Gel Documentation Systems Market Analysis:

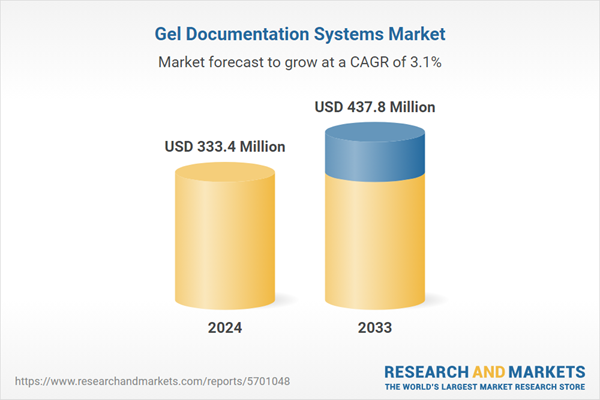

- Market Growth and Size: The market is experiencing robust growth, driven by increasing demands in molecular biology and genetic research. This growth is reflected in the escalating investment in genomic and proteomic research, enhancing the market size and indicating a promising future outlook.

- Technological Advancements: Significant technological advancements in molecular biology have catalyzed market growth. These include high-resolution cameras, automated image analysis, and cloud integration, leading to more efficient and accurate systems, and thereby expanding the market scope.

- Industry Applications: Gel documentation systems find extensive applications in academic research, pharmaceutical development, and clinical diagnostics. Their critical role in genetic and protein analysis, especially in the growing field of personalized medicine, underscores their market significance.

- Key Market Trends: A key trend in the market is the rising emphasis on compliance and documentation, driven by stringent regulatory standards. Additionally, the shift towards automation and software integration in these systems represents a notable market trend.

- Geographical Trends: Geographically, regions with high investment in biotechnology and pharmaceutical research, such as North America and Europe, show strong market dominance. However, emerging economies in Asia-Pacific are rapidly growing markets due to increasing research activities and investments in healthcare infrastructure.

- Competitive Landscape: The market is characterized by competition among established players who offer advanced, integrated solutions. There's a focus on innovation and partnerships to expand market reach and meet the diverse needs of the research community.

- Challenges and Opportunities: While challenges include high costs and complexity of advanced systems, opportunities lie in the ongoing technological innovations and the expanding applications in molecular biology research. The growing need for sophisticated research tools in emerging markets also presents significant opportunities for market expansion.

Gel Documentation Systems Market Trends:

Technological advancements in molecular biology

The global market is significantly influenced by the rapid advancements in molecular biology technologies. These advancements include enhanced resolution cameras, automated software for image analysis, and integration with cloud-based storage systems, facilitating easier data management and sharing. Additionally, the development of sophisticated imaging techniques has led to improved detection and analysis of nucleic acids and proteins in gel documentation, catering to the increasing demand for high-throughput and accurate results in genetic research, diagnostic procedures, and pharmaceutical development. This trend reflects a shift towards more efficient, reliable, and user-friendly systems, driving market growth as research facilities and laboratories seek to upgrade their equipment.Rising investment in genomic and proteomic research

The expansion of genomic and proteomic research activities, fueled by increasing investments from both public and private sectors, is a critical driver for the market. Along with this, the growing focus on understanding genetic and protein functions in medical research, particularly in personalized medicine and genetic disorder studies, necessitates advanced gel documentation systems for effective analysis.As a result, laboratories and research institutions are investing in these systems to support the detailed and complex analysis required in these fields. The considerable growth in research activities, particularly in the biotechnology and pharmaceutical sectors, is providing a boost to the demand for advanced gel documentation systems, contributing significantly to market growth.

Growing emphasis on compliance and documentation in research

The heightened focus on compliance with regulatory standards and documentation in research and clinical laboratories is a major factor propelling the market. Laboratories are required to adhere to strict guidelines regarding data accuracy, reproducibility, and traceability. Gel documentation systems, equipped with advanced software, facilitate compliance by offering precise, reproducible results and maintaining comprehensive records of experiments.This ensures that research findings meet the stringent standards of regulatory bodies, which is crucial in academic research, clinical diagnostics, and drug development. Moreover, the need for systems that can provide detailed documentation and comply with regulatory requirements is thus driving the adoption of advanced documentation systems in various research and clinical settings.

Gel Documentation Systems Industry Segmentation:

The research provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product type, light source, detection technique, application, and end user.Breakup by Product Type:

- Instruments

- Software

- Accessorie.

Instruments account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product type. This includes instruments, software, and accessories. According to the report, instruments represented the largest segment.The instruments segment holds the largest share of the market, predominantly due to its indispensable role in molecular biology and genetic research. This segment includes a range of sophisticated equipment designed for imaging and analyzing nucleic acids and proteins. Additionally, the instruments are integral for accurate and efficient documentation and analysis in various applications, such as DNA sequencing, PCR analysis, and protein quantification. The demand for these instruments is bolstered by technological advancements that enhance their functionality and user-friendliness.

This includes features such as high-resolution imaging, automated data capture, and advanced software integration, making them vital tools in research laboratories and academic institutions. The sustained growth in this segment is fueled by the increasing need for advanced analytical tools in genomic and proteomic research, coupled with rising investments in the biotechnology and pharmaceutical sectors.

Along with this, the software segment in the market is gaining traction due to the growing need for sophisticated data analysis and management tools in molecular biology research. This segment encompasses a variety of software solutions designed for image processing, data analysis, and storage, which are essential for interpreting results obtained from gel documentation instruments. The software ensures accuracy, reproducibility, and compliance with regulatory standards, making it a critical component of the system.

Innovations in this sector, such as the integration of artificial intelligence and cloud-based data management, are enhancing the capabilities of gel documentation systems, facilitating more detailed and efficient analysis. The demand for this segment is driven by the complex nature of genetic and proteomic data, necessitating advanced software for comprehensive analysis and interpretation.

Apart from this, the accessories segment, while smaller compared to Instruments, plays a crucial supporting role in the market. This segment includes various supplementary items such as UV shields, filters, trays, and camera attachments. These accessories are essential for optimizing the performance and extending the functionality of gel documentation instruments. They ensure safety, enhance image quality, and provide versatility in various experimental setups. The demand for accessories is directly influenced by the sales of instruments, as they are often required for specific applications or replacements.

Breakup by Light Source:

- Light Emitting Diodes

- UV

- Lase.

Light emitting diodes hold the largest share of the industry

A detailed breakup and analysis of the market based on the light source have also been provided in the report. This includes light emitting diodes, UV, and laser. According to the report, light emitting diodes accounted for the largest market share.The segment of light emitting diodes (LEDs) holds the largest market share, primarily due to their energy efficiency, longer lifespan, and lower heat output compared to traditional light sources. LEDs are favored for their versatility, as they can be used for a wide range of applications, including DNA, RNA, and protein analysis. Their growing popularity is also attributed to the reduced risk of sample damage, as LEDs emit less heat, and the adaptability to various imaging modes, such as fluorescence and chemiluminescence. Additionally, the increasing adoption of LED-based systems across research laboratories and academic institutions underscores their importance in the segment, driven by ongoing improvements in LED technology and their alignment with the trend towards more sustainable and efficient laboratory equipment.

In addition, the ultraviolet (UV) light source segment in systems, while not as dominant as LEDs, plays a critical role in specific applications, particularly in DNA and RNA analysis. UV light sources are traditionally used in gel documentation for their ability to excite nucleic acid stains, making them visible for imaging. UV light sources remain integral in many laboratory setups, especially where specific staining techniques and traditional methodologies are prevalent. The market demand for UV-based systems is sustained by their proven effectiveness in certain applications, although there is a noticeable shift towards safer and more efficient alternatives, such as LEDs and lasers, in line with innovative technology and safety standards.

On the contrary, the laser segment, though smaller in comparison to LEDs and UV, is significant in the market for its precision and sensitivity in imaging applications. Lasers provide a highly focused light source, ideal for applications requiring detailed analysis and high-resolution imaging. This is particularly beneficial in advanced molecular biology techniques, where the detection of low-abundance proteins or nucleic acids is essential. Laser-based systems are favored for their superior imaging capabilities in fluorescence-based applications, offering enhanced sensitivity and specificity.

Breakup by Detection Technique:

- UV Detectors

- Fluorescence

- Chemiluminescenc.

UV detectors represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the detection technique. This includes UV detectors, fluorescence, and chemiluminescence. According to the report, UV detectors represented the largest segment.The segment of UV detectors commands the largest share in the market, primarily due to their widespread use in basic molecular biology applications. UV detectors are extensively used for the visualization of DNA and RNA gels, where nucleic acids are typically stained with ethidium bromide or similar dyes that fluoresce under UV light. These detectors offer simplicity and effectiveness, making them a staple in many laboratory settings for routine gel documentation tasks. Along with this, the widespread availability, cost-effectiveness, and ease of use of UV detectors ensure their continued dominance in the market, particularly in educational and small-scale research settings where advanced features may not be necessary.

On the other hand, the fluorescence segment plays a vital role in the market, catering to advanced research applications that require high sensitivity and specificity. Fluorescence detection is preferred for its ability to detect specific proteins or nucleic acids using fluorescent tags or stains, allowing for more precise and quantitative analysis. This technique is essential in applications such as quantitative PCR, microarray analysis, and protein gel electrophoresis.

The demand for fluorescence-based systems is driven by their increased sensitivity and the growing need for detailed molecular analysis in research and diagnostic applications. In addition, the development of new fluorescent dyes and probes, coupled with advancements in imaging technology, continues to enhance the capabilities and applications of fluorescence detection in gel documentation.

Moreover, the chemiluminescence segment, while smaller in market share compared to UV detectors and fluorescence, is significant for its application in high-sensitivity detection of proteins, especially in Western blotting. Chemiluminescence involves the detection of light emitted during a chemical reaction, providing a highly sensitive method for analyzing low-abundance proteins. This technique is favored in applications where maximum sensitivity is required, and it has become a standard in many protein analysis protocols.

The growth of this segment is propelled by the demand for precise and sensitive protein detection methods in biomedical research and pharmaceutical development. As research continues to delve into more complex protein interactions and functions, the demand for chemiluminescence-based systems is expected to grow, driven by their unmatched sensitivity and specificity in protein analysis.

Breakup by Application:

- Nucleic Acid Quantification

- Protein Quantification

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes nucleic acid quantification, protein quantification, and others. According to the report, nucleic acid quantification accounted for the largest market share.

The nucleic acid quantification segment holds the largest share of the market, underscoring its fundamental role in molecular biology research. This application involves measuring the concentration and purity of DNA or RNA samples, which is crucial in various molecular biology techniques such as PCR, sequencing, cloning, and genotyping. Additionally, the demand in this segment is fueled by the growing importance of genetic research, diagnostics, and personalized medicine, where accurate nucleic acid quantification is essential. They are equipped with UV or fluorescence detection and are widely used for this purpose, offering rapid, sensitive, and accurate measurements of nucleic acids. The increasing investment in genomic research, coupled with the rise in genetic testing and diagnostics, continues to drive the expansion of this segment.

On the contrary, the protein quantification segment, while smaller compared to nucleic acid quantification, is a critical component of the market. This segment focuses on the analysis and measurement of proteins, essential in understanding biological processes and in the development of therapeutic drugs. Protein quantification is pivotal in various applications, including enzyme-linked immunosorbent assay (ELISA), Western blotting, and other proteomic techniques. The growth in this segment is driven by the expanding field of proteomics and the increasing importance of protein studies in disease research, drug discovery, and diagnostic development.

Breakup by End User:

- Academic and Research Institutes

- Pharma and Biotech Companies

- Diagnostic Laboratories

Academic and research institutes represent a major segment of the market. This segment includes universities, government research organizations, and independent research institutions that extensively utilize gel documentation systems for educational and research purposes. The demand in this segment is driven by the need for advanced tools in molecular biology, genomics, and proteomics research.

Academic and research institutions often engage in fundamental research, which requires accurate and efficient documentation and analysis of nucleic acids and proteins. The growth in this segment is sustained by continuous investments in research and education, along with the expanding scope of molecular biology studies in understanding various biological processes and diseases.

Along with this, the segment of pharma and biotech companies holds a significant market share in the market. This segment encompasses pharmaceutical companies and biotechnology firms that use these systems for drug discovery, development, and quality control processes. The use of gel documentation in this sector is crucial for the validation of research findings, monitoring of production processes, and ensuring regulatory compliance. The demand in this segment is propelled by the increasing emphasis on research and development activities in the pharmaceutical industry, the growing need for new therapeutics, and the stringent regulatory environment that necessitates precise and reliable documentation of experimental data.

Furthermore, diagnostic laboratories form an essential segment of the market. This segment includes clinical and pathology laboratories that use gel documentation for diagnostic purposes, such as disease detection, genetic testing, and biomarker research. The role of gel documentation in diagnostics is vital due to the need for accurate and rapid analysis of patient samples.

This segment's growth is driven by the rising prevalence of genetic disorders, infectious diseases, and the increasing importance of personalized medicine. In addition, the adoption of advanced systems in diagnostic laboratories is further accelerated by technological advancements that offer higher efficiency, accuracy, and compliance with diagnostic standards.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Afric.

North America leads the market, accounting for the largest gel documentation systems market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.North America dominates the market, primarily due to its advanced healthcare infrastructure, significant investments in research and development, and the presence of key pharmaceutical and biotech companies. The region's market leadership is bolstered by robust government support for genomic and proteomic research, alongside stringent regulatory frameworks that mandate high-quality research practices.

The United States, in particular, is a major contributor to this market segment, driven by its cutting-edge research in molecular biology, substantial academic and research expenditures, and the presence of leading technology innovators. The adoption of advanced gel documentation systems is further accelerated by the region's focus on personalized medicine and the growing demand for high-throughput and accurate diagnostic methods.

Along with this, the Asia-Pacific region is a rapidly growing segment of the market, driven by increasing investments in healthcare infrastructure, research activities, and biotechnology. Countries such as China, Japan, and India are leading this growth, with their expanding research sectors, increasing government support for life sciences research, and a growing focus on pharmaceutical and diagnostic advancements. Additionally, the rising prevalence of genetic diseases and the expanding biotech industry in the region also contribute to the demand for advanced gel documentation systems. This growth is further supported by the increasing number of academic and research institutions and the growing adoption of advanced technologies in molecular biology research.

In addition, Europe holds a significant position in the market, characterized by its strong research infrastructure, high healthcare expenditure, and the presence of numerous leading pharmaceutical and biotechnology companies. The market in this region is driven by substantial government and private funding for research and development, particularly in countries including Germany, the United Kingdom, and France.

The region’s emphasis on innovation and quality in research methodologies, coupled with stringent regulatory standards for documentation and compliance, underpins the demand for advanced gel documentation systems. Europe's strong focus on genomic and proteomic research, as well as the increasing use of these systems in diagnostic applications, further fuels market growth.

Apart from this, the Latin American market is developing, with growth driven by the increasing focus on research and development in life sciences and the gradual expansion of healthcare infrastructure. Countries such as Brazil and Mexico are leading this growth, with their rising investments in academic and pharmaceutical research. While the market is smaller compared to North America and Europe, there is a growing awareness of advanced molecular biology techniques and an increasing demand for sophisticated research tools, which contribute to the regional market expansion. The region’s growth is also supported by government initiatives to improve healthcare and research capabilities, as well as increasing collaborations with global research entities.

Moreover, the Middle East and Africa region represents an emerging segment in the market, primarily driven by the increasing investment in healthcare infrastructure and research activities. The growth in this region is led by countries such as Saudi Arabia, the United Arab Emirates, and South Africa, which are focusing on advancing their healthcare and research sectors. The market in this region is expected to grow as governments and private sectors continue to invest in healthcare and research, and as awareness of the importance of molecular biology in diagnostics and therapeutics increases.

Leading Key Players in the Gel Documentation Systems Industry:

Key players in the market are actively engaging in various strategies to strengthen their market position and address the growing demands of the sector. These strategies include research and development initiatives to introduce innovative and more efficient products, with a focus on enhancing imaging quality, user-friendliness, and software integration. Additionally, they are forming strategic partnerships and collaborations with academic and research institutions to expand their market reach and gain access to emerging technologies.Mergers and acquisitions are also a common strategy, allowing companies to consolidate their market presence and expand their product portfolios. Furthermore, these players are increasingly focusing on expanding their geographic footprint, particularly in rapidly growing markets such as Asia Pacific and Latin America, to tap into new customer bases and leverage emerging market opportunities.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Analytik Jena AG (Endress+Hauser)

- Atto Corporation

- Azure Biosystems Inc

- Bio-Rad Laboratories Inc.

- Cleaver Scientific

- Corning Incorporated

- Isogen Life Science B.V.

- LI-COR Biosciences

- MaestroGen Inc.

- Sigma-Aldrich (Merck KGaA)

- Syngene International Ltd. (Biocon Limited)

- Thermo Fisher Scientific Inc.

Key Questions Answered in This Report

- How big is the gel documentation systems market?

- What is the expected growth rate of the global gel documentation systems market during 2025-2033?

- What are the key factors driving the global gel documentation systems market?

- What has been the impact of COVID-19 on the global gel documentation systems market?

- What is the breakup of the global gel documentation systems market based on the product type?

- What is the breakup of the global gel documentation systems market based on the light source?

- What is the breakup of the global gel documentation systems market based on the detection technique?

- What is the breakup of the global gel documentation systems market based on the application?

- What are the key regions in the global gel documentation systems market?

- Who are the key players/companies in the global gel documentation systems market?

Table of Contents

Companies Mentioned

- Analytik Jena AG (Endress+Hauser)

- Atto Corporation

- Azure Biosystems Inc

- Bio-Rad Laboratories Inc.

- Cleaver Scientific

- Corning Incorporated

- Isogen Life Science B.V.

- LI-COR Biosciences

- MaestroGen Inc.

- Sigma-Aldrich (Merck KGaA)

- Syngene International Ltd. (Biocon Limited)

- Thermo Fisher Scientific Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 333.4 Million |

| Forecasted Market Value ( USD | $ 437.8 Million |

| Compound Annual Growth Rate | 3.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |