Key Highlights

- Huge businesses cancelled flexible office memberships to save on costs. And while some co-working space operators remain open for business, they are mandated to adhere to safety and social distancing measures, which considerably impact the space allocated for occupants within a shared location. COVID-19 had a significant impact on the Co-Working Spaces marketin the country leading the demand for shared office spaces to drop over the course of the lockdowns.

- However, post pandemic, businesses will find ways to avoid big-ticket spending and huge financial commitments. This, in turn, will drive demand for pre-built corporate spaces and lease flexibility.

- Flexible office spaces including co-working are still at a nascent stage in the region. The current flexible office space landscape is largely dominated by domestic players or niche operators. Certain key global brands are yet to enter the market and others have not introduced their full-service offerings. Occupiers on the other hand are contemplating regulatory and other implications of flexible spaces on their local operations.

Bahrain Co-Working Office Space Market Trends

Increase in Foreign Investment to Boost the Economy

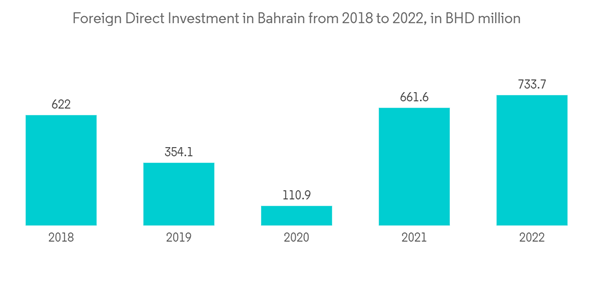

Foreign Direct Investment (FDI) to Bahrain registered a 5.8% increase to BD13.3 billion (USD 34.48 billion) in 2022, as per the provisional results of 2022 FDI statistics.The statistics showed that the kingdom’s FDI inflows were dominated mostly by electricity, gas steam & air conditioning supply, manufacturing and financial & insurance activities sectors at BD226.8, BD187.1, and BD95.5 million respectively.

Last year the country registered 24 investments, down from a three-year average of 43 investments a decade earlier. However, when measured by capital expenditure, 2022 was Bahrain’s second-best year for FDI over the past decade. It mobilised USD 2.2 Billion worth of FDI, boosted by big clean-power projects from the likes of the UAE’s Yellow Door Energy.

Increase in Millennial Population

Millennials, or those between the ages of 20 and 40, are reshaping the world and demanding new methods of working. Bahrain's real estate business is focusing on altering working and work space demands in order to respond to future needs.The use of co-working spaces, a shared setting where people doing a variety of vocations can work together and separately inside the same place, is a new way of working that has recently emerged. The spaces are frequently urban and trendy, and they are a far cry from some of the harsher 'cubicle farms' of previous years. They provide freedom, flexibility, and a diverse range of work settings.

Millennials are increasingly entering the workforce, and their presence necessitates a paradigm shift in the workplace. There are 14,000 coworking spaces in operation throughout the world, and by the end of this year, 1.7 million workers, largely millennials, will have taken advantage of the improved working circumstances offered by coworking spaces.

Bahrain Co-Working Office Space Industry Overview

Bahrain co-working office space market is fragmented with lot of companies in office space industry. Some of the major players are Servcorp, Letswork Inc, Space 340, Spire Hub and Regus.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Servcorp

- Letswork Inc.

- Space 340

- Spire Hub

- Regus

- The Startup Factory

- Prime Instant Offices

- Diwan Hub

- Brilliant Lab

- Brinc Batelco IoT Hub*