Sugar is used in Germany across various industries such as fast food, confectionary, and food & beverages. Sugar provides the body with energy in the form of glucose, which is essential for the optimal functioning of the brain, muscles, and nervous system under normal conditions. The country is known for its bounty of delicious desserts and sweet treats such as Bienenstich (Bee Sting Cake), Rote Grütze (Red Berry “Pudding”), Fruit and Quark Pastries, and chwarzwälder Kirschtorte (Black Forest Cake) among a few.

In 2020, according to the Observatory of Economic Complexity (OEC) data, the country exported $2.6B in sugar and sugar confectionery, this leads the way toward making Germany the 3rd largest exporter of sugar and sugar confectionery. Moreover, during the same year, the country imported $1.62B in sugar and sugar confectionery, becoming the 4th largest importer of sugar and sugar confectionery in the world. The country imports sugar primarily from the Netherlands, France, Belgium, Italy, and Poland.

Major Developments

Recently, in August 2022, Nordzucker, who is Germany’s second-largest sugar producer, announced that the sugar refining season for 2022 would begin in September and it is being planned in a way that beet processing will be completed by the end of January 2023. Consequently, they attained success in converting refinery plants to oil fuel because uncertainty can be there when gas supplies are used. Moreover, they also added that over 80% of Nordzucker’s German sugar production capacity has been converted back to oil. This will impact the sugar market in the country during the forecast period.Market Restraints

Over the years, people have significantly changed their habits toward the healthier side. Sugar, which is a staple food across the globe, can lead to severe health diseases if taken in excess. People demanding low-sugar or sugar-free alternatives is a key market restraint. This strong demand is linked to increasing cases of diabetes and obesity. Moreover, the International Diabetes Federation (IDF) estimates that the global prevalence rate of diabetes over the previous ten years was 3% per year. According to the IDF, there will be 592 million individuals living with diabetes globally by 2035. The German government has also been taking initiatives to promote a healthier lifestyle. In 2019, The World Health Organization (WHO) called childhood obesity a growing problem in Germany, and half of all adults in Germany were overweight, according to the statistics released by Federal Nutrition Minister Julia Klöckner in the same year. Therefore, Germany's Professional Association of Pediatricians and Youth Physicians (BVKJ) wanted the government to introduce a sugar tax in the country to combat rising obesity among young people. With the introduction of the alcopops tax - or tax on sweet alcoholic drinks, prices of the item including sugar could have been raised, which would make the consumers avoid the intake of sugar products.COVID-19 Insights

The COVID-19 pandemic had drastically affected staple foods, as due to the lockdown production units were closed. It worsened the value chain. Along with that, sugar demand from hotels, retailers, bars, and other establishments was also stopped due to the nation wise lockdown. Apart from being used as a final good, it disrupted the industry where it is used as an intermediate good, such as food, and beverage. The sugar supplies to these industries were stopped, and therefore, even they had to put a halt in their operations.Market Segmentation:

- By Source

- Cane Sugar

- Beet Sugar

- By Type

- Granular

- Powder

- Liquid

- By Application

- Dairy

- Beverages

- Confectionery & Bakery

- Processed Food

- Others

- By Distribution Channel

- Online

- Offline

Table of Contents

1. INTRODUCTION1.1. Market Overview

1.2. COVID-19 Scenario

1.3. Market Definition

1.4. Market Segmentation

2. RESEARCH METHODOLOGY

2.1. Research Data

2.2. Assumptions

3. EXECUTIVE SUMMARY

3.1. Research Highlights

4. MARKET DYNAMICS

4.1. Market Drivers

4.2. Market Restraints

4.3. Porter’s Five Force Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of New Entrants

4.3.4. Threat of Substitutes

4.3.5. Competitive Rivalry in the Industry

4.4. Industry Value Chain Analysis

5. GERMANY SUGAR MARKET, BY SOURCE

5.1. Introduction

5.2. Cane Sugar

5.3. Beet Sugar

6. GERMANY SUGAR MARKET, BY TYPE

6.1. Introduction

6.2. Granular

6.3. Powder

6.4. Liquid

7. GERMANY SUGAR MARKET, BY APPLICATION

7.1. Introduction

7.2. Dairy

7.3. Beverages

7.4. Confectionery & Bakery

7.5. Processed Food

7.6. Others

8. GERMANY SUGAR MARKET, BY DISTRIBUTION CHANNEL

8.1. Introduction

8.2. Online

8.3. Offline

9. COMPETITIVE ENVIRONMENT AND ANALYSIS

9.1. Major Players and Strategy Analysis

9.2. Emerging Players and Market Lucrativeness

9.3. Mergers, Acquisitions, Agreements, and Collaborations

9.4. Vendor Competitiveness Matrix

10. COMPANY PROFILES

10.1. Südzucker AG

10.2. Tereos

10.3. AB Sugar

10.4. NORDZUCKER AG

10.5. Pfeifer & Langen

10.6. Cosun Beet Company GmbH & Co.

*List is not exhaustive

Companies Mentioned

- Südzucker AG

- Tereos

- AB Sugar

- NORDZUCKER AG

- Pfeifer & Langen

- Cosun Beet Company GmbH & Co.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 84 |

| Published | December 2022 |

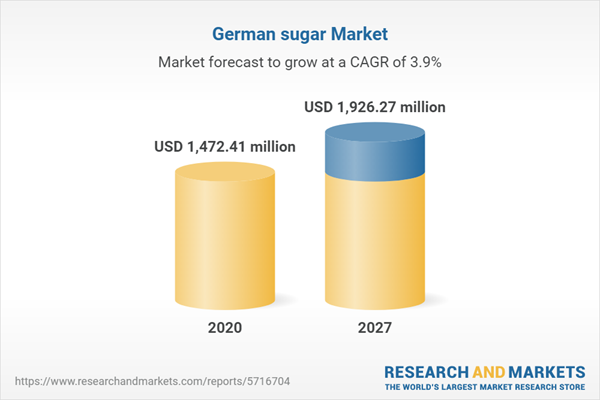

| Forecast Period | 2020 - 2027 |

| Estimated Market Value ( USD | $ 1472.41 million |

| Forecasted Market Value ( USD | $ 1926.27 million |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Germany |

| No. of Companies Mentioned | 6 |