Spend management is a collection of procedures that assure enterprise purchasing, procurement, and sourcing decisions made in the interest of company efficiency and the bottom line. The main objective of spend management is to enhance business while minimizing costs, enhancing supplier bonds, and mitigating the financial threat.

Spend management is first and foremost linked to Spend analysis, strategic sourcing, and supplier relationship management are all included in procurement. However, spend management software would help the chief financial and procurement officers continue the expenditures’ transparency. Spend analysis is also known as the territory known as spend management which includes commodity management, strategic sourcing, incorporates spend analysis, and industry spend benchmarking.

Spend analysis is utilized for various purposes in different organizations. The final aim of the business is to achieve the highest profitability for the company. Moreover, to enhance and minimize the cycle period, operating assist enterprise search new ways of savings that were unexplored. Enterprise success or downfall can be based on the amount of money it invests in the spend management platform.

The platform allows consumers to identify where they are wasting their money and where it can be utilized perfectly, providing minimum risks, a spending routine, and intensified cash flow. The installation of automated cloud-based e-procurement systems can enhance spend management and cost-effective expense cost. The E-procurement or electronic procurement systems contains Bidding, negotiations, and a document store for contracts, requests for quotes (RFQs), and requests for proposals (RFPs).

COVID-19 Impact Analysis

The COVID-19 Impact had a negative effect on the spend management platform and majorly impacted various industries. The market is majorly affected due to the decline in activities across all sectors. Due to the COVID-19 outbreak, businesses are reevaluating their IT investments, contributing to a significant decrease in business software. For example, Coupa Software acquired Llama soft in November 2020 to expand its standing as a spend management platform. It assists in filling the time-space and provides constant accounting and actual time-spending transparency.Market Growth Factors

Utilizing Spend Analytics More Widely In Businesses

Spend management is a blanket term used to mention the procedure and track records of all the booking, payments, and transactions and helps monitor other organization expenditures. Moreover, companies are leveraging more and more data to utilize their spending, especially the expense of the companies. Spend management technologies are assisting organizations in handling their supply chains better. They provide real-time transparency and details of the service discounts, product lines, and distributor relationships.Increasing Use Of Cloud-Based Business Spending Software

Enterprises are adopting cloud-based organization spending solutions to assist innovation which will boost the growth of the spend management platform. With cloud-based solutions, companies can rapidly and calmly expand new ASP.NET web applications and services without investing in costly technologies. To start up and grow, enterprises used to have to invest in on-premise servers. Today, enterprises can develop custom software using their preferred app architecture whenever they want to stay competitive in their market.Marketing Restraining Factor

Lack Of Technical Expertise

Organizations’ procurement teams are overloaded with routine purchasing order processing, everyday purchasing tasks, supplier management, and many other tasks. Although, expenditure management requires ongoing initiatives to continuously collate, execute, assess, and define spending chances for saving data. It is challenging to evaluate or create a strategy for managing the company's spending when a businessperson needs a complete understanding of it. Real-time visibility is a common problem.Deployment Outlook

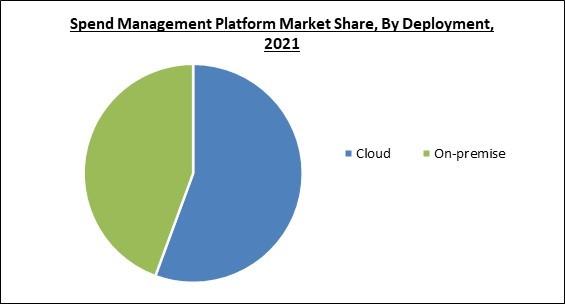

Based on the Deployment, the Spend Management Platform Market is segmented into On-premise and Cloud-based. The cloud segment acquired the highest revenue share in the spend management platform market in 2021. It is because utilizing the cloud-based helps small & medium size organizations to generate profit from the spend management software without spending the high adoption cost of the initial software installation by using cloud-based deployment.Enterprise Outlook

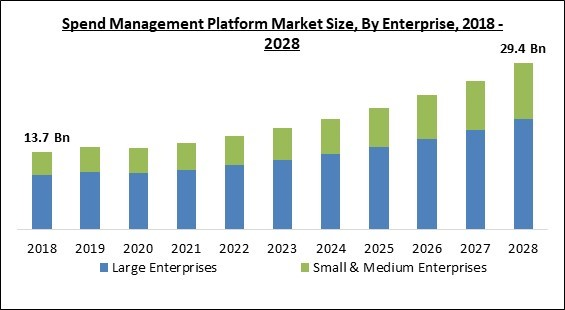

On the basis of Enterprise, the Spend Management Platform Market is divided into Large Enterprises and Small & Medium Enterprises. The small & medium enterprises segment recorded a significant revenue share in the spend management platform market in 2021. It is due to the reasons such as growing effectiveness in productivity, benefits, and organization function. Moreover, small & mid-size enterprises feel the bump in their expenditure more. Therefore, spend management is essential for all financial success.Application Outlook

By Application, the Spend Management Platform Market is classified into Consumer goods, Retail, Healthcare & Pharmaceutical, Manufacturing, and Others. The manufacturing segment garnered the highest revenue share in the spend management platform market in 2021. Due to the growing demands for AI software and cloud-based technologies for various small- and large-scale enterprises to utilize their spend management platforms.Regional Outlook

Region-wise, the Spend Management Platform Market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment acquired the largest revenue share in the spend management platform market in 2021. It is because the North America robust economy and developed internet adoption rates have forced the isolated infrastructure to transfer towards the cloud technology. Moreover, North America spend management platform industry helps manage the resources, time, and valuable data because of neck-to-neck competition.The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Coupa Software Inc., SAP SE, The Sage Group PLC, SutiSoft, Inc., NB Ventures, Inc. (Global eProcure), Proactis Holdings Limited (Café Bidco Limited), VA Tech Ventures Pvt Ltd (Happay)(Cred), Sievo Oy, Expensify, Inc., and Procurify Technologies, Inc.

Strategies Deployed in Spend Management Platform Market

Partnerships, Collaborations and Agreements:

- Sep-2021: Coupa teamed up with Carahsoft, a US-based technology company providing, software, IT hardware, and consulting services to government and educational institutions. Under this collaboration, Coupa’s Spend Management platform can be accessed by the public sector via Carahsoft’s NASA Solutions for Enterprise-Wide Procurement (SEWP) V contracts, Information Technology Enterprise Solutions - Software 2 (ITES-SW2), OMNIA Partners, and also through resellers network.

- Jun-2021: Proactis partnered with EPSA, a France-based company providing management and business consultancy services. This partnership enables bePayd's market share to further increase in the French market. bePayd is a company under Proactis Holdings.

- May-2020: Sage Intacct, part of The Sage Group PLC partnered with Airbase, a platform providing payment execution, and spend approvals services. This partnership enables Sage to help its customer manage and enhance workflows for spending, and provide them a comprehensive spend management solutions.

Acquisitions and Mergers:

- Aug-2022: Sage Group signed an agreement to acquire Lockstep, a US-based company providing a platform meant for the accounting department to streamline accounts receivable and accounts payable. With this acquisition, Sage Group and Lockstep both will continue to work on eradicating the obstacle that hinders the accounting teams to perform better by automating their workflows, and also enables Sage to move towards its aim to become a trusted network for Small and Midsize Businesses (SMB).

- Jul-2022: SAP took over Askdata, a business software providing service integration, business analytics, and big data analysis. With Askdata a part of SAP, SAP's potential to serve organizations has significantly increased and enables SAP's clients to take informed decisions by taking advantage of AI-driven natural language searches.

- Mar-2022: SAP acquired Taulia, a US-based company providing working capital management solutions. This acquisition broadened SAP's network and further advanced SAP's solutions.

- Mar-2021: SAP completed the acquisition of Signavio, a business process management company specializing in business process analysis, modeling tools, and decision management. This combination of SAP's business process intelligence and Signavio enables SAP to better serve its customers by providing an end-to-end business process transformation suite.

- Nov-2020: Coupa Software acquired Llamasoft, a supply-chain company providing software and expertise to large organizations to design and enhance their supply-chain network operations. Through this acquisition, Coupa aims to develop a superior Business Spend Management platform for helping companies everywhere in maximizing the value of every dollar spent in a simple, smart, and safe way.

Geographical Expansions:

- Sep-2022: GEP expanded its business by opening a new office in Abu Dhabi. The new office in Abu Dhabi offers a wide range of supply chain and procurement consulting, services, and procurement software platforms. This geographical expansion aligns with the firm's aspiration to expand its business across essential regions.

- Jul-2022: Coupa expanded its geographical footprint by establishing three new offices in Mexico City, São Paulo, and Bogotá. These new facilities provide Coupa opportunities to grow and collaborate.

Scope of the Study

By Deployment

- Cloud

- On-premise

By Enterprise

- Large Enterprises

- Small & Medium Enterprises

By Application

- Manufacturing

- Consumer Goods

- Retail

- Healthcare & Pharmaceutical

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Coupa Software Inc.

- SAP SE

- The Sage Group PLC

- SutiSoft, Inc.

- NB Ventures, Inc. (Global eProcure)

- Proactis Holdings Limited (Café Bidco Limited)

- VA Tech Ventures Pvt Ltd (Happay)(Cred)

- Sievo Oy

- Expensify, Inc.

- Procurify Technologies, Inc.

Unique Offerings

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Coupa Software Inc.

- SAP SE

- The Sage Group PLC

- SutiSoft, Inc.

- NB Ventures, Inc. (Global eProcure)

- Proactis Holdings Limited (Café Bidco Limited)

- VA Tech Ventures Pvt Ltd (Happay)(Cred)

- Sievo Oy

- Expensify, Inc.

- Procurify Technologies, Inc.