The total movement of products over an inland transportation network is referred to as freight transport. All supply chains and logistical systems rely heavily on freight transportation. The market"s growth is linked to the affordable shipping costs set by suppliers of freight transport services and the many free trade agreements between nations.

For instance, Canada and the European Union agreed to a thorough economic trade pact. 98% of the tariffs on European goods traded across Europe and Canada are being eliminated by the Canadian government as a result of this agreement. By lowering commodity prices, which naturally boosts demand for freight transportation, such agreements help the freight transport market expand.

Many freight transportation management solutions, including fleet tracking & maintenance, warehouse management system, security & monitoring system, and 3PL solutions, can be used to address logistics issues because end-users and manufacturers in developing nations, like India, lack the internal control necessary to do so. This aspect stimulates the development of the target market as a whole.

Additional factors driving the demand for specialist freight transport and supply chain execution competencies include the expansion of e-commerce and entrepreneurial endeavors. Because logistics, inventory, and fixed expenses are reduced when shippers hire freight transportation services, they benefit.

Numerous businesses have outsourced their freight transport operations as a result of globalization since they are unable to manage global supply chain activities. Cargo transportation businesses offer better and more creative ways to maximize the efficiency of their services, offering benefits including lower capital costs, door-to-door service, flexibility, and a lower chance of damage during transit.

COVID-19 Impact Analysis

Global supply chain activities have been adversely affected by the COVID-19 pandemic. The crisis put unheard-of pressure on the logistics and transportation systems. Lockdowns were put into place in a number of nations, which caused uncertainty for the shippers while shipping their products. The logistics networks were disturbed by the imbalance between supply and demand, along with the lack of long-haul and last-mile fulfillment service capacity, which limited the growth of the freight transport sector. A decline in consumption has also been seen on the demand side.Market Growth Factors

Rapid Industrialization And Increasing Acceptance Of Industry 4.0

It is anticipated that rapid industrialization and the growing adoption of Industry 4.0 will enable the manufacture of high-quality goods at low cost. Road freight transportation is the best option for Industry 4.0 since it provides flexible and more affordable short-distance transit. Additionally, the demand for food, beverages, and other consumer goods is anticipated to rise with population growth, supporting market growth. The future of the global supply chain is finally beginning to be shaped by Industry 4.0 as a true driving force. Thus, the market for freight transportation is driven by the growing use of Industry 4.0.Escalating Need For Prompt Delivery

In particular, the logistics sector has seen an increase in the need for on-time delivery, which has evolved into a crucial differentiator among its rivals. The market has grown due to the introduction of numerous technologies in freight transportation for efficient management of the transportation process. One-third of the cost of logistics is accounted for by transportation management, which has a significant impact on how well the market as a whole performs. For brands, increased client retention is facilitated by on-time delivery. As a result, the market for freight transportation is driven by the rising need for on-time delivery.Market Restraining Factors

Increased Carbon Emissions

As pandemic restrictions were eased and passenger and cargo traffic picked up after a historic fall in 2020, world Co2 emissions from the transport industry recovered in 2021, rising by 8% to over 7.7 Gt CO2. a number of variables, including the increased carbon emissions brought on by the usage of diesel fuel in road transportation. Transport emissions are rising far more quickly than GDP in many emerging nations. Thus, the growth of the freight transportation market is being hampered by rising carbon emissions.Offering Outlook

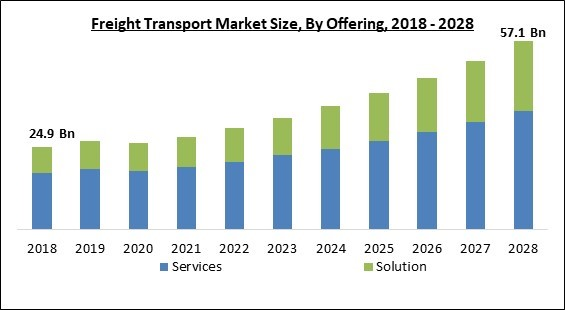

Based on offering, the market is categorized into Solutions and Services. In 2021, the service segment accounted for a large share of the revenue. On the basis of service offerings, the service segment is further categorized into Managed services, business services, and system integration. The demand for freight management services, which help companies deliver freight and complete the supply chain effectively and economically, is primarily responsible for the segment"s rise.Mode Of Transportation Outlook

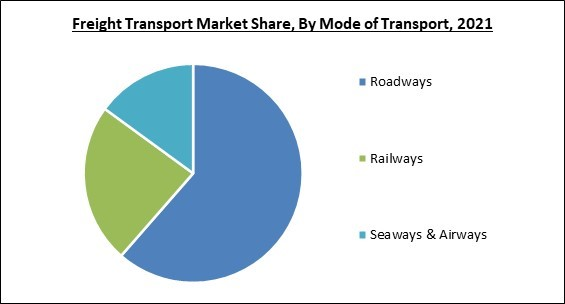

Based on the mode of transportation, the market is categorized into railways, roads, seaways, and aviation. During the forecast period, it is anticipated that the Seaways & airways segment will develop at a promising rate. The adoption of sustainable aviation fuels in response to climate change, speedier delivery, and rapid airport building in developing nations are all factors contributing to the growth of this market.Verticals Outlook

Based on verticals, the market is categorized into Retail & E-commerce, Automotive, Aerospace & Defense, Pharmaceuticals, Energy, and Others. The pharmaceutical segment is anticipated to expand at significant growth during the anticipated period. The most important link in a logistical network is pharmaceutical transport since the commodities being delivered are meant for human consumption. To guarantee that the drugs are delivered to the end user in the proper manner, total control over the entire distribution chain is necessary.Regional Outlook

Based on geography, the market is categorized into North America, Europe, Asia Pacific, and LAMEA. North America dominated the global market in 2021 and is predicted to maintain its dominance during the forecast period. Due to the presence of numerous significant logistics businesses, e-commerce behemoths, and suppliers of freight solutions in the United States and Canada. The continuing development and uptake of emerging technologies like artificial intelligence, machine learning, and near-field communication also contribute to the expansion of the market.The Cardinal Matrix - Freight Transport Market Competition Analysis

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; United Parcel Service, Inc. is the forerunner in the Freight Transport Market. Companies such as Oracle Corporation, FedEx Corporation, and SAP SE are some of the key innovators in Freight Transport Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include C.H. Robinson Worldwide, Inc., Deutsche Post DHL Group (The Deutsche Post AG), FedEx Corporation, Kuehne + Nagel International AG (Kuehne Holding AG), United Parcel Service, Inc., SAP SE, Oracle Corporation, Schneider National, Inc., DSV A/S, and Nippon Express Co., Ltd.

Strategies Deployed in Freight Transport Market

Product Launches and Product Expansions:

- Oct-2022: Kuehne+Nagel entered into a partnership with Pepco, a fast-growing retailer engaged in providing apparel for the entire family and household products at very low prices. Under this partnership, Kuehne+Nagel would offer automation and warehousing specialization for the Bulgarian, Romanian and Greek markets. Moreover, this partnership not only addresses Pepco’s requirement for speed and agility but also serves for a better sustainable future.

- Jun-2022: Oracle partnered with Kyndryl, an IT infrastructure services provider. The partnership is aimed to help customers boost their journey to the cloud by providing managed cloud solutions to enterprises across the world.

- Apr-2022: United Parcel Service (UPS) signed an agreement with Jumia, the Pan-African e-commerce platform. Through this Agreement, Jumia would extend to extend United Parcel Service"s logistics abilities and infrastructure for enhancing its delivery service offering in Africa.

- Feb-2022: C.H. Robinson partnered with Waymo via, an autonomous driving solution for moving goods. Through this partnership, Companies would integrate C.H. Robinson’s Navisphere technology, one of the most connected platforms with the Waymo Driver, an autonomous driving technology. Moreover, this partnership would structure upcoming developments and broaden autonomous driving technology as an extra transportation solution.

- Jan-2022: FedEx Corporation came into collaboration with Microsoft Corporation, a technology corporation engaged in the production of computer software, consumer electronics, and personal computers. Through this partnership, companies would transform logistics, commerce, and supply chains. Additionally, FedEx would integrate FedEx network intelligence with abilities from Microsoft Dynamics 365 to unveil “logistics as a service”, a cross-platform for merchants, brands, and retailers.

- Dec-2021: FedEx Express, a subsidiary of FedEx Corp., came into partnership with Delhivery, the fully-integrated logistics services player in India. Under this agreement, both companies would offer advanced solutions and services aimed to enhance efficiency, speed, and access for Delhivery and FedEx customers to open up India"s ability in International trade.

- Oct-2021: Kuehne+Nagel announced its expanded partnered with Blume Global, a provider of supply chain execution and visibility technology solutions. Under this partnership, Blume would offer Kuehne+Nagel a cognitive intermodal TMS, among other solutions, for its complete North American business.

- Jun-2021: United Parcel Service partners with ParcelHub, a retail business company with expertise in offering courier service and fulfillment centers. Under this partnership, United Parcel Service would extend its retail footprint in Malaysia and capitalize on the region"s growing logistics and e-commerce demand.

- Jul-2020: United Parcel Service partnered with Estafeta, an express and logistic service company for online retailers. This partnership would allow small and midsize businesses (SMEs) in Mexico to reach over 220 countries and territories across the world, also customers in the United States within a business day.

Acquisitions and Mergers:

- Nov-2022: UPS acquired Bomi Group, a provider of healthcare logistics. Under this acquisition, UPS Healthcare, a healthcare unit of UPS would add temperature-controlled facilities in 14 countries across Latin America and Europe.

- Sep-2022: DHL Supply Chain acquired Monta, a Dutch fulfillment provider. Under the acquisition, DHL would improve its response to the requirements of Small and Medium Enterprises and smaller online stores.

- Jun-2022: Schneider acquired deBoer Transportation, a regional and dedicated carrier. This acquisition aligns with Schneider’s strategy and combines deBoer Transportation into existing businesses of Schneider with equipment and drivers offered to assist growth opportunities in power-only and dedicated operations.

- Mar-2022: Deutsche Post DHL Group completed the acquisition of J.F. Hillebrand Group AG, a company with expertise in the logistics of beer, spirits, and wine. Through this acquisition, Deutsche Post DHL Group would add multiple services to its ocean freight offering, which would reinforce longstanding client relationships and income from the beginning.

- Jan-2022: Schneider completed the acquisition of Midwest Logistics Systems, a truckload carrier based in Ohio, United States. Through this acquisition, Schneider would increase annual revenue in its operations with more than 5000 trucks.

- May-2021: C.H. Robinson took over Combinex Holding B.V., a company specializing in transport services for dry goods and fresh & frozen goods. Under this acquisition, C.H. Robinson would reinforce its presence in Europe specifically in Western Europe. Moreover, Combinex would deliver more haul abilities with a dedicated fleet, broadening its footprint in the short-medium haul market.

- May-2021: Kuehne+Nagel took over Apex International, a global player in anilox and embossing technologies. This acquisition aimed to broaden Kuehne+Nagel"s presence in the Asian market, particularly on the transpacific and intra-Asia trade routes.

- Mar-2020: C.H. Robinson completed the acquisition of Prime Distribution Services, a North American provider of retail consolidation and value-added warehouse services. This acquisition would broaden C.H. Robinson’s retail consolidation business and delivers additional abilities, specialization, and scale to the company"s offering.

Scope of the Study

By Offering

- Services

- Solution

- Freight Security & Monitoring System

- Fleet Tracking & Maintenance Solution

- Warehouse Management System

- Freight Information Management System

- Freight Transportation Cost Management

- Freight Mobility & Operational Management Solutions

- Freight 3PL Solution

By Mode of Transport

- Roadways

- Railways

- Seaways & Airways

By Vertical

- Retail & E-commerce

- Automotive

- Aerospace & Defense

- Pharmaceuticals

- Energy

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- C.H. Robinson Worldwide, Inc.

- Deutsche Post DHL Group (The Deutsche Post AG)

- FedEx Corporation

- Kuehne + Nagel International AG (Kuehne Holding AG)

- United Parcel Service, Inc.

- SAP SE

- Oracle Corporation

- Schneider National, Inc.

- DSV A/S

- Nippon Express Co., Ltd.

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Global Freight Transport Market, by Offering

1.4.2 Global Freight Transport Market, by Mode of Transport

1.4.3 Global Freight Transport Market, by Vertical

1.4.4 Global Freight Transport Market, by Geography

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

3.1 Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Partnerships, Collaborations and Agreements

3.2.2 Acquisition and Mergers

3.3 Top Winning Strategies

3.3.1 Key Leading Strategies: Percentage Distribution (2018-2022)

3.3.2 Key Strategic Move: (Partnerships, Collaborations and Agreements : 2019, Apr - 2022, Oct) Leading Players

Chapter 4. Global Freight Transport Market by Offering

4.1 Global Services Market by Region

4.2 Global Solution Market by Region

4.3 Global Freight Transport Market by Solution Type

4.3.1 Global Freight Security & Monitoring System Market by Region

4.3.2 Global Fleet Tracking & Maintenance Solution Market by Region

4.3.3 Global Warehouse Management System Market by Region

4.3.4 Global Freight Information Management System Market by Region

4.3.5 Global Freight Transportation Cost Management Market by Region

4.3.6 Global Freight Mobility & Operational Management Solutions Market by Region

4.3.7 Global Freight 3PL Solution Market by Region

Chapter 5. Global Freight Transport Market by Mode of Transport

5.1 Global Roadways Market by Region

5.2 Global Railways Market by Region

5.3 Global Seaways & Airways Market by Region

Chapter 6. Global Freight Transport Market by Vertical

6.1 Global Retail & E-commerce Market by Region

6.2 Global Automotive Market by Region

6.3 Global Aerospace & Defense Market by Region

6.4 Global Pharmaceuticals Market by Region

6.5 Global Energy Market by Region

6.6 Global Others Market by Region

Chapter 7. Global Freight Transport Market by Region

7.1 North America Freight Transport Market

7.1.1 North America Freight Transport Market by Offering

7.1.1.1 North America Services Market by Country

7.1.1.2 North America Solution Market by Country

7.1.1.3 North America Freight Transport Market by Solution Type

7.1.1.3.1 North America Freight Security & Monitoring System Market by Country

7.1.1.3.2 North America Fleet Tracking & Maintenance Solution Market by Country

7.1.1.3.3 North America Warehouse Management System Market by Country

7.1.1.3.4 North America Freight Information Management System Market by Country

7.1.1.3.5 North America Freight Transportation Cost Management Market by Country

7.1.1.3.6 North America Freight Mobility & Operational Management Solutions Market by Country

7.1.1.3.7 North America Freight 3PL Solution Market by Country

7.1.2 North America Freight Transport Market by Mode of Transport

7.1.2.1 North America Roadways Market by Country

7.1.2.2 North America Railways Market by Country

7.1.2.3 North America Seaways & Airways Market by Country

7.1.3 North America Freight Transport Market by Vertical

7.1.3.1 North America Retail & E-commerce Market by Country

7.1.3.2 North America Automotive Market by Country

7.1.3.3 North America Aerospace & Defense Market by Country

7.1.3.4 North America Pharmaceuticals Market by Country

7.1.3.5 North America Energy Market by Country

7.1.3.6 North America Others Market by Country

7.1.4 North America Freight Transport Market by Country

7.1.4.1 US Freight Transport Market

7.1.4.1.1 US Freight Transport Market by Offering

7.1.4.1.1.1 US Freight Transport Market by Solution Type

7.1.4.1.2 US Freight Transport Market by Mode of Transport

7.1.4.1.3 US Freight Transport Market by Vertical

7.1.4.2 Canada Freight Transport Market

7.1.4.2.1 Canada Freight Transport Market by Offering

7.1.4.2.1.1 Canada Freight Transport Market by Solution Type

7.1.4.2.2 Canada Freight Transport Market by Mode of Transport

7.1.4.2.3 Canada Freight Transport Market by Vertical

7.1.4.3 Mexico Freight Transport Market

7.1.4.3.1 Mexico Freight Transport Market by Offering

7.1.4.3.1.1 Mexico Freight Transport Market by Solution Type

7.1.4.3.2 Mexico Freight Transport Market by Mode of Transport

7.1.4.3.3 Mexico Freight Transport Market by Vertical

7.1.4.4 Rest of North America Freight Transport Market

7.1.4.4.1 Rest of North America Freight Transport Market by Offering

7.1.4.4.1.1 Rest of North America Freight Transport Market by Solution Type

7.1.4.4.2 Rest of North America Freight Transport Market by Mode of Transport

7.1.4.4.3 Rest of North America Freight Transport Market by Vertical

7.2 Europe Freight Transport Market

7.2.1 Europe Freight Transport Market by Offering

7.2.1.1 Europe Services Market by Country

7.2.1.2 Europe Solution Market by Country

7.2.1.3 Europe Freight Transport Market by Solution Type

7.2.1.3.1 Europe Freight Security & Monitoring System Market by Country

7.2.1.3.2 Europe Fleet Tracking & Maintenance Solution Market by Country

7.2.1.3.3 Europe Warehouse Management System Market by Country

7.2.1.3.4 Europe Freight Information Management System Market by Country

7.2.1.3.5 Europe Freight Transportation Cost Management Market by Country

7.2.1.3.6 Europe Freight Mobility & Operational Management Solutions Market by Country

7.2.1.3.7 Europe Freight 3PL Solution Market by Country

7.2.2 Europe Freight Transport Market by Mode of Transport

7.2.2.1 Europe Roadways Market by Country

7.2.2.2 Europe Railways Market by Country

7.2.2.3 Europe Seaways & Airways Market by Country

7.2.3 Europe Freight Transport Market by Vertical

7.2.3.1 Europe Retail & E-commerce Market by Country

7.2.3.2 Europe Automotive Market by Country

7.2.3.3 Europe Aerospace & Defense Market by Country

7.2.3.4 Europe Pharmaceuticals Market by Country

7.2.3.5 Europe Energy Market by Country

7.2.3.6 Europe Others Market by Country

7.2.4 Europe Freight Transport Market by Country

7.2.4.1 Germany Freight Transport Market

7.2.4.1.1 Germany Freight Transport Market by Offering

7.2.4.1.1.1 Germany Freight Transport Market by Solution Type

7.2.4.1.2 Germany Freight Transport Market by Mode of Transport

7.2.4.1.3 Germany Freight Transport Market by Vertical

7.2.4.2 UK Freight Transport Market

7.2.4.2.1 UK Freight Transport Market by Offering

7.2.4.2.1.1 UK Freight Transport Market by Solution Type

7.2.4.2.2 UK Freight Transport Market by Mode of Transport

7.2.4.2.3 UK Freight Transport Market by Vertical

7.2.4.3 France Freight Transport Market

7.2.4.3.1 France Freight Transport Market by Offering

7.2.4.3.1.1 France Freight Transport Market by Solution Type

7.2.4.3.2 France Freight Transport Market by Mode of Transport

7.2.4.3.3 France Freight Transport Market by Vertical

7.2.4.4 Russia Freight Transport Market

7.2.4.4.1 Russia Freight Transport Market by Offering

7.2.4.4.1.1 Russia Freight Transport Market by Solution Type

7.2.4.4.2 Russia Freight Transport Market by Mode of Transport

7.2.4.4.3 Russia Freight Transport Market by Vertical

7.2.4.5 Spain Freight Transport Market

7.2.4.5.1 Spain Freight Transport Market by Offering

7.2.4.5.1.1 Spain Freight Transport Market by Solution Type

7.2.4.5.2 Spain Freight Transport Market by Mode of Transport

7.2.4.5.3 Spain Freight Transport Market by Vertical

7.2.4.6 Italy Freight Transport Market

7.2.4.6.1 Italy Freight Transport Market by Offering

7.2.4.6.1.1 Italy Freight Transport Market by Solution Type

7.2.4.6.2 Italy Freight Transport Market by Mode of Transport

7.2.4.6.3 Italy Freight Transport Market by Vertical

7.2.4.7 Rest of Europe Freight Transport Market

7.2.4.7.1 Rest of Europe Freight Transport Market by Offering

7.2.4.7.1.1 Rest of Europe Freight Transport Market by Solution Type

7.2.4.7.2 Rest of Europe Freight Transport Market by Mode of Transport

7.2.4.7.3 Rest of Europe Freight Transport Market by Vertical

7.3 Asia Pacific Freight Transport Market

7.3.1 Asia Pacific Freight Transport Market by Offering

7.3.1.1 Asia Pacific Services Market by Country

7.3.1.2 Asia Pacific Solution Market by Country

7.3.1.3 Asia Pacific Freight Transport Market by Solution Type

7.3.1.3.1 Asia Pacific Freight Security & Monitoring System Market by Country

7.3.1.3.2 Asia Pacific Fleet Tracking & Maintenance Solution Market by Country

7.3.1.3.3 Asia Pacific Warehouse Management System Market by Country

7.3.1.3.4 Asia Pacific Freight Information Management System Market by Country

7.3.1.3.5 Asia Pacific Freight Transportation Cost Management Market by Country

7.3.1.3.6 Asia Pacific Freight Mobility & Operational Management Solutions Market by Country

7.3.1.3.7 Asia Pacific Freight 3PL Solution Market by Country

7.3.2 Asia Pacific Freight Transport Market by Mode of Transport

7.3.2.1 Asia Pacific Roadways Market by Country

7.3.2.2 Asia Pacific Railways Market by Country

7.3.2.3 Asia Pacific Seaways & Airways Market by Country

7.3.3 Asia Pacific Freight Transport Market by Vertical

7.3.3.1 Asia Pacific Retail & E-commerce Market by Country

7.3.3.2 Asia Pacific Automotive Market by Country

7.3.3.3 Asia Pacific Aerospace & Defense Market by Country

7.3.3.4 Asia Pacific Pharmaceuticals Market by Country

7.3.3.5 Asia Pacific Energy Market by Country

7.3.3.6 Asia Pacific Others Market by Country

7.3.4 Asia Pacific Freight Transport Market by Country

7.3.4.1 China Freight Transport Market

7.3.4.1.1 China Freight Transport Market by Offering

7.3.4.1.1.1 China Freight Transport Market by Solution Type

7.3.4.1.2 China Freight Transport Market by Mode of Transport

7.3.4.1.3 China Freight Transport Market by Vertical

7.3.4.2 Japan Freight Transport Market

7.3.4.2.1 Japan Freight Transport Market by Offering

7.3.4.2.1.1 Japan Freight Transport Market by Solution Type

7.3.4.2.2 Japan Freight Transport Market by Mode of Transport

7.3.4.2.3 Japan Freight Transport Market by Vertical

7.3.4.3 India Freight Transport Market

7.3.4.3.1 India Freight Transport Market by Offering

7.3.4.3.1.1 India Freight Transport Market by Solution Type

7.3.4.3.2 India Freight Transport Market by Mode of Transport

7.3.4.3.3 India Freight Transport Market by Vertical

7.3.4.4 South Korea Freight Transport Market

7.3.4.4.1 South Korea Freight Transport Market by Offering

7.3.4.4.1.1 South Korea Freight Transport Market by Solution Type

7.3.4.4.2 South Korea Freight Transport Market by Mode of Transport

7.3.4.4.3 South Korea Freight Transport Market by Vertical

7.3.4.5 Singapore Freight Transport Market

7.3.4.5.1 Singapore Freight Transport Market by Offering

7.3.4.5.1.1 Singapore Freight Transport Market by Solution Type

7.3.4.5.2 Singapore Freight Transport Market by Mode of Transport

7.3.4.5.3 Singapore Freight Transport Market by Vertical

7.3.4.6 Malaysia Freight Transport Market

7.3.4.6.1 Malaysia Freight Transport Market by Offering

7.3.4.6.1.1 Malaysia Freight Transport Market by Solution Type

7.3.4.6.2 Malaysia Freight Transport Market by Mode of Transport

7.3.4.6.3 Malaysia Freight Transport Market by Vertical

7.3.4.7 Rest of Asia Pacific Freight Transport Market

7.3.4.7.1 Rest of Asia Pacific Freight Transport Market by Offering

7.3.4.7.1.1 Rest of Asia Pacific Freight Transport Market by Solution Type

7.3.4.7.2 Rest of Asia Pacific Freight Transport Market by Mode of Transport

7.3.4.7.3 Rest of Asia Pacific Freight Transport Market by Vertical

7.4 LAMEA Freight Transport Market

7.4.1 LAMEA Freight Transport Market by Offering

7.4.1.1 LAMEA Services Market by Country

7.4.1.2 LAMEA Solution Market by Country

7.4.1.3 LAMEA Freight Transport Market by Solution Type

7.4.1.3.1 LAMEA Freight Security & Monitoring System Market by Country

7.4.1.3.2 LAMEA Fleet Tracking & Maintenance Solution Market by Country

7.4.1.3.3 LAMEA Warehouse Management System Market by Country

7.4.1.3.4 LAMEA Freight Information Management System Market by Country

7.4.1.3.5 LAMEA Freight Transportation Cost Management Market by Country

7.4.1.3.6 LAMEA Freight Mobility & Operational Management Solutions Market by Country

7.4.1.3.7 LAMEA Freight 3PL Solution Market by Country

7.4.2 LAMEA Freight Transport Market by Mode of Transport

7.4.2.1 LAMEA Roadways Market by Country

7.4.2.2 LAMEA Railways Market by Country

7.4.2.3 LAMEA Seaways & Airways Market by Country

7.4.3 LAMEA Freight Transport Market by Vertical

7.4.3.1 LAMEA Retail & E-commerce Market by Country

7.4.3.2 LAMEA Automotive Market by Country

7.4.3.3 LAMEA Aerospace & Defense Market by Country

7.4.3.4 LAMEA Pharmaceuticals Market by Country

7.4.3.5 LAMEA Energy Market by Country

7.4.3.6 LAMEA Others Market by Country

7.4.4 LAMEA Freight Transport Market by Country

7.4.4.1 Brazil Freight Transport Market

7.4.4.1.1 Brazil Freight Transport Market by Offering

7.4.4.1.1.1 Brazil Freight Transport Market by Solution Type

7.4.4.1.2 Brazil Freight Transport Market by Mode of Transport

7.4.4.1.3 Brazil Freight Transport Market by Vertical

7.4.4.2 Argentina Freight Transport Market

7.4.4.2.1 Argentina Freight Transport Market by Offering

7.4.4.2.1.1 Argentina Freight Transport Market by Solution Type

7.4.4.2.2 Argentina Freight Transport Market by Mode of Transport

7.4.4.2.3 Argentina Freight Transport Market by Vertical

7.4.4.3 UAE Freight Transport Market

7.4.4.3.1 UAE Freight Transport Market by Offering

7.4.4.3.1.1 UAE Freight Transport Market by Solution Type

7.4.4.3.2 UAE Freight Transport Market by Mode of Transport

7.4.4.3.3 UAE Freight Transport Market by Vertical

7.4.4.4 Saudi Arabia Freight Transport Market

7.4.4.4.1 Saudi Arabia Freight Transport Market by Offering

7.4.4.4.1.1 Saudi Arabia Freight Transport Market by Solution Type

7.4.4.4.2 Saudi Arabia Freight Transport Market by Mode of Transport

7.4.4.4.3 Saudi Arabia Freight Transport Market by Vertical

7.4.4.5 South Africa Freight Transport Market

7.4.4.5.1 South Africa Freight Transport Market by Offering

7.4.4.5.1.1 South Africa Freight Transport Market by Solution Type

7.4.4.5.2 South Africa Freight Transport Market by Mode of Transport

7.4.4.5.3 South Africa Freight Transport Market by Vertical

7.4.4.6 Nigeria Freight Transport Market

7.4.4.6.1 Nigeria Freight Transport Market by Offering

7.4.4.6.1.1 Nigeria Freight Transport Market by Solution Type

7.4.4.6.2 Nigeria Freight Transport Market by Mode of Transport

7.4.4.6.3 Nigeria Freight Transport Market by Vertical

7.4.4.7 Rest of LAMEA Freight Transport Market

7.4.4.7.1 Rest of LAMEA Freight Transport Market by Offering

7.4.4.7.1.1 Rest of LAMEA Freight Transport Market by Solution Type

7.4.4.7.2 Rest of LAMEA Freight Transport Market by Mode of Transport

7.4.4.7.3 Rest of LAMEA Freight Transport Market by Vertical

Chapter 8. Company Profiles

8.1 SAP SE

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Segmental and Regional Analysis

8.1.4 Research & Development Expense

8.1.5 Recent strategies and developments:

8.1.5.1 Partnerships, Collaborations, and Agreements:

8.2 Oracle Corporation

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Segmental and Regional Analysis

8.2.4 Research & Development Expense

8.2.5 Recent strategies and developments:

8.2.5.1 Partnerships, Collaborations, and Agreements:

8.2.6 SWOT Analysis

8.3 Kuehne + Nagel International AG (Kuehne Holding AG)

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Segmental and Regional Analysis

8.3.4 Recent strategies and developments:

8.3.4.1 Partnerships, Collaborations, and Agreements:

8.3.4.2 Acquisition and Mergers:

8.4 C.H. Robinson Worldwide, Inc.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Regional & Segmental Analysis

8.4.4 Recent strategies and developments:

8.4.4.1 Partnerships, Collaborations, and Agreements:

8.4.4.2 Acquisition and Mergers:

8.5 United Parcel Service, Inc.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Segmental and Regional Analysis

8.5.4 Recent strategies and developments:

8.5.4.1 Partnerships, Collaborations, and Agreements:

8.5.4.2 Acquisition and Mergers:

8.6 Deutsche Post DHL Group (The Deutsche Post AG)

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Segmental and Regional Analysis

8.6.4 Recent strategies and developments:

8.6.4.1 Acquisition and Mergers:

8.7 FedEx Corporation

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Segmental and Regional Analysis

8.7.4 Recent strategies and developments:

8.7.4.1 Partnerships, Collaborations, and Agreements:

8.8 Schneider National, Inc.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Segmental Analysis

8.8.4 Recent strategies and developments:

8.8.4.1 Acquisition and Mergers:

8.9 DSV A/S

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Segmental and Regional Analysis

8.10. Nippon Express Co., Ltd.

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Segmental Analysis

Companies Mentioned

- C.H. Robinson Worldwide, Inc.

- Deutsche Post DHL Group (The Deutsche Post AG)

- FedEx Corporation

- Kuehne + Nagel International AG (Kuehne Holding AG)

- United Parcel Service, Inc.

- SAP SE

- Oracle Corporation

- Schneider National, Inc.

- DSV A/S

- Nippon Express Co., Ltd.