, medical devices, and military and defense. According to the report, automotive accounted for the largest market share.The automotive industry plays a role, in driving the market by using microcontrollers for functions in vehicles. Modern cars incorporate microcontrollers to oversee systems such as engine control, entertainment, safety features, and driver assistance technologies. This increase in parts calls for flexible microcontroller sockets to ensure smooth integration and upkeep. The growing popularity of self driving cars further boosts the need, for control systems and sensors.

Car manufacturers emphasize the importance of high performance microcontroller sockets that can endure conditions and guarantee system durability. As a result the sectors focus on innovation and improved vehicle intelligence is significantly fueling the advancement and transformation of the microcontroller socket market growth to meet the industry expanding needs.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Afric.

Asia Pacific leads the market, accounting for the largest microcontroller socket market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for microcontroller socket.Asia Pacific microcontroller socket market size is expected to grow significantly over the forecast period due to the increasing demand for the product in various countries such as Japan and China. The rising demand for sockets in the microelectronics industry in various applications has led to the growth of the industry and accelerated product demand. The market is also expected to grow steadily over the forecast period due to the increasing development in the smart energy sector and wireless communications sector.

Competitive Landscape:

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:- Advanced Interconnections

- Andon Electronics

- Aries Electronics Inc.

- Johnstech International Corporation

- Loranger International Corporation

- Microchip Technology

- Mill-Max Mfg. Corp.

- PRECI-DIP SA

- TE Connectivity

- Texas Instruments Inc.

To take advantage of these prospects, manufacturers have begun manufacturing powertrain applications. Miniaturized designs are characterized by low power consumption and weight. Such advancements in the microcontroller socket industry have helped to increase functionality per chip with high output and input, thereby creating a positive microcontroller socket market overview.

Key Questions Answered in This Report

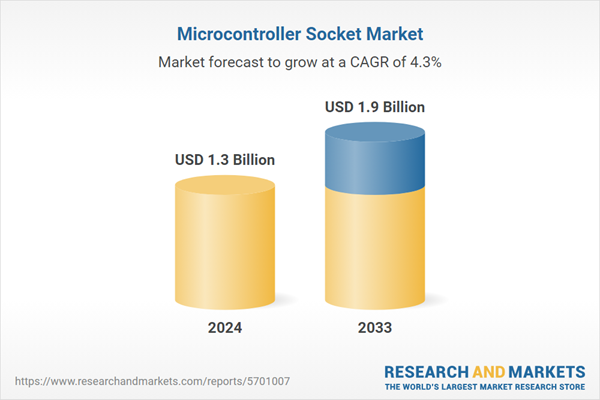

- What was the size of the global microcontroller socket market in 2024?

- What is the expected growth rate of the global microcontroller socket market during 2025-2033?

- What are the key factors driving the global microcontroller socket market?

- What has been the impact of COVID-19 on the global microcontroller socket market?

- What is the breakup of the global microcontroller socket market based on the product?

- What is the breakup of the global microcontroller socket market based on the application?

- What are the key regions in the global microcontroller socket market?

- Who are the key players/companies in the global microcontroller socket market?

Table of Contents

Companies Mentioned

- Advanced Interconnections

- Andon Electronics

- Aries Electronics Inc.

- Johnstech International Corporation

- Loranger International Corporation

- Microchip Technology

- Mill-Max Mfg. Corp.

- PRECI-DIP SA

- TE Connectivity

- Texas Instruments Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 1.3 Billion |

| Forecasted Market Value ( USD | $ 1.9 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |