Increasing Need for Customization of Satellite and Launch Vehicle Platforms

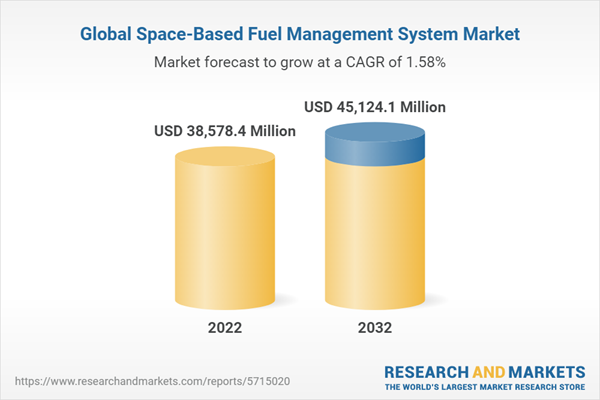

The global space-based fuel management system market is estimated to reach $45,124.1 million in 2032 from $38,578.4 million in 2022, at a growth rate of 1.58% during the forecast period 2022-2032. The space-based fuel management system technology companies have witnessed the demand from the growing commercial industry. The ecosystem of the space-based fuel management system market comprises system manufacturers, original equipment manufacturers (OEMs), and end users.

Market Lifecycle Stage

In 1957, when the Sputnik-1 satellite was launched, it implemented a fuel regulator, which failed and resulted in excess fuel consumption. Since then, till 2022, propulsion system technologies and fuel management systems have come a long way in being cost-effective and efficient. Companies like Northrop Grumman and Lockheed Martin have shown their capabilities in the propulsion system and fuel management system department.

Currently, many space agencies and commercial companies across the globe have been focusing on developing low Earth orbit (LEO) satellite constellations. This would drive the market for the space-based fuel management system. Moreover, rising research and development activities to develop cost-efficient propulsion technologies and fuel management systems are other factors contributing to the growth of the LEO-focused space-based fuel management system market. For instance, in June 2022, ThrustMe signed a contract with European Space Agency (ESA) to provide an NPT30-I2-1.5U electric propulsion system for the GOMX-5 mission under ESA general support technology programme (GSTP).

Impact

- The increasing number of smaller telecom satellites in low Earth orbit (LEO) with the upcoming mega-constellation has placed a high demand for the production of space-based fuel management systems during the forecast period.

- Furthermore, there is a rise in research and development activities for building cost-effective space-based fuel management systems for satellites.

Market Segmentation

Segmentation 1: by Application

- Satellite

- Launch Vehicle

- Deep Space Vehicle

The satellite application type segment is expected to dominate the global space-based fuel management system market during the forecast period 2022-2032.

Segmentation 2: by Component

- Sensors

- Valves

- Flow Controllers

- Mass Flow Sensors

- Pressure Transducers

- Particle Filters

- Plumbing/Tubing

Based on component, the global space-based fuel management system market is expected to be dominated by plumbing and tubing segment during the forecast period.

Segmentation 3: by Region

- North America - U.S., Canada

- Europe - France, Germany, Russia, U.K., and Rest-of-Europe

- Asia-Pacific - China, India, Japan, and Rest-of-Asia-Pacific

- Rest-of-the-World - Middle East and Africa and Latin America

Recent Developments in the Global Space-Based Fuel Management System Market

- In July 2022, Thales Alenia Space received a contract of $2.4 million from European Space Agency (ESA) to develop Skimsat, a small satellite bus for very low Earth orbit (VLEO). The contract also includes developing electrical propulsion to air drag in VLEO.

- In August 2022, Astra Space won a contract from Airbus for the development of electric propulsion systems using xenon and krypton as propellants for its line of small satellites.

- In August 2021, the European Space Agency signed a contract with Airbus for the construction of European Service Module (ESM) propulsion systems for Orion spacecraft that will be responsible for orbital maneuvering and position control.

- In April 2021, Lockheed Martin received a contract worth $2.9 million from the U.S. DoD agency DARPA to build and demonstrate nuclear-based propulsion systems by 2025 to power spacecraft for missions beyond LEO.

Demand - Drivers and Limitations

The following are the drivers for the global space-based fuel management system market:

- Increasing Demand for Fuel Management Systems due to the Serial Production of Satellites and Launch Vehicles

- Increasing Need for Customization of Satellite and Launch Vehicle Platforms

The following are the challenges for the global space-based fuel management system market:

- Modular Propulsion Solutions Negating the Need for Commoditized Fuel Management Solutions

- Evolution of Integrated Propulsion Solutions Restricting the Choice of Fuel Management System Components

The following are the opportunities for the global space-based fuel management system market:

- Evolution of New Environment-Friendly Spacecraft Fuels

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of space-based fuel management system markets available for deployment in the industries for space platforms and their potential globally.

Growth/Marketing Strategy: The global space-based fuel management system market has seen major development by key players operating in the market, such as business expansion activities, contracts, mergers, partnerships, collaborations, and joint ventures. The favored strategy for the companies has been contracted to strengthen their position in the global space-based fuel management system market. For instance, in April 2021, ThrustMe signed a contract with the Norwegian Space Agency to be its prime supplier of propulsion systems for their NorSat-1TD satellite.

Competitive Strategy: Key players in the global space-based fuel management system market analyzed and profiled in the study involve satellite propulsion manufacturers. Moreover, a detailed competitive benchmarking of the players operating in the global space-based fuel management system market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as contracts, partnerships, agreements, acquisitions, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analysis of the company's coverage, product portfolio, and market penetration.

The top segment players leading the market include established players of fuel management systems for satellites which constitute 80% of the presence in the market. Other players include start-up entities that account for approximately 20% of the presence in the market.

Key Companies Profiled

- Airbus

- Accion Systems

- Benchmark Space System

- Cobham

- Exotrail

- IHI Aerospace Co. Ltd

- Lockheed Martin Corporation

- Microcosm Inc.

- Moog Inc.

- Northrop Grumman

- Orbion Space Technology

- Reaction Engines

- Safran S.A.

- Thales Alenia Space

- ThrustMe

Table of Contents

1 Markets

1.1 Industry Outlook

1.1.1 Space-Based Fuel Management System Market: Overview

1.1.2 New Space Business Scenario: An Emerging Opportunity for the Space-Based Fuel Management System Market

1.1.2.1 Increase in LEO-Based Small Satellite Market

1.1.2.2 Growth in Small Launch Vehicle (SLV) Market

1.1.3 Impact of Increasing Deployment of Electric Propulsion Systems

1.1.4 Evolving Customer Requirement

1.1.5 Ongoing and Upcoming Projects

1.1.5.1 Eta Space Cryogenic Fluid Management Technology Demonstration

1.1.5.2 Lockheed Martin Cryogenic Fluid Management Technology Demonstration

1.1.6 Start-ups and Investment Scenario

1.1.7 Evolving In-Orbit Re-Fuelling Depot: Large-Scale Fuel Management System

1.2 Business Dynamics

1.2.1 Business Drivers

1.2.1.1 Increasing Demand for Fuel Management Systems due to the Serial Production of Satellites and Launch Vehicles

1.2.1.2 Increasing Need for Customization of Satellite and Launch Vehicle Platforms

1.2.2 Business Challenges

1.2.2.1 Modular Propulsion Solutions Negating the Need for Commoditized Fuel Management Solutions

1.2.2.2 Evolution of Integrated Propulsion Solutions Restricting the Choice of Fuel Management System Components

1.2.3 Business Opportunities

1.2.3.1 Evolution of New Environment-Friendly Spacecraft Fuels

1.3 Business Strategies

1.3.1 Partnerships, Collaborations, Agreements, and Contracts

1.3.2 Mergers and Acquisitions

1.3.3 Other Developments

2 Application

2.1 Global Space-Based Fuel Management System Market (by Application)

2.1.1 Market Overview

2.1.1.1 Demand Analysis of Space-Based Fuel Management System Market (by Application)

2.1.2 Satellite

2.1.2.1 Demand Analysis of Space-Based Fuel Management System Market (by Satellite)

2.1.2.2 Small Satellite (0-500 kg)

2.1.2.3 Medium Satellite (501-1000 kg)

2.1.2.4 Large Satellite (Above 1000 kg)

2.1.3 Launch Vehicle

2.1.3.1 Small Lift Launch Vehicle (0-2,200 kg)

2.1.3.2 Medium and Heavy Lift Launch Vehicle (2,201 kg and Above)

2.1.4 Deep Space Vehicle

2.1.4.1 Orbiters

2.1.4.2 Landers

3 Products

3.1 Global Space-based Fuel Management System Market (by Component)

3.1.1 Market Overview

3.1.1.1 Demand Analysis of the Space-based Fuel Management System Market (by Component)

3.1.2 Sensors

3.1.3 Valves

3.1.4 Flow Controllers

3.1.5 Mass Flow Sensors

3.1.6 Pressure Transducers

3.1.7 Particle Filters

3.1.8 Plumbing/Tubing

4 Region

4.1 Global Space-Based Fuel Management System Market (by Region)

4.2 North America

4.2.1 Market

4.2.1.1 Key Manufacturers and Suppliers in North America

4.2.1.2 Business Drivers

4.2.1.3 Business Challenges

4.2.2 Application

4.2.2.1 North America Space-Based Fuel Management System Market (by Application)

4.2.3 North America (by Country)

4.2.3.1 U.S.

4.2.3.1.1 Market

4.2.3.1.1.1 Key Manufacturers and Suppliers in the U.S.

4.2.3.1.2 Application

4.2.3.1.2.1 U.S. Space-Based Fuel Management System Market (by Application)

4.2.3.2 Canada

4.2.3.2.1 Market

4.2.3.2.1.1 Key Manufacturers and Suppliers in Canada

4.2.3.2.2 Application

4.2.3.2.2.1 Canada Space-Based Fuel Management System Market (by Application)

4.3 Europe

4.3.1 Market

4.3.1.1 Key Manufacturers and Suppliers in Europe

4.3.1.2 Business Drivers

4.3.1.3 Business Challenges

4.3.2 Application

4.3.2.1 Europe Space-Based Fuel Management System Market (by Application)

4.3.3 Europe (by Country)

4.3.3.1 U.K.

4.3.3.1.1 Market

4.3.3.1.1.1 Key Manufacturers and Suppliers in the U.K.

4.3.3.1.2 Application

4.3.3.1.2.1 U.K. Space-Based Fuel Management System Market (by Application)

4.3.3.2 Germany

4.3.3.2.1 Application

4.3.3.2.1.1 Germany Space-Based Fuel Management System Market (by Application)

4.3.3.3 France

4.3.3.3.1 Market

4.3.3.3.1.1 Key Manufacturers and Suppliers in France

4.3.3.3.2 Application

4.3.3.3.2.1 France Space-Based Fuel Management System Market (by Application)

4.3.3.4 Russia

4.3.3.4.1 Application

4.3.3.4.1.1 Russia Space-Based Fuel Management System Market (by Application)

4.3.3.5 Rest-of-Europe

4.3.3.5.1 Application

4.3.3.5.1.1 Rest-of-Europe Space-Based Fuel Management System Market (by Application)

4.4 Asia-Pacific

4.4.1 Market

4.4.1.1 Key Manufacturers and Suppliers in Asia-Pacific

4.4.1.2 Business Drivers

4.4.1.3 Business Challenges

4.4.2 Application

4.4.2.1 Asia-Pacific Space-Based Fuel Management System Market (by Application)

4.4.3 Asia-Pacific (by Country)

4.4.3.1 China

4.4.3.1.1 China Space-Based Fuel Management System Market (by Application)

4.4.3.2 India

4.4.3.3 Key Manufacturers and Suppliers in India

4.4.3.3.1 Application

4.4.3.3.1.1 India Space-Based Fuel Management System Market (by Application)

4.4.3.4 Japan

4.4.3.4.1 Market

4.4.3.4.1.1 Key Manufacturers and Suppliers in Japan

4.4.3.4.2 Application

4.4.3.4.2.1 Japan Space-Based Fuel Management System Market (by Application)

4.4.3.5 Rest-of-Asia-Pacific

4.4.3.5.1.1 Business Challenges

4.4.3.5.2 Application

4.4.3.5.2.1 Rest-of-Asia-Pacific Space-Based Fuel Management System Market (by Application)

4.5 Rest-of-the-World

4.5.1 Market

4.5.1.1 Business Drivers

4.5.1.2 Business Challenges

4.5.2 Application

4.5.2.1 Rest-of-the-World Space-Based Fuel Management System Market (by Application)

4.5.3 Rest-of-the-World (by Region)

4.5.3.1 Middle East and Africa

4.5.3.1.1 Business Drivers

4.5.3.1.2 Business Challenges

4.5.3.1.3 Middle East and Africa Space-Based Fuel Management System Market

4.5.3.2 Latin America

4.5.3.2.1 Latin America Space-Based Fuel Management System Market

5 Markets - Competitive Benchmarking & Company Profiles

5.1 Competitive Benchmarking

5.2 Airbus

5.2.1 Company Overview

5.2.1.1 Role of Airbus in the Space-Based Fuel Management System Market

5.2.2 Business Strategies

5.2.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

5.2.3 R&D Analysis

5.2.4 Analyst View

5.3 Accion Systems

5.3.1 Company Overview

5.3.1.1 Role of Accion Systems in the Space-Based Fuel Management System Market

5.3.2 Business Strategies

5.3.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

5.3.3 Analyst View

5.4 Benchmark Space System

5.4.1 Company Overview

5.4.1.1 Role of Benchmark Space System in the Space-Based Fuel Management System Market

5.4.2 Business Strategies

5.4.2.1 Benchmark Space System: Partnerships, Collaborations, Agreements, Investments, and Contracts

5.4.3 Analyst View

5.5 Cobham

5.5.1 Company Overview

5.5.1.1 Role of Cobham in the Space-Based Fuel Management System Market

5.5.2 Analyst View

5.6 Exotrail

5.6.1 Company Overview

5.6.1.1 Role of Exotrail in the Space-Based Fuel Management System Market

5.6.2 Business Strategies

5.6.2.1 Exotrail: Partnerships, Collaborations, Agreements, Investments, and Contracts

5.6.3 Analyst View

5.7 IHI Aerospace Co. Ltd

5.7.1 Company Overview

5.7.1.1 Role of IHI Aerospace Co., Ltd. in the Space-Based Fuel Management System Market

5.7.2 Business Strategies

5.7.2.1 IHI Aerospace Co., Ltd.: Partnerships, Collaborations, Agreements, Investments, and Contracts

5.7.3 Analyst View

5.8 Lockheed Martin Corporation

5.8.1 Company Overview

5.8.1.1 Role of Lockheed Martin Corporation in the Space-Based Fuel Management System Market

5.8.2 Business Strategies

5.8.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

5.8.3 R&D Analysis

5.8.4 Analyst View

5.9 Microcosm Inc.

5.9.1 Company Overview

5.9.1.1 Role of Microcosm Inc. in the Space-Based Fuel Management System Market

5.9.2 Analyst View

5.1 Moog Inc.

5.10.1.1 Company Overview

5.10.1.2 Role of Moog Inc. in the Space-Based Fuel Management System Market

5.10.2 R&D Analysis

5.10.3 Analyst View

5.11 Northrop Grumman

5.11.1 Company Overview

5.11.1.1 Role of Northrop Grumman in the Space-Based Fuel Management System Market

5.11.2 Business Strategies

5.11.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

5.11.3 R&D Analysis

5.11.4 Analyst View

5.12 Orbion Space Technology

5.12.1 Company Overview

5.12.1.1 Role of Orbion Space Technology in the Space-Based Fuel Management System Market

5.12.2 Business Strategies

5.12.2.1 Orbion Space Technology: Partnerships, Collaborations, Agreements, Investments, and Contracts

5.12.3 Analyst View

5.13 Reaction Engines

5.13.1 Company Overview

5.13.1.1 Role of Reaction Engines in the Space-Based Fuel Management System Market

5.13.2 Analyst View

5.14 Safran S.A.

5.14.1 Company Overview

5.14.1.1 Role of Safran S.A. in the Space-Based Fuel Management System Market

5.14.2 R&D Analysis

5.14.3 Analyst View

5.15 Thales Alenia Space

5.15.1 Company Overview

5.15.1.1 Role of Thales Alenia Space in the Space-Based Fuel Management System Market

5.15.2 Business Strategies

5.15.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

5.15.3 Analyst View

5.16 ThrustMe

5.16.1 Company Overview

5.16.1.1 Role of ThrustMe in the Space-Based Fuel Management System Market

5.16.2 Business Strategies

5.16.2.1 Partnerships, Collaborations, Agreements, Investments, and Contracts

5.16.3 Analyst View

6 Growth Opportunity and Recommendation

6.1 Growth Opportunities

6.1.1 Growth Opportunity: Growing Need for Customized Fuel Management Systems

6.1.1.1 Recommendations

6.1.2 Growth Opportunity: Need for New Fuel Management Solutions

6.1.2.1 Recommendations

7 Research Methodology

7.1 Factors for Data Prediction and Modelling

List of Figures

Figure 1: Global Space-Based Fuel Management System Market, Units, 2021-2032

Figure 2: Global Space-Based Fuel Management System Market, $Million, 2021-2032

Figure 3: Global Space-Based Fuel Management System Market (by Application), Units, 2021 and 2032

Figure 4: Global Space-Based Fuel Management System Market (by Application), $Million, 2021 and 2032

Figure 5: Global Space-Based Fuel Management System Market (by Component), Number of Units, 2021 and 2032

Figure 6: Global Space-Based Fuel Management System Market (by Component), $Million, 2021 and 2032

Figure 7: Global Space-Based Fuel Management System Market (by Region), $Million, 2032

Figure 8: Space-Based Fuel Management System Market Coverage

Figure 9: LEO-Based Small Satellite Scenario (0-500 kg), Number of Launches, 2021-2032

Figure 10: Global Small Launch Vehicle Scenarios, 2021-2027

Figure 11: Business Dynamics of the Global Space-Based Fuel Management System Market

Figure 12: Share of Key Business Strategies and Developments, January 2019-November 2022

Figure 13: Global Space-Based Fuel Management System Market, Competitive Benchmarking

Figure 14: Airbus R&D Analysis, $Million, 2019-2021

Figure 15: Lockheed Martin Corporation.: R&D Analysis, $Million, 2019-2021

Figure 16: Moog Inc. R&D Analysis, $Million, 2019-2021

Figure 17: Northrop Grumman R&D Analysis, $Million, 2019-2021

Figure 18: Safran S.A., R&D Analysis, $Million, 2019-2021

Figure 19: Research Methodology

Figure 20: Top-Down and Bottom-Up Approach

Figure 21: Assumptions and Limitations

List of Tables

Table 1: Start-ups and Investments Scenario

Table 2: Partnerships, Collaborations, Agreements, and Contracts, January 2020-November 2022

Table 3: Mergers and Acquisitions, January 2020-November 2022

Table 4: Other Developments, January 2020-November 2022

Table 5: Global Space-Based Fuel Management System Market (by Application), $Million and Units, 2021-2032

Table 6: Global Space-Based Fuel Management System Market (by Satellite), $Million and Units, 2021-2032

Table 7: Global Space-Based Fuel Management System Market (by Launch Vehicle Type), $Million and Units, 2021-2032

Table 8: Global Space-based Fuel Management System Market (by Component), $Million and Units, 2021-2032

Table 9: Global Space-Based Fuel Management System Market (by Region), $Million and Units, 2021-2032

Table 10: North America Space-Based Fuel Management System Market (by Application), $Million and Units, 2021-2032

Table 11: U.S. Space-Based Fuel Management System Market (by Application), $Million and Units, 2021-2032

Table 12: Canada Space-Based Fuel Management System Market (by Application), $Million and Units, 2021-2032

Table 13: Europe Space-Based Fuel Management System Market (by Application), $Million and Units, 2021-2032

Table 14: U.K. Space-Based Fuel Management System Market (by Application), $Million and Units, 2021-2032

Table 15: Germany Space-Based Fuel Management System Market (by Application), $Million and Units, 2021-2032

Table 16: France Space-Based Fuel Management System Market (by Application), $Million and Units, 2021-2032

Table 17: Russia Space-Based Fuel Management System Market (by Application), $Million and Units, 2021-2032

Table 18: Rest-of-Europe Space-Based Fuel Management System Market (by Application), $Million and Units, 2021-2032

Table 19: Asia-Pacific Space-Based Fuel Management System Market (by Application), $Million and Units, 2021-2032

Table 20: China Space-Based Fuel Management System Market (by Application), $Million and Units, 2021-2032

Table 21: India Space-Based Fuel Management System Market (by Application), $Million and Units, 2021-2032

Table 22: Japan Space-Based Fuel Management System Market (by Application), $Million and Units, 2021-2032

Table 23: Rest-of-Asia-Pacific Space-Based Fuel Management System Market (by Application), $Million and Units, 2021-2032

Table 24: Rest-of-the-World Space-Based Fuel Management System Market (by Application), $Million and Units, 2021-2032

Table 25: Middle East and Africa Space-Based Fuel Management System Market, $Million and Units, 2021-2032

Table 26: Latin America Space-Based Fuel Management System Market, $Million and Units, 2021-2032

Table 27: Benchmarking and Weightage Parameters

Table 28: Airbus: Product Portfolio

Table 29: Airbus: Partnerships, Collaborations, Agreements, Investments, and Contracts

Table 30: Accion Systems: Product Portfolio

Table 31: Accion Systems: Partnerships, Collaborations, Agreements, Investments, and Contracts

Table 32: Benchmark Space System: Product Portfolio

Table 33: Partnerships, Collaborations, Agreements, Investments, and Contracts

Table 34: Cobham: Product Portfolio

Table 35: Exotrail: Product Portfolio

Table 36: Partnerships, Collaborations, Agreements, Investments, and Contracts

Table 37: IHI Aerospace Co., Ltd.: Product Portfolio

Table 38: IHI Aerospace Co., Ltd.: Partnerships, Collaborations, Agreements, Investments, and Contracts

Table 39: Lockheed Martin Corporation Product Portfolio

Table 40: Lockheed Martin Corporation: Partnerships, Collaborations, Agreements, Investments, and Contracts

Table 41: Microcosm Inc.: Product Portfolio

Table 42: Moog Inc.: Product Portfolio

Table 43: Northrop Grumman.: Product Portfolio

Table 44: Northrop Grumman: Partnerships, Collaborations, Agreements, Investments, and Contracts

Table 45: Orbion Space Technology: Product Portfolio

Table 46: Partnerships, Collaborations, Agreements, Investments, and Contracts

Table 47: Reaction Engines: Product Portfolio

Table 48: Safran S.A.: Product Portfolio

Table 49: Thales Alenia Space: Product Portfolio

Table 50: Thales Alenia Space: Partnerships, Collaborations, Agreements, Investments, and Contracts

Table 51: ThrustMe: Product Portfolio

Table 52: ThrustMe: Partnerships, Collaborations, Agreements, Investments, and Contracts

Companies Mentioned

- Airbus

- Accion Systems

- Benchmark Space System

- Cobham

- Exotrail

- IHI Aerospace Co. Ltd

- Lockheed Martin Corporation

- Microcosm Inc.

- Moog Inc.

- Northrop Grumman

- Orbion Space Technology

- Reaction Engines

- Safran S.A.

- Thales Alenia Space

- ThrustMe

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 126 |

| Published | January 2023 |

| Forecast Period | 2022 - 2032 |

| Estimated Market Value ( USD | $ 38578.4 Million |

| Forecasted Market Value ( USD | $ 45124.1 Million |

| Compound Annual Growth Rate | 1.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |