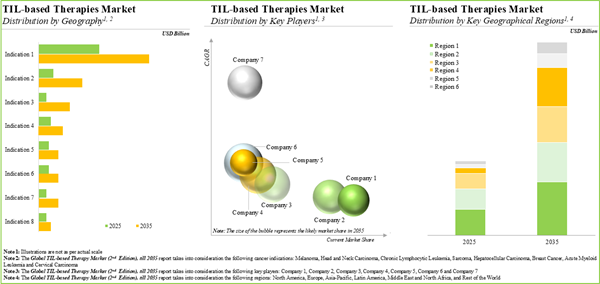

The global TIL therapy market is estimated to grow from USD 0.087 billion in the current year to USD 5 billion by 2035, at a CAGR of 40% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Target Indication

- Melanoma

- Head and Neck Carcinoma

- Chronic Lymphocytic Leukemia

- Sarcoma

- Hepatocellular Carcinoma

- Breast Cancer

- Acute Myeloid Leukemia

- Cervical Carcinoma

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Middle East and North Africa

- Latin America

- Rest of the World

Key Players

Global TIL Therapies Market: Growth and Trends

Recent advancements in modified tumor infiltrating lymphocytes (TIL)-based interventions highlight the potential of these innovative therapies for treating various oncological and non-oncological disorders. This highly specific and promising form of cell therapy, which is pre-sensitized to cancer specific antigens, is anticipated to revolutionize cancer treatment. It is worth noting that more than 100 clinical trials are currently underway to investigate TIL therapies across different geographies. Given the substantial evidence supporting the clinical advantages and therapeutic potential of TIL therapies, several investors have invested over USD 2.7 billion, across 30 instances. Moreover, clinical success is likely to draw in investments that are likely to support the ongoing and anticipated therapy development initiatives. Driven by the encouraging clinical trial results, ongoing pace of innovation and sufficient financial support from investors, the TIL therapy market is likely to witness significant growth during the forecast period.

Global TIL Therapies Market: Key Insights

The report delves into the current state of the global TIL therapies market and identifies potential growth opportunities within the industry. Some key findings from the report include:

- Over 75 TIL-based therapies are being evaluated across different stages of preclinical / clinical development either as monotherapies or in combination with other drugs for the treatment of various oncological disorders.

- Both industry and non-industry players have demonstrated keen interest in the development of novel TIL-based therapies; further, melanoma emerged as the most popular target indication.

- Majority (56%) of industry players based in North America are actively undertaking efforts for the development / commercialization of TIL-based cell therapies; the industry is dominated by the presence of mid-sized players.

- Over the past decade, close to 95 clinical trials have been registered across different geographies for the evaluation of TIL-based therapies; extensive efforts are underway to improve the successive generations of such therapies.

- Close to 55 scientists from renowned universities are presently involved in the clinical development of TIL-based therapies; majority of these KOLs are primarily based in the US and China.

- Close to 200 players claim to have the required capabilities to manufacture different types of cell therapies; such firms also offer a wide range of services across different stages of product development.

- A growing interest in the development of TIL-based therapies is reflected from the increase in R&D agreements in the last few years; majority of the such deals were signed between players based in North America.

- Several investors, having realized the opportunity within this upcoming segment of T-cell immunotherapy, have invested USD 2.7 billion, across 30 instances.

- More than 165 patents have been filed / granted by various stakeholders in order to protect the intellectual property generated within this field.

- With a growing focus on the development pipeline and encouraging clinical results, the market is expected to witness an annualized growth rate of 40% in the next decade.

Global TIL Therapies Market: Key Segments

Currently, Melanoma Occupies the Largest Share of the Global TIL Therapies Market

Based on the target indication, the market is segmented into melanoma, head and neck carcinoma, chronic lymphocytic leukemia, sarcoma, hepatocellular carcinoma, breast cancer, acute myeloid leukemia and cervical carcinoma. At present, melanoma holds the maximum share of the global TIL therapies market. This trend is unlikely to change in the near future.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific, Middle East and North Africa, and Latin America. Currently, North America captures the maximum share of the global TIL therapies market. It is worth highlighting that, over the years, the market in Europe is expected to grow at a higher CAGR.

Some Key Players in the Global TIL Therapies Market include:

- Iovance Biotherapeutics

- Bristol-Myers Squibb

- Instil Bio

- Lytix Biopharma

- CAR-T (Shanghai) Cell Biotechnology

- Incyte Corporation

- Prometheus Laboratories

Global TIL Therapies Market: Research Coverage

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global TIL therapies market, focusing on key market segments, including [A] target indication, [B] key players and [C] key geographical regions.

- Market Landscape: A comprehensive evaluation of the overall market landscape of TIL therapy, considering various parameters, such as [A] type of developer, [B] phase of development, [C] therapeutic area, [D] key target indications, [E] source of T-cells, [F] route of administration, [G] dosing frequency, [H] target patient segment, [I] type of therapy and [J] developer landscape.

- Drug Profiles: In-depth profiles of mid- to late-stage clinical products (phase I/II or above), focusing on [A] overview of the therapy, [B] its mechanism of action, [C] dosage information, [D] details on the cost and sales information (wherever available), [E] a clinical development plan, and [F] clinical trial results.

- Company Profiles: In-depth profiles of key industry players in TIL therapy market, focusing on [A] company overviews, [B] product portfolio specific to TIL therapies [C] technology portfolio (if available), [D] recent developments related to TIL therapies and [E] the manufacturing capabilities of the companies.

- Clinical Trial Analysis: Examination of completed, ongoing, and planned clinical studies of various TIL therapies based on parameters like [A] trial registration year, [B] enrolled patient population, [C] trial status, [D] trial phase, [E] target patient segment, [F] type of sponsor / collaborator, [G] study design, [H] most active players (in terms of number of registered trials), [I] key focus areas and [J] geography.

- Key Opinion Leaders: An in-depth examination that emphasizes the key opinion leaders (KOLs) within this field includes an evaluation of various principal investigators overseeing clinical trials associated with TIL therapies. In addition, the chapter highlights the most prominent KOLs, based on third-party scoring criteria.

- Partnerships and Collaborations: An analysis of partnerships established in this sector, covering R&D agreements, license agreements (specific to technology platforms and product candidates), manufacturing agreements, clinical trial collaborations and others.

- Funding and Investment Analysis: A detailed evaluation of the investments made into companies having proprietary TIL therapies / technologies, encompassing venture capital financing, capital raised from IPOs and subsequent offerings, grants, and debt financing.

- Patent Analysis: Detailed analysis of various patents filed / granted related to tumor infiltrating lymphocytes based on [A] type of patent (granted and patent applications), [B] patent publication year, [C] geographical distribution, [D] type of player, [E] Cooperative Patent Classification (CPC) symbols, [F] emerging focus areas, [G] leading players (in terms of number of patents) and [H] patent benchmarking. It also includes a detailed patent valuation analysis.

- Case Study: A case study on manufacturing cell therapy products, highlighting the key challenges, and a detailed list of contract service providers and in-house manufacturers involved in this space.

- Cost Price Analysis: A comprehensive discussion on the various factors that are likely to influence the pricing of cell-based therapies. This includes an exploration of different models and approaches that pharmaceutical companies may consider while determining the prices of their lead therapy candidates that are likely to be marketed in the near future.

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What kind of partnership models are commonly adopted by industry stakeholders?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Iovance Biotherapeutics

- Bristol-Myers Squibb

- Instil Bio

- Lytix Biopharma

- CAR-T (Shanghai) Cell Biotechnology

- Incyte Corporation

- Prometheus Laboratories

Methodology

LOADING...