Home textile refers to the fabrics utilized for decorating and furnishing the home. The market for home textiles includes a wide range of functional as well as decorative products which are used for enhancing the home. Market players in the home textile market manufacture both artificial as well as natural fabric. Also, various products are available in the market that are made up by mixing both natural & artificial textile. Rising attraction toward home decor coupled with the changing lifestyle of people supports the market growth.

Usually, home textiles are manufactured by knitting, weaving, knotting non-woven, and pressing the fibers altogether. Some of the home textile products include curtains, cushion covers, furnishing fabric, bedspreads, rugs, napkins, and table linen. Various manufacturers are now producing home textiles made up of fabrics such as polyester, silks, and others. Also, some manufacturers are producing attractive products made up of bamboo and soya. Consumers do not want their elegantly-furnished and modern homes to be decorated with dull and conventional textile products which is arising the need for attractive home textiles.

Consumers are now more attracted to the use of products manufactured by the latest apparel technologies. For example, various manufacturers in the market are offering bed sheets that are made by Coolmax and Thermolite fabrics. Textiles are emerging as an integral part of today’s ideal home, in daily use as well as household installations. These textiles give a soothing look to the home’s interior.

Various advancements in technologies have transformed conventional textiles into high-performance textiles via adding various functionalities and improving the durability of products. This would allow the manufacturers to adopt the trend of electronic textiles that combine sustainable materials to easily reuse & dispose of and integrate nanotechnology in personal items that are for routine use. Hollow fibers having insulation properties are widely used in sleeping bags. Various other types of fibers are rising and being adopted to reduce the foams in furniture due to the risk of catching fire and other health hazards associated with the usage of such materials.

COVID-19 Impact Analysis

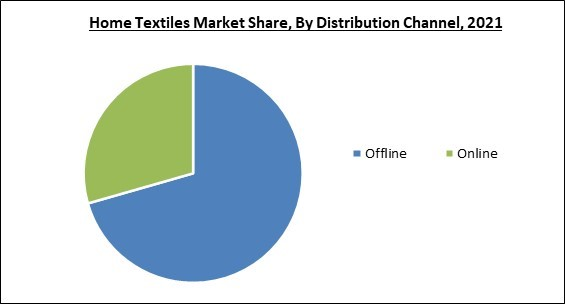

The widespread of novel coronavirus had a severe impact on the world’s economy. The home textiles market has also been negatively impacted during the pandemic period. Offline distribution channel had witnessed a major decline in the sale of home textiles. Changing lifestyle during the pandemic period along with the loss of jobs and less disposable incomes has resulted in this. Consumers preferred to spend more on essentials and ignore such products which are not necessary. Along with this, the manufacturing units were closed due to the lockdown, shortage of workforce, and other restrictions imposed by the governments of various regions. This has resulted in reduced production of home textiles. Moreover, the supply chains were also severely impacted due to trade and travel restrictionsMarket Growth Factors

3D fabric gaining traction in the market

The home textile market is witnessing a major shift in preference due to rising innovations in 3D cotton textiles. Although cotton is well known for its excess freshwater consumption which is posing pressure on natural resources. Due to this manufacturing companies are alternative cotton fabrics like lotus, and hemp nettles with the aim to avoid the exploitation of natural resources.Rising demand for sustainable silk

Customers are now becoming more aware of vegan silk. Conventional silk is a large contributor to environmental pollution which is a matter of concern. Due to this, cruelty-free silk is gaining more attention, especially from consumers who are environmentally conscious. Various other silk fabrics like spider silk, art silk, and soy silk are emerging as opportunities for the manufacturers of home textile products.Market Restraining Factors

Less availability of raw material

Although the concept of smart home textiles is latest trend, it has disadvantages when considering raw material availability. Everything used in the manufacturing of sustainable home textiles is required to be verified which may lead to delays in manufacturing. The market is witnessing raw material scarcity, which may lead to rising prices which may cause concerns such as cash flow problems and project delays. Instead of various alternatives, there are only a few solutions available in the market.Distribution Channel Outlook

On the basis of distribution channel, the home textiles market is fragmented into offline and online. The online segment covered a substantial revenue share in the home textiles market in 2021. This is attributable to the growing internet penetration and the growth of the e-commerce sector. The market in this segment is expanding due to the comfort of shopping through mobile phones without going to market.Product Outlook

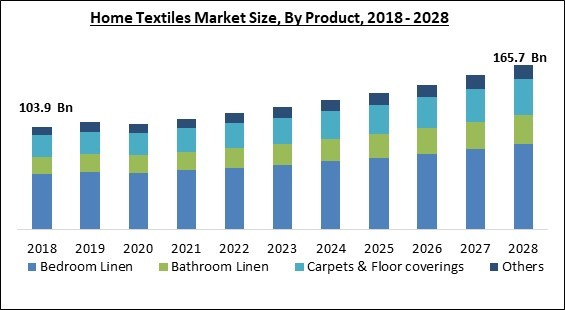

Based on product, the home textile market is segmented into bedroom linen, bathroom linen, carpets & floor coverings and others. In 2021, the bedroom linen segment dominated the home textile market with the maximum revenue share. Consumers are largely demanding bedsheets and other such products having digital printing. The demand for bedroom linens such as electronic thermal blankets is rising as these blankets could change their temperature automatically as per the user's body temperature and the climatic temperature.Regional Outlook

Region wise, the home textile market is analyzed across North America, Europe, Asia Pacific and LAMEA. The Asia Pacific region led the home textile market by generating the highest revenue share in 2021. This could be a result of growing residential construction and investment in real estate. Also, urbanization in regional nations such as India is rising the demand for such products to enhance the interior of homes. The rising spendable income of the people in regional nations such as India and China are further surging the demand for premium quality products.The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Evonik Industries AG (RAG-Stiftung), PPG Industries, Inc., Agropur Dairy Cooperative, Huber Engineered Materials (J.M. Huber Corporation), Kao Corporation, Solvay SA, Univar Solutions, Inc., Cabot Corporation and Brenntag SE

Scope of the Study

By Distribution Channel

- Offline

- Online

By Product

- Bedroom Linen

- Bathroom Linen

- Carpets & Floor coverings

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Evonik Industries AG (RAG-Stiftung)

- PPG Industries, Inc.

- Agropur Dairy Cooperative

- Huber Engineered Materials (J.M. Huber Corporation)

- Kao Corporation

- Solvay SA

- Univar Solutions, Inc.

- Cabot Corporation

- Brenntag SE

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Evonik Industries AG (RAG-Stiftung)

- PPG Industries, Inc.

- Agropur Dairy Cooperative

- Huber Engineered Materials (J.M. Huber Corporation)

- Kao Corporation

- Solvay SA

- Univar Solutions, Inc.

- Cabot Corporation

- Brenntag SE