Speak directly to the analyst to clarify any post sales queries you may have.

Key Advantages of 5G:

- Streamlining growing complexity in the operational activities.

- Managing the increasing competition from renewable resources.

- Supports improving margins by minimizing cost.

- Helps in timely maintenance and prevents equipment failure.

- Increases operational efficiency by employing decreasing unmanned downtime.

MARKET TRENDS & OPPORTUNITIES

Industry 4.0 To Boost 5G in Oil & Gas Market

Industry 4.0 is currently essential for all entities engaged in the production and manufacturing processes. Evolution in the utility sector mandates the incorporation of Industry 4.0 in day-to-day activities. The utility sector is an integral part of the new industrial revolution era. Transformations such as process automation, integrating machines for predictive diagnostics and maintenance, equipment health tracking, and digitizing other operational parameters require the integration of Industry 4.0 in the energy sector. Oil & gas companies across the globe are also mandating incorporation of Industry 4.0 in daily operational activities. Oil & gas companies, especially in the upstream sector, are incorporating the advantages of industry 4.0 to enhance their overall operations. This is also required to remain relevant in the market due to the rising competition from the increasing demand for renewable energy, electric vehicle, and new hydrocarbon sources. Industry 4.0 also enables unmanned drilling operations, forecast maintenance needs, and enable asset management. Modernizing services and solution offerings in tandem with the improvising industry practices is set to be the key to growth over the next few years.Growing Adoption of Digitization in Oilfield

Oil & gas companies are proactively implementing digital transformation techniques in their operations, which can contribute towards the 5G in oil & gas market growth. The advancement in automation processes, sensing technologies, and data analytics drives these developments. Digitization in the oilfield or digital oilfield is the concept that integrates business processes with digital technologies such as IoT, AI, augmented reality, VR, digital twin, and cloud systems. This process supports companies by collecting real-time data from sensors, pressure and temperature meters, tank-level sensors, and others. Assimilation of such advanced technologies increases any oil or gas field's operational efficiency.Helps In:

- Enabling smooth decision-making regarding drilling in remote areas,

- Minimizes the unplanned shutdown of equipment as well as others,

- Enables the oil & gas companies to achieve maximum productivity by automation and monitoring of oilfields through live video feeds for visual monitoring and evaluation.

INDUSTRY CHALLENGES

Shift Towards Renewable & Alternate Energy Sources

In the last decade, the evolution of renewable energy has been enormous. Production and the installed capacity of renewable technologies have increased substantially, driven by encouraging global government policies. In addition, increasing climate catastrophes such as floods, extreme rain, wildfires, and others have mandated the increased use of renewables as electricity sources. Renewable energy technologies improve energy security and mitigate the adverse effects of climate change. They also provide direct and indirect economic advantages, thus gradually reducing the dependency on fossil fuels. Reduced reliance on oil & gas and sustainability initiatives are expected to result in decreased oil & gas activities which are expected to eventually impact the adoption of 5 G-related digital technologies in the oil & gas sector. Such factors can eventually hamper the growth of the 5G in oil & gas market.SEGMENTATION INSIGHTS

INSIGHTS BY APPLICATION

Based on application, the 5G in oil & gas market is divided into three segments: downstream, upstream, and midstream. The upstream industry accounted for the highest share of the global 5G in oil & gas market and is expected to reach USD 13.50 billion by 2030. This segment involves carrying out the most crucial activities, such as initial surveying and exploration of new fields and extraction and pre-processing crude oil and gas. Systems such as downhole drilling motors, oil platform tensioner systems, exploration stacks, and digital technologies such as IoT, AI, Big Data, and cloud computing have been integrated with almost all stages of oil & gas development.Midstream oil & gas industry is one of the three major stages of the overall oil & gas industry. The prime activities at this stage include processing, storing, and transporting oil & natural gas. The global midstream 5G in oil & gas market is expected to reach USD 0.88 billion in 2023. The use of digital technologies in the midstream segment enables companies to transport oil & gas products safely as sensor track the location of the truck, prevent incidents and reduce unnecessary manual checks of the systems.

Segmentation by Application:

- Upstream

- Midstream

- Downstream

INSIGHTS BY SPECTRUM

The mid-band segment in the 5G in oil & gas market is the largest segment by spectrum and accounts for a share of 64.00%. Mid-band spectrum is appropriate for ultra-high-speed applications which require low latency. This spectrum dominates the market owing to its advantages, such as transmitting vast amounts of data across significant distances. It is essential to bridge the gap between rural and urban areas by offering good broadband speed and connectivity. In addition, evolving technologies such as the Multiple Input, Multiple Output technique (MIMO), Advanced Antenna Systems (AAS), and state-of-the-art beamforming technology support the use of the mid-band spectrum.Segmentation by Spectrum:

- High-Band

- Low-Band

- Mid-Band

GEOGRAPHICAL ANALYSIS

China holds the most significant 5G in oil & gas market share globally and is growing at a CAGR of 24.39% during the forecast period. The country is amongst the top economies boosting the adoption and establishment of 5G technologies globally. Digital transformation is becoming necessary for organizations to remain competitive in the market. Various oil & gas companies in the country are adopting the latest technologies, such as AI-based solutions, predictive maintenance, and others, to gain a competitive edge and drive revenue growth. China is among the global leaders in 5G technology, with around 86,500 5G base stations. Furthermore, robust support from the government to promote digitization across rural and urban areas and in the industry is also expected to support market growth.Following China, the US is expected to lead the global 5G in oil & gas market at second position with a share of 22.00% by revenue in 2023. The growth is supported by the high penetration of highly skilled labor, high technology, and the presence of many oil & gas companies such as ExxonMobil, Shell, Chevron Corporation, and others. These companies embracing digital technology across its operation are the significant elements expected to support market growth in the US during the forecast period. However, the strong control of the FCC over the 5G network for providing licenses and spectrum allocation is leading to the slow adoption of the 5G network.

Segmentation by Geography:

- US

- Europe

- UK

- Norway

- Russia

- Italy

- China

- Vietnam

- Middle East & North Africa

- Tunisia

- Algeria

- Egypt

- Morocco

- Libya

- Sudan

- Turkey

- Saudi Arabia

- Rest of the World

- Canada

- India

- Brazil

- Mexico

- Venezuela

COMPANY AND STRATEGIES

Major companies in the global 5G in oil & gas market are Huawei (China), Hitachi Energy (Switzerland), Nokia (Finland), and Ericsson (Sweden), among others. These companies serve the global industry with 5G, routing, and other technologies. These players have adopted strategies such as expansion, acquisitions, new product development, joint ventures, and others to increase their revenues in the 5G in oil & gas market. However, limited vendors are offering 5G services across the oil & gas industry, giving opportunities for the local and regional telecommunication and network technology firms to leverage their 5G network across the oil & gas industry.Further, the competitive scenario in the global 5G in oil & gas market is deepening, and the fast-changing technological environment can adversely affect the companies as customers expect continual innovations and upgrades. The market is consolidated, with few players providing 5G networks in the oil & gas industry with high functionality. The 5G in oil & gas market structure is in an oligopoly state, characterized by a few top players who have significant influence in the market. Vendors are now focusing on developing their portfolios to drive growth. Vendors are actively investing in R&D and collaborating with stakeholders for better insights and revenue growth.

Key Vendors

- Athonet

- Cisco

- Ericsson

- Hitachi Energy

- Huawei

- Niral Network

- Nokia

- Sierra Wireless

Other Prominent Vendors

- Alibaba Cloud

- Fuze

- Google (Google Cloud)

- Intrado

- Microsoft (Microsoft Azure)

- NTT

- Qualcomm

- Samsung

- Sateliot

- Verizon

- Windstream

- ZTE

KEY QUESTIONS ANSWERED

1. How big is the 5G in oil & gas market?2. Which region dominates the global 5G in oil & gas market?

3. Who are the key players in the global 5G in oil & gas market?

4. What is the growth rate of the global 5G in oil & gas market?

5. What are the key driving factors in the 5G in oil & gas market?

Table of Contents

1 Research Methodology2 Research Objectives

3 Research Process

4 Scope & Coverage

4.1 Market Definition

4.1.1 Inclusions

4.1.2 Exclusions

4.1.3 Market Estimation Caveats

4.2 Base Year

4.3 Scope of the Study

4.3.1 Market Segmentation by Geography

5 Report Assumptions & Caveats

5.1 Key Caveats

5.2 Currency Conversion

5.3 Market Derivation

6 Premium Insights

6.1 Introduction

6.2 Market Synopsis

6.2.1 Drivers

6.2.2 Opportunities

6.2.3 Challenges

6.3 Segment Review

6.3.1 Application

6.3.2 Spectrum

6.3.3 Geography

6.4 Companies & Strategies

7 Market at a Glance

8 Introduction

8.1 Overview

8.2 Network Scenario

8.2.1 Private Network

8.2.2 Public Network

9 5G Outlook

9.1 Overview

9.1.1 Route to 5G Deployment

9.1.2 Drivers & Challenges of 5G Network Technology

9.1.3 Probable Opportunities for 5G

9.2 Adoption of 5G Technology Across Countries

9.2.1 Russia

9.2.2 Gulf States

9.2.3 South Korea

9.3 Development/ Deployment of 5G Network

9.3.1 North America

9.3.2 Latin America

9.3.3 Apac

9.3.4 Middle East & Africa

9.3.5 Europe

9.4 5G Ecosystem Cycle

9.4.1 Infrastructure

9.4.2 Spectrum

9.4.3 Devices

9.4.4 Impact

10 Case Study Analysis

10.1 Case I: Requirement for High-Capacity Broadband in the Gulf of Mexico

10.1.1 Business Need:

10.1.2 Solution

10.1.3 Outcome

10.2 Case Ii: Digitization of Operations

10.2.1 Business Need

10.2.2 Solution

10.2.3 Outcome

10.3 Case Iii: Need for Mobile Phone Connectivity at Sea

10.3.1 Business Need

10.3.2 Solution

10.3.3 Outcome

10.4 Use Cases in Oil & Gas Industry

10.4.1 Multi-Vision Smart Surveillance (Mvss)

10.4.2 3D Ar/Vr for Maintenance & Troubleshooting

10.4.3 Body-Worn Camera

10.4.4 Real-Time Vehicle Surveillance Camera

10.5 5G Technology Network Providers

10.5.1 5G Explorers

10.5.2 5G Potentials

10.5.3 5G Aspirational

10.5.4 5G Pacesetters

10.6 History of Cellular Wireless Networks

10.6.1 1G

10.6.2 2G

10.6.3 3G

10.6.4 4G

10.6.5 5G

10.7 Global Oil & Gas Industry

10.7.1 Overview

10.7.2 Crude Oil

10.7.3 Natural Gas

10.7.4 Current & Future Trends

11 Market Opportunities & Trends

11.1 Recent Developments in 5G Technology

11.1.1 Recent Launches/ Developments in the 5G Oil & Gas Market

11.2 Digitization of Oilfields

11.3 Integration of Ai in Oil & Gas Industry

11.4 Adoption of Enhanced Oil Recovery Technique

12 Market Growth Enablers

12.1 Expansion of Upstream Production Activity

12.2 Adoption of Digital Twin

12.3 Industry 4.0 Implementation in Oil & Gas Industry

12.4 Increased Penetration of 5G Network & Sd-Wan

13 Market Restraints

13.1 Security Concerns

13.2 5G Adoption Barriers

13.3 Shift Toward Renewable & Alternate Energy Sources

14 Market Landscape

14.1 Market Overview

14.2 Regulations

14.2.1 3Gpp

14.2.2 5G Alliance for Connected Industries and Automation (5G-Acia)

14.2.3 European Telecommunication Standard Institute

14.3 Survey Response: Digitization in Oilfield

14.3.1 Accelerators of IoT & Digitization in Oil & Gas

14.3.2 Options to Develop or Procure New Technologies

14.3.3 Obstacles in Digital Oilfields

14.4 Market Size & Forecast

14.5 Five Forces Analysis

14.5.1 Threat of New Entrants

14.5.2 Bargaining Power of Suppliers

14.5.3 Bargaining Power of Buyers

14.5.4 Threat of Substitutes

14.5.5 Competitive Rivalry

15 Application

15.1 Market Snapshot & Growth Engine

15.2 Market Overview

15.3 IoT Deployment in Oil & Gas Industry

15.3.1 Shell

15.3.2 Exxonmobil

15.3.3 Chevron

15.3.4 Saudi Aramco

15.3.5 Halliburton

15.4 Upstream

15.4.1 Market Overview

15.4.2 Market Size & Forecast

15.4.3 Market by Geography

15.5 Midstream

15.5.1 Market Overview

15.5.2 Market Size & Forecast

15.5.3 Market by Geography

15.6 Downstream

15.6.1 Market Overview

15.6.2 Market Size & Forecast

15.6.3 Market by Geography

16 Spectrum

16.1 Market Snapshot & Growth Engine

16.2 Market Overview

16.3 Process of Spectrum Allocation

16.4 High-Band

16.4.1 Market Overview

16.4.2 Market Size & Forecast

16.4.3 Market by Geography

16.5 Mid-Band

16.5.1 Market Overview

16.5.2 Market Size & Forecast

16.5.3 Market by Geography

16.6 Low-Band

16.6.1 Market Overview

16.6.2 Market Size & Forecast

16.6.3 Market by Geography

17 Geography

17.1 Market Snapshot & Growth Engine

17.2 Geographic Overview

17.3 Mena Countries

17.3.1 5G Outlook in Tunisia

17.3.2 5G Outlook in Algeria, Egypt, Morocco, and Turkey

17.3.3 5G Outlook in Libya and Sudan

17.4 Vietnam

18 US

18.1 Market Overview

18.1.1 Fcc Regulation:

18.1.2 Oil & Gas Statistics: US

18.1.3 5G in Oil & Gas

18.2 Market Size & Forecast

18.3 Application

18.4 Spectrum

19 China

19.1 Market Overview

19.1.1 Recent Developments/ Investments in 5G Network

19.1.2 Oil & Gas Statistics: China

19.2 Market Size & Forecast

19.3 Application

19.4 Spectrum

20 Europe

20.1 Market Overview

20.1.1 Oil & Gas Statistics: Europe

20.2 UK

20.3 Norway

20.4 Russia

20.5 Italy

20.6 Market Size & Forecast

20.7 Application

20.8 Spectrum

21 Saudi Arabia

21.1 Market Overview

21.1.1 Oil & Gas Statistics: Saudi Arabia

21.2 Market Size & Forecast

21.3 Application

21.4 Spectrum

22 Rest of the World

22.1 Canada

22.1.1 Oil & Gas Statistics

22.2 India

22.2.1 Oil & Gas Statistics

22.3 Brazil

22.3.1 Oil & Gas Statistics

22.4 Mexico

22.4.1 Oil & Gas: Statistics

22.5 Venezuela

22.5.1 Oil & Gas Statistics

23 Competitive Landscape

23.1 Competition Overview

23.1.1 Key Players in 5G Ecosystem

23.1.2 Offerings by Startups

24 Key Company Profiles

24.1 Athonet

24.1.1 Business Overview

24.1.2 Product & Service Offerings

24.1.3 Key Strategies

24.1.4 Key Strengths

24.1.5 Key Opportunities

24.2 Cisco

24.2.1 Business Overview

24.2.2 Financial Overview

24.2.3 Product & Service Offerings

24.2.4 Key Strategies

24.2.5 Key Strengths

24.2.6 Key Opportunities

24.3 Telefonaktiebolaget Lm Ericsson

24.3.1 Business Overview

24.3.2 Financial Overview

24.3.3 Telefonaktiebolaget Lm Ericsson

24.3.4 Product & Service Offerings

24.3.5 Key Strategies

24.3.6 Key Strengths

24.3.7 Key Opportunities

24.4 Hitachi Energy

24.4.1 Business Overview

24.4.2 Financial Overview

24.4.3 Hitachi Energy in 5G in Oil & Gas Market

24.4.4 Product & Service Offerings

24.4.5 Key Strategies

24.4.6 Key Strengths

24.4.7 Key Opportunities

24.5 Huawei

24.5.1 Business Overview

24.5.2 Financial Overview

24.5.3 Huawei in 5G in Oil & Gas Market

24.5.4 Product & Service Offerings

24.5.5 Key Strategies

24.5.6 Key Strengths

24.5.7 Key Opportunities

24.6 Niral Networks

24.6.1 Business Overview

24.6.2 Product & Service Offerings

24.6.3 Key Strategies

24.6.4 Key Strengths

24.6.5 Key Opportunities

24.7 Nokia

24.7.1 Business Overview

24.7.2 Financial Overview

24.7.3 Nokia in 5G in Oil & Gas Market

24.7.4 Product & Service Offerings

24.7.5 Key Strategies

24.7.6 Key Strengths

24.7.7 Key Opportunities

24.8 Sierra Wireless

24.8.1 Business Overview

24.8.2 Financial Overview

24.8.3 Product & Service Offerings

24.8.4 Key Strategies

24.8.5 Key Strengths

24.8.6 Key Opportunities

25 Other Prominent Players

25.1 Alibaba Cloud

25.1.1 Business Overview

25.1.2 Product & Service Offerings

25.2 Fuze

25.2.1 Business Overview

25.2.2 Product & Service Offerings

25.3 Google (Google Cloud)

25.3.1 Business Overview

25.3.2 Product & Service Offerings

25.4 Intrado

25.4.1 Business Overview

25.4.2 Product & Service Offerings

25.5 Microsoft (Microsoft Azure)

25.5.1 Business Overview

25.5.2 Product & Service Offerings

25.6 Ntt

25.6.1 Business Overview

25.6.2 Product & Service Offerings

25.7 Qualcomm

25.7.1 Business Overview

25.7.2 Product & Service Offerings

25.8 Samsung

25.8.1 Business Overview

25.8.2 Product & Service Offerings

25.9 Sateliot

25.9.1 Business Overview

25.9.2 Product & Service Offerings

25.10 Verizon

25.10.1 Business Overview

25.10.2 Product & Service Offerings

25.11 Windstream

25.11.1 Business Overview

25.11.2 Product & Service Offerings

25.12 Zte

25.12.1 Business Overview

25.12.2 Product & Service Offerings

26 Report Summary

26.1 Key Takeaways

26.2 Strategic Recommendations

27 Quantitative Summary

27.1 Spectrum

27.1.1 High-Band

27.1.2 Low-Band

27.1.3 Mid-Band

27.2 Application

27.2.1 Upstream

27.2.2 Midstream

27.2.3 Downstream

28 Geography

28.1 US

28.1.1 Application

28.1.2 Spectrum

28.2 China

28.2.1 Application

28.2.2 Spectrum

28.3 Europe

28.3.1 Application

28.3.2 Spectrum

28.4 Saudi Arabia

28.4.1 Application

28.4.2 Spectrum

29 Appendix

29.1 Abbreviations

Companies Mentioned

- Athonet

- Cisco

- Ericsson

- Hitachi Energy

- Huawei

- Niral Network

- Nokia

- Sierra Wireless

- Alibaba Cloud

- Fuze

- Google (Google Cloud)

- Intrado

- Microsoft (Microsoft Azure)

- NTT

- Qualcomm

- Samsung

- Sateliot

- Verizon

- Windstream

- ZTE

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

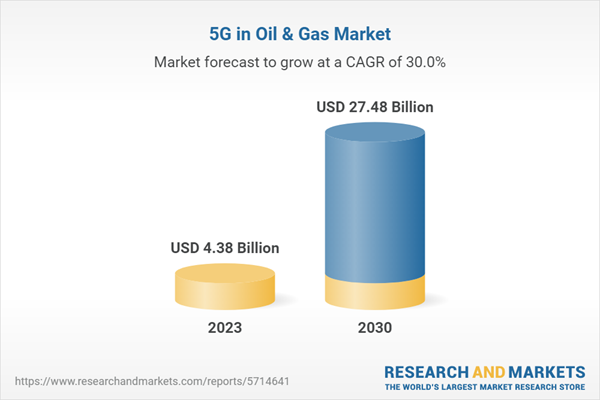

| Report Attribute | Details |

|---|---|

| No. of Pages | 267 |

| Published | January 2023 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 4.38 Billion |

| Forecasted Market Value ( USD | $ 27.48 Billion |

| Compound Annual Growth Rate | 30.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |