Speak directly to the analyst to clarify any post sales queries you may have.

Customized battery-operated power tools that augment productivity were manufactured due to rising work intensity and plummeting performance. The small, light and powerful batteries offered divergence, and the innovations in battery technology were mainly driven by the trends in the electrical and electronic equipment market. Advances in battery technology also enable the introduction of new products and services in the market. Due to the rapidly shifting technology and rising awareness amongst people, the acceptance of cordless hammer drills is high, given the high-quality performance and efficiency.

Among the two variants in the cordless hammer drills market, brushed and brushless, the brushless is the more sought-after one given its efficiency, low maintenance, and durability, thus attracting demand and helping the entire cordless hammer drills market.

INDUSTRY OPPORTUNITY & CHALLENGE ANALYSIS

RISE IN RENOVATIONS

- The usage of the internet and smartphones, and other devices is increasing with time. Meaning information is now readily available. The readily available information and resources have enabled people to adopt and adapt rapidly. The rise in internet penetration paved the way for more innovative and cost-effective ideas in several verticals. People started to show a keen interest in making changes in and around their personal and professional spaces.

- Developed countries like Europe are witnessing aggressive renovations in the region as the region is adopting energy-efficient ways to support Net Zero emission targets, which calls for numerous upgrades and renovations. All of this is expected to drive the demand for cordless hammer drills, thus boosting the cordless hammer drills market and allowing the players to leverage the industry and earn revenues.

MULTIUTILITY OF CORDLESS HAMMER DRILLS

- Hammer drills are used to drill holes in hard materials and are usually not used for materials on which standard drills are utilized. Hammer drills are occasionally used against hard materials such as concrete, stone, or masonry. However, most hammer drills come with an option to be used as both hammer drills and standard drills by switching off the hammering feature as and when required. So, buying such hammer drills would allow the user to have the benefit of owning multiple tools by investing in just one. Hammer drills have several variants based on voltage, motor type, and other aspects. Users owning a hammer drill can use it for hobbies and DIY activities.

AVAILABILITY OF MORE AFFORDABLE ALTERNATIVES

- Most cordless hammer drills come with the provision of switching the hammer function of the machine and using it like a standard drill machine; by this provision, the hammer drills suffice the need for a general drill machine along with a hammer drill. Users who have the frequent utility of hammer drills prefer buying them and get the added benefit of using them as a standard drilling machine. However, users of standard drill machines do not choose hammer drills, especially the cordless variant, as it is quite expensive given that most require lithium-ion batteries, which hinders the cordless hammer drills market growth.

SEGMENTATION INSIGHTS

INSIGHTS BY MOTOR TYPE

The brushless and brushed cordless hammer drills can be compared based on several parameters: cost, performance, power consumption, usability, maintenance, and more. A few parameters, such as cost and performance, are crucial variables when choosing the most appropriate for usage.Regarding cost, the brushless variant of the cordless hammer drill is more expensive when compared to the brushed variant, which could pose a challenge to the growth of the cordless hammer drill market. The global brushless cordless hammer drills market was valued at USD 920.87 million in 2021.

Drills with brushed motors are weighty and noisy. If one needs to use it for an extended amount of time while wearing hearing protection, it substantially affects the user's shoulders and back which could act as a challenge for the brushed-type hammer drills.

Segmentation by Motor Type

- Brushless

- Brushed

INSIGHTS BY APPLICATION

The objective of global industries to achieve sustainability and eco-friendly resources has led to the rise in the installation of renewable energy infrastructures such as wind turbines and solar panels. This will eventually drive the cordless hammer drills market, and the energy sector is expected to grow rapidly. There have been rapid advancements in energy efficiency throughout the globe, and countries adopting energy-efficient ways for which infrastructural changes must be made. These structural changes in infrastructure are expected to demand a lot of renovation, driving the demand for the cordless hammer drills market and helping the market strong.The commercial application is the largest revenue contributor, followed by the residential sector. It was valued at USD 484.04 million in 2021 and is growing with a CAGR of 11.46%.

Segmentation by Application

- Commercial

- Residential

- Industrial

INSIGHTS BY VOLTAGE

Users have different needs and requirements when owning a power tool, such as cordless hammer drills. This type of tool is mainly used for remodeling and renovation purposes when it comes to commercial applications. When used professionally, it might require cordless hammer drills that have a longer run time and are more potent as the hammer drills are used on rigid materials such as masonry. For professional usage, cordless hammer drills such as the ones that are 18v and above are more beneficial. The global 18V cordless hammer drills market was valued at USD 678.69 million in 2021.Usually, the higher the number, the better the performance. However, this is not always the case when purchasing cordless hammer drills and similar tools. 12-volt drills and equipment are suitable for everyday tasks. This is because they provide enough power to complete the tasks without the additional bulk of a bigger tool. The global 12V cordless hammer drills market is growing at a CAGR of 10.65% during the forecast period.

Segmentation by Voltage

- 12V

- 18V

- 20V & Above

INSIGHTS BY CHUCK SIZE

Due to high torque, a 1/2 inch hammer drill is relatively more powerful than its counterparts. This increases the durability of 1/2 inch drills. Therefore, it is the most preferred variant amongst its counterparts holding the maximum market share in the global cordless hammer drills market.The normal chuck size is 10mm, or 3/8 inch, as it is often called. These can only handle a tiny bit and are less powerful than those with bigger chucks. To compensate, they are typically less expensive than other drills. This chuck-size variety produced approximately USD 229.22 million in revenue in the global cordless hammer drills market in 2021.

Segmentation by Chuck Size

- 1/2”

- 3/8” & Above

GEOGRAPHICAL ANALYSIS

The rising economic development, growth of renovation and reconstruction activities, and demand for convenience tools have contributed to the growth of the global cordless hammer drills market. Battery-operated cordless hammer drills have widespread use across the residential and commercial sectors. They are used in various verticals, including construction, renovation, and more.In 2021, North America was the largest cordless hammer drills market, with a share of 28.16%. Large-scale industries such as construction are driving the region's market for Li-ion-operated cordless hammer drills. Furthermore, the DIY culture is highly predominant in America that needs tools such as hammer drills when working on tough materials such as concrete and others. With the rise in green building regulations, high disposable income, and immigration rates, the demand for cordless hammer drills is expected to surge during the forecast period. Green building regulations require a lot of changes to be made in terms of sustainability which would lead to a rise in renovation work requiring hammer drills, thus leading to the growth in demand for the cordless hammer drill.

North America was followed by Europe, APAC, Latin America, and MEA, given the rapid growth in the global construction and renovation industry.

Segmentation by Geography

- APAC

- China

- India

- South Korea

- Japan

- Australia

- North America

- US

- Canada

- Europe

- UK

- France

- Italy

- Germany

- Spain

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- South Africa

COMPETITIVE LANDSCAPE

The global cordless hammer drills market is characterized by low market concentration with high competition. The present scenario drives vendors to alter and refine their unique value propositions to achieve a strong market presence. Currently, the industry is moderately fragmented and is dominated by vendors such as Stanley Black & Decker, Bosch, and TTI. These significant vendors have a global presence in the three major regions of North America, APAC, and Europe.Vendors must develop new technologies and remain abreast with upcoming innovations to have a competitive advantage. To gain more cordless hammer drills market share, many international players are expected to expand their reach worldwide during the forecast period, especially in the fast-developing countries in APAC and Latin America. In addition, improving global economic conditions will fuel the industry’s growth, making it an attractive time to launch new products.

Key Company Profiles

- Stanley Black & Decker

- Robert Bosch

- Techtronic Industries Company

- Makita

- Hilti

Other Prominent Vendors

- Atlas Copco

- Apex Tool Group

- Ingersoll Rand

- Snap-On

- Koki Holdings

- Emerson

- Panasonic

- Fortive

- Positec

- CHEVRON

- FEIN

- FERM

- AIMCO

- Uryu Seisaku

- INTRSKOL

- Festool

- Kyocera

- CS Unitec

- Dynabrade

- Husqvarna

- STIHL

- Oregon Tool, Inc.

KEY QUESTIONS ANSWERED

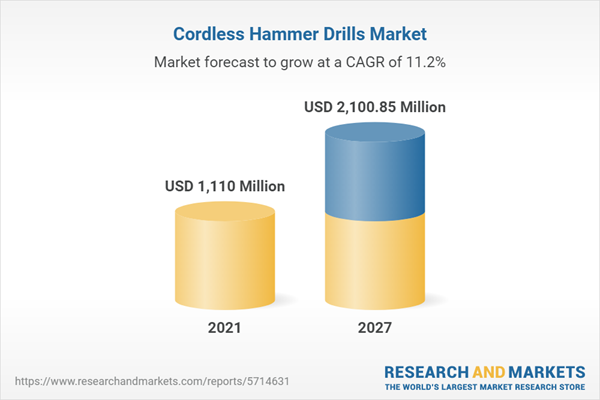

1. What is the revenue from the global cordless hammer drills market?2. What is the growth rate of the global cordless hammer drills market?

3. What is the global cordless hammer drills market projected market size by 2027?

4. Which region dominates the global cordless hammer drills market?

5. What are the key driving factors in the cordless hammer drills market?

Table of Contents

1 Research Methodology2 Research Objectives

3 Research Process

4 Scope & Coverage

4.1 Market Definition

4.1.1 Inclusions

4.1.2 Exclusions

4.1.3 Market Estimation Caveats

4.2 Base Year

4.3 Scope of the Study

4.3.1 Market Segmentation by Motor Type

4.3.2 Market Segmentation by Application

4.3.3 Market Segmentation by Voltage

4.3.4 Market Segmentation by Chuck Size

4.3.5 Market Segmentation by Geography

5 Report Assumptions & Caveats

5.1 Key Caveats

5.2 Currency Conversion

5.3 Market Derivation

6 Market at a Glance

7 Premium Insights

7.1 Report Review

7.2 Opportunity & Challenge Analysis

7.3 Segment Analysis

7.4 Regional Analysis

7.5 Competitive Landscape

8 Introduction

8.1 Overview

8.2 Value Chain Analysis

8.2.1 Raw Materials

8.2.2 Manufacturers

8.2.3 Retailers

8.2.4 Users

8.3 Frequently Asked Questions

8.3.1 at What Rate Will the Global Cordless Hammer Drills Market Grow Post-2022?

8.3.2 What Are the Major Factors Affecting the Cordless Hammer Drills Market?

8.3.3 What is the Difference Between Hammer Drills and Impact Drivers?

8.3.4 What is the State of the Cordless Hammer Drills Market in Different Regions Across the Globe?

8.3.5 Why Are Cordless Hammer Drill Tools Expensive, and Will Their Prices Continue to Rise?

9 Market Opportunities & Trends

9.1 Rise in Renovations

9.2 Development of Li-Ion Batteries

10 Market Growth Enablers

10.1 Increase in Demand from Commercial Spaces

10.2 Multiutility of Cordless Hammer Drills

10.3 Rise in Diy Activities Across the Globe

11 Market Restraints

11.1 Availability of Affordable Alternatives

11.2 Lack of Skilled Labor in Emerging Economies

11.3 Us-China Trade War

12 Market Landscape

12.1 Market Overview

12.2 Market Size & Forecast

12.3 Five Forces Analysis

12.3.1 Threat of New Entrants

12.3.2 Bargaining Power of Suppliers

12.3.3 Bargaining Power of Buyers

12.3.4 Threat of Substitutes

12.3.5 Competitive Rivalry

13 Motor Type

13.1 Market Snapshot & Growth Engine

13.2 Market Overview

13.3 Brushless

13.3.1 Market Overview

13.3.2 Market Size & Forecast

13.3.3 Market by Geography

13.4 Brushed

13.4.1 Market Overview

13.4.2 Market Size & Forecast

13.4.3 Market by Geography

14 Application

14.1 Market Snapshot & Growth Engine

14.2 Market Overview

14.3 Commercial

14.3.1 Market Overview

14.3.2 Market Size & Forecast

14.3.3 Market by Geography

14.4 Residential

14.4.1 Market Overview

14.4.2 Market Size & Forecast

14.4.3 Market by Geography

14.5 Industrial

14.5.1 Market Overview

14.5.2 Market Size & Forecast

14.5.3 Market by Geography

15 Voltage

15.1 Market Snapshot & Growth Engine

15.2 Market Overview

15.3 12V

15.3.1 Market Overview

15.3.2 Market Size & Forecast

15.3.3 Market by Geography

15.4 18V

15.4.1 Market Overview

15.4.2 Market Size & Forecast

15.4.3 Market by Geography

15.5 20V & Above

15.5.1 Market Overview

15.5.2 Market Size & Forecast

15.5.3 Market by Geography

16 Chuck Size

16.1 Market Snapshot & Growth Engine

16.2 Market Overview

16.3 1/2”

16.3.1 Market Overview

16.3.2 Market Size & Forecast

16.3.3 Market by Geography

16.4 3/8” & Above

16.4.1 Market Overview

16.4.2 Market Size & Forecast

16.4.3 Market by Geography

17 Geography

17.1 Market Snapshot & Growth Engine

17.2 Geographic Overview

18 North America

18.1 Market Overview

18.2 Market Size & Forecast

18.3 Motor Type

18.3.1 Market Size & Forecast

18.4 Application

18.4.1 Market Size & Forecast

18.5 Voltage

18.5.1 Market Size & Forecast

18.6 Chuck Size

18.6.1 Market Size & Forecast

18.7 Key Countries

18.7.1 Us: Market Size & Forecast

18.7.2 Canada: Market Size & Forecast

19 Europe

19.1 Market Overview

19.2 Market Size & Forecast

19.3 Motor Type

19.3.1 Market Size & Forecast

19.4 Application

19.4.1 Market Size & Forecast

19.5 Voltage

19.5.1 Market Size & Forecast

19.6 Chuck Size

19.6.1 Market Size & Forecast

19.7 Key Countries

19.7.1 Uk: Market Size & Forecast

19.7.2 Germany: Market Size & Forecast

19.7.3 France: Market Size & Forecast

19.7.4 Spain: Market Size & Forecast

19.7.5 Italy: Market Size & Forecast

20 Apac

20.1 Market Overview

20.2 Market Size & Forecast

20.3 Motor Type

20.3.1 Market Size & Forecast

20.4 Application

20.4.1 Market Size & Forecast

20.5 Voltage

20.5.1 Market Size & Forecast

20.6 Chuck Size

20.6.1 Market Size & Forecast

20.7 Key Countries

20.7.1 China: Market Size & Forecast

20.7.2 Japan: Market Size & Forecast

20.7.3 South Korea: Market Size & Forecast

20.7.4 Australia: Market Size & Forecast

20.7.5 India: Market Size & Forecast

21 Latin America

21.1 Market Overview

21.2 Market Size & Forecast

21.3 Motor Type

21.3.1 Market Size & Forecast

21.4 Application

21.4.1 Market Size & Forecast

21.5 Voltage

21.5.1 Market Size & Forecast

21.6 Chuck Size

21.6.1 Market Size & Forecast

21.7 Key Countries

21.7.1 Brazil: Market Size & Forecast

21.7.2 Mexico: Market Size & Forecast

22 Middle East and Africa

22.1 Market Overview

22.2 Market Size & Forecast

22.3 Motor Type

22.3.1 Market Size & Forecast

22.4 Application

22.4.1 Market Size & Forecast

22.5 Voltage

22.5.1 Market Size & Forecast

22.6 Chuck Size

22.6.1 Market Size & Forecast

22.7 Key Countries

22.7.1 South Africa: Market Size & Forecast

22.7.2 Saudi Arabia: Market Size & Forecast

22.7.3 Uae: Market Size & Forecast

22.7.4 Turkey: Market Size & Forecast

23 Competitive Landscape

23.1 Competition Overview

24 Key Company Profiles

24.1 Stanley Black & Decker

24.1.1 Business Overview

24.1.2 Product Offerings

24.1.3 Key Strategies

24.1.4 Key Strengths

24.1.5 Key Opportunities

24.2 Robert Bosch

24.2.1 Business Overview

24.2.2 Product Offerings

24.2.3 Key Strategies

24.2.4 Key Strengths

24.2.5 Key Opportunities

24.3 Techtronic Industries Company

24.3.1 Business Overview

24.3.2 Product Offerings

24.3.3 Key Strategies

24.3.4 Key Strengths

24.3.5 Key Opportunities

24.4 Makita

24.4.1 Business Overview

24.4.2 Product Offerings

24.4.3 Key Strategies

24.4.4 Key Strengths

24.4.5 Key Opportunities

24.5 Hilti

24.5.1 Business Overview

24.5.2 Product Offerings

24.5.3 Key Strategies

24.5.4 Key Strengths

24.5.5 Key Opportunities

25 Other Prominent Vendors

25.1 Atlas Copco

25.1.1 Business Overview

25.1.2 Product Offerings

25.2 Apex Tool Group

25.2.1 Business Overview

25.2.2 Product Offerings

25.3 Ingersoll Rand

25.3.1 Business Overview

25.3.2 Product Offerings

25.4 Snap-On

25.4.1 Business Overview

25.4.2 Product Offerings

25.5 Koki Holdings

25.5.1 Business Overview

25.5.2 Product Offerings

25.6 Emerson

25.6.1 Business Overview

25.6.2 Product Offerings

25.7 Panasonic Electric Works Europe AG

25.7.1 Business Overview

25.7.2 Product Offerings

25.8 Fortive

25.8.1 Business Overview

25.8.2 Product Offerings

25.9 Positec

25.9.1 Business Overview

25.9.2 Product Offerings

25.10 Chevron

25.10.1 Business Overview

25.10.2 Product Offerings

25.11 Fein

25.11.1 Business Overview

25.11.2 Product Offerings

25.12 Ferm

25.12.1 Business Overview

25.12.2 Product Offerings

25.13 Aimco

25.13.1 Business Overview

25.13.2 Product Offerings

25.14 Uryu Seisaku

25.14.1 Business Overview

25.14.2 Product Offerings

25.15 Interskol

25.15.1 Business Overview

25.15.2 Product Offerings

25.16 Festool

25.16.1 Business Overview

25.16.2 Product Offerings

25.17 Kyocera

25.17.1 Business Overview

25.17.2 Product Offerings

25.18 Cs Unitec

25.18.1 Business Overview

25.18.2 Product Offerings

25.19 Dynabrade

25.19.1 Business Overview

25.19.2 Product Offerings

25.20 Husqvarna

25.20.1 Business Overview

25.20.2 Product Offerings

25.21 Stihl

25.21.1 Business Overview

25.21.2 Product Offerings

25.22 Oregon Tool

25.22.1 Business Overview

25.22.2 Product Offerings

26 Report Summary

26.1 Key Takeaways

26.2 Strategic Recommendations

27 Quantitative Summary

27.1 Market by Geography

27.2 Market by Motor Type

27.2.1 Brushless

27.2.2 Brushed

27.3 Market by Application

27.3.1 Commercial

27.3.2 Residential

27.3.3 Industrial

27.4 Market by Voltage

27.4.1 18V

27.4.2 12V

27.4.3 20V & Above

27.5 Market by Chuck Size

27.5.1 1/2”

27.5.2 3/8”

27.6 North America

27.6.1 Motor Type

27.6.2 Application

27.6.3 Voltage

27.6.4 Chuck Size

27.7 Europe

27.7.1 Motor Type

27.7.2 Application

27.7.3 Voltage

27.7.4 Chuck Size

27.8 Apac

27.8.1 Motor Type

27.8.2 Application

27.8.3 Voltage

27.8.4 Chuck Size

27.9 Latin America

27.9.1 Motor Type

27.9.2 Application

27.9.3 Voltage

27.9.4 Chuck Size

27.10 Middle East & Africa

27.10.1 Motor Type

27.10.2 Application

27.10.3 Voltage

27.10.4 Chuck Size

28 Appendix

28.1 Abbreviations

Companies Mentioned

- Stanley Black & Decker

- Robert Bosch

- Techtronic Industries Company

- Makita

- Hilti

- Atlas Copco

- Apex Tool Group

- Ingersoll Rand

- Snap-On

- Koki Holdings

- Emerson

- Panasonic

- Fortive

- Positec

- CHEVRON

- FEIN

- FERM

- AIMCO

- Uryu Seisaku

- INTRSKOL

- Festool

- Kyocera

- CS Unitec

- Dynabrade

- Husqvarna

- STIHL

- Oregon Tool, Inc.

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 229 |

| Published | January 2023 |

| Forecast Period | 2021 - 2027 |

| Estimated Market Value ( USD | $ 1110 Million |

| Forecasted Market Value ( USD | $ 2100.85 Million |

| Compound Annual Growth Rate | 11.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |