Dental Floss Market Analysis:

- Major Market Drivers: Increasing awareness about oral hygiene, rising prevalence of dental issues, and significant developments in dental care products are some of the major market drivers.

- Key Market Trends: Some of the key market trends include growth in sustainable and biodegradable dental floss products, increased adoption of flavored and specialized dental floss, and rapid expansion of e-commerce and online retailing of dental care products.

- Geographical Trends: The rising awareness about oral hygiene practices, robust competition level, and rising disposable income levels are propelling the North America dental floss market.

- Competitive Landscape: 3M Company, Alfred Becht GmbH, Colgate-Palmolive Company, Dr. Fresh LLC, Dr. Wild & Co. AG, Lion Corporation, Perrigo Company plc, Prestige Consumer Healthcare Inc., Procter & Gamble Company, Sunstar Group and The Humble Co. AB, are among some of the key players in the dental floss industry.

- Challenges and Opportunities: Some of the challenges include increasing competition from alternative dental care products, growing environmental concerns, and restricted awareness across developing regions. Whereas, growing penetration in untapped markets, production of sustainable and biodegradable floss, and increasing online sales and marketing strategies are factors positively driving the dental floss demand.

Dental Floss Market Trends:

Increasing Awareness about Oral Hygiene

The rising awareness about the importance of oral hygiene significantly drives the global dental floss market. Over the past decade, dental health campaigns and initiatives by government bodies, dental associations, and private companies have emphasized the importance of maintaining oral hygiene to prevent dental diseases such as cavities, gingivitis, and periodontitis. These campaigns have successfully educated the public about the role of dental floss in removing plaque and food particles from areas that toothbrushes cannot reach.The increased awareness is particularly notable among younger generations who are more health-conscious and proactive about their well-being. This shift in consumer behavior has led to a higher adoption rate of dental floss as part of daily oral care routines. Moreover, the proliferation of information through digital media and social platforms has further created a positive dental floss market outlook, reached a broader audience and reinforced the practice of flossing regularly.

Rising Prevalence of Dental Issues

The increasing incidence of dental problems globally is a critical factor driving the demand for dental floss. According to a report by the WORLD HEALTH ORGANIZATION, the number of individuals dealing with oral diseases is 3.5 Billion. Poor dietary habits, high consumption of sugary foods and beverages, and inadequate oral hygiene practices contribute to the prevalence of dental caries and periodontal diseases. As these conditions often lead to severe health issues if left untreated, there is a growing emphasis on preventive care. Dental professionals recommend flossing as an essential preventive measure to reduce the risk of tooth decay and gum disease.The rising awareness about the correlation between oral health and overall health has also propelled more individuals to adopt flossing as part of their daily routine, thereby leading to a positive dental floss market growth. Furthermore, the aging population, particularly in developed countries, presents a significant market as older adults are more susceptible to dental problems and seek effective solutions to maintain oral health.

Innovations in Dental Care Products

Innovations and advancements in dental care products have significantly boosted the global dental floss market. Manufacturers are continually developing new and improved floss products to meet consumer demands for convenience, effectiveness, and sustainability. Innovations such as flavored floss, eco-friendly biodegradable floss, floss picks, and water flossers have expanded the product range and attracted a diverse consumer base. Flavored floss appeals to younger users and those looking for a more pleasant flossing experience. Biodegradable and eco-friendly options cater to environmentally conscious consumers. Floss picks and water flossers provide alternative methods for those who find traditional flossing challenging.These innovations not only enhance the user experience but also encourage more people to incorporate flossing into their daily oral care regimen. Additionally, the growing trend of personalization in dental care, where consumers seek products tailored to their specific needs, has led to the development of specialized floss types, further increasing the dental floss market scope.

Dental Floss Industry Segmentation:

The research provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product and distribution channel.Breakup by Product:

- Waxed Floss

- Unwaxed Floss

- Dental Tape

- Other.

Waxed floss accounts for the majority of the market share

The dental floss market report has provided a detailed breakup and analysis of the market based on the product. This includes waxed floss, unwaxed floss, dental tape, and others. According to the report, waxed floss represented the largest segment.Waxed dental floss holds the largest segment in the market breakup by product due to its superior ease of use and effectiveness compared to unwaxed floss. The wax coating on the floss provides a smoother surface, allowing it to glide easily between teeth without fraying or breaking, which makes it more user-friendly, especially for those with tightly spaced teeth.

This enhanced usability reduces the discomfort often associated with flossing, encouraging more consistent use among consumers. Additionally, the waxed floss can incorporate flavors such as mint, making the flossing experience more pleasant and further boosting its popularity, thus contributing to the dental floss market revenue. The wax coating also helps in the removal of plaque and debris by providing a better grip and increasing the durability of the floss.

Breakup by Distribution Channel:

- Offline

- Onlin.

Offline holds the largest share in the industry

A detailed breakup and analysis of the market based on distribution channel have also been provided in the report. This includes offline and online. According to the report, offline accounted for the largest market share.The offline segment holds the largest dental floss market share as brick-and-mortar stores, including supermarkets, drugstores, and specialty health and beauty shops, offer a tactile shopping experience that many consumers prefer. Shoppers can physically examine products, compare different brands, and seek immediate advice from in-store staff, which enhances their purchasing confidence.

This is particularly important for dental hygiene products, where consumers often look for specific features such as texture, flavor, and packaging. Additionally, in-store promotions and discounts play a crucial role in attracting customers. Offline stores frequently offer special deals and loyalty programs that incentivize purchases. Secondly, the habit and convenience of picking up dental floss during routine grocery or pharmacy visits contribute significantly to the dominance of this segment.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Afric.

North America leads the market, accounting for the largest market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America was the largest regional market for dental floss.North America leads as the largest segment in the global dental floss market due to several key factors. The high level of awareness and education about oral hygiene in this region has significantly contributed to the widespread adoption of dental floss. This awareness is reinforced by proactive health campaigns and regular dental check-ups recommended by healthcare professionals, thus positively increasing the dental floss market value. Additionally, North America has a robust healthcare infrastructure that supports frequent dental visits, where professionals often emphasize the importance of flossing. The region also benefits from a high disposable income, allowing consumers to invest in premium dental care products.

Another contributing factor is the strong presence of key market players and the availability of a wide variety of dental floss products, including innovative and specialized options that cater to diverse consumer preferences. The dental floss market forecast suggests the rising prevalence of dental issues, prompting preventive measures among the population, thus propelling the market growth.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the dental floss industry include 3M Company, Alfred Becht GmbH, Colgate-Palmolive Company, Dr. Fresh LLC, Dr. Wild & Co. AG, Lion Corporation, Perrigo Company plc, Prestige Consumer Healthcare Inc., Procter & Gamble Company, Sunstar Group and The Humble Co. AB.

- Key players are undertaking various strategic efforts to drive market growth. These efforts include continuous product innovation, strategic partnerships, and extensive marketing campaigns. Companies are investing heavily in research and development to create advanced dental floss products that cater to evolving consumer preferences. For instance, they are introducing flavored floss, eco-friendly biodegradable options, and technologically enhanced floss picks and water flossers to attract a broader customer base. Additionally, collaborations with dental associations and health organizations help in promoting the benefits of flossing, thereby leading to positive dental floss market statistics. Key players are also expanding their distribution networks to enhance product availability, leveraging both traditional retail and e-commerce platforms. This expansion ensures that their products reach a wider audience, including remote and underserved areas.

Key Questions Answered in This Report

- How big is the global dental floss market?

- What is the expected growth rate of the global dental floss market during 2025-2033?

- What are the key factors driving the global dental floss market?

- What has been the impact of COVID-19 on the global dental floss market?

- What is the breakup of the global dental floss market based on the product?

- What is the breakup of the global dental floss market based on the distribution channel?

- What are the key regions in the global dental floss market?

- Who are the key players/companies in the global dental floss market?

Table of Contents

Companies Mentioned

- 3M Company

- Alfred Becht GmbH

- Colgate-Palmolive Company

- Dr. Fresh LLC

- Dr. Wild & Co. AG

- Lion Corporation

- Perrigo Company plc

- Prestige Consumer Healthcare Inc.

- Procter & Gamble Company

- Sunstar Group

- The Humble Co. AB

Table Information

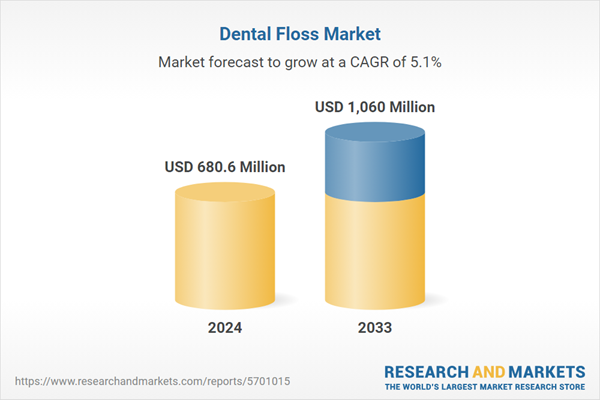

| Report Attribute | Details |

|---|---|

| No. of Pages | 143 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 680.6 Million |

| Forecasted Market Value ( USD | $ 1060 Million |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |