Mining Drills & Breakers Market Analysis:

- Major Market Drivers: The global market for mining drills & breakers is observed to be experiencing a surge on the back of few influencing factors, such as the rapid industrialization and urbanization, which has propelled the requirement for miniaturized drilling and breaking tools due to an increase in consumption of minerals and metals. Moreover, the widespread adoption of automated machinery in mining, specifically remote controlled, and wireless are well cited factors, which is further expected to drive the mining drills & breakers market share. The adoption of the modern drilling and breaking solutions are furthermore required by the strict regulations on the protection of workers and of the environment, which is stimulating the market growth. Apart from this, the rise in demand for the commodity from the mining sector in developing economies and extensive investment in infrastructure development are the major drivers of the market. Furthermore, the increasing fashion of exploration on complex and distant terrains requires breakthrough drilling and breaking technologies, which is accelerating the mining drills & breakers demand.

- Key Market Trends: Artificial intelligence (AI) and machine learning (ML) algorithms are integrated with drilling and breaking equipment, which is one of the primary trends that will push the market further by implementing predictive maintenance and optimizing operational performance. Another major trend is growing demand for small, lightweight drilling systems that are able to operate in tight spaces and hard-to-reach locations. The use of data analytics and sensor technologies also helps miners to monitor their work at real-time levels and make decisions. Besides this, an increasing demand of autonomous drilling system lessening dependence on human labor is expected to herald in greater operational efficiency, which is another key mining drills & breakers market trends. Additionally, innovations in drilling technology involving chemical analysis of rock and identifying deep mineral horizons, is providing a considerable thrust to the market growth.

- Geographical Trends: Asia Pacific is the largest market for mining drills & breakers around the globe, with high mineral resource reserves and rapid growth of mining activities. Moreover, the increasing consumption of base metals in countries like India, China, and Australia. China, especially, leads the market due to its large coal mining works and investments in mining projects, which is further providing a positive mining drills & breakers market outlook. Apart from this, increasing industrial expansion and urbanization in the region increases the requirement for metals and minerals, thereby fueling the market for drilling & breaking equipment. The Asia Pacific mining explosive market is also expanding due to the support of good government policies concerned with the domestic mining industry involving several initiatives taken to enhance the movements across these provinces.

- Competitive Landscape: The competitive landscape of the market is characterized by the presence of key mining drills & breakers companies, such as Atlas Copco AB, Boart Longyear, Casagrande S.p.A., Caterpillar Inc., Doosan Corporation, Epiroc AB, Furukawa Co. Ltd., Geodrill Limited, Komatsu Ltd., Sandvik AB, Soosan Heavy Industries Co. Ltd., etc.

- Challenges and Opportunities: The mining drills & breakers market faces several challenges and opportunities in its trajectory of growth. One significant challenge is the volatility in commodity prices, which can impact investment decisions and demand for drilling and breaking equipment. Moreover, stringent environmental regulations and community resistance to mining operations pose challenges to market expansion. Additionally, the high initial investment and operational costs associated with advanced drilling and breaking equipment may hinder market growth, particularly for small and medium-sized mining enterprises, which is accelerating the mining drills & breakers industry. Furthermore, geopolitical tensions and regulatory uncertainties in key mining regions can disrupt supply chains and affect market dynamics.

Mining Drills & Breakers Market Trends:

Increasing Demand for Minerals and Metals

The increasing need for metal and minerals as an outcome of fast urbanization and industrialization observed in developing economies such as China and India accounts to a main attribute driving the global mining drills & breakers market. Additionally, the increasing urbanization of global populations, the extension of infrastructural development, and the pursuit of raw materials such as iron ore, copper and gold across the globe are accelerating the market growth.As a result, the mining companies are expected to refurbish their drilling and breaking equipment to cater to the increased demand of these resources. Apart from this, the surging utilization of metals in applications such as construction, automotive and electronics across the globe is also acting as a key catalyst in the spurring the demand for mining activities, consequently encouraging the growth of drills and breakers market.

Technological Advancements in Mining Operations

The face of mining operations has become automated through advancements in mining technology, revolutionizing mining processes with advanced automation, remote operation features and the Internet of Things (IoT) integration that empowers efficiency, safety, and productivity. State-of-the-art drills and breakers come with various additions such as real-time monitoring, predictive maintenance, and even autonomous operation which will reduce down time and limit the amount of human involvement. This technological advancement is not only vital for operational efficiency but will also facilitate opening new remote and inaccessible deposits for mining companies to explore and mine, thus increasing the range of mineral explorations and extractions.Stringent Regulations on Safety and Environmental Protection

Stringent rules framed for long-term protection of workers and environment has forced mining companies to invest in low emission, low noise and low operation risk equipment. For instance, The Federal Mine Safety and Health Act (Mine Act) requires that the U.S Department of Labor's Mine Safety and Health Administration (MSHA) conduct inspections of all mines at least four times a year to ensure safe and healthy work environments for miners.Furthermore, stringent environmental standards and guidelines by various governments for mining activities are pushing market players to embrace driller and breaker products that are more environment friendly than conventional alternatives - in turn buoying the demand for environmentally safe drilling and breaking solutions. Furthermore, burgeoning emphasis on sustainable mining practices will compel demand for drills and breakers that lower the carbon footprint of mining operations, fostering research and development (R&D) as well as adoption of novel and environmentally friendly drills and breakers.

Mining Drills & Breakers Industry Segmentation:

The research provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on the type, product, application and sales channel.Breakup by Type:

- Drills

- Breaker.

Drills accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes drills and breakers. According to the report, drills are represented the largest segment.The drills segment is driven by the increasing demand for efficient and precise drilling techniques in mining operations. As mining activities expand to meet the growing global need for minerals and metals, the emphasis on precision drilling has intensified. Advanced drilling technologies enable mining companies to accurately target mineral deposits, minimizing waste and optimizing resource extraction. Efficiency in drilling not only enhances productivity but also reduces operational costs, making it a critical factor in the competitive mining industry.

Innovations such as automated drilling rigs, real-time data analytics, and advanced software for drill planning and monitoring contribute to more effective and efficient drilling processes. These technologies facilitate better decision-making, improve safety standards, and allow for the extraction of deeper and more complex ore bodies. Consequently, mining companies are increasingly investing in state-of-the-art drilling equipment to boost their operational capabilities and maintain profitability in a challenging market landscape.

Breakup by Product:

- Rotary Drills

- Crawler Drills

- Rock Breakers

- Hydraulic Breakers

- Other.

Rotary drills accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product. This includes rotary drills, crawler drills, rock breakers, hydraulic breakers, and others. According to the report, rotary drills represented the largest segment.The rotary drills segment is driven by the increasing technological advancements that are enhancing drilling efficiency and precision in mining operations. Innovations such as automated drilling systems, real-time data monitoring, and advanced drill bit designs have revolutionized rotary drilling processes, allowing for greater accuracy and reduced operational costs. Automation reduces the reliance on manual labor, thereby decreasing human error and improving safety in hazardous mining environments. Real-time data monitoring enables operators to make informed decisions quickly, optimizing drilling parameters to suit varying geological conditions and ensuring the maximum yield of resources.

Additionally, advanced drill bit technologies, including polycrystalline diamond compact (PDC) bits, have significantly improved the durability and performance of rotary drills, making them more effective in penetrating hard rock formations. These technological improvements not only enhance productivity but also extend the lifespan of drilling equipment, offering substantial cost savings to mining companies.

Breakup by Application:

- Metal Mining

- Mineral Mining

- Coal Minin.

Metal mining accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes metal mining, mineral mining, and coal mining. According to the report, metal mining represented the largest segment.The metal mining segment is driven by the increasing demand for metals such as iron, copper, gold, and aluminum in various industrial applications. As global industrialization accelerates, the need for these metals in manufacturing, construction, and infrastructure development surges, prompting mining companies to boost production. The expansion of urban centers and the construction of smart cities require significant quantities of steel and aluminum, further fueling the demand for efficient mining operations.

Additionally, the growing renewable energy sector relies heavily on metals like copper for electrical components and gold for its conductive properties in electronic devices. This escalating demand necessitates advanced drilling and breaking equipment capable of handling large-scale extraction operations efficiently, thus driving growth in the metal mining segment.

Breakup by Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftersale.

Original Equipment Manufacturer (OEM) accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes original equipment manufacturer (OEM) and aftersales. According to the report, original equipment manufacturer (OEM) represented the largest segment.The OEM segment in the mining drills & breakers market is driven by the increasing demand for high-quality, reliable equipment. Original equipment manufacturers (OEMs) are known for their stringent quality control measures, advanced engineering capabilities, and use of superior materials, which ensure the production of robust and durable equipment. Mining companies prioritize reliability and efficiency in their operations, and OEMs provide the assurance of consistency and performance, reducing the risk of equipment failure and downtime.

Additionally, the reputation of OEMs for providing comprehensive after-sales support, including maintenance services, spare parts availability, and technical assistance, enhances their appeal to mining operators seeking long-term partnerships. The complexity and scale of modern mining projects necessitate the use of advanced equipment with precise specifications, which OEMs are well-equipped to deliver, thus driving the segment's growth.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Afric.

Asia-Pacific leads the market, accounting for the largest mining drills & breakers market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia-Pacific accounted for the largest market share.The Asia Pacific market is driven by the increasing urbanization and industrialization in countries like China, India, and Southeast Asian nations. Rapid urban growth demands extensive infrastructure development, including residential, commercial, and industrial projects, which in turn necessitates a steady supply of minerals and metals. As cities expand and new industrial hubs emerge, the construction sector flourishes, boosting the demand for advanced drilling and breaking equipment to extract raw materials efficiently and sustainably. This infrastructure boom fuels investment in mining activities, driving the need for cutting-edge drills and breakers that can meet the high demands of large-scale construction projects.

Additionally, industrialization leads to the establishment of numerous manufacturing plants, further increasing the need for metals and minerals, thus stimulating the mining sector's growth and the subsequent market for mining drills and breakers in the Asia Pacific region. Moreover, advanced technologies such as AI-powered machinery, real-time data analytics, and autonomous drilling systems enable mining companies to optimize their processes, reduce operational costs, and minimize human intervention, thereby improving safety and reducing the risk of accidents. These innovations also facilitate the extraction of minerals from deeper and more challenging deposits, expanding the scope of exploration and ensuring a more efficient use of resources.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the mining drills & breakers include Atlas Copco AB, Boart Longyear, Casagrande S.p.A., Caterpillar Inc., Doosan Corporation, Epiroc AB, Furukawa Co. Ltd., Geodrill Limited, Komatsu Ltd., Sandvik AB, Soosan Heavy Industries Co. Ltd., etc.

- In the global mining drills & breakers market, key players are strategically enhancing their competitive edge through innovation, partnerships, and sustainable practices. They are investing heavily in R&D to introduce advanced, automated, and IoT-integrated equipment that increases efficiency, safety, and precision in mining operations. Collaborations and partnerships are being formed to expand technological capabilities and market reach, particularly in emerging economies. These companies are also focusing on eco-friendly solutions, developing equipment that minimizes environmental impact through reduced emissions and energy consumption. Furthermore, they are engaging in mergers and acquisitions to consolidate their market positions and diversify their product portfolios. To address the growing demand for sustainable mining practices, they are incorporating renewable energy technologies, such as electric and hydrogen-powered drills and breakers, into their offerings. This multi-faceted approach ensures they remain at the forefront of industry advancements and meet evolving market demands.

Key Questions Answered in This Report

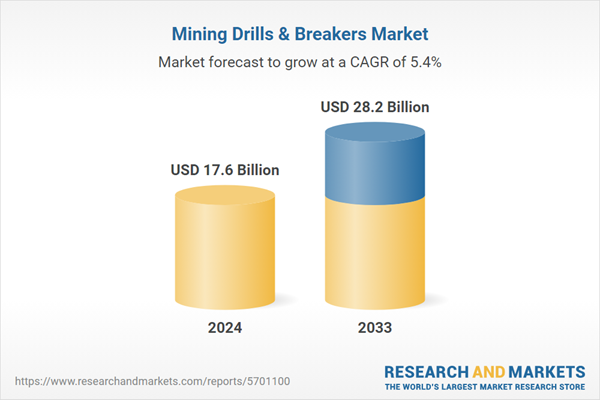

- What was the size of the global mining drills & breakers market in 2024?

- What is the expected growth rate of the global mining drills & breakers market during 2025-2033?

- What are the key factors driving the global mining drills & breakers market?

- What has been the impact of COVID-19 on the global mining drills & breakers market?

- What is the breakup of the global mining drills & breakers market based on the type?

- What is the breakup of the global mining drills & breakers market based on the product?

- What is the breakup of the global mining drills & breakers market based on the application?

- What is the breakup of the global mining drills & breakers market based on the sales channel?

- What are the key regions in the global mining drills & breakers market?

- Who are the key players/companies in the global mining drills & breakers market?

Table of Contents

Companies Mentioned

- Atlas Copco AB

- Boart Longyear

- Casagrande S.p.A.

- Caterpillar Inc.

- Doosan Corporation

- Epiroc AB

- Furukawa Co. Ltd.

- Geodrill Limited

- Komatsu Ltd.

- Sandvik AB

- Soosan Heavy Industries Co. Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 138 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 17.6 Billion |

| Forecasted Market Value ( USD | $ 28.2 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |