Rice starch is a polymeric carbohydrate generally in the form of insoluble white powder and consists of amylopectin and amylose. It has a neutral taste and thus aids in preserving the natural flavor of the food. It is majorly used in the food processing industry. It provides excellent benefits like texture stability throughout the product’s shelf life, aids in the creation of simple and clean labels and transparent gel, and helps create a creamy and rich texture.

Rice starch is classified into tiny particles, with a particle size much smaller than other grains, roots, and tubers (for instance, corn and potatoes). Rice starch is a tasteless and fine-grained powder created by processing raw rice. Rice starch provides a creamy texture and can be utilized as a natural substitute for fat. Rice starch is used in many fields like food, pharmaceutical, cosmetics, and chemical.

In addition, rice starch is used to prepare products like processed food mixes, canned baby food, and medications. Modified rice starch is one of the most popular vegetarian alternatives to traditional gelatin powder. It adds a smooth, creamy texture to numerous foods like soups and sauces. Extracting starch from rice produces large amounts of fibers and protein residues.

COVID-19 Impact Analysis

The outbreak of COVID-19 has significantly affected supply chains, manufacturing operations, and international trade among most of the industry verticals. Many market players were enforced to shut down production facilities or operate below their optimal production capacities due to the imposed restriction as to curb the effect of COVID-19. Many nations also suspended contracts for rice export which further endangered the rice quantity. The less availability of raw materials because of the supply chain disruption resulted in the declined production of rice starch due to the pandemic. However, with the rice export restriction and the quarantine measures eased up globally, many regions" rice production and trade got back on track, and the rice starch market is expected to get back on track.Market Growth Factors

The rising consumption of organic processed food

Due to the busy schedule and life of individuals, the demand for convenience food has significantly increased, which is further boosted by the rising disposable income. The ratio of amylopectin and amylose affects the starch gelling, thickening, and binding. Various breeding techniques allow these ratios to be adjusted as per requirement, making starch a primary ingredient for the preparation of convenience foods. Also, the food sector is known to be the fastest-growing sector globally, with increasing exports from emerging countries and strengthening presence of the sector in the existing market. Owing to this, the market growth is predicted to propel over the forecast period.Usage of rice starch for targeting vegan consumers

Modified rice starch is quite a popular alternative to regular powdered gelatin. Rice starch adds a smooth, creamy texture to sauces and soups. Rice starch extraction yields a prominent amount of fiber and protein residue. Low-fat dairy beverages have a smooth texture and an utterly creamy flavor. Modified and clean-label rice starch gives stability and an evident smoothness to dairy fruit products while also conserving their rich, fruity flavor. Many major companies in the sector are focusing on launching organic products to lure new consumers. The usage of rice starch as a vegetarian alternative of gelatin in many products is expected to raise the rice starch market’s growth during the forecast period.Market Restraining Factors

Possible side effects of rice starch

Rice starch has a high Glycemic Index (GI), which measures how quickly one’s body processes and converts carbs into sugar which is later absorbed into the body through the bloodstream. Food with high GI causes rapid sugar spikes, which can lead to diabetes and cause unhealthy blood sugar fluctuations. This is because foods made from starch are rich in glucose precursors like amylopectin, which is the main form of rapidly digestible starch in the human body. The starch in different foods is converted into sugar at different rates, which causes variable rates of blood sugar elevation, insulin response, and satiety (the sense of fullness one gets after only eating a portion of food). These adverse health effects associated with the rice starch may restrict the consumption and thus could hamper the growth of the rice starch market.Type Outlook

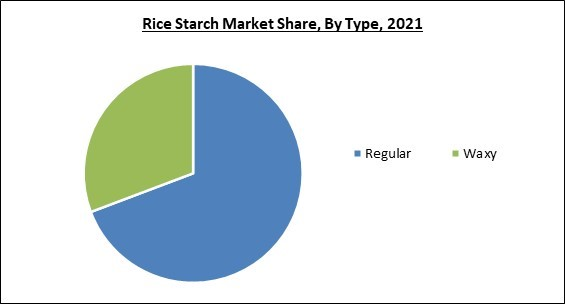

Based on the type, the rice starch market is segmented into waxy and regular. The waxy segment covered a substantial revenue share in the rice starch market in 2021. This is due to the higher presence of relative crystallinity values and also the increased solubility & swelling indices. Waxy rice starch is isolated from rice and treated for greater gelatinization temperatures because of its high amylopectin content. Also, due to the low gelling temperature and smaller granule size, waxy rice starch offers better water binding at low process temperatures of around 70-80C. The market is expected to grow in this segment due to the attractive benefits of this type of rice starch.Form Outlook

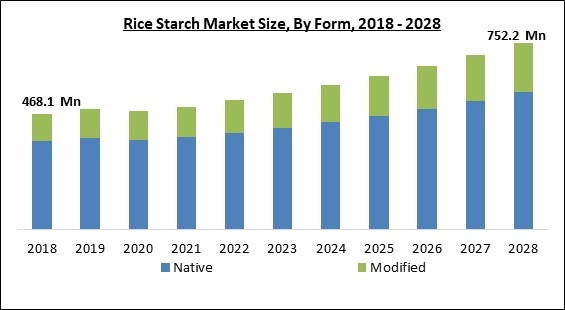

On the basis of form, the rice starch market is divided into native and modified. The native segment held the highest revenue share in the rice starch market in 2021. This is due to its usage in frozen cakes, brewing adjuncts, sheeted snacks, breading & batters, dry mix sauces and soups, and pet products. Additionally, the precooked or cooked native rice starch can aid in reducing fat in spreadable foods, for instance, pâté, because of their high added creaminess, which further aids the segment to grow in the projected period.Nature Outlook

By nature, the rice starch market is classified into organic and conventional. The conventional segment dominated the rice starch market by maximum revenue share in 2021. This is because of the various benefits conventional farming offers to the farmers, like convenience, ease, and safety of crops in farming. In addition, conventionally grown rice used to manufacture rice starch ensures a hefty yield to the farmers and helps them generate revenue. Thus, the numerous benefits of the conventional farming will boost the segment’s growth.End-use Outlook

Based on the end use, the rice starch market is bifurcated into food & beverage, cosmetic & personal care, paper, laundry, pharmaceutical and others. The paper segment registered a significant revenue share in the rice starch market in 2021. This is due to its usage as a beater additive and to improve the physical properties of the paper like tearing, bursting, folding and tensile endurance. The properties of starch could be considerably enhanced by chemical and physical modification. Also, the starch has been chemically modified in cationic starch, and its effect on the strength properties of the paper is manufactured from various materials. Hence, using rice starch for its added benefits in the paper industry will increase the segment’s growth.Regional Outlook

Region-wise, the rice starch market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region led the rice starch market with maximum revenue share in 2021. This is due to the large rice production capacity of the emerging Asian nations such as India. As a result of the wide production and availability of the rice, the manufacturing of rice starch is also high in region. Also, the improving per capita income, the betterment of various industries, and the rising demand for natural-based products are expected to aid the growth of the rice starch market in the region.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Ingredion Incorporated, BENEO GmbH (Südzucker AG), A&B Ingredients, Inc., Bangkok Starch Industrial Company Limited, Jiangxi Golden Agriculture Biotech Co., Ltd., Thai Flour Industry Co., Ltd., Ettlinger Corporation, Starch Asia, WFM Starch Products, and Pruthvi"s Foods Private Limited.

Scope of the Study

By Form

- Native

- Modified

By Type

- Regular

- Waxy

By Nature

- Conventional

- Organic

By End-use

- Food & Beverages

- Laundry

- Paper

- Pharmaceutical

- Cosmetics & Personal Care

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Ingredion Incorporated

- BENEO GmbH (Südzucker AG)

- A&B Ingredients, Inc.

- Bangkok Starch Industrial Company Limited

- Jiangxi Golden Agriculture Biotech Co., Ltd.

- Thai Flour Industry Co., Ltd.

- Ettlinger Corporation

- Starch Asia

- WFM Starch Products

- Pruthvi"s Foods Private Limited

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Global Rice Starch Market, by Form

1.4.2 Global Rice Starch Market, by Type

1.4.3 Global Rice Starch Market, by Nature

1.4.4 Global Rice Starch Market, by End Use

1.4.5 Global Rice Starch Market, by Geography

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition & Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Global Rice Starch Market by Form

3.1 Global Native Market by Region

3.2 Global Modified Market by Region

Chapter 4. Global Rice Starch Market by Type

4.1 Global Regular Market by Region

4.2 Global Waxy Market by Region

Chapter 5. Global Rice Starch Market by Nature

5.1 Global Conventional Market by Region

5.2 Global Organic Market by Region

Chapter 6. Global Rice Starch Market by End Use

6.1 Global Food & Beverages Market by Region

6.2 Global Laundry Market by Region

6.3 Global Paper Market by Region

6.4 Global Pharmaceutical Market by Region

6.5 Global Cosmetics & Personal Care Market by Region

6.6 Global Others Market by Region

Chapter 7. Global Rice Starch Market by Region

7.1 North America Rice Starch Market

7.1.1 North America Rice Starch Market by Form

7.1.1.1 North America Native Market by Country

7.1.1.2 North America Modified Market by Country

7.1.2 North America Rice Starch Market by Type

7.1.2.1 North America Regular Market by Country

7.1.2.2 North America Waxy Market by Country

7.1.3 North America Rice Starch Market by Nature

7.1.3.1 North America Conventional Market by Country

7.1.3.2 North America Organic Market by Country

7.1.4 North America Rice Starch Market by End Use

7.1.4.1 North America Food & Beverages Market by Country

7.1.4.2 North America Laundry Market by Country

7.1.4.3 North America Paper Market by Country

7.1.4.4 North America Pharmaceutical Market by Country

7.1.4.5 North America Cosmetics & Personal Care Market by Country

7.1.4.6 North America Others Market by Country

7.1.5 North America Rice Starch Market by Country

7.1.5.1 US Rice Starch Market

7.1.5.1.1 US Rice Starch Market by Form

7.1.5.1.2 US Rice Starch Market by Type

7.1.5.1.3 US Rice Starch Market by Nature

7.1.5.1.4 US Rice Starch Market by End Use

7.1.5.2 Canada Rice Starch Market

7.1.5.2.1 Canada Rice Starch Market by Form

7.1.5.2.2 Canada Rice Starch Market by Type

7.1.5.2.3 Canada Rice Starch Market by Nature

7.1.5.2.4 Canada Rice Starch Market by End Use

7.1.5.3 Mexico Rice Starch Market

7.1.5.3.1 Mexico Rice Starch Market by Form

7.1.5.3.2 Mexico Rice Starch Market by Type

7.1.5.3.3 Mexico Rice Starch Market by Nature

7.1.5.3.4 Mexico Rice Starch Market by End Use

7.1.5.4 Rest of North America Rice Starch Market

7.1.5.4.1 Rest of North America Rice Starch Market by Form

7.1.5.4.2 Rest of North America Rice Starch Market by Type

7.1.5.4.3 Rest of North America Rice Starch Market by Nature

7.1.5.4.4 Rest of North America Rice Starch Market by End Use

7.2 Europe Rice Starch Market

7.2.1 Europe Rice Starch Market by Form

7.2.1.1 Europe Native Market by Country

7.2.1.2 Europe Modified Market by Country

7.2.2 Europe Rice Starch Market by Type

7.2.2.1 Europe Regular Market by Country

7.2.2.2 Europe Waxy Market by Country

7.2.3 Europe Rice Starch Market by Nature

7.2.3.1 Europe Conventional Market by Country

7.2.3.2 Europe Organic Market by Country

7.2.4 Europe Rice Starch Market by End Use

7.2.4.1 Europe Food & Beverages Market by Country

7.2.4.2 Europe Laundry Market by Country

7.2.4.3 Europe Paper Market by Country

7.2.4.4 Europe Pharmaceutical Market by Country

7.2.4.5 Europe Cosmetics & Personal Care Market by Country

7.2.4.6 Europe Others Market by Country

7.2.5 Europe Rice Starch Market by Country

7.2.5.1 Germany Rice Starch Market

7.2.5.1.1 Germany Rice Starch Market by Form

7.2.5.1.2 Germany Rice Starch Market by Type

7.2.5.1.3 Germany Rice Starch Market by Nature

7.2.5.1.4 Germany Rice Starch Market by End Use

7.2.5.2 UK Rice Starch Market

7.2.5.2.1 UK Rice Starch Market by Form

7.2.5.2.2 UK Rice Starch Market by Type

7.2.5.2.3 UK Rice Starch Market by Nature

7.2.5.2.4 UK Rice Starch Market by End Use

7.2.5.3 France Rice Starch Market

7.2.5.3.1 France Rice Starch Market by Form

7.2.5.3.2 France Rice Starch Market by Type

7.2.5.3.3 France Rice Starch Market by Nature

7.2.5.3.4 France Rice Starch Market by End Use

7.2.5.4 Russia Rice Starch Market

7.2.5.4.1 Russia Rice Starch Market by Form

7.2.5.4.2 Russia Rice Starch Market by Type

7.2.5.4.3 Russia Rice Starch Market by Nature

7.2.5.4.4 Russia Rice Starch Market by End Use

7.2.5.5 Spain Rice Starch Market

7.2.5.5.1 Spain Rice Starch Market by Form

7.2.5.5.2 Spain Rice Starch Market by Type

7.2.5.5.3 Spain Rice Starch Market by Nature

7.2.5.5.4 Spain Rice Starch Market by End Use

7.2.5.6 Italy Rice Starch Market

7.2.5.6.1 Italy Rice Starch Market by Form

7.2.5.6.2 Italy Rice Starch Market by Type

7.2.5.6.3 Italy Rice Starch Market by Nature

7.2.5.6.4 Italy Rice Starch Market by End Use

7.2.5.7 Rest of Europe Rice Starch Market

7.2.5.7.1 Rest of Europe Rice Starch Market by Form

7.2.5.7.2 Rest of Europe Rice Starch Market by Type

7.2.5.7.3 Rest of Europe Rice Starch Market by Nature

7.2.5.7.4 Rest of Europe Rice Starch Market by End Use

7.3 Asia Pacific Rice Starch Market

7.3.1 Asia Pacific Rice Starch Market by Form

7.3.1.1 Asia Pacific Native Market by Country

7.3.1.2 Asia Pacific Modified Market by Country

7.3.2 Asia Pacific Rice Starch Market by Type

7.3.2.1 Asia Pacific Regular Market by Country

7.3.2.2 Asia Pacific Waxy Market by Country

7.3.3 Asia Pacific Rice Starch Market by Nature

7.3.3.1 Asia Pacific Conventional Market by Country

7.3.3.2 Asia Pacific Organic Market by Country

7.3.4 Asia Pacific Rice Starch Market by End Use

7.3.4.1 Asia Pacific Food & Beverages Market by Country

7.3.4.2 Asia Pacific Laundry Market by Country

7.3.4.3 Asia Pacific Paper Market by Country

7.3.4.4 Asia Pacific Pharmaceutical Market by Country

7.3.4.5 Asia Pacific Cosmetics & Personal Care Market by Country

7.3.4.6 Asia Pacific Others Market by Country

7.3.5 Asia Pacific Rice Starch Market by Country

7.3.5.1 China Rice Starch Market

7.3.5.1.1 China Rice Starch Market by Form

7.3.5.1.2 China Rice Starch Market by Type

7.3.5.1.3 China Rice Starch Market by Nature

7.3.5.1.4 China Rice Starch Market by End Use

7.3.5.2 Japan Rice Starch Market

7.3.5.2.1 Japan Rice Starch Market by Form

7.3.5.2.2 Japan Rice Starch Market by Type

7.3.5.2.3 Japan Rice Starch Market by Nature

7.3.5.2.4 Japan Rice Starch Market by End Use

7.3.5.3 India Rice Starch Market

7.3.5.3.1 India Rice Starch Market by Form

7.3.5.3.2 India Rice Starch Market by Type

7.3.5.3.3 India Rice Starch Market by Nature

7.3.5.3.4 India Rice Starch Market by End Use

7.3.5.4 South Korea Rice Starch Market

7.3.5.4.1 South Korea Rice Starch Market by Form

7.3.5.4.2 South Korea Rice Starch Market by Type

7.3.5.4.3 South Korea Rice Starch Market by Nature

7.3.5.4.4 South Korea Rice Starch Market by End Use

7.3.5.5 Singapore Rice Starch Market

7.3.5.5.1 Singapore Rice Starch Market by Form

7.3.5.5.2 Singapore Rice Starch Market by Type

7.3.5.5.3 Singapore Rice Starch Market by Nature

7.3.5.5.4 Singapore Rice Starch Market by End Use

7.3.5.6 Malaysia Rice Starch Market

7.3.5.6.1 Malaysia Rice Starch Market by Form

7.3.5.6.2 Malaysia Rice Starch Market by Type

7.3.5.6.3 Malaysia Rice Starch Market by Nature

7.3.5.6.4 Malaysia Rice Starch Market by End Use

7.3.5.7 Rest of Asia Pacific Rice Starch Market

7.3.5.7.1 Rest of Asia Pacific Rice Starch Market by Form

7.3.5.7.2 Rest of Asia Pacific Rice Starch Market by Type

7.3.5.7.3 Rest of Asia Pacific Rice Starch Market by Nature

7.3.5.7.4 Rest of Asia Pacific Rice Starch Market by End Use

7.4 LAMEA Rice Starch Market

7.4.1 LAMEA Rice Starch Market by Form

7.4.1.1 LAMEA Native Market by Country

7.4.1.2 LAMEA Modified Market by Country

7.4.2 LAMEA Rice Starch Market by Type

7.4.2.1 LAMEA Regular Market by Country

7.4.2.2 LAMEA Waxy Market by Country

7.4.3 LAMEA Rice Starch Market by Nature

7.4.3.1 LAMEA Conventional Market by Country

7.4.3.2 LAMEA Organic Market by Country

7.4.4 LAMEA Rice Starch Market by End Use

7.4.4.1 LAMEA Food & Beverages Market by Country

7.4.4.2 LAMEA Laundry Market by Country

7.4.4.3 LAMEA Paper Market by Country

7.4.4.4 LAMEA Pharmaceutical Market by Country

7.4.4.5 LAMEA Cosmetics & Personal Care Market by Country

7.4.4.6 LAMEA Others Market by Country

7.4.5 LAMEA Rice Starch Market by Country

7.4.5.1 Brazil Rice Starch Market

7.4.5.1.1 Brazil Rice Starch Market by Form

7.4.5.1.2 Brazil Rice Starch Market by Type

7.4.5.1.3 Brazil Rice Starch Market by Nature

7.4.5.1.4 Brazil Rice Starch Market by End Use

7.4.5.2 Argentina Rice Starch Market

7.4.5.2.1 Argentina Rice Starch Market by Form

7.4.5.2.2 Argentina Rice Starch Market by Type

7.4.5.2.3 Argentina Rice Starch Market by Nature

7.4.5.2.4 Argentina Rice Starch Market by End Use

7.4.5.3 UAE Rice Starch Market

7.4.5.3.1 UAE Rice Starch Market by Form

7.4.5.3.2 UAE Rice Starch Market by Type

7.4.5.3.3 UAE Rice Starch Market by Nature

7.4.5.3.4 UAE Rice Starch Market by End Use

7.4.5.4 Saudi Arabia Rice Starch Market

7.4.5.4.1 Saudi Arabia Rice Starch Market by Form

7.4.5.4.2 Saudi Arabia Rice Starch Market by Type

7.4.5.4.3 Saudi Arabia Rice Starch Market by Nature

7.4.5.4.4 Saudi Arabia Rice Starch Market by End Use

7.4.5.5 South Africa Rice Starch Market

7.4.5.5.1 South Africa Rice Starch Market by Form

7.4.5.5.2 South Africa Rice Starch Market by Type

7.4.5.5.3 South Africa Rice Starch Market by Nature

7.4.5.5.4 South Africa Rice Starch Market by End Use

7.4.5.6 Nigeria Rice Starch Market

7.4.5.6.1 Nigeria Rice Starch Market by Form

7.4.5.6.2 Nigeria Rice Starch Market by Type

7.4.5.6.3 Nigeria Rice Starch Market by Nature

7.4.5.6.4 Nigeria Rice Starch Market by End Use

7.4.5.7 Rest of LAMEA Rice Starch Market

7.4.5.7.1 Rest of LAMEA Rice Starch Market by Form

7.4.5.7.2 Rest of LAMEA Rice Starch Market by Type

7.4.5.7.3 Rest of LAMEA Rice Starch Market by Nature

7.4.5.7.4 Rest of LAMEA Rice Starch Market by End Use

Chapter 8. Company Profiles

8.1 Ingredion Incorporated

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Regional Analysis

8.1.4 Research & Development Expenses

8.1.5 Recent strategies and developments:

8.1.5.1 Geographical Expansions:

8.2 BENEO GmbH (Südzucker AG)

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Segmental and Regional Analysis

8.2.4 Research & Development Expenses

8.2.5 Recent strategies and developments:

8.2.5.1 Product Launches and Product Expansions:

8.3 A&B Ingredients, Inc.

8.3.1 Company Overview

8.4 Bangkok Starch Industrial Company Limited

8.4.1 Company Overview

8.5 Jiangxi Golden Agriculture Biotech Co., Ltd. (Jiangxi Golden Agriculture Rice Industry Group)

8.5.1 Company Overview

8.6 Thai Flour Industry Co., Ltd.

8.6.1 Company Overview

8.7 Ettlinger Corporation

8.7.1 Company Overview

8.8 Starch Asia

8.8.1 Company Overview

8.9 WFM Starch Products

8.9.1 Company Overview

8.10. Pruthvi's Foods Private Limited

8.10.1 Company Overview

Companies Mentioned

- Ingredion Incorporated

- BENEO GmbH (Südzucker AG)

- A&B Ingredients, Inc.

- Bangkok Starch Industrial Company Limited

- Jiangxi Golden Agriculture Biotech Co., Ltd.

- Thai Flour Industry Co., Ltd.

- Ettlinger Corporation

- Starch Asia

- WFM Starch Products

- Pruthvi's Foods Private Limited