The global liposome development and liposome manufacturing services market is estimated to grow to USD 2.34 billion by 2035, at a CAGR of 9.7% during the forecast period to 2035.

Liposome Development and Liposome Manufacturing Services Market: Growth and Trends

Low drug solubility and its corresponding impact on bioavailability have remained a primary cause of concern for several drug candidates. According to a recent study, approximately 40% of marketed pharmacological products and close to 90% of drug candidates under development, have been associated with solubility and / or permeability issues, resulting in poor bioavailability. It is worth noting that, every year, a large number of drugs fail to reach the market due to poor bioavailability and issues associated with aqueous solubility. As a result, the industry is actively seeking various tools / methods to mitigate this challenge. Amongst the different approaches employed to enhance the bioavailability of therapeutic interventions, liposomes and other lipidic excipients have garnered the attention of drug developers, owing to their ability to act as drug carriers for complex, albeit highly promising therapeutics.

Manufacturing of liposomes is a highly complex and capital-intensive process fraught with a range of challenges, including highly technical processes (which demand niche and specialized expertise), infrastructure limitations, capacity constraints, and challenges in achieving clinical-grade production. Given the technical complexities associated with the manufacturing of such formulations, developers are increasingly relying on service providers. With increase in the number of liposome based therapeutics, the liposome development and manufacturing services market is anticipated to witness a steady growth in the near future.

Liposome Development and Liposome Manufacturing Services Market: Key Insights

The report delves into the current state of the liposome development and liposome manufacturing services market and identifies potential growth opportunities within the industry.

Some key findings from the report include:

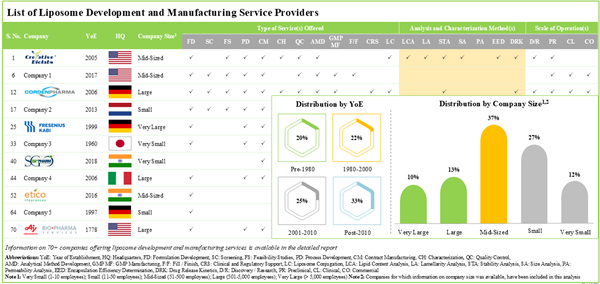

- Presently, over 70 players claim to offer a wide range of liposome development and manufacturing services across different scales of operation.

- Leveraging their expertise, stakeholders offer a variety of services for a myriad of highly potent liposomes; around 60% of the service providers possess the capability for stability analysis of liposomes.

- Close to 700 patents related to liposomes have been filed by various stakeholders in order to protect the intellectual property generated within this field.

- The growing interest is also reflected by the events being organized globally; such platforms provide an opportunity to industry stakeholders / researchers to share ideas and develop a better understanding of liposomes.

- 800+ clinical trials related to liposomes have been registered till date; the majority (38%) of these trials were / are being conducted across various clinical sites based in Europe.

- Since 2017, more than 6,000+ articles focused on liposomes have been published in high-impact journals, highlighting the substantial efforts undertaken by researchers.

Liposome Development and Liposome Manufacturing Services Market: Key Segments

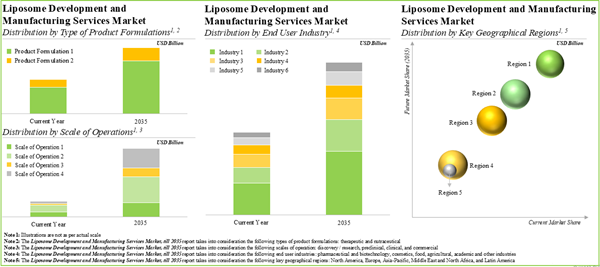

Therapeutic Formulations Occupy the Largest Share of the Liposome Development and Liposome Manufacturing Services Market

Based on the type of product formulation, the market is segmented into therapeutic and nutraceutical. Currently, the therapeutic formulation holds the maximum share of the liposome development and liposome manufacturing services market. It is worth highlighting that the liposome development and liposome manufacturing services market for nutraceuticals is likely to grow at a relatively higher CAGR.

Clinical Scale is Likely to Dominate the Liposome Development and Liposome Manufacturing Services Market

Based on the scale of operation, the market is segmented into discovery / research, preclinical, clinical and commercial. At present, the clinical scale captures the highest share of the liposome development and liposome manufacturing services market. It is worth highlighting that the discovery / research scale is to drive the market in the future with a relatively higher CAGR.

Pharmaceutical and Biotechnology Industry Occupies the Largest Share of the Liposome Development and Liposome Manufacturing Services Market

Based on the type of end-user, the market is segmented into pharmaceutical and biotechnology, cosmetics, food, agricultural, academic, and other industries. Currently, the pharmaceutical and biotechnology industry holds the maximum share of the liposome development and liposome manufacturing services market. This trend is unlikely to change in the foreseeable future.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific, Middle East and North Africa, and Latin America. The majority share is expected to be captured by players based in North America. It is worth highlighting that, over the years, the market in Latin America is expected to grow at a higher CAGR.

Sample Players in the Liposome Development and Liposome Manufacturing Services Market, Profiled in the Report Include:

- Baxter BioPharma Solutions

- Charles River Laboratories

- Evonik

- Fresenius Kabi

- GEA

- Intertek

- Fujifilm

The market sizing and opportunity analysis has been segmented across the following parameters:

Type Of Product Formulation

- Therapeutic

- Nutraceutical

Type of Scale of Operation

- Discovery / Research

- Preclinical

- Clinical and Commercial

Type of End User

- Pharmaceutical and Biotechnology,

- Cosmetics

- Food

- Agricultural

- Academic

- Other Industries

Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and North Africa

Liposome Development and Liposome Manufacturing Services Market: Research Coverage

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the liposome development and manufacturing services market, focusing on key market segments, including type of product formulation, type of scale of operation, type of end user, and key geographical regions.

- Market Landscape: A comprehensive evaluation of liposome development and manufacturing service providers involved in the liposome development and manufacturing services market, considering various parameters, such as year of establishment, company size (in terms of number of employees), region of headquarters, types of method(s) for liposome preparation, type of service(s) offered, liposome bioconjugation target(s), scalability, liposome analysis and characterization method(s), application(s) of liposomes, scale of operation and end user (s).

- Company Profiles: In-depth profiles of key industry players offering liposome development and manufacturing services across various geographies, focusing on company overviews, financial information (if available), service portfolio, recent developments and an informed future outlook.

- Clinical Trial Analysis: Examination of completed, ongoing, and planned clinical studies of liposomes based on parameters like trial registration year, trial status, trial registration year and patients enrolled, trial phase, type of sponsor / collaborator, study design, leading players (in terms of number of trials conducted), disease indication(s), popular therapeutic areas, type of treatment, emerging focus areas and regional distribution of trials (in terms of number of trials conducted and trial status).

- Publication Analysis: A detailed review of scientific articles related to research on liposomes, based on several relevant parameters, such as year of publication, application area(s), emerging focus areas and the top journals (in terms of number of publications and impact factor).

- Patent Analysis: Detailed analysis of various patents filed / granted for liposomes based on type of patent, patent publication year, granted patents and patent applications, geography, CPC symbols, emerging focus areas, type of organization, leading players (in terms of number of patents granted / filed) and patent characteristics. It also includes a patent benchmarking analysis and a detailed valuation analysis.

- Global Event Analysis: An analysis of recent events, covering webinars, conferences, seminars, workshops, symposiums and summits that were organized for stakeholders in this market, based on several relevant parameters, such as year of event, event platform, type of event, geography, evolutionary trends in event agenda, most active event organizers, active industry and non-industry players (in terms of number of events that each company participated in), seniority level of event speakers, affiliated department of event speakers, most active speakers (in terms of number of events) and a geographical mapping of upcoming events.

- Outsourcing: Go / No-Go Framework: An insightful framework that emphasizes the key indicators and factors that needs to be considered by liposome developers to determine whether to manufacture their respective products in-house or outsource the manufacturing operation to contract service providers.

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Baxter BioPharma Solutions

- Charles River Laboratories

- Evonik

- Fresenius Kabi

- GEA

- Intertek

- Fujifilm

Methodology

LOADING...