Increasing Number of Prostate Cancer Screening and Testing

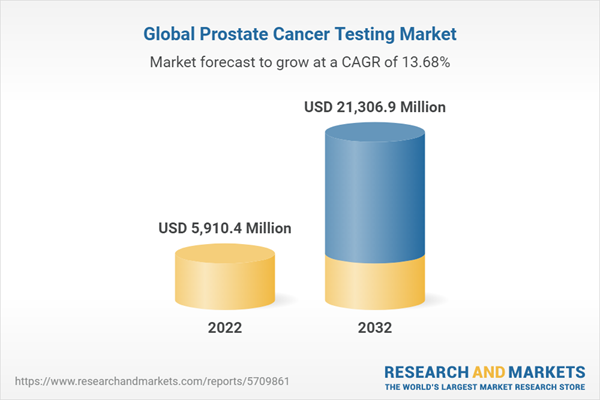

In 2021, the global prostate cancer testing market was valued at $5,246.9 million, and it is expected to reach $21,306.9 million by 2032, growing at a CAGR of 13.68% during the forecast period 2022-2032. The growth in the global prostate cancer testing market is expected to be driven by high investments in the field of cancer research and the rising prevalence of prostate cancer globally. In addition, the focus of business leaders is establishing a deep understanding to address the unmet needs in clinical research to understand the prostate cancer market.

Market Lifecycle Stage

The global prostate cancer testing market is in progressing phase. PSA screening or testing in a general population has increased the incidence of prostate cancer in recent decades. In addition, prostate cancer testing is essential in precision medicine because it assures the safe and successful use of tailored therapies. The majority of the companies in the global prostate cancer testing market provide biomarker tests that are urine, blood, and tissue-based, as well as testing services. Furthermore, applications of prostate cancer testing are primarily clinical and research.

Impact

One of the main reasons for the expansion of the prostate cancer testing market in the upcoming years is the rise in prostate cancer cases. Prostate cancer is the second most frequent disease diagnosed in men, and its frequency is rising across the globe. Prostate cancer is thought to be diagnosed in one million additional cases worldwide each year. Due to an aging population, growing urbanization, and accompanying lifestyle changes, the overall incidence of prostate cancer has increased over the past few decades.

Impact of COVID-19

During the coronavirus disease 2019 (COVID-19) pandemic, a number of disease models issued warnings about an excess of cancer fatalities brought on by missed cancer screenings as a result of the general population's quarantine and a lack of healthcare resources. The COVID-19 pandemic has had a negative impact on early diagnosis in the specific case of prostate cancer, the second most common cancer in men, by reducing participation in screening programs and on time from diagnostic testing to surgery/radiotherapy, which may translate into a worse prostate-cancer-specific death rate in the coming years. Additionally, in other areas, including Florida, state governments disallowed non-essential healthcare services.

Significant reductions in cancer screenings were seen in the early stages of the COVID-19 pandemic. According to a research paper published in January 2022 by the University of Florida, screenings for prostate cancer were reduced by 74%. Due to these screening figures, there may have been thousands more cancer deaths in the U.S. than were registered.

For instance, prostate-specific antigen (PSA) testing rates and the identification of several urological malignancies, including prostate cancer, have been found to be declining in significantly afflicted populations. Several Australian urologists worry that men with possibly curable prostate cancer may have missed their chance for a cure due to low screening test uptake during the lockdowns of 2020. According to a research paper published by BMC Urology in June 2022, a total of 4,048,099 PSA tests and 118,328 prostate biopsies were performed in Australia over the six years of data analysis. In the years 2019 and 2020, 68,429 prostate magnetic resonance imaging (MRI) were performed. Between 2015 and 2019, there were, on average, 19,573 prostate biopsies and 678,082 PSA testing performed per year.

Market Segmentation

Segmentation 1: by Test Type

- Pre-Biopsy Test

- Biopsy

- Post-Biopsy Test

Based on test type, the pre-biopsy test in the global prostate cancer testing market is expected to be dominated by the test type segment. This is due to the increasing popularity of prostate cancer testing and rising awareness related to prostate cancer testing.

Segmentation 2: by Application

- Clinical

- Research

Based on application, the global prostate cancer testing market is dominated by the clinical segment owing to the rising R&D activity focused on the development of prostate cancer testing. The diagnosis of prostate cancer has developed a new molecular-based diagnostics technology. To detect clinically relevant cancer upon diagnosis, several tools or therapeutic options are required to improve the patient’s quality of life.

Segmentation 3: by End User

- Cancer Research Institutes

- Diagnostic Laboratories

- Hospitals and Clinics

- Ambulatory Surgical Center (ASCs)

- Others

Based on end user, the global prostate cancer testing market is dominated by the ambulatory surgical centers (ASCs) segment owing to their rise in number. They are dedicated to offering same-day surgical care, including testing and protective procedures. ASCs, which have a proven track record of providing high-quality treatment and successful patient outcomes, have altered the outpatient experience for millions of Americans by giving patients a more convenient option for hospital-based outpatient operations.

Segmentation 4: by Region

- North America - U.S., and Canada

- Europe - U.K., Germany, France, Italy, Spain, Netherlands and Rest-of-Europe

- Asia-Pacific - Japan, China, India, South Korea, Australia, and Rest-of-Asia-Pacific

- Latin America - Brazil, Mexico, and Rest-of-Latin America

- Rest-of-the-World

North America generated the highest revenue of $2,702.9 million in 2021, which is attributed to the several established diagnostics manufacturers in this region who are focusing on expanding their portfolios in prostate cancer testing and are collaborating with service providers and pharmaceutical giants to co-market prostate cancer testing solutions with its complementary precision medicine solutions. Moreover, the U.S. government is currently undertaking several initiatives to develop tests for cancer and provide funds to new start-ups in the cancer diagnostics field.

Recent Developments in the Global Prostate Cancer Testing Market

- In September 2022, Veracyte, Inc. announced the publishing of data in the Journal of the National Cancer Institute to demonstrate the company’s decipher prostate genomic classifier may help identify African American men with early, localized prostate cancer who are most likely to harbor more aggressive disease.

- In August 2019, BioReference Laboratories, Inc. announced the selection by The IPA Association of America (TIPAAA) as its provider of laboratory services and to assist with data analytics for its members’ patients. The agreement is designed to enhance patient care and offers collaborative health management tools to TIPAAA members, which includes more than 667 medical organizations in 39 states. The members can have convenient access to BioReference’s comprehensive laboratory testing menu, including routine and specialty tests, as well as the 4Kscore for detecting aggressive prostate cancer.

- In June 2021, Thermo Fisher Scientific announced submissions open for the Oncomine Clinical Research Grant program to support clinical research projects in oncology. The grant aims to provide funding for high-quality molecular profiling studies focusing on the impact of immune-based treatments for cancer patients.

Demand - Drivers and Limitations

The following are the demand drivers for the global prostate cancer testing market:

- Rising Prevalence of Prostate Cancer Globally

- Increasing Number of Prostate Cancer Screening and Testing

- Government Initiatives Related to Prostate Cancer

The market is expected to face some limitations due to the following challenges:

- Probability of False Positive Results of Prostate Cancer Testing

- Clinical Gaps Related to Prostate Cancer Testing

How can this report add value to an organization?

Workflow/Innovation Strategy: The workflow segment helps the reader understand the two prostate cancer testing, i.e., pre-biopsy, biopsy, and post-biopsy, which further aid in diagnosis. Moreover, the study provides the reader with a detailed understanding of the different applications of prostate cancer testing in clinical and research applications.

Growth/Marketing Strategy: Prostate cancer testing is being used for both research and clinical application. Various companies are providing urine and blood, and tissue-based biomarkers that aid in the diagnosis, which is also the key strategy for market players to excel in the current prostate cancer testing market.

Competitive Strategy: Key players in the global prostate cancer testing market are analyzed and profiled in the study, including manufacturers who are involved in new product launches, acquisitions, expansions, and strategic collaborations. Moreover, a detailed competitive benchmarking of the players operating in the global prostate cancer testing market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some of the prominent names in this market are:

- Abbott.

- Abcam plc.

- Agilent Technologies, Inc.

- Bio-Techne. (ExoDx)

- Cleveland Diagnostics, Inc.

- Danaher. (Beckman Coulter, Inc.)

- Exact Sciences Corporation

- F. Hoffmann-La Roche Ltd (FOUNDATION MEDICINE, INC.)

- H.U. Group Holdings, Inc. (Fujeribio)

- mdxhealth.

- Siemens Healthcare GmbH

- Myriad Genetics, Inc.

- NeoGenomics Laboratories.

- OPKO Health, Inc. (GenPath)

- Veracyte, Inc.

Companies that are not a part of the aforementioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

1 Markets

1.1 Product Definition

1.1.1 Inclusion and Exclusion Criteria

1.2 Market Scope

1.2.1 Scope of the Study

1.2.2 Key Questions Answered in the Report

1.3 Research Methodology

1.3.1 Global Prostate Cancer Testing Market: Research Methodology

1.3.2 Data Sources

1.3.2.1 Primary Data Sources

1.3.2.2 Secondary Data Sources

1.3.3 Market Estimation Model

1.3.4 Criteria for Company Profiling

1.4 Market: Overview

1.4.1 Market Definition

1.4.2 Market Footprint and Growth Potential

1.4.3 Future Potential

1.4.4 COVID-19 Impact on Global Prostate Cancer Testing Market

2 Industry Analysis

2.1 Overview

2.2 Legal Requirements and Framework in the U.S.

2.2.1 National Comprehensive Cancer Network (NCCN) Guidelines

2.2.2 American Urological Association (AUA)

2.2.3 American Cancer Society (ACS)

2.2.4 U.S. Preventive Services Task Force (USPSTF)

2.3 Legal Requirements and Framework in Europe

2.4 Legal Requirements and Framework in Asia-Pacific

2.4.1 China

2.5 Patent Analysis

2.5.1 Patent Filing Trend

2.5.2 Patent Analysis (by Year)

2.5.3 Patent Analysis (by Region)

2.5.4 Patent Analysis (by Country)

3 Global Prostate Cancer Testing Market: Market Dynamics

3.1 Overview

3.1.1 Impact Analysis

3.2 Market Drivers

3.2.1 Rising Prevalence of Prostate Cancer Globally

3.2.1.1 Disease Trend

3.2.1.2 Increasing Number of Prostate Cancer Screening and Testing

3.2.1.3 Government Initiatives Related to Prostate Cancer

3.2.2 Market Restraints

3.2.2.1 Probability of False Positive Results of Prostate Cancer Testing

3.2.2.2 Clinical Gaps Related to Prostate Cancer Testing

3.2.3 Market Opportunities

3.2.3.1 New Treatment Therapy and Technique for Prostate Cancer

4 Global Prostate Cancer Testing Market: Competitive Landscape

4.1 Overview

4.2 Corporate Strategies

4.2.1 Mergers and Acquisitions

4.2.2 Synergistic Activities

4.2.3 Business Expansions and Funding

4.3 Business Strategies

4.3.1 Product Launches and Approvals

4.3.2 Publications

4.3.3 Licenses and Agreements

4.3.4 Other Activities

4.4 Market Share Analysis

5 Global Prostate Cancer Testing Market (by Test Type), Value ($million), 2021-2032

5.1 Overview

5.2 Pre-biopsy Test

5.2.1 Biomarker Test

5.2.1.1 Blood-Based

5.2.1.2 Urine-Based

5.2.2 Imaging Test

5.3 Biopsy

5.4 Post-Biopsy Test

5.4.1 Tissue-Based Biomarker Test

6 Global Prostate Cancer Testing Market (by Application), Value ($Million), 2021-2032

6.1 Overview

6.2 Clinical

6.3 Research

7 Global Prostate Cancer Testing Market (by End User), Value ($Million), 2021-2032

7.1 Overview

7.2 Cancer Research Institutes

7.3 Diagnostic Laboratories

7.4 Hospitals and Clinics

7.5 Ambulatory Surgical Centers (ASCs)

7.6 Others

8 Global Prostate Cancer Testing Market (by Region), Value ($Million), 2021-2032

8.1 Overview

8.2 North America

8.2.1 U.S.

8.2.2 Canada

8.3 Europe

8.3.1 Germany

8.3.2 France

8.3.3 U.K.

8.3.4 Italy

8.3.5 Spain

8.3.6 Netherlands

8.3.7 Rest-of-Europe

8.4 Asia-Pacific

8.4.1 China

8.4.2 Japan

8.4.3 India

8.4.4 Australia

8.4.5 South Korea

8.4.6 Rest-of-Asia-Pacific (RoAPAC)

8.5 Latin America

8.5.1 Brazil

8.5.2 Mexico

8.5.3 Rest-of-Latin America

8.6 Rest-of-the-World (RoW)

9 Company Profiles

9.1 Overview

9.2 Abbott.

9.2.1 Company Overview

9.2.2 Role of Abbott. in the Global Prostate Cancer Testing Market

9.2.3 Key Competitors of the Company

9.2.4 Financials

9.2.5 Key Insights about the Financial Health of the Company

9.2.6 Analyst Perspective

9.3 Abcam plc.

9.3.1 Company Overview

9.3.2 Role of Abcam plc. in the Global Prostate Cancer Testing Market

9.3.3 Key Customers of the Company

9.3.4 Key Competitors of the Company

9.3.5 Financials

9.3.6 Analyst Perspective

9.4 Agilent Technologies, Inc.

9.4.1 Company Overview

9.4.2 Role of Agilent Technologies, Inc. in the Global Prostate Cancer Testing Market

9.4.3 Key Competitors of the Company

9.4.4 Financials

9.4.5 Analyst Perspective

9.5 Bio-Techne. (ExoDx)

9.5.1 Company Overview

9.5.2 Role of Bio-Techne. (ExoDx) in the Global Prostate Cancer Testing Market

9.5.3 Key Competitors of the Company

9.5.4 Financials

9.5.5 Key Insights about the Financial Health of the Company

9.5.6 Corporate Strategies

9.5.7 Business Strategies

9.5.8 Analyst Perspective

9.6 Cleveland Diagnostics, Inc.

9.6.1 Company Overview

9.6.2 Role of Cleveland Diagnostics, Inc. in the Global Prostate Cancer Testing Market

9.6.3 Key Competitors of the Company

9.6.4 Corporate Strategies

9.6.5 Business Strategies

9.6.6 Analyst Perspective

9.7 Danaher. (Beckman Coulter, Inc.)

9.7.1 Company Overview

9.7.2 Role of Danaher. (Beckman Coulter, Inc.) in the Global Prostate Cancer Testing Market

9.7.3 Key Competitors of the Company

9.7.4 Financials

9.7.5 Key Insights about the Financial Health of the Company

9.7.6 Analyst Perspective

9.8 Exact Sciences Corporation

9.8.1 Company Overview

9.8.2 Role of Exact Sciences Corporation in the Global Prostate Cancer Testing Market

9.8.3 Key Customers of the Company

9.8.4 Key Competitors of the Company

9.8.5 Financials

9.8.6 Key Insights about the Financial Health of the Company

9.8.7 Corporate Strategies

9.8.8 Business Strategies

9.8.9 Analyst Perspective

9.9 F. Hoffmann-La Roche Ltd (FOUNDATION MEDICINE, INC.)

9.9.1 Company Overview

9.9.2 Role of F. Hoffmann-La Roche Ltd (FOUNDATION MEDICINE, INC.) in the Global Prostate Cancer Testing Market

9.9.3 Key Competitors of the Company

9.9.4 Financials

9.9.5 Key Insights about the Financial Health of the Company

9.9.6 Corporate Strategies

9.9.7 Business Strategies

9.9.8 Analyst Perspective

9.1 H.U. Group Holdings, Inc. (Fujeribio)

9.10.1 Company Overview

9.10.2 Role of H.U. Group Holdings, Inc. (Fujeribio) in the Global Prostate Cancer Testing Market

9.10.3 Key Competitors of the Company

9.10.4 Financials

9.10.5 Analyst Perspective

9.11 mdxhealth.

9.11.1 Company Overview

9.11.2 Role of mdxhealth. in the Global Prostate Cancer Testing Market

9.11.3 Financials

9.11.4 Key Insights about the Financial Health of the Company

9.11.5 Corporate Strategies

9.11.5.1 Mergers and Acquisitions

9.11.6 Business Strategies

9.11.7 Analyst Perspective

9.12 Siemens Healthcare GmbH

9.12.1 Company Overview

9.12.2 Role of Siemens Healthcare GmbH in the Global Prostate Cancer Testing Market

9.12.3 Key Competitors of the Company

9.12.4 Financials

9.12.5 Key Insights about the Financial Health of the Company

9.12.6 Analyst Perspective

9.13 Myriad Genetics, Inc.

9.13.1 Company Overview

9.13.2 Role of Myriad Genetics, Inc. in the Global Prostate Cancer Testing Market

9.13.3 Key Competitors of the Company

9.13.4 Corporate Strategies

9.13.5 Business Strategies

9.13.6 Financials

9.13.7 Key Insights about the Financial Health of the Company

9.13.8 Analyst Perspective

9.14 NeoGenomics Laboratories.

9.14.1 Company Overview

9.14.2 Role of NeoGenomics Laboratories. in the Global Prostate Cancer Testing Market

9.14.3 Key Competitors of the Company

9.14.4 Financials

9.14.5 Key Insights about the Financial Health of the Company

9.14.6 Business Strategies

9.14.7 Analyst Perspective

9.15 OPKO Health, Inc. (GenPath)

9.15.1 Company Overview

9.15.2 Role of OPKO Health, Inc. (GenPath) in the Global Prostate Cancer Testing Market

9.15.3 Key Customers of the Company

9.15.4 Key Competitors of the Company

9.15.5 Financials

9.15.6 Key Insights about the Financial Health of the Company

9.15.7 Corporate Strategies

9.15.8 Business Strategies

9.15.9 Analyst Perspective

9.16 Veracyte, Inc.

9.16.1 Company Overview

9.16.2 Role of Veracyte, Inc. in the Global Prostate Cancer Testing Market

9.16.3 Key Customers of the Company

9.16.4 Key Competitors of the Company

9.16.5 Financials

9.16.6 Corporate Strategies

9.16.7 Analyst Perspective

9.17 Emerging Companies

9.17.1 Exact imaging

9.17.2 Proteomedix

9.17.3 Gregor Diagnostics

List of Figures

Figure 1: Tests Related to Prostate Cancer

Figure 2: Global Prostate Cancer Testing Market Segmentation

Figure 3: Share of Global Prostate Cancer Testing Market (by Test Type), $Million, 2021 and 2032

Figure 4: Share of Global Prostate Cancer Testing Market (by Application), $Million, 2021 and 2032

Figure 5: Share of Global Prostate Cancer Testing Market (by End User), $Million, 2021 and 2032

Figure 6: Global Prostate Cancer Testing Market Segmentation

Figure 7: Global Prostate Cancer Testing Market: Research Methodology

Figure 8: Primary Research Methodology

Figure 9: Bottom-Up Approach (Segment-Wise Analysis)

Figure 10: Top-Down Approach (Segment-Wise Analysis)

Figure 11: Workflow of Prostate Cancer Testing (NCCN Guidelines)

Figure 12: NCCN Guidelines for Prostate Cancer Propose Germline Testing for Patients

Figure 13: Year-Wise Analysis of Patents Related to Global Prostate Cancer Testing, January 2019-November 2022

Figure 14: Region-Wise Analysis of Patents Related to Prostate Cancer Testing, January 2019-November 2022

Figure 15: Country-Wise Analysis of Patents Related to Prostate Cancer Testing, January 2019-November 2022

Figure 16: Global Prostate Cancer Testing Market - Market Dynamics

Figure 17: Likert Scale

Figure 18: Impact Analysis of Market Drivers and Market Challenges on the Global Prostate Cancer Testing Market

Figure 19: Trend of New Cases and Death Rate Related to Prostate Cancer Market

Figure 20: Share of Key Developments, January 2019-November 2022

Figure 21: Share of Mergers and Acquisitions (by Company), January 2019-November 2022

Figure 22: Share of Synergistic Activities (by Company), January 2019-November 2022

Figure 23: Number of Business Expansions and Funding Activities (by Company), January 2019-November 2022

Figure 24: Number of Product Launches and Approvals (by Company), January 2019-November 2022

Figure 25: Share of Publications (by Company), January 2019-November 2022

Figure 26: Number of Licenses and Agreements (by Company), January 2019-November 2022

Figure 27: Number of Other Activities (by Company), January 2019-November 2022

Figure 28: Market Share Analysis of Global Prostate Cancer Testing Market (Pre-Biopsy Testing), 2021

Figure 29: Market Share Analysis of Global Prostate Cancer Testing Market (Post-Biopsy Tissue Testing), 2021

Figure 30: Global Prostate Cancer Testing Market (by Test Type)

Figure 31: Share of Global Prostate Cancer Testing Market (by Test Type), $Million, 2021 and 2032

Figure 32: Global Prostate Cancer Testing Market (Pre-Biopsy Test), $Million, 2021-2032

Figure 33: Phases of Biomarker

Figure 34: Classification of Biomarker

Figure 35: Biomarker Test: Prostate Cancer

Figure 36: Biomarker Testing: Goals

Figure 37: Global Prostate Cancer Testing Market (Biomarker Test), $Million, 2021-2032

Figure 38: Global Prostate Cancer Testing Market (Blood-Based), $Million, 2021-2032

Figure 39: Global Prostate Cancer Testing Market (Urine-Based), $Million, 2021-2032

Figure 40: Advantages of Imaging Test: Prostate Cancer

Figure 41: Imaging Test: Prostate Cancer

Figure 42: Advantages of mp-MRI

Figure 43: Global Prostate Cancer Testing Market (Imaging Test), $Million, 2021-2032

Figure 44: Uses of TRUS-Based Biopsy

Figure 45: Prostate Biopsy Methods

Figure 46: Global Prostate Cancer Testing Market (Biopsy), $Million, 2021-2032

Figure 47: Global Prostate Cancer Testing Market (Post-Biopsy Test), $Million, 2021-2032

Figure 48: Utility of Tissue-Based Biomarker in Prostate Cancer Management

Figure 49: Global Prostate Cancer Testing Market (Tissue-Based Biomarker Test), $Million, 2021-2032

Figure 50: Share of global Prostate Cancer Testing Market (by Application), $Million, 2021 and 2032

Figure 51: Global Prostate Cancer Testing Market (Clinical), $Million, 2021-2032

Figure 52: Global Prostate Cancer Testing Market (Research), $Million, 2021-2032

Figure 53: Global Prostate Cancer Testing Market (by End User)

Figure 54: Share of Global Prostate Cancer Testing Market (by End User), $Million, 2021 and 2032

Figure 55: Global Prostate Cancer Testing Market (Cancer Research Institute), $Million, 2021-2032

Figure 56: Global Prostate Cancer Testing Market (Diagnostic Laboratories), $Million, 2021-2032

Figure 57: Global Prostate Cancer Testing Market (Hospitals and Clinics), $Million, 2021-2032

Figure 58: Global Prostate Cancer Testing Market (Ambulatory Surgical Centers), $Million, 2021-2032

Figure 59: Global Prostate Cancer Testing Market (Others), $Million, 2021-2032

Figure 60: Global Prostate Cancer Testing Market Snapshot (by Region)

Figure 61: Global Prostate Cancer Testing Market (by Region), $Million, 2022-2032

Figure 62: North America Prostate Cancer Testing Market, $Million, 2022-2032

Figure 63: North America: Market Dynamics

Figure 64: North America Prostate Cancer Testing Market (by Country), $Million, 2021-2032

Figure 65: U.S. Prostate Cancer Testing Market, $Million, 2021-2032

Figure 66: U.S. Prostate Cancer Testing Market (by Test Type), $Million, 2021-2032

Figure 67: Canada Prostate Cancer Testing Market, $Million, 2022-2032

Figure 68: Canada Prostate Cancer Testing Market (by Test Type), $Million, 2021-2032

Figure 69: Europe Prostate Cancer Testing Market, $Million, 2022-2032

Figure 70: Europe: Market Dynamics

Figure 71: Europe Prostate Cancer Testing Market (by Country), $Million, 2021-2032

Figure 72: Germany Prostate Cancer Testing Market, $Million, 2021-2032

Figure 73: Germany Prostate Cancer Testing Market (by Test Type), $Million, 2021-2032

Figure 74: France Prostate Cancer Testing Market, $Million, 2021-2032

Figure 75: France Prostate Cancer Testing Market (by Test Type), $Million, 2021-2032

Figure 76: U.K. Prostate Cancer Testing Market, $Million, 2021-2032

Figure 77: U.K. Prostate Cancer Testing Market (by Test Type), $Million, 2021-2032

Figure 78: Italy Prostate Cancer Testing Market, $Million, 2021-2032

Figure 79: Italy Prostate Cancer Testing Market (by Test Type), $Million, 2021-2032

Figure 80: Spain Prostate Cancer Testing Market, $Million, 2021-2032

Figure 81: Spain Prostate Cancer Testing Market (by Test Type), $Million, 2021-2032

Figure 82: Netherlands Prostate Cancer Testing Market, $Million, 2021-2032

Figure 83: Netherlands Prostate Cancer Testing Market (by Test Type), $Million, 2021-2032

Figure 84: Rest-of-Europe Prostate Cancer Testing Market, $Million, 2021-2032

Figure 85: Rest-of-Europe Prostate Cancer Testing Market (by Test Type), $Million, 2021-2032

Figure 86: Asia-Pacific Prostate Cancer Testing Market, $Million, 2022-2032

Figure 87: Asia-Pacific: Market Dynamics

Figure 88: Asia-Pacific Prostate Cancer Testing Market (by Country), $Million, 2021-2032

Figure 89: China Prostate Cancer Testing Market, $Million, 2021-2032

Figure 90: China Prostate Cancer Testing Market (by Test Type), $Million, 2021-2032

Figure 91: Japan Prostate Cancer Testing Market, $Million, 2021-2032

Figure 92: Japan Prostate Cancer Testing Market (by Test Type), $Million, 2021-2032

Figure 93: India Prostate Cancer Testing Market, $Million, 2021-2032

Figure 94: India Prostate Cancer Testing Market (by Test Type), $Million, 2021-2032

Figure 95: Australia Prostate Cancer Testing Market, $Million, 2021-2032

Figure 96: Australia Prostate Cancer Testing Market (by Test Type), $Million, 2021-2032

Figure 97: South Korea Prostate Cancer Testing Market, $Million, 2021-2032

Figure 98: South Korea Prostate Cancer Testing Market (by Test Type), $Million, 2021-2032

Figure 99: Rest-of-Asia-Pacific Korea Prostate Cancer Testing Market, $Million, 2021-2032

Figure 100: Rest-of-Asia-Pacific Prostate Cancer Testing Market (by Test Type), $Million, 2021-2032

Figure 101: Latin America Prostate Cancer Testing Market, $Million, 2022-2032

Figure 102: Latin America: Market Dynamics

Figure 103: Latin America Prostate Cancer Testing Market (by Country), $Million, 2021-2032

Figure 104: Brazil Prostate Cancer Testing Market, $Million, 2021-2032

Figure 105: Brazil Prostate Cancer Testing Market (by Test Type), $Million, 2021-2032

Figure 106: Mexico Prostate Cancer Testing Market, $Million, 2021-2032

Figure 107: Mexico Prostate Cancer Testing Market (by Test Type), $Million, 2021-2032

Figure 108: Rest-of-Latin America Prostate Cancer Testing Market, $Million, 2021-2032

Figure 109: Rest-of-Latin America Prostate Cancer Testing Market (by Test Type), $Million, 2021-2032

Figure 110: Rest-of-the-World Prostate Cancer Testing Market, $Million, 2022-2032

Figure 111: Total Number of Companies Profiled

Figure 112: Abbott.: Product Portfolio

Figure 113: Abbott.: Overall Financials, $Million, 2019-2021

Figure 114: Abbott.: Revenue (by Segment), $Million, 2019-2021

Figure 115: Abbott.: Revenue (by Region), $Million, 2019-2021

Figure 116: Abbott.: R&D Expenditure, $Million, 2019-2021

Figure 117: Abcam plc.: Product Portfolio

Figure 118: Abcam plc.: Overall Financials, $Million, 2018-2020

Figure 119: Abcam plc.: Revenue (by Segment), $Million, 2019-2020

Figure 120: Abcam plc.: Revenue (by Region), $Million, 2018-2020

Figure 121: Abcam plc.: R&D Expenditure, $Million, 2019-2021

Figure 122: Agilent Technologies, Inc.: Product Portfolio

Figure 123: Agilent Technologies, Inc.: Overall Financials, $Million, 2019-2021

Figure 124: Agilent Technologies, Inc.: Revenue (by Segment), $Million, 2019-2021

Figure 125: Agilent Technologies, Inc.: Revenue (by Region), $Million, 2019-2021

Figure 126: Agilent Technologies, Inc: R&D Expenditure, $Million, 2019-2021

Figure 127: Bio-Techne. (ExoDx): Product Portfolio

Figure 128: Bio-Techne. (ExoDx): Overall Financials, $Million, 2020-2022

Figure 129: Bio-Techne. (ExoDx): Revenue (by Segment), $Million, 2020-2022

Figure 130: Bio-Techne. (ExoDx): Revenue (by Region), $Million, 2020-2022

Figure 131: Bio-Techne. (ExoDx): R&D Expenditure, $Million, 2020-2022

Figure 132: Cleveland Diagnostics, Inc.: Product Portfolio

Figure 133: Danaher. (Beckman Coulter, Inc.): Product Portfolio

Figure 134: Danaher. (Beckman Coulter, Inc.): Overall Financials, $Million, 2019-2021

Figure 135: Danaher. (Beckman Coulter, Inc.): Revenue (by Segment), $Million, 2019-2021

Figure 136: Danaher. (Beckman Coulter, Inc.): Revenue (by Region), $Million, 2019-2021

Figure 137: Danaher. (Beckman Coulter, Inc.): R&D Expenditure, $Million, 2019-2021

Figure 138: Exact Sciences Corporation: Product Portfolio

Figure 139: Exact Sciences Corporation: Overall Financials, $Million, 2019-2021

Figure 140: Exact Sciences Corporation.: Revenue (by Segment), $Million, 2019-2021

Figure 141: Exact Sciences Corporation: Revenue (by Region), $Million, 2019-2021

Figure 142: Exact Sciences Corporation: R&D Expenditure, $Million, 2019-2021

Figure 143: F. Hoffmann-La Roche Ltd (FOUNDATION MEDICINE, INC.): Product Portfolio

Figure 144: F. Hoffmann-La Roche Ltd (FOUNDATION MEDICINE, INC.): Overall Financials, $Million, 2019-2021

Figure 145: F. Hoffmann-La Roche Ltd (FOUNDATION MEDICINE, INC.): Revenue (by Segment), $Million, 2019-2021

Figure 146: F. Hoffmann-La Roche Ltd (FOUNDATION MEDICINE, INC.): Revenue (by Region), $Million, 2019-2021

Figure 147: F. Hoffmann-La Roche Ltd (FOUNDATION MEDICINE, INC.): R&D Expenditure, $Million, 2019-2021

Figure 148: H.U. Group Holdings, Inc. (Fujeribio): Product Portfolio

Figure 149: H.U. Group Holdings, Inc. (Fujeribio): Overall Financials, $Million, 2018-2020

Figure 150: H.U. Group Holdings, Inc. (Fujeribio): Revenue (by Segment), $Million, 2019-2021

Figure 151: H.U. Group Holdings, Inc. (Fujeribio): R&D Expenditure, $Million, 2018-2020

Figure 152: mdxhealth.: Product Portfolio

Figure 153: mdxhealth.: Overall Financials, $Million, 2019-2021

Figure 154: mdxhealth.: Revenue (by Segment), $Million, 2019-2021

Figure 155: mdxhealth.: R&D Expenditure, $Million, 2019-2021

Figure 156: Siemens Healthcare GmbH: Product Portfolio

Figure 157: Siemens Healthcare GmbH: Overall Financials, $Million, 2019-2021

Figure 158: Siemens Healthcare GmbH: Revenue (by Segment), $Million, 2019-2021

Figure 159: Siemens Healthcare GmbH: Revenue (by Region), $Million, 2019-2021

Figure 160: Siemens Healthcare GmbH: R&D Expenditure, $Million, 2019-2021

Figure 161: Myriad Genetics, Inc.: Product Portfolio

Figure 162: Myriad Genetics, Inc.: Overall Financials, $Million, 2019-2021

Figure 163: Myriad Genetics, Inc.: Revenue (by Segment), $Million, 2019-2021

Figure 164: Myriad Genetics, Inc.: R&D Expenditure, $Million, 2019-2021

Figure 165: NeoGenomics Laboratories.: Product Portfolio

Figure 166: NeoGenomics Laboratories.: Overall Financials, $Million, 2019-2021

Figure 167: NeoGenomics Laboratories.: Revenue (by Segment), $Million, 2019-2021

Figure 168: NeoGenomics Laboratories.: R&D Expenditure, $Million, 2019-2021

Figure 169: OPKO Health, Inc. (GenPath): Product Portfolio

Figure 170: OPKO Health, Inc. (GenPath): Overall Financials, $Million, 2019-2021

Figure 171: OPKO Health, Inc. (GenPath): Revenue (by Segment), $Million, 2019-2021

Figure 172: OPKO Health, Inc. (GenPath): R&D Expenditure, $Million, 2019-2021

Figure 173: Veracyte, Inc.: Product Portfolio

Figure 174: Veracyte, Inc.: Overall Financials, $Million, 2019-2021

Figure 175: Veracyte, Inc.: Revenue (by Segment), $Million, 2019-2021

Figure 176: Veracyte, Inc.: Revenue (by Region), $Million, 2019-2021

Figure 177: Veracyte, Inc: R&D Expenditure, $Million, 2019-2021

List of Tables

Table 1: Impact Analysis of Market Drivers, Restraints, and Opportunities on the Global Prostate Cancer Testing Market

Table 2: Likert Scale

Table 3: Numerous Risk Categories for Clinically Localized Prostate Cancer

Table 4: Estimated Number of Deaths in 2018 and in 2040

Table 5: Recommendations Related to Prostate Cancer Screening

Table 6: Blood-Based Biomarkers for Prostate Cancer

Table 7: Guidance and Age Recommendations: Prostate Cancer

Table 8: Urine-Based Biomarkers for Prostate Cancer

Table 9: PCA3 Test Score

Table 10: Tissue-Based Biomarkers for Prostate Cancer

Companies Mentioned

- Abbott.

- Abcam plc.

- Agilent Technologies, Inc.

- Bio-Techne. (ExoDx)

- Cleveland Diagnostics, Inc.

- Danaher. (Beckman Coulter, Inc.)

- Exact Sciences Corporation

- F. Hoffmann-La Roche Ltd (FOUNDATION MEDICINE, INC.)

- H.U. Group Holdings, Inc. (Fujeribio)

- mdxhealth.

- Siemens Healthcare GmbH

- Myriad Genetics, Inc.

- NeoGenomics Laboratories.

- OPKO Health, Inc. (GenPath)

- Veracyte, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 223 |

| Published | December 2022 |

| Forecast Period | 2022 - 2032 |

| Estimated Market Value ( USD | $ 5910.4 Million |

| Forecasted Market Value ( USD | $ 21306.9 Million |

| Compound Annual Growth Rate | 13.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |