Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

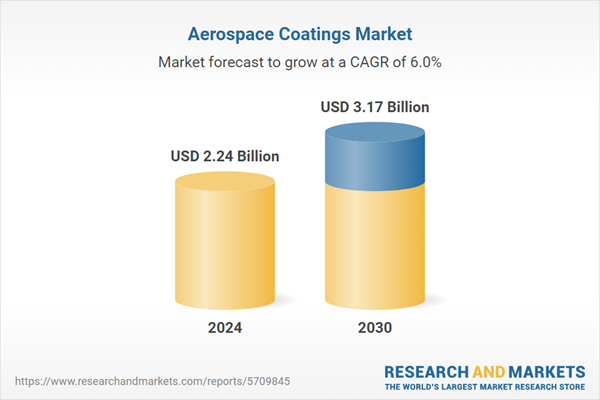

Future growth will be shaped by next-generation innovations, including smart coatings with anti-icing, self-healing, and radar-absorbing capabilities, the commercialization of eco-friendly, low-VOC formulations, and solutions tailored for lightweight composite materials increasingly used in new aircraft designs. At the same time, defense modernization initiatives worldwide are accelerating demand for high-performance, mission-specific coatings. Collectively, these dynamics position the aerospace coatings sector as a high-value, technology-driven market with strong long-term expansion prospects.

Key Market Drivers

Expansion of Commercial Aviation

The expansion of commercial aviation is a primary driver of growth in the global aerospace coating market, The FAA’s Air Traffic Organization (ATO) oversees the safe and efficient movement of over 44,000 flights and more than 3 million passengers daily, coordinating operations across 29 million square miles of controlled airspace. This scale underscores ATO’s critical role in maintaining the reliability and safety of U.S.and international aviation traffic, as increasing air travel demands translate directly into higher production, maintenance, and refurbishment of aircraft, all of which rely heavily on advanced coating solutions. With rising passenger traffic worldwide, airlines are continuously expanding their fleets to meet capacity requirements, especially in fast-growing regions such as Asia-Pacific, North America, and the Middle East. This surge in new aircraft deliveries stimulates demand for aerospace coatings that ensure structural integrity, aerodynamic efficiency, and long-term protection against environmental stressors such as UV radiation, moisture, and temperature fluctuations.

Fleet modernization and aircraft refurbishment initiatives further reinforce this demand. As part of its broader transformation strategy, Air India is investing $400 million to modernize the interiors of 67 aircraft, with a strong emphasis on upgrading its A320neo fleet. The initiative is designed to elevate service standards, enhance passenger experience, and align the airline’s fleet with global benchmarks in comfort and efficiency. Airlines are investing in Maintenance, Repair, and Overhaul (MRO) programs to extend the service life of their aircraft and improve operational efficiency. High-performance coatings are crucial in these processes, providing corrosion protection, reducing maintenance frequency, and enhancing surface aesthetics.

Commercial aviation trends toward lightweight, fuel-efficient aircraft amplify the role of coatings. Advanced coatings, such as polyurethane and epoxy-based liquid systems, contribute to weight optimization while offering high durability, helping airlines reduce fuel consumption and operational costs. The emphasis on regulatory compliance and sustainability also drives adoption of low-VOC and environmentally friendly coatings across commercial fleets, aligning with global emissions reduction targets.

The rapid growth of commercial aviation through fleet expansion, modernization, and MRO activities creates sustained demand for innovative, high-performance, and eco-friendly aerospace coatings, positioning this factor as a critical market driver with long-term impact on the global aerospace coating industry.

Key Market Challenges

High Cost of Advanced Coatings

Advanced aerospace coatings, such as polyurethane, epoxy, and specialized liquid systems, are expensive due to the high-quality raw materials, complex formulation processes, and stringent performance requirements. The high cost can be a barrier for smaller aircraft manufacturers and MRO service providers, particularly in emerging markets, limiting widespread adoption. Additionally, incorporating specialized features like anti-corrosion, anti-icing, or radar-absorbing properties further increases production costs, creating budget constraints and slowing market penetration in cost-sensitive regions.Key Market Trends

Adoption of Eco-Friendly and Sustainable Coating Solutions

A significant trend in the aerospace coating market is the shift toward environmentally sustainable solutions. Manufacturers are increasingly developing waterborne, low-VOC, and bio-based coatings to meet global environmental standards and reduce carbon footprints. This trend is being driven not only by regulatory pressure but also by airlines’ sustainability initiatives, which prioritize the use of coatings that minimize environmental impact without compromising performance. The ongoing R&D in eco-friendly formulations positions the market for long-term innovation and adoption, particularly in regions with strict environmental compliance frameworks.Key Market Players

- Akzo Nobel N.V.

- The Sherwin-Williams Company

- PPG Industries, Inc

- Axalta Coating Systems Ltd

- Asahi Kinzoku Kogyo Inc.

- Brycoat.Inc.

- International Aerospace Coatings Holdings LP

- Nippon Paint Holdings Co., Ltd

- Hentzen Coatings, Inc

- BASF Coatings GmbH

Report Scope:

In this report, the Global Aerospace Coatings Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Aerospace Coatings Market, By Resin:

- Polyurethane

- Epoxy

- Others

Aerospace Coatings Market, By Product:

- Liquid

- Powder

Aerospace Coatings Market, By End User:

- Commercial

- Military

- Others

Aerospace Coatings Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Aerospace Coatings Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Akzo Nobel N.V.

- The Sherwin-Williams Company

- PPG Industries, Inc

- Axalta Coating Systems Ltd

- Asahi Kinzoku Kogyo Inc.

- Brycoat.Inc.

- International Aerospace Coatings Holdings LP

- Nippon Paint Holdings Co., Ltd

- Hentzen Coatings, Inc

- BASF Coatings GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.24 Billion |

| Forecasted Market Value ( USD | $ 3.17 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |