Blockchain technology, also referred to as distributed ledger technology (DLT), serves an integral part of the pharmaceutical supply chain. It enhances the trackability and traceability of drugs and other pharmaceutical products, thereby reducing the prevalence of counterfeit drugs and medicine. The drug discovery process, which involves the identification of a relevant biological target and a corresponding pharmacological lead, is deemed crucial to the clinical success of a drug candidate. However, it is a well-known fact that, approximately 80% of the medical studies fail to produce desired results due to various errors, including fraud, data falsification, and trial misconduct. This can be taken care of by the blockchain, acting as a strong platform for an enhanced clinical practice in terms of maintaining patient records and enrolling patients for trials. It also enhances the storage and transparency of medical data. In addition, the ledger can be used to contain all the updated information along with an encrypted patient identity to secure patient data.

Key Market Insights

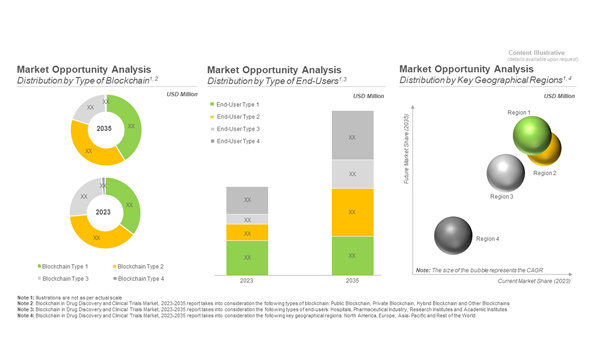

The Blockchain in Drug Discovery and Clinical Trials Market: Distribution by Type of Blockchain (Public Blockchain, Private Blockchain, Hybrid Blockchain, and Other Blockchains), Type of End-User (Hospitals, Pharmaceutical Industry, Research Institutes and Academic Institutes), and Key Geographical Regions (North America, Europe, Asia-Pacific, and Rest of the World): Industry Trends and Global Forecasts, 2023-2035 report features an extensive study of the current market landscape and future potential of blockchain in drug discovery and clinical trials. The report highlights the efforts of several stakeholders engaged in this rapidly emerging segment of the pharmaceutical industry and answers many key questions related to this domain.

What is Blockchain and How Does it Work?

Blockchain is a decentralized, distributed, digital ledger that is used to record transactions on a common digital platform. It is worth noting, that the record cannot be altered retroactively without the alteration of all subsequent blocks and the consensus of the network. Further, the technology was developed to facilitate secure transactions between different stakeholders, without involving third parties. There are few simple steps on which blockchain works

- Each transaction being performed is recorded along with relevant details

- The different nodes of the network verify if the transaction is valid

- Each transaction being verified is added to the block

- Once the block is complete, it is added to the chain

What is the Future Potential of Blockchain in Healthcare?

The popularity of blockchain technology has grown invariably in the last few years. The technology has the potential to revolutionize the healthcare sector as it has emerged as a viable option to store / exchange data within the healthcare industry. Further, it provides a faster solution for tracking and authenticating medical shipments / drugs across the supply chain and during logistics operations. In addition to compiling longitudinal patient records such as disease registries, laboratory results, and treatment related data records.

Which Pharmaceutical Companies are using Blockchain?

Examples of some of the pharmaceutical companies using blockchain include (in alphabetic order) Amgen, Novartis, Pfizer and Sanofi.

What is the Current Market Landscape of the Blockchain Market Focused on Drug Discovery and Clinical Trials?

Various types of blockchain platforms, including public blockchain, private blockchain, and consortium blockchain, are currently being used across different drug development applications (DDA), such as drug discovery, intellectual property management, electronic health record management, vaccine distribution, drug authenticity, drug supply chain, drug data management, clinical trial management, and electronic signature. It is worth highlighting that more than 50 blockchain providers offer their proprietary platforms for these applications to various industries, including healthcare, pharmaceuticals, and government organizations.

What are the Key Value Drivers of Blockchain Market in Drug Discovery and Clinical Trials?

In recent years, the use of blockchain has been on the rise, driven by several technological advancements and the growing demand for safe and secure methods of patient recruitment, retention and data management in drug discovery and clinical trials. It is worth mentioning that the use of blockchain technology in drug discovery operations is expected to improve the overall drug development process by enabling traceability in the drug supply chain and identification of counterfeit drugs and medicines.

What are the Key Advantages Offered by Novel Blockchain Platforms in Drug Discovery and Clinical Trials?

In recent years, the use of blockchain technology in healthcare, specifically in drug discovery and clinical trial management has been on the rise. This can be attributed to the fact that blockchain provides a faster solution for tracking and authenticating pharmaceutical products / drugs across the supply chain. In addition, clinical trial data can be saved securely over blockchain platforms / portals. Further, the technology enables patients to access to their medical data, ensuring that such data is only shared with the owner’s permission.

What are the Key Trends in the Blockchain in Drug Discovery and Clinical Trials Market?

It is worth highlighting that 500+ research articles in this domain have been published in high-impact journals over a period of six years, highlighting the substantial efforts made by researchers. Majority of these publications are research articles focused on evaluating the use of blockchain across drug supply chain and clinical trial management.

What is the Market Size of Blockchain in Drug Discovery and Clinical Trials Market?

As the adoption of blockchain, specifically for drug development applications, increases amongst innovators in the pharma and biopharma industries, lucrative opportunities are expected to be emerge for players engaged in the blockchain for drug discovery and clinical trials market. The blockchain market, focusing on drug discovery and clinical trials, is expected to witness a healthy growth of over 22% in the coming decade; the opportunity is likely to be well distributed across various types of blockchain, types of end-users and key geographical regions.

Who are the Key Players in the Blockchain in Drug Discovery and Clinical Trials Market?

Examples of key players engaged in this domain (which have also been captured in this report) include (in alphabetic order) Alten Calsoft Labs, ConsenSys, IBM, Infosys, Stratumn and Tech Mahindra.

Scope of the Report

The study presents an in-depth analysis of the various firms / organizations that are engaged in this domain, across different segments.

The study presents an in-depth analysis, highlighting the capabilities of various stakeholders engaged in this domain, across different geographies. Amongst other elements, the report includes:

- An executive summary of the insights captured during our research. It offers a high-level view on the current state of blockchain in drug discovery and clinical trials market and its likely evolution in the short to mid and long term.

- A general overview of blockchain technology, along with information on its types and applications across various industries. It also highlights the applications of blockchain, specifically in drug discovery and clinical trials. Further, the chapter features a discussion on the challenges, key growth drivers, and future perspectives associated with the use of blockchain in drug discovery and clinical trials.

- A detailed assessment of the overall market landscape of companies offering blockchain technology for drug discovery and clinical trials, based on several relevant parameters, such as year of establishment, company size (in terms of number of employees), location of headquarters, type of blockchain(s) (public blockchain, private blockchain, and consortium blockchain), type of drug development application(s) (drug discovery, intellectual property management, electronic health record management, vaccine distribution, drug authenticity, drug supply chain, drug data management, clinical trial management, and electronic signatures), application(s) within clinical trial management (operational excellence, predictive analysis, site investigation, patient recruitment retention, vendor management, patient data management, risk based monitoring, and data visualization), and type of end-user(s) (healthcare industry, pharmaceutical industry, and government organizations).

- A detailed competitiveness analysis of blockchain technology providers based on supplier strength (in terms of the years of experience), portfolio diversity (in terms of type of drug development application(s), application(s) within clinical trial management and type of end-user(s)), and portfolio strength (in terms of type of blockchain(s)).

- Elaborate profiles of key players providing blockchain platforms for drug discovery applications. Each profile includes a brief overview of the company, financial information (if available), details on application areas of proprietary platform, recent developments and an informed future outlook.

- A detailed analysis of recent partnerships inked between stakeholders engaged in this domain, since 2017, based on several relevant parameters, such as year of partnership, type of partnership, most active players (in terms of number of partnerships and type of partnership), type of drug development applications, type of partner, regional analysis, intercontinental and intracontinental agreements.

- A detailed review of over 500 peer-reviewed, scientific articles focused on blockchain in the pharmaceutical industry, based on several relevant parameters, such as year of publication, type of article, popular publishers, popular copyright holders and keywords. The chapter also highlights the top journals, in terms of number of articles published and impact factor.

- A discussion on affiliated trends, key drivers, and challenges under a SWOT framework, featuring a Harvey ball analysis, highlighting the relative impact of each SWOT parameter on the overall blockchain in drug discovery and clinical trials market.

- A case study highlighting the applications of blockchain across various industries, such as healthcare, banking and financial, automotive, education, telecom, transportation and travel industries, and its likely evolution in the foreseen future.

One of the key objectives of the report was to estimate the current opportunity and future growth potential of blockchain in drug discovery and clinical trials market over the coming years. We have provided informed estimates on the likely evolution of the market for the period, 2023-2035. Our year-wise projections of the current and future opportunity have further been segmented based on relevant parameters, such as type of blockchain (public blockchain, private blockchain, hybrid blockchain, and other blockchains), type of end-user (hospitals, pharmaceutical industry, research institutes and academic institutes) and key geographical regions (North America, Europe, Asia-Pacific, and Rest of the world). In order to account for future uncertainties associated with some of the key parameters and to add robustness to our model, we have provided three market forecast scenarios, namely conservative, base, and optimistic scenarios, representing different tracks of the industry’s evolution.

The opinions and insights presented in the report were influenced by discussions held with stakeholders in this domain. The report features detailed transcript of interview held with the industry stakeholders.

All actual figures have been sourced and analyzed from publicly available information forums and primary research discussions. Financial figures mentioned in this report are in USD, unless otherwise specified.

Frequently Asked Questions

Question 1: What is the growth rate of blockchain market focusing on drug discovery and clinical trials?

Answer: The blockchain market focusing on drug discovery and clinical trials is expected to grow at an annualized rate of 22% between 2023 to 2035.

Question 2: Which region will lead the blockchain market focusing on drug discovery and clinical trials?

Answer: North America and Asia-Pacific are anticipated to capture over 65% of the market share by 2035. The market in Europe is likely to grow at a relatively faster pace in the long term.

Question 3: Which segment, in terms of type of blockchain, dominate the blockchain market focusing on drug discovery and clinical trials?

Answer: Currently, private blockchain dominates the blockchain market in drug discovery and clinical trials. However, in the foreseen future, public blockchain is expected to drive the market.

Question 4: Which segment, in terms of type of end-user, accounts for the largest share in the blockchain market focusing on drug discovery and clinical trials?

Answer: Pharmaceutical industries and Academic Institutes are anticipated to capture around 60% of the market share by 2035. In addition, the market for hospitals is likely to grow at a relatively faster pace, in the long term.

Question 5: What kind of partnership models are most commonly being adopted by stakeholders engaged in this domain?

Answer: Platform utilization emerged as the most popular type of partnership model adopted by players engaged in providing blockchain in drug discovery and clinical trials. This is followed by platform integration agreements and strategic alliances.

Table of Contents

1. PREFACE

1.1. Scope of the Report

1.2. Market Segmentation

1.3. Research Methodology

1.4. Key Questions Answered

1.5. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

3.1. Chapter Overview

3.2. Overview of Blockchain

3.2.1. Ethereum vs Hyperledger Fabric

3.3. Types of Blockchain

3.3.1. Permissionless or Public Blockchain

3.3.2. Permissioned or Private Blockchain

3.3.3. Federated or Consortium Blockchain

3.4. Applications of Blockchain Across Various Industries

3.5. Applications of Blockchain in Drug Discovery and Clinical Trials

3.6. Advantages and Limitations of Blockchain

3.7. Future Perspectives

4. MARKET OVERVIEW

4.1. Chapter Overview

4.2. Blockchain Technology Providers: Overall Market Landscape

4.2.1. Analysis by Year of Establishment

4.2.2. Analysis by Company Size

4.2.3. Analysis by Region of Headquarters

4.2.4. Analysis by Location of Headquarters

4.2.5. Analysis by Year of Establishment, Company Size, and Region of Headquarters

4.2.6. Analysis by Type of Blockchain(s)

4.2.7. Analysis by Type of Drug Development Application(s)

4.2.8. Analysis by Application(s) within Clinical Trial Management

4.2.9. Analysis by Type of End-User(s)

4.2.10. Analysis by Type of Blockchain and Type of End-User(s)

4.2.11. Analysis by Type of Blockchain and Type of Drug Development Application(s)

5. COMPANY COMPETITIVENESS ANALYSIS

5.1. Chapter Overview

5.2. Assumptions / Key Parameters

5.3. Methodology

5.4. Company Competitiveness Analysis: Blockchain Technology Providers based inNorth America (Peer Group I)

5.5. Company Competitiveness Analysis: Blockchain Technology Providers based inEurope (Peer Group II)

5.6. Company Competitiveness Analysis: Blockchain Technology Providers based inAsia Pacific and RoW (Peer Group III)

6. COMPANY PROFILES

6.1. Chapter Overview

6.2. Alten Calsoft Labs

6.2.1. Company Overview

6.2.2. Financial Information

6.2.3. Application Areas of Proprietary Platform

6.2.4. Recent Developments and Future Outlook

6.3. ConsenSys

6.3.1. Company Overview

6.3.2. Application Areas of Proprietary Platform

6.3.3. Recent Developments and Future Outlook

6.4. IBM

6.4.1. Company Overview

6.4.2. Financial Information

6.4.3. Application Areas of Proprietary Platform

6.4.4. Recent Development and Future Outlooks

6.5. Stratumn

6.5.1. Company Overview

6.5.2. Application Areas of Proprietary Platform

6.5.3. Recent Development and Future Outlook

6.6. Infosys

6.6.1. Company Overview

6.6.2. Financial Information

6.6.3. Application Areas of Proprietary Platform

6.6.4. Recent Developments and Future Outlook

6.7. Tech Mahindra

6.7.1. Company Overview

6.7.2. Financial Information

6.7.3. Application Areas of Proprietary Platform

6.7.4. Recent Developments and Future Outlook

6.8. Humanscape

6.8.1. Company Overview

6.8.2. Application Areas of Proprietary Platform

6.8.3. Recent Developments and Future Outlook

6.9. Hyperledger Foundation

6.9.1. Company Overview

6.9.2. Application Areas of Proprietary Platform

6.9.3. Recent Developments and Future Outlook

6.10. Innoplexus

6.10.1. Company Overview

6.10.2. Application Areas of Proprietary Platform

6.10.3. Recent Developments and Future Outlook

6.11. Medsphere

6.11.1. Company Overview

6.11.2. Application Areas of Proprietary Platform

6.11.3. Recent Developments and Future Outlook

6.12. Solulab

6.12.1. Company Overview

6.12.2. Application Areas of Proprietary Platform

6.12.3. Recent Developments and Future Outlook

7. PARTNERSHIPS AND COLLABORATIONS

7.1. Chapter Overview

7.2. Partnership Models

7.3 Blockchain in Drug Discovery and Clinical Trials: Recent Partnerships and Collaborations

7.3.1. Analysis by Year of Partnership

7.3.2. Analysis by Type of Partnership

7.3.3. Analysis by Year and Type of Partnership

7.3.4. Analysis by Company Size and Type of Partnership

7.3.5. Most Active Players: Distribution by Number of Partnerships

7.3.6. Most Active Players: Distribution by Type of Partnership

7.3.7. Analysis by Type of Pharmaceutical Applications

7.3.8. Analysis by Type of Partner

7.3.9. Analysis by Geographical Region

7.3.9.1. Local and International Agreements

7.3.9.2. Intercontinental and Intracontinental Agreements

8. PUBLICATION ANALYSIS

8.1. Chapter Overview

8.2. Scope and Methodology

8.3. Blockchain Technology in Pharmaceutical Industry: Recent Publications

8.3.1. Analysis by Year of Publication

8.3.2. Analysis by Type of Article

8.3.3. Popular Journals: Analysis by Number of Publications

8.3.4. Popular Publishers: Analysis by Number of Publications

8.3.5. Popular Copyright Holders: Analysis by Number of Publications

8.3.6. Analysis by Popular Keywords

8.3.7. Analysis by Impact Factor

8.3.8. Popular Journals: Analysis by Journal Impact Factor

9. SWOT ANALYSIS

9.1. Chapter Overview

9.2. Blockchain in Drug Discovery and Clinical Trials: SWOT Analysis

9.3. Comparison of SWOT Factors

9.3.1. Strengths

9.3.1.1. Transparency and Traceability

9.3.1.2. Cost Reduction and Data Integrity

9.3.1.3. Safe and Secure Transactions

9.3.1.4. Patient Data Management

9.3.2. Weaknesses

9.3.2.1. Implementation Expense

9.3.2.2. Storage

9.3.2.3. Immutability of Data

9.3.2.4. High Energy Consumption

9.3.3. Threats

9.3.3.1. Blockchain is Prone to Cyber Attacks

9.3.3.2. Scalability

9.3.3.3. Lack of Regulations Issued by Legal Authorities

9.3.4. Opportunities

10. CASE STUDY: APPLICATIONS OF BLOCKCHAIN IN HEALTHCARE AND OTHER INDUSTRIES

10.1. Chapter Overview

10.2. Applications of Blockchain Across Various Industries

10.2.1 Blockchain in Healthcare

10.2.2. Blockchain in Banking and Financial Industry

10.2.3. Blockchain in Automotive Industry

10.2.4. Blockchain in Education

10.2.5. Blockchain in Telecom Industry

10.2.6. Blockchain in Transportation

10.2.7. Blockchain in Travel Industry

11. MARKET FORECAST AND OPPORTUNITY ANALYSIS

11.1. Chapter Overview

11.2. Forecast Methodology and Key Assumptions

11.3. Blockchain in Drug Discovery and Clinical Trials Market, 2023-2035

11.4. Blockchain in Drug Discovery and Clinical Trials Market: Distribution by Type of Blockchain, 2023 and 2035

11.4.1. Blockchain in Drug Discovery and Clinical Trials Market for PublicBlockchain, 2023-2035

11.4.2. Blockchain in Drug Discovery and Clinical Trials Market for PrivateBlockchain, 2023-2035

11.4.3. Blockchain in Drug Discovery and Clinical Trials Market for HybridBlockchain, 2023-2035

11.4.4. Blockchain in Drug Discovery and Clinical Trials Market for Others,2023-2035

11.5. Blockchain in Drug Discovery and Clinical Trials Market: Distribution by Type of End-User, 2023 and 2035

11.5.1. Blockchain in Drug Discovery and Clinical Trials Market for Hospitals, 2023-2035

11.5.2. Blockchain in Drug Discovery and Clinical Trials Market forPharmaceutical Industry, 2023-2035

11.5.3. Blockchain in Drug Discovery and Clinical Trials Market for Research Institutes, 2023-2035

11.5.4. Blockchain in Drug Discovery and Clinical Trials Market for Academic Institutes, 2023-2035

11.6. Blockchain in Drug Discovery and Clinical Trials Market: Distribution by Key Geographical Regions, 2023 and 2035

11.6.1. Blockchain in Drug Discovery and Clinical Trials Market in NorthAmerica, 2023-2035

11.6.2. Blockchain in Drug Discovery and Clinical Trials Market in Europe,2023-2035

11.6.3. Blockchain in Drug Discovery and Clinical Trials Market in Asia-Pacific, 2023-2035

11.6.4. Blockchain in Drug Discovery and Clinical Trials Market in Rest of theWorld, 2023-2035

12. CONCLUDING REMARKS

13. EXECUTIVE INSIGHTS

14. APPENDIX 1: TABULATED DATA

15. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List Of Figures

Figure 2.1 Executive Summary: Overall Market Landscape

Figure 2.2 Executive Summary: Partnerships and Collaborations

Figure 2.3 Executive Summary: Publication Analysis

Figure 2.4 Executive Summary: Market Sizing and Opportunity Analysis

Figure 3.1 Historical Evolution of Blockchain Technology

Figure 3.2 Types of Blockchain

Figure 3.3 Applications of Blockchain Across Various Industries

Figure 3.4 Advantages and Limitations of Blockchain

Figure 4.1 Blockchain Technology Providers: Distribution by Year of Establishment

Figure 4.2 Blockchain Technology Providers: Distribution by Company Size

Figure 4.3 Blockchain Technology Providers: Distribution by Region of Headquarters

Figure 4.4 Blockchain Technology Providers: Distribution by Location of Headquarters

Figure 4.5 Blockchain Technology Providers: Distribution Year of Establishment, Company Size, and Region of Headquarters

Figure 4.6 Blockchain Technology Providers: Distribution by Type of Blockchain(s)

Figure 4.7 Blockchain Technology Providers: Distribution by Type of Drug Development Application(s)

Figure 4.8 Blockchain Technology Providers: Distribution by Application(s) within Clinical Trial Management

Figure 4.9 Blockchain Technology Providers: Distribution by Type of End-User(s)

Figure 4.10 Blockchain Technology Providers: Distribution by Type of Blockchain and Type of End-User(s)

Figure 4.11 Blockchain Technology Providers: Distribution by Type of Blockchain and Type of Drug Development Application(s)

Figure 5.1 Company Competitiveness Analysis: Blockchain Technology Providers based in North America (Peer Group I)

Figure 5.2 Company Competitiveness Analysis: Blockchain Technology Providers based in Europe (Peer Group II)

Figure 5.3 Company Competitiveness Analysis: Blockchain Technology Providers based in Asia Pacific and RoW (Peer Group III)

Figure 6.1 Alten Calsoft Labs: Annual Revenues, 2018- H1 2022 (EUR Billion)

Figure 6.2 Alten Calsoft Labs: Application Areas of Proprietary Platform

Figure 6.3 ConsenSys: Application Areas of Proprietary Platform

Figure 6.4 IBM: Annual Revenues, 2018- H1 2022 (USD Billion)

Figure 6.5 IBM: Application Areas of Proprietary Platform

Figure 6.6 Stratumn: Application Areas of Proprietary Platform

Figure 6.7 Infosys: Annual Revenues, 2018- H1 2022 (USD Billion)

Figure 6.8 Infosys: Application Areas of Proprietary Platform

Figure 6.9 Tech Mahindra: Annual Revenues, 2018- H1 2022 (USD Billion)

Figure 6.10 Tech Mahindra: Application Areas of Proprietary Platform

Figure 7.1 Partnerships and Collaborations: Distribution by Year of Partnership, 2017-2022

Figure 7.2 Partnerships and Collaborations: Distribution by Type of Partnership

Figure 7.3 Partnerships and Collaborations: Distribution by Year and Type of Partnership

Figure 7.4 Partnerships and Collaborations: Distribution by Company Size and Type of Partnership

Figure 7.5 Most Active Partners: Distribution by Number of Partnerships

Figure 7.6 Most Active Players: Distribution by Type of Partnership

Figure 7.7 Partnerships and Collaborations: Distribution by Type of Pharmaceutical Applications

Figure 7.8 Partnerships and Collaborations: Distribution by Type of Partner

Figure 7.9 Partnerships and Collaborations: Distribution by Geographical Region

Figure 7.10 Partnerships and Collaborations: Local and International Agreements

Figure 7.11 Partnerships and Collaborations: Intercontinental and Intracontinental Agreements

Figure 8.1 Publication Analysis: Cumulative Year-wise Trend, 2016-2022

Figure 8.2 Publication Analysis: Distribution by Type of Article

Figure 8.3 Popular Journals: Distribution by Number of Publications

Figure 8.4 Popular Publishers: Distribution by Number of Publications

Figure 8.5 Popular Copyright Holders: Distribution by Number of Publications

Figure 8.6 Word Cloud: Key Focus Areas

Figure 8.7 Publication Analysis: Distribution by Impact Factor

Figure 8.8 Popular Journals: Distribution by Journal Impact Factor

Figure 9.1 Blockchain Technology in Pharmaceutical Industry: SWOT Analysis

Figure 9.2 SWOT Factors: Harvey Ball Analysis

Figure 10.1 Key Applications of Blockchain Across Various Industries

Figure 11.1 Blockchain in Drug Discovery and Clinical Trials Market, 2023-2035

Figure 11.2 Blockchain in Drug Discovery and Clinical Trials Market: Distribution by Type of Blockchain, 2023 and 2035 (USD Million)

Figure 11.3 Blockchain in Drug Discovery and Clinical Trials Market for Public Blockchain, 2023-2035 (USD Million)

Figure 11.4 Blockchain in Drug Discovery and Clinical Trials Market for Private Blockchain, 2023-2035 USD Million)

Figure 11.5 Blockchain in Drug Discovery and Clinical Trials Market for Hybrid Blockchain, 2023-2035 USD Million)

Figure 11.6 Blockchain in Drug Discovery and Clinical Trials Market for Other Blockchains, 2023-2035 (USD Million)

Figure 11.7 Blockchain in Drug Discovery and Clinical Trials Market: Distribution by Type of End-User, 2023 and 2035 (USD Million)

Figure 11.8 Blockchain in Drug Discovery and Clinical Trials Market for Hospitals, 2023-2035 (USD Million)

Figure11.9 Blockchain in Drug Discovery and Clinical Trials Market for Pharmaceutical Industry, 2023- 2035 (USD Million)

Figure 11.10 Blockchain in Drug Discovery and Clinical Trials Market for Research Institutes, 2023-2035 (USD Million)

Figure 11.11 Blockchain in Drug Discovery and Clinical Trials Market for Academic Institutes, 2023-2035 (USD Million)

Figure 11.12 Blockchain in Drug Discovery and Clinical Trials Market: Distribution by Key Geographical Regions, 2023 and 2035 (USD Million)

Figure 11.13 Blockchain in Drug Discovery and Clinical Trials Market in North America, 2023-2035 (USD Million)

Figure 11.14 Blockchain in Drug Discovery and Clinical Trials Market in Europe, 2023-2035 (USD Million)

Figure 11.15 Blockchain in Drug Discovery and Clinical Trials Market in Asia- Pacific, 2023-2035 (USD Million)

Figure 11.16 Blockchain in Drug Discovery and Clinical Trials Market in Rest of the World, 2023-2035 (USD Million)

Figure 12.1 Concluding Remarks: Blockchain Technology Providers: Market Landscape

Figure 12.2 Concluding Remarks: Partnerships and Collaborations

Figure 12.3 Concluding Remarks: Publication Analysis

Figure 12.4 Concluding Remarks: Market Sizing and Opportunity Analysis

List Of Tables

Table 4.1 List of Blockchain Technology Providers

Table 4.2 Blockchain Technology Providers: Information on Type of Blockchain(s)

Table 4.3 Blockchain Technology Providers: Information on Type of End-User(s)

Table 4.4 Blockchain Technology Providers: Information on Type of Drug Development Application(s)

Table 6.1 Blockchain in Drug Discovery and Clinical Trials: List of Companies Profiled

Table 6.2 Alten Calsoft Labs: Key Highlights

Table 6.3 Alten Calsoft Labs: Recent Developments and Future Outlook

Table 6.4 ConsenSys: Key Highlights

Table 6.5 ConsenSys: Recent Developments and Future Outlook

Table 6.6 IBM: Key Highlights

Table 6.7 IBM: Recent Developments and Future Outlook

Table 6.8 Stratumn: Key Highlights

Table 6.9 Infosys: Key Highlights

Table 6.10 Infosys: Recent Developments and Future Outlook

Table 6.11 Tech mahindra: Key Highlights

Table 6.12 Tech Mahindra: Recent Developments and Future Outlook

Table 6.13 Blockchain in Drug Discovery and Clinical Trials: List of Companies Profiled

Table 6.14 Humanscape: Key Highlights

Table 6.15 Humanscape: Application Areas of Proprietary Platform

Table 6.16 Humanscape: Recent Developments and Future Outlook

Table 6.17 Hyperledger Foundation: Key Highlights

Table 6.18 Hyperledger Foundation: Application Areas of Proprietary Platform

Table 6.19 Hyperledger Foundation: Recent Developments and Future Outlook

Table 6.20 Innoplexus: Key Highlights

Table 6.21 Innoplexus: Application Areas of Proprietary Platform

Table 6.22 Innoplexus: Recent Developments and Future Outlook

Table 6.23 Medsphere: Key Highlights

Table 6.24 Medsphere: Application Areas of Proprietary Platform

Table 6.25 Medsphere: Recent Developments and Future Outlook

Table 6.26 Solulab: Key Highlights

Table 6.27 Solulab: Application Areas of Proprietary Platform

Table 6.28 Solulab: Recent Developments and Future Outlook

Table 7.1 Blockchain in Drug Discovery and Clinical Trials: List of Partnerships and Collaborations, 2017-2022

Table 10.1 Blockchain Technology in Education: Application Scenarios

Table 14.1 Blockchain Technology Providers: Distribution by Year of Establishment

Table 14.2 Blockchain Technology Providers: Distribution by Company Size

Table 14.3 Blockchain Technology Providers: Distribution by Region of Headquarters

Table 14.4 Blockchain Technology Providers: Distribution by Location of Headquarters

Table 14.5 Blockchain Technology Providers: Distribution by Year of Establishment, Company Size, and Region of Headquarters

Table 14.6 Blockchain Technology Providers: Distribution by Type of Blockchain(s)

Table 14.7 Blockchain Technology Providers: Distribution by Type of Drug Development Application(s)

Table 14.8 Blockchain Technology Providers: Distribution by Application(s) within Clinical Trial Management

Table 14.9 Blockchain Technology Providers: Distribution by Type of End-User(s)

Table 14.10 Blockchain Technology Providers: Distribution by Type of Blockchain and Type of End-User(s)

Table 14.11 Blockchain Technology Providers: Distribution by Type of Blockchain and Type of Drug Development Application(s)

Table 14.12 Alten Calsoft Labs: Annual Revenues, 2018-H1 2022 (EUR Billion)

Table 14.13 IBM: Annual Revenues, 2018-H1 2022 (USD Billion)

Table 14.14 Infosys: Annual Revenues, 2018-H1 2022 (USD Billion)

Table 14.15 Tech Mahindra: Annual Revenues, 2018-H1 2022 (USD Billion)

Table 14.16 Partnerships and Collaborations: Distribution by Year of Partnership, 2017- 2022

Table 14.17 Partnerships and Collaborations: Distribution by Type of Partnership

Table 14.18 Partnerships and Collaborations: Distribution by Year and Type of Partnership, 2017-2022

Table 14.19 Partnerships and Collaborations: Distribution by Company Size and Type of Partnership

Table 14.20 Most Active Players: Distribution by Number of Partnerships

Table 14.21 Most Active Players: Distribution by Type of Partnerships

Table 14.22 Partnerships and Collaborations: Distribution by Type of PharmaceuticalApplications

Table 14.23 Partnerships and Collaborations: Distribution by Type of Partner

Table 14.24 Partnerships and Collaborations: Distribution by Geographical Region

Table 14.25 Partnerships and Collaborations: Local and International Agreements

Table 14.25 Partnerships and Collaborations: Intercontinental and Intracontinental Agreements

Table 14.26 Publication Analysis: Cumulative Year-Wise Trend, 2016-2022

Table 14.27 Publication Analysis: Distribution by Type of Article

Table 14.28 Popular Journals: Distribution by Number of Publications

Table 14.29 Popular Publishers: Distribution by Number of Publications

Table 14.30 Popular Copyright Holders: Distribution by Number of Publications

Table 14.31 Publication Analysis: Distribution by Impact Factor

Table 14.32 Popular Journals: Distribution by Journal Impact Factor

Table 14.33 Blockchain in Drug Discovery and Clinical Trials Market 2023-2035, Conservative, Base, and Optimistic Scenarios, 2023-2035 (USD Million)

Table 14.34 Blockchain in Drug Discovery and Clinical Trials Market: Distribution by Type of Blockchain, 2023 and 2035

Table 14.35 Blockchain in Drug Discovery and Clinical Trials Market for Public Blockchain, 2023-2035: Conservative, Base, and Optimistic Scenarios (USD Million)

Table 14.36 Blockchain in Drug Discovery and Clinical Trials Market for Private Blockchain, 2023-2035: Conservative, Base and Optimistic Scenarios, (USD Million)

Table 14.37 Blockchain in Drug Discovery and Clinical Trials Market for Hybrid Blockchain, 2023-2035: Conservative, Base and Optimistic Scenarios, (USD Million)

Table 14.38 Blockchain in Drug Discovery and Clinical Trials Market for Other Blockchains, 2023-2035: Conservative, Base and Optimistic Scenarios, (USD Million)

Table 14.39 Blockchain in Drug Discovery and Clinical Trials Market: Distribution by Type of End-User, 2023 and 2035

Table 14.40 Blockchain in Drug Discovery and Clinical Trials Market for Hospitals, 2023-2035: Conservative, Base and Optimistic Scenarios, (USD Million)

Table 14.41 Blockchain in Drug Discovery and Clinical Trials Market for Pharmaceutical Industry, 2023-2035: Conservative, Base and Optimistic Scenarios, (USD Million)

Table 14.42 Blockchain in Drug Discovery and Clinical Trials Market for Research Institutes, 2023-2035: Conservative, Base and Optimistic Scenarios, (USD Million)

Table 14.43 Blockchain in Drug Discovery and Clinical Trials Market for Academic Institutes, 2023-2035: Conservative, Base and Optimistic Scenarios, (USD Million)

Table 14.44 Blockchain in Drug Discovery and Clinical Trials Market: Distribution by Key Geographical Regions, 2023 and 2035

Table 14.45 Blockchain in Drug Discovery and Clinical Trials Market in North America, 2023-2035: Conservative, Base and Optimistic Scenarios, (USD Million)

Table 14.46 Blockchain in Drug Discovery and Clinical Trials Market in Europe, 2023-2035: Conservative, Base and Optimistic Scenarios, (USD Million)

Table 14.47 Blockchain in Drug Discovery and Clinical Trials Market in Asia- Pacific, 2023-2035: Conservative, Base and Optimistic Scenarios, (USD Million)

Table 14.48 Blockchain in Drug Discovery and Clinical Trials Market in Rest of the World, 2023-2035: Conservative, Base and Optimistic Scenarios, (USD Million)

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ACL Digital

- Aculys Pharma

- Akiri

- AME Publishing Company

- American Medical Association

- AOSIS

- APPII

- BioMed Central

- BlockCerts

- Blockchain BioPharma (also known as Blockchain Pharmaceuticals)

- Blockcube

- Blockpharma

- Bloqcube

- Blue.cloud

- British Medical Association (BMA)

- BurstIQ

- Cardinal Health

- Chainlink

- CHR. Michelsen Institute (CMI)

- Chronicled

- Clinical Supply Blockchain Working Group (CSBWG)

- Clinlogix (acquired by NAMSA)

- ClinTex

- ConsenSys

- ConsilX

- Coral Health

- Crucial Data Solutions

- Crystalchain

- Doc.AI

- Elsevier

- Embleema

- Equideum Health

- EXOCHAIN

- Factom

- FarmaTrust

- FHIRBlocks (acquired by ConsenSys Health)

- Frontiers

- Gem

- Gilgamesh

- Guardtime

- Hashed Health

- HealthVerity

- Hindawi

- Humanscape

- Hyperledger Foundation

- Hypertrust Patient Data Care (HPDC)

- IBM

- Infosys

- Innoplexus

- Institute of Electrical and Electronic Engineers (IEEE)

- Intel

- International Society of Global Health (ISoGH)

- International Trade Administration

- iSolve

- Jannsen

- Jireh Group

- Joule

- LabCorp

- LEA LABS

- LedgerDomain

- LTO Network

- Luna

- Mary Ann Liebert

- Matrix Medical Communications

- Mayo Clinic

- MediBloc

- Medicalchain

- MediConnect

- Medidata

- Medsphere

- MELLODDY

- Missouri State Medical Association

- modum

- Multidisciplinary Digital Publishing Institute

- National Academy of Medicine

- OCEASOFT

- ODEM

- PAREXEL

- PERSOWN

- PharmaLedger

- Pistoia Alliance

- PokitDok

- Premier Blockchain Hub

- Quantoz

- SAGE Publishing

- SAP

- ServBlock

- Shivom

- Shyft Network

- Sichuan Hejia

- Social Science Electronic Publishing

- Society of Laparoscopic & Robotic Surgeons (SLS)

- SoluLab

- Sphereon

- Springer Publishing

- StaTwig

- Stratumn

- SUSMED

- Systech International

- Tada Cognitive Solutions

- Tech Mahindra

- The Academy of Medical Sciences

- TomoChain

- Tracekey Solutions

- Triall

- Ubiquity Press

- VeChain

- Wiley

- World Health Organization

Methodology

LOADING...