Speak directly to the analyst to clarify any post sales queries you may have.

- The garden and lawn tractors are compact utility tractors with a heavy-duty design used for mowing garden yards, green cover areas, and others, which are highly influenced by the weather conditions. The demand for lawn and garden tractors arises in summer and spring, increasing time spent on lawn care activities. On the other hand, golf courses are becoming more popular across developed and developing countries. The golf courses require regular ground maintenance and upkeep of the field, which necessitates using lawn and garden tractors.

- The constant development of lawn and garden tractors is to maintain a sustainable presence in the market. There have been considerable developments in tractors regarding features and models. For instance, high-capacity lawn and garden tractors are expanding as plantation areas are developed, lawns are replaced, new landscapes are designed, and the installation of residential buildings and malls, theme parks, and others boosts the lawn and garden tractor market demand. These factors will likely propel the lawn and garden tractor product demand in developing economies such as India, Vietnam, China, and Brazil.

MARKET TRENDS AND OPPORTUNITIES

Incorporate Lawn And Garden Tractor With Technology

- Rapid technological advancements in recent years have led to the emergence of new technologies for lawn care equipment. These technologies help enhance the effectiveness and efficiency of lawn care machines. Such as the, AI technology enables electric drive tractors to make decisions and figure out the best path for mowing, till gardens, and grade driveways. The smart autonomous lawn tractor is inbuilt with a Global Positioning System (GPS) that allows the equipment to move automatically throughout the facility. The equipment also uses smart technology for mapping the facilities, with increased capabilities for computing power in a small footprint that can be controlled using a smartphone in combination with low-cost optics and sensors. Thus, incorporating such technology with the equipment will drive product sales in the lawn and garden tractor market during the forecast period.

Growth In Commercial Construction

- In 2020, there was a steep decline in the commercial sector due to the hard-hit hotel & motel industry and sports & convention centers. The commercial sector has been witnessing constant growth since 2021 with the reopening of the economy. The construction of hotels, amusement parks, private & government offices, and sports & convention centers is growing, supporting the commercial sector's lawn and garden tractor market. Hotels and resorts are also key contributors to the demand for lawn and garden tractors. The construction of various hotels and office spaces is expected to support market growth in the coming years. Such as, in Manhattan, 12 million square feet of new office space are expected to be available by 2022. Hence, expanding office spaces is expected to boost the green acreage across large office buildings, supporting the market's demand for lawn and garden tractors.

SEGMENTATION ANALYSIS

INSIGHTS BY PRODUCT TYPE

The global lawn and garden tractor market by product type is segmented into lawn tractors and garden tractors. In 2021, the lawn tractor market held a revenue share of 76.68% globally. It is expected to grow enormously during the forecast period due to its mowing and tilling performance in distinct soil conditions. The ability of lawn tractors to handle slopes is the main reason for their growth. These tractors have a large customer base in sports turf, golf, large parks, and hobby farm industries.Vendors continue introducing new models, improving existing features, and adding various attachments to tractors. For instance, Steiner launched the Steiner 450 tractor in 2022. The tractor is equipped with a strong engine, hydraulic system, articulating, wide stance, an oscillation frame, new hydraulic weight transfer, traction boost system, mowing capabilities, and more than 25 attachments; the tractor can perform a whole range of activities from sweeping to snow blowing.

Segmentation By Product Type

- Lawn tractors

- Garden tractors

INSIGHTS BY FUEL TYPE

The gas-powered land and garden tractor dominated the global lawn and garden tractor market in terms of both revenue and unit shipments in 2021. The high power and better efficiency drive the demand for these lawn and garden tractors in the market. However, the rising fuel cost in various countries such as Poland and others is expected to hamper the demand for these lawn and garden tractors in the market during the forecast period. With its robust design, a gas-powered lawn and garden tractor remains in demand and thus proves to be an excellent choice for tougher and more demanding work. Gas-powered lawn and garden tractors do not have to be charged and are not limited in range by a cord. In 2021, the gas-powered lawn and garden tractor market accounted for a revenue and unit shipment share of 72.67%and 79.46%, respectively.Segmentation By Fuel Type

- Gasoline-Powered

- Battery-Powered

- Propane-Powered

INSIGHTS BY END-USER

In 2021, the professional landscaping services segment accounted for a revenue share of 37.32% in the global lawn and garden tractor market. It was expected to witness an incremental growth of USD 339.06 million during the forecast period. The US has over 600,000 landscaping service providers throughout the country. Most of these landscaping service providers are smaller players with limited geographical presence and a focus on specific offerings. Professional landscaping services have started to gain a reputation in developing economies, including China, India, Brazil, and others, due to the low disposable revenue of the public. Moreover, the growing investment among professional landscapers will likely propel the demand for this end-user segment.Segmentation By End-User

- Professional Landscaping Services

- Golf Courses & Other Sports Arenas

- Residential

- Government & Others

INSIGHTS BY DRIVE TYPE

The global lawn and garden tractor market by drive type is segmented into 2-wheeled and 4-wheeled tractors. In 2021, 2WD lawn and garden tractors dominated the market, accounting for a revenue and unit shipment share of 77.23% and 80.43%, respectively. The 2WD tractor can have better maneuverability and is ideally suited for flat terrain with many obstacles, including shrubs, flower beds, and other lawn ornaments. Factors such as low cost, better maneuverability, and ease of reversing the equipment drive the demand for these lawn and garden tractors in the market. Some examples of 2WD lawn and garden tractors include KÖPPL - Model Series 500, Ginko - Model R 702 Series, Twist - Model 5, and others.Segmentation By Drive Type

- 2 Wheeled Tractor

- 4 Wheeled Tractor

INSIGHTS BY HORSEPOWER

In 2021, 18-24 HP lawn and garden tractors dominated the global lawn and garden tractor market, accounting for a revenue and unit shipment share of 39.63% and 40.05%, respectively. Developing countries like the US and Japan's economic prosperity contributes to the enormous potential growth. Home gardening, farming activities, and other green areas propel market growth among other countries in the global market.Segmentation By Horsepower

- < 18 HP

- 18 - 24 HP

- > 24 HP

INSIGHTS BY START TYPE

In 2021, the push-type lawn and garden tractor accounted for a revenue share of 71.45% in the global lawn and garden tractor market. It was expected to witness an incremental growth of USD 691.12 million during the forecast period.Nowadays, most lawn and garden tractor vendors like honda and Hayter are shifting to electric push button type technology rather than recoil starter rope or key start. The electric push button starts the engine effortlessly instead of pulling a recoil starter cord to turn over the engine. So the push-button technology drove the lawn tractor segment in the forecast period.

Segmentation By Start Type

- Push Start

- Key Start

INSIGHTS BY DISTRIBUTION CHANNEL

The offline distribution channel is expected to dominate the global lawn and garden tractor market and account for a revenue share of 62.19%. This segment is expected to witness an incremental growth of USD 470.42 million during the forecast period. Factors such as the broader reach in areas that lack better connectivity and high consumer trust associated with personally experiencing the quality of products are driving the growth of this segment. Although the online channel holds a relatively lower share in the lawn and garden tractor market, it is expected to grow at a higher CAGR of 5.94% (by value) during the forecast period.The proliferation of e-commerce and raising awareness of the benefits of online purchases, such as heavy discounts, occasional offers, and rising demand for convenience, is driving the growth of the online segment.

Segmentation By Distribution Channel

- Offline

- Online

GEOGRAPHICAL ANALYSIS

North America's lawn and garden tractor market was valued at USD 1 billion in 2021 and accounted for the largest global revenue share of 39.16% in 2021. A large residential sector and numerous golf courses across the region support the demand for the equipment. North America has the largest number of golf courses worldwide. The US and Canada together account for more than 18,700 golf courses. The US opened more than 25 new golf courses nationwide in 2019−2020. Most golf courses across the country are public facilities and allow free playing, encouraging greater participation among people. Hence, the presence of many golf courses across the region is expected to support the lawn and garden tractor market growth during the forecast period.Europe is expected to be one of the fastest-growing geographical segments at a CAGR of 5.61% (by revenue) in the global lawn and garden tractor market during the forecast period. Factors such as rising urbanization, increasing regional investments, and the rapidly growing construction of residential & commercial spaces with a green cover drive the demand for lawn and garden tractors. Europe, considered one of the largest and leading markets in the gardening equipment segment, is mainly expected to be driven by residential end-users that are profoundly increasing their usage.

Companies are expected to use robust ground management equipment, increasing the need for landscaping services in the area. A growing number of commercial spaces, along with the number of public parks and lawn areas, are also boosting the demand for garden tractors in the region.

Segmentation by Geography

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Sweden

- Netherlands

- Belgium

- Poland

- Switzerland

- Finland

- Austria

- APAC

- China

- Australia

- Japan

- South Korea

- India

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

COMPETITIVE LANDSCAPE

The global lawn and garden tractor market is moderately fragmented, with many local and international players. As consumers expect constant advancements and upgrades in garden equipment, the increasingly changing economic environment may have a negative impact on vendors. The current situation pushes vendors to adjust and improve their value proposition to attain a good business presence. While the market is characterized by the presence of diversified international vendors and a few regional vendors, as foreign players will expand their market footprint, it would be increasingly difficult for regional vendors to compete with them, particularly in terms of technology and customer base. AriensCo, Deere & Company, Honda Motor Company, Husqvarna Group, and Kubota Corporation are the key vendors in the global lawn and garden tractor market. A rise in product/service expansions, technical advancements, and M&As are expected to exacerbate industry competitiveness further.Vendors are using innovative market models to accelerate growth and concentrate on expanding their organization's portfolio. During the forecast period, many foreign players are expected to expand their presence worldwide, particularly in the APAC and Latin American regions' fast-developing countries, to gain more lawn and garden tractor market share. In addition, improving global economic conditions will boost demand expansion, making it an enticing time to introduce new products.

Key Vendors

- AriensCo

- Deere & Company

- Honda Motor Company

- Husqvarna Group

- Kubota Corporation

Other Prominent Vendors

- Stanley Black & Decker

- The Toro Company

- STIGA S.p.A

- Briggs & Stratton

- AGCO Corporation

- Emak S.p.A

- AL-KO Gardentech

- BOB CAT

- FARMTRAC TRACTORS EUROPE

- ISEKI & CO., LTD.

- GRASSHOPPER COMPANY

- COBRA

- TEXTRON INCORPORATED

- Yangzhou Weibang

- AS-Motor

- VICTA LAWNCARE PTY LTD

- CHERVON

- Generac Power Systems

- IHI Shibaura Machinery Corporation

- Masport

KEY QUESTIONS ANSWERED

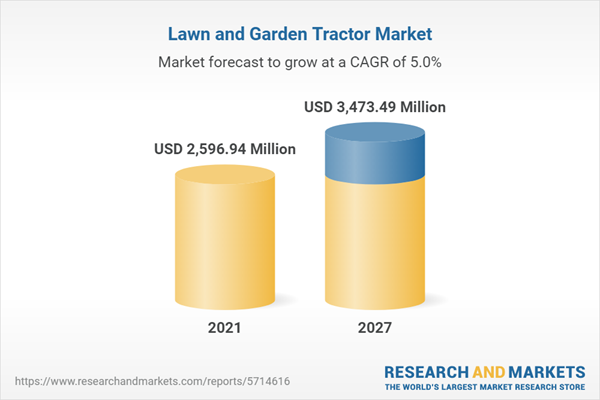

1. How big is the lawn and garden tractor market?2. What is the growth rate of the lawn and garden tractor market?

3. What will be the global lawn and garden tractor market share in shipments by 2027?

4. Who are the key players in the global lawn and garden tractor market?

5. What are the significant trends impacting the global lawn and garden tractor market?

6. Which region holds the largest global lawn and garden tractor market share?

Table of Contents

1 Research Methodology2 Research Objectives

3 Research Process

4 Scope & Coverage

4.1 Market Definition

4.1.1 Inclusions

4.1.2 Exclusions

4.1.3 Market Estimation Caveats

4.2 Base Year

4.3 Scope of the Study

4.4 Market Segmentation

4.4.1 Market Segmentation by Product Type

4.4.2 Market Segmentation by Fuel Type

4.4.3 Market Segmentation by End-User

4.4.4 Market Segmentation by Drive Type

4.4.5 Market Segmentation by Horsepower

4.4.6 Market Segmentation by Start Type

4.4.7 Market Segmentation by Distribution Channel

4.4.8 Market Segmentation by Geography

5 Report Assumptions & Caveats

5.1 Key Caveats

5.2 Currency Conversion

5.3 Market Derivation

6 Premium Insights

7 Market at a Glance

8 Introduction

8.1 Overview

8.2 Lawn & Garden Tractors

8.3 Consumer Behavior

8.4 Development of Li-Ion Batteries

8.5 Penetration of Green Areas

8.6 Dynamics of the Landscaping Industry

8.7 Value Chain Analysis

8.7.1 Raw Material & Component Suppliers

8.7.2 Manufacturers

8.7.3 Retailers /Distributors

8.7.4 End-Users

8.8 Components, Raw Materials, and Manufacturing

8.9 Regulations & Standards

8.10 Impact of Covid-19

9 Market Opportunities & Trends

9.1 Technological Advancements in Lawn & Garden Tractors

9.2 Growing Landscaping Industry

9.3 Increasing Adoption of Green Spaces & Green Roofs

10 Market Growth Enablers

10.1 Growing Demand from Golf Courses

10.2 Rising Demand for Home Ownership & Home Improvement

10.3 Growth in Commercial Construction

11 Market Restraints

11.1 Growing Usage of Artificial Grass

11.2 Shortage of Skilled & Qualified Labor

11.3 Increased Competition from Chinese Vendors

12 Market Landscape

12.1 Market Overview

12.2 Market Size & Forecast

12.2.1 by Value

12.2.2 by Volume

12.3 Market by Geography

12.3.1 by Value

12.3.2 by Volume

12.4 Five Forces Analysis

12.4.1 Threat of New Entrants

12.4.2 Bargaining Power of Suppliers

12.4.3 Bargaining Power of Buyers

12.4.4 Threat of Substitutes

12.4.5 Competitive Rivalry

13 Product Type

13.1 Market Snapshot & Growth Engine (Value)

13.2 Market Snapshot & Growth Engine (Volume)

13.3 Market Overview

13.4 Lawn Tractors

13.4.1 Market Overview

13.4.2 Market Size & Forecast 2021-2027 (Value & Volume)

13.4.3 Market by Geography 2021-2027 (Value & Volume)

13.5 Garden Tractors

13.5.1 Market Overview

13.5.2 Market Size & Forecast 2021-2027 (Value & Volume)

13.5.3 Market by Geography 2021-2027 (Value & Volume)

14 Fuel Type

14.1 Market Snapshot & Growth Engine (Value)

14.2 Market Snapshot & Growth Engine (Volume)

14.3 Market Overview

14.4 Gasoline-Powered

14.4.1 Market Overview

14.4.2 Market Size & Forecast 2021-2027 (Value & Volume)

14.4.3 Market by Geography 2021-2027 (Value & Volume)

14.5 Battery-Powered

14.5.1 Market Overview

14.5.2 Market Size & Forecast 2021-2027 (Value & Volume)

14.5.3 Market by Geography 2021-2027 (Value & Volume)

14.6 Propane-Powered

14.6.1 Market Overview

14.6.2 Market Size & Forecast 2021-2027 (Value & Volume)

14.6.3 Market by Geography 2021-2027 (Value & Volume)

15 End-User

15.1 Market Snapshot & Growth Engine (Value)

15.2 Market Snapshot & Growth Engine (Volume)

15.3 Market Overview

15.4 Professional Landscaping Services

15.4.1 Market Overview

15.4.2 Market Size & Forecast 2021-2027 (Value & Volume)

15.4.3 Market by Geography 2021-2027 (Value & Volume)

15.5 Residential

15.5.1 Market Overview

15.5.2 Market Size & Forecast 2021-2027 (Value & Volume)

15.5.3 Market by Geography 2021-2027 (Value & Volume)

15.6 Golf Courses & Other Sports Arenas

15.6.1 Market Overview

15.6.2 Market Size & Forecast 2021-2027 (Value & Volume)

15.6.3 Market by Geography 2021-2027 (Value & Volume)

15.7 Government & Others

15.7.1 Market Overview

15.7.2 Market Size & Forecast 2021-2027 (Value & Volume)

15.7.3 Market by Geography 2021-2027 (Value & Volume)

16 Drive Type

16.1 Market Snapshot & Growth Engine (Value)

16.2 Market Snapshot & Growth Engine (Volume)

16.3 Market Overview

16.4 2Wd

16.4.1 Market Overview

16.4.2 Market Size & Forecast 2021-2027 (Value & Volume)

16.4.3 Market by Geography 2021-2027 (Value & Volume)

16.5 4Wd

16.5.1 Market Overview

16.5.2 Market Size & Forecast 2021-2027 (Value & Volume)

16.5.3 Market by Geography 2021-2027 (Value & Volume)

17 Horsepower

17.1 Market Snapshot & Growth Engine (Value)

17.2 Market Snapshot & Growth Engine (Volume)

17.3 Market Overview

17.4 < 18 Hp

17.4.1 Market Overview

17.4.2 Market Size & Forecast 2021-2027 (Value & Volume)

17.4.3 Market by Geography 2021-2027 (Value & Volume)

17.5 18-24 Hp

17.5.1 Market Overview

17.5.2 Market Size & Forecast 2021-2027 (Value & Volume)

17.5.3 Market by Geography 2021-2027 (Value & Volume)

17.6 >24 Hp

17.6.1 Market Overview

17.6.2 Market Size & Forecast 2021-2027 (Value & Volume)

17.6.3 Market by Geography 2021-2027 (Value & Volume)

18 Start Type

18.1 Market Snapshot & Growth Engine (Value)

18.2 Market Snapshot & Growth Engine (Volume)

18.3 Market Overview

18.4 Push Start

18.4.1 Market Overview

18.4.2 Market Size & Forecast 2021-2027 (Value & Volume)

18.4.3 Market by Geography 2021-2027 (Value & Volume)

18.5 Key Start

18.5.1 Market Overview

18.5.2 Market Size & Forecast 2021-2027 (Value & Volume)

18.5.3 Market by Geography 2021-2027 (Value & Volume)

19 Distribution Channel

19.1 Market Snapshot & Growth Engine (Value)

19.2 Market Snapshot & Growth Engine (Volume)

19.3 Market Overview

19.4 Offline

19.4.1 Market Overview

19.4.2 Market Size & Forecast 2021-2027 (Value & Volume)

19.4.3 Market by Geography 2021-2027 (Value & Volume)

19.5 Online

19.5.1 Market Overview

19.5.2 Market Size & Forecast 2021-2027 (Value & Volume)

19.5.3 Market by Geography 2021-2027 (Value & Volume)

20 Geography

20.1 Market Snapshot & Growth Engine (Value)

20.2 Market Snapshot & Growth Engine (Volume)

20.3 Geographic Overview

21 North America

21.1 Market Overview

21.2 Market Size & Forecast

21.3 Product Type

21.3.1 Market Size & Forecast 2021-2027 (Value & Volume)

21.4 Fuel Type

21.4.1 Market Size & Forecast 2021-2027 (Value & Volume)

21.5 End-User

21.5.1 Market Size & Forecast 2021-2027 (Value & Volume)

21.6 Horsepower

21.6.1 Market Size & Forecast 2021-2027 (Value & Volume)

21.7 Drive Type

21.7.1 Market Size & Forecast 2021-2027 (Value & Volume)

21.8 Start Type

21.8.1 Market Size & Forecast 2021-2027 (Value & Volume)

21.9 Distribution Channel

21.9.1 Market Size & Forecast 2021-2027 (Value & Volume)

21.10 Key Countries

21.10.1 Market Snapshot & Growth Engine (Value)

21.10.2 Market Snapshot & Growth Engine (Volume)

21.10.3 Us: Market Size & Forecast

21.10.4 Canada: Market Size & Forecast

22 Europe

22.1 Market Overview

22.2 Market Size & Forecast

22.3 Product Type

22.3.1 Market Size & Forecast 2021-2027 (Value & Volume)

22.4 Fuel Type

22.4.1 Market Size & Forecast 2021-2027 (Value & Volume)

22.5 End-User

22.5.1 Market Size & Forecast 2021-2027 (Value & Volume)

22.6 Horsepower

22.6.1 Market Size & Forecast 2021-2027 (Value & Volume)

22.7 Drive Type

22.7.1 Market Size & Forecast 2021-2027 (Value & Volume)

22.8 Start Type

22.8.1 Market Size & Forecast 2021-2027 (Value & Volume)

22.9 Distribution Channel

22.9.1 Market Size & Forecast 2021-2027 (Value & Volume)

22.10 Key Countries

22.10.1 Market Snapshot & Growth Engine (Value)

22.10.2 Market Snapshot & Growth Engine (Volume)

22.10.3 Uk: Market Size & Forecast

22.10.4 Germany: Market Size & Forecast

22.10.5 France: Market Size & Forecast

22.10.6 Italy: Market Size & Forecast

22.10.7 Spain: Market Size & Forecast

22.10.8 Sweden: Market Size & Forecast

22.10.9 Netherlands: Market Size & Forecast

22.10.10 Belgium: Market Size & Forecast

22.10.11 Poland: Market Size & Forecast

22.10.12 Switzerland: Market Size & Forecast

22.10.13 Finland: Market Size & Forecast

22.10.14 Austria: Market Size & Forecast

23 Apac

23.1 Market Overview

23.2 Market Size & Forecast

23.3 Product Type

23.3.1 Market Size & Forecast 2021-2027 (Value & Volume)

23.4 Fuel Type

23.4.1 Market Size & Forecast 2021-2027 (Value & Volume)

23.5 End-User

23.5.1 Market Size & Forecast 2021-2027 (Value & Volume)

23.6 Horsepower

23.6.1 Market Size & Forecast 2021-2027 (Value & Volume)

23.7 Drive Type

23.7.1 Market Size & Forecast 2021-2027 (Value & Volume)

23.8 Start Type

23.8.1 Market Size & Forecast 2021-2027 (Value & Volume)

23.9 Distribution Channel

23.9.1 Market Size & Forecast 2021-2027 (Value & Volume)

23.10 Key Countries

23.10.1 Market Snapshot & Growth Engine (Value)

23.10.2 Market Snapshot & Growth Engine (Volume)

23.10.3 China: Market Size & Forecast

23.10.4 Australia: Market Size & Forecast

23.10.5 Japan: Market Size & Forecast

23.10.6 South Korea: Market Size & Forecast

23.10.7 India: Market Size & Forecast

24 Latin America

24.1 Market Overview

24.2 Market Size & Forecast

24.3 Product Type

24.3.1 Market Size & Forecast 2021-2027 (Value & Volume)

24.4 Fuel Type

24.4.1 Market Size & Forecast 2021-2027 (Value & Volume)

24.5 End-User

24.5.1 Market Size & Forecast 2021-2027 (Value & Volume)

24.6 Horsepower

24.6.1 Market Size & Forecast 2021-2027 (Value & Volume)

24.7 Drive Type

24.7.1 Market Size & Forecast 2021-2027 (Value & Volume)

24.8 Start Type

24.8.1 Market Size & Forecast 2021-2027 (Value & Volume)

24.9 Distribution Channel

24.9.1 Market Size & Forecast 2021-2027 (Value & Volume)

24.10 Key Countries

24.10.1 Market Snapshot & Growth Engine (Value)

24.10.2 Market Snapshot & Growth Engine (Volume)

24.10.3 Brazil: Market Size & Forecast

24.10.4 Mexico: Market Size & Forecast

24.10.5 Argentina: Market Size & Forecast

25 Middle East & Africa

25.1 Market Overview

25.2 Market Size & Forecast

25.3 Product Type

25.3.1 Market Size & Forecast 2021-2027 (Value & Volume)

25.4 Fuel Type

25.4.1 Market Size & Forecast 2021-2027 (Value & Volume)

25.5 End-User

25.5.1 Market Size & Forecast 2021-2027 (Value & Volume)

25.6 Horsepower

25.6.1 Market Size & Forecast 2021-2027 (Value & Volume)

25.7 Drive Type

25.7.1 Market Size & Forecast 2021-2027 (Value & Volume)

25.8 Start Type

25.8.1 Market Size & Forecast 2021-2027 (Value & Volume)

25.9 Distribution Channel

25.9.1 Market Size & Forecast 2021-2027 (Value & Volume)

25.10 Key Countries

25.10.1 Market Snapshot & Growth Engine (Value)

25.10.2 Market Snapshot & Growth Engine (Volume)

25.10.3 Saudi Arabia: Market Size & Forecast

25.10.4 Uae: Market Size & Forecast

25.10.5 South Africa: Market Size & Forecast

26 Competitive Landscape

26.1 Competition Overview

27 Key Company Profiles

27.1 Ariens Company (Ariensco)

27.1.1 Business Overview

27.1.2 Product Offerings

27.1.3 Key Strategies

27.1.4 Key Strengths

27.1.5 Key Opportunity

27.2 Deere & Company

27.2.1 Business Overview

27.2.2 Product Offerings

27.2.3 Key Strategies

27.2.4 Key Strengths

27.2.5 Key Opportunities

27.3 Honda

27.3.1 Business Overview

27.3.2 Product Offerings

27.3.3 Key Strategies

27.3.4 Key Strengths

27.3.5 Key Opportunities

27.4 Husqvarna Group

27.4.1 Business Overview

27.4.2 Product Offerings

27.4.3 Key Strategies

27.4.4 Key Strengths

27.4.5 Key Opportunities

27.5 Kubota Corporation

27.5.1 Business Overview

27.5.2 Product Offerings

27.5.3 Key Strategies

27.5.4 Key Strengths

27.5.5 Key Opportunities

28 Other Prominent Vendors

28.1 Stanley Black & Decker

28.1.1 Business Overview

28.1.2 Product Offerings

28.2 the Toro Company

28.2.1 Business Overview

28.2.2 Product Offerings

28.3 Stiga Group

28.3.1 Business Overview

28.3.2 Product Offerings

28.4 Briggs & Stratton

28.4.1 Business Overview

28.4.2 Product Offerings

28.5 Agco

28.5.1 Business Overview

28.5.2 Product Offerings

28.6 Emak Group

28.6.1 Business Overview

28.6.2 Product Offerings

28.7 Al-Ko

28.7.1 Business Overview

28.7.2 Product Offerings

28.8 Bobcat

28.8.1 Business Overview

28.8.2 Product Offering

28.9 Farmtrac Tractors Europe

28.9.1 Business Overview

28.9.2 Product Offering

28.10 Iseki

28.10.1 Business Overview

28.10.2 Product Offerings

28.11 the Grasshopper Company (Moridge Manufacturing)

28.11.1 Business Overview

28.11.2 Product Offerings

28.12 Cobra

28.12.1 Business Overview

28.12.2 Product Offering

28.13 Textron

28.13.1 Business Overview

28.13.2 Product Offering

28.14 Yangzhou Weibang

28.14.1 Business Overview

28.14.2 Product Offering

28.15 As-Motor

28.15.1 Business Overview

28.15.2 Product Offerings

28.16 Victa Lawncare Pty Ltd

28.16.1 Business Overview

28.16.2 Product Offerings

28.17 Chervon Group

28.17.1 Business Overview

28.17.2 Product Offerings

28.18 Generac Power Systems

28.18.1 Business Overview

28.18.2 Product Offerings

28.19 Ihi Shibaura Machinery Corporation

28.19.1 Business Overview

28.19.2 Product Offerings

28.20 Masport

28.20.1 Business Overview

28.20.2 Product Offerings

29 Report Summary

29.1 Key Takeaways

29.2 Strategic Recommendations

30 Quantitative Summary

30.1 Market by Geography

30.2 Product Type

30.2.1 Market Size & Forecast (Value & Volume)

30.3 Fuel Type

30.3.1 Market Size & Forecast (Value & Volume)

30.4 End-User

30.4.1 Market Size & Forecast (Value & Volume)

30.5 Horsepower

30.5.1 Market Size & Forecast (Value & Volume)

30.6 Start Type

30.6.1 Market Size & Forecast (Value & Volume)

30.7 Drive Type

30.7.1 Market Size & Forecast (Value & Volume)

30.8 Distribution Channel

30.8.1 Market Size & Forecast (Value & Volume)

31 Appendix

31.1 Abbreviations

Companies Mentioned

- AriensCo

- Deere & Company

- Honda Motor Company

- Husqvarna Group

- Kubota Corporation

- Stanley Black & Decker

- The Toro Company

- STIGA S.p.A

- Briggs & Stratton

- AGCO Corporation

- Emak S.p.A

- AL-KO Gardentech

- BOB CAT

- FARMTRAC TRACTORS EUROPE

- ISEKI & CO., LTD.

- GRASSHOPPER COMPANY

- COBRA

- TEXTRON INCORPORATED

- Yangzhou Weibang

- AS-Motor

- VICTA LAWNCARE PTY LTD

- CHERVON

- Generac Power Systems

- IHI Shibaura Machinery Corporation

- Masport

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 397 |

| Published | January 2023 |

| Forecast Period | 2021 - 2027 |

| Estimated Market Value ( USD | $ 2596.94 Million |

| Forecasted Market Value ( USD | $ 3473.49 Million |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |