Escalation in Interventional Radiology to Boost the Middle East & Africa Embolization Coils Market

The market players are aggressively conducting research and development activities on embolization coils. Also, the market is dynamic and complex, characterized by recurrent product launches and plentiful clinical trials. The embolization coils market has various growth opportunities due to the rising prevalence of peripheral vascular disease, neurovascular diseases, cardiac conditions, and other chronic diseases that lead to vascular disorders. The current trend for endovascular treatments or embolization coils is interventional radiology. The treatment is a minimally invasive procedure under the guidance of X-rays. The benefits of interventional radiology have proven itself to be the best treatment option for the control of extensive blood flow. Interventional radiology is also helpful in the field of gynecology during cesarean section procedures where the patients experience extensive blood loss. The rise in the prevalence of liver and kidney cancer has contributed extensively to the need for treatment. The rise in the geriatric population, which is highly affected by endovascular diseases, brain stroke, heart stroke, and chronic diseases, is adding up to the market's growth. Therefore, interventional radiology is highly preferred for the geriatric population to treat diseases as it is a minimally invasive procedure. In addition, the other advantages, such as less hospital stay, fast recovery, and less dependence on others after the procedure, attract the patients more.Middle East & Africa Embolization Coils Market Overview

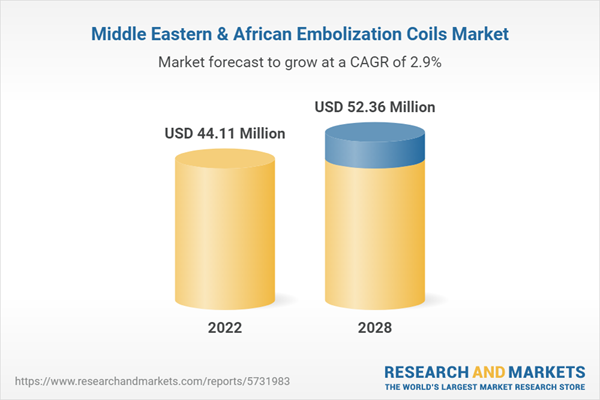

The Middle East and Africa embolization coils market is segmented into Saudi Arabia, South Africa, UAE, and the rest of Middle East and Africa. The embolization coil market in the region is expected to grow due to rising prevalence of chronic diseases, growing healthcare expenditure, and growing collaborations by market players. Saudi Arabia has experienced a significant change in the people’s standard of the living and lifestyle, the changes has led to increase in the consumption of fatty and poor quality of food. The administration of MOH is very much centralized, regional executives have limited independence in financing and planning of services. However, the major expenses are authorized by the central administration of MOH. Thus, owing to the above-mentioned factors the Middle East & Africa embolization coils market is likely to grow in the forecasted period.Middle East & Africa embolization coils market Segmentation

The Middle East & Africa embolization coils market is segmented on the basis of type, material, application, end user, and country. Based on type, the Middle East & Africa embolization coils market is bifurcated into detachable coil and pushable coil. The detachable coil segment held a larger market share in 2022.

- Based on material, the Middle East & Africa embolization coils market is segmented into platinum, platinum & hydrogel, and platinum tungsten alloy. The platinum segment held the largest market share in 2022.

- Based on application, the Middle East & Africa embolization coils market is segmented into neurology, cardiology, urology, oncology, peripheral vascular disease, and others. The neurology segment held the largest market share in 2022.

- Based on end user, the Middle East & Africa embolization coils market is segmented into hospital, cardiac center, ambulatory center, and other. The hospital segment held the largest market share in 2022.

- Based on country, the Middle East & Africa embolization coils market is segmented into the Saudi Arabia, South Africa, the UAE, and the Rest of Middle East & Africa. Saudi Arabia dominated the market share in 2022.

Table of Contents

1. Introduction1.1 Study Scope

1.2 Research Report Guidance

1.3 Market Segmentation

1.3.1 MEA Embolization Coils Market- By Type

1.3.2 MEA Embolization Coils Market- By Material

1.3.3 MEA Embolization Coils Material- By Application

1.3.4 MEA Embolization Coils Market- By End User

1.3.5 MEA Embolization Coils Market - By Country

2. MEA Embolization Coils Market - Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. MEA Embolization Coils Market - Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 MEA - PEST Analysis

4.3 Expert Opinion

5. MEA Embolization Coils Market - Key Market Dynamics

5.1 Market Drivers

5.1.1 Rise in Occurrence of Cardiac Aneurysm

5.1.2 Increase in Prevalence of Cancer Cases

5.1.3 Rise in Patient Preference for Minimally Invasive Events

5.1.4 Progressive Aging Population & Escalation in Associated Chronic Diseases

5.2 Market Restraints

5.2.1 High Amount of Embolization Coils

5.2.2 Various Product Recalls

5.3 Market Opportunities

5.3.1 Upward Applications of Embolization Coils

5.4 Future Trends

5.4.1 Escalation in Interventional Radiology

5.5 Impact analysis

6. Embolization Coils Market - MEA Analysis

6.1 MEA Embolization Coils Market Revenue Forecast and Analysis

7. MEA Embolization Coils Market Analysis - By Type

7.1 Overview

7.2 Embolization Coils Market Revenue Share, by Type (2022 & 2028)

7.3 Detachable Coils

7.3.1 Overview

7.3.2 Detachable Coils: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

7.4 Pushable Coils

7.4.1 Overview

7.4.2 Pushable Coils: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

8. MEA Embolization Coils Market Analysis - By Material

8.1 Overview

8.2 Embolization Coils Market Revenue Share, by Material (2022 & 2028)

8.3 Platinum

8.3.1 Overview

8.3.2 Platinum: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

8.4 Platinum & Hydrogel

8.4.1 Overview

8.4.2 Platinum & Hydrogels: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

8.5 Platinum Tungsten Alloys

8.5.1 Overview

8.5.2 Platinum Tungsten Alloys: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

9. MEA Embolization Coils Market Analysis - By Application

9.1 Overview

9.2 Embolization Coils Market Revenue Share, by Application (2022 & 2028)

9.3 Neurology

9.3.1 Overview

9.3.2 Neurology: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

9.4 Cardiology

9.4.1 Overview

9.4.2 Cardiology: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

9.5 Urology

9.5.1 Overview

9.5.2 Urology: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

9.6 Oncology

9.6.1 Overview

9.6.2 Oncology: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

9.7 Peripheral Vascular Disease

9.7.1 Overview

9.7.2 Peripheral Vascular Disease: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

9.8 Others

9.8.1 Overview

9.8.2 Others: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

10. MEA Embolization Coils Market Analysis - By End User

10.1 Overview

10.2 Embolization Coils Market Revenue Share, by End User (2022 & 2028)

10.3 Hospital

10.3.1 Overview

10.3.2 Hospital: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

10.4 Cardiac Centers

10.4.1 Overview

10.4.2 Cardiac Centers: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

10.5 Ambulatory Centers

10.5.1 Overview

10.5.2 Ambulatory Centers: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

10.6 Others

10.6.1 Overview

10.6.2 Others: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

11. MEA Embolization Coils Market - by Country

11.1 Middle East & Africa Embolization Coils Market Revenue and Forecasts to 2028

11.1.1 Overview

11.1.2 Middle East & Africa: Embolization Coil Market, by Country, 2022 & 2028 (%)

11.1.2.1 Saudi Arabia: Embolization Coil Market- Revenue and Forecast to 2028 (US$ Million)

11.1.2.1.1 Saudi Arabia: Embolization Coil Market- Revenue and Forecast to 2028 (US$ Million)

11.1.2.1.2 Saudi Arabia: Embolization Coil Market, by Type, 2019-2028 (US$ Million)

11.1.2.1.3 Saudi Arabia: Embolization Coil Market, by Material, 2019-2028 (US$ Million)

11.1.2.1.4 Saudi Arabia: Embolization Coil Market, by Application, 2019-2028 (US$ Million)

11.1.2.1.5 Saudi Arabia: Embolization Coil Market, by End User, 2019-2028 (US$ Million)

11.1.2.2 South Africa: Embolization Coil Market- Revenue and Forecast to 2028 (US$ Million)

11.1.2.2.1 South Africa: Embolization Coil Market- Revenue and Forecast to 2028 (US$ Million)

11.1.2.2.2 South Africa: Embolization Coil Market, by Type, 2019-2028 (US$ Million)

11.1.2.2.3 South Africa: Embolization Coil Market, by Material, 2019-2028 (US$ Million)

11.1.2.2.4 South Africa: Embolization Coil Market, by Application, 2019-2028 (US$ Million)

11.1.2.2.5 South Africa: Embolization Coil Market, by End User, 2019-2028 (US$ Million)

11.1.2.3 UAE: Embolization Coil Market- Revenue and Forecast to 2028 (US$ Million)

11.1.2.3.1 UAE: Embolization Coil Market- Revenue and Forecast to 2028 (US$ Million)

11.1.2.3.2 UAE: Embolization Coil Market, by Type, 2019-2028 (US$ Million)

11.1.2.3.3 UAE: Embolization Coil Market, by Material, 2019-2028 (US$ Million)

11.1.2.3.4 UAE: Embolization Coil Market, by Application, 2019-2028 (US$ Million)

11.1.2.3.5 UAE: Embolization Coil Market, by End User, 2019-2028 (US$ Million)

11.1.2.4 Rest of Middle East and Africa: Embolization Coil Market- Revenue and Forecast to 2028 (US$ Million)

11.1.2.4.1 Rest of Middle East and Africa: Embolization Coil Market- Revenue and Forecast to 2028 (US$ Million)

11.1.2.4.2 Rest of Middle East & Africa: Embolization Coil Market, by Type, 2019-2028 (US$ Million)

11.1.2.4.3 Rest of Middle East & Africa: Embolization Coil, by Material, 2019-2028 (US$ Million)

11.1.2.4.4 Rest of Middle East & Africa: Embolization Coil, by Application, 2019-2028 (US$ Million)

11.1.2.4.5 Rest of Middle East & Africa: Embolization Coil, by End User, 2019-2028 (US$ Million)

12. Embolization Coils Market -Industry Landscape

12.1 Overview

12.2 Growth Strategies Done by the Companies in the Market, 2021(%)

12.3 Organic Developments

12.3.1 Overview

12.4 Inorganic Developments

12.4.1 Overview

13. Company Profiles

13.1 Terumo Corporation

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Medtronic

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Boston Scientific Corporation

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Stryker

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 KANEKA CORPORATION

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 MicroPort Scientific Corporation

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Penumbra, Inc.

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Cook Medical LLC

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Johnson & Johnson Services, Inc.

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

13.10 Shape Memory Medical INC

13.10.1 Key Facts

13.10.2 Business Description

13.10.3 Products and Services

13.10.4 Financial Overview

13.10.5 SWOT Analysis

13.10.6 Key Developments

14. Appendix

14.1 About the Publisher

14.2 Glossary of Terms

Table 1. Saudi Arabia Embolization Coil Market, by Type - Revenue and Forecast to 2028 (US$ Million)

Table 2. Saudi Arabia Embolization Coil Market, by Material - Revenue and Forecast to 2028 (US$ Million)

Table 3. Saudi Arabia Embolization Coil Market, by Application - Revenue and Forecast to 2028 (US$ Million)

Table 4. Saudi Arabia Embolization Coil Market, by End User - Revenue and Forecast to 2028 (US$ Million)

Table 5. South Africa Embolization Coil Market, by Type - Revenue and Forecast to 2028 (US$ Million)

Table 6. South Africa Embolization Coil Market, by Material- Revenue and Forecast to 2028 (US$ Million)

Table 7. South Africa Embolization Coil Market, by Application - Revenue and Forecast to 2028 (US$ Million)

Table 8. South Africa Embolization Coil Market, by End User - Revenue and Forecast to 2028 (US$ Million)

Table 9. UAE Embolization Coil Market, by Type- Revenue and Forecast to 2028 (US$ Million)

Table 10. UAE Embolization Coil Market, by Material - Revenue and Forecast to 2028 (US$ Million)

Table 11. UAE Embolization Coil Market, by Application - Revenue and Forecast to 2028 (US$ Million)

Table 12. UAE Embolization Coil Market, by End User - Revenue and Forecast to 2028 (US$ Million)

Table 13. Rest of Middle East & Africa Embolization Coil Market, by Type - Revenue and Forecast to 2028 (US$ Million)

Table 14. Rest of Middle East and Africa Embolization Coil Market, by Material - Revenue and Forecast to 2028 (USD Million)

Table 15. Rest of Middle East and Africa Embolization Coil Market, by Application - Revenue and Forecast to 2028 (USD Million)

Table 16. Rest of Middle East & Africa Embolization Coil, by End User - Revenue and Forecast to 2028 (US$ Million)

Table 17. Organic Developments Done by Companies

Table 18. Inorganic Developments Done by Companies

Table 19. Glossary of Terms, Embolization Coil Market

Figure 1. MEA Embolization Coils Market Segmentation

Figure 2. MEA Embolization Coils Market Segmentation, By Country

Figure 3. MEA Embolization Coils Market Overview

Figure 4. Detachable Coils Segment Held Largest Share by Type in Embolization Coils market

Figure 5. Saudi Arabia is Expected to Show Remarkable Growth During the Forecast Period

Figure 6. MEA: PEST Analysis

Figure 7. MEA Expert Opinion

Figure 8. MEA Embolization Coils Market Impact Analysis of Drivers and Restraints

Figure 9. MEA Embolization Coils Market - Revenue Forecast and Analysis - 2020- 2028

Figure 10. MEA Embolization Coils Market Revenue Share, by Type (2022 & 2028)

Figure 11. MEA Detachable Coils: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

Figure 12. MEA Pushable Coils: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

Figure 13. MEA Embolization Coils Market Revenue Share, by Material (2022 & 2028)

Figure 14. MEA Platinum: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

Figure 15. MEA Platinum & Hydrogels: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

Figure 16. MEA Platinum Tungsten Alloy: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

Figure 17. MEA Embolization Coils Market Revenue Share, by Application (2022 & 2028)

Figure 18. MEA Neurology: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

Figure 19. MEA Cardiology: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

Figure 20. MEA Urology: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

Figure 21. MEA Oncology: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

Figure 22. MEA Peripheral Vascular Disease: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

Figure 23. MEA Others: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

Figure 24. MEA Embolization Coils Market Revenue Share, by End User (2022 & 2028)

Figure 25. MEA Hospital: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

Figure 26. MEA Cardiac Centers: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

Figure 27. MEA Ambulatory Centers: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

Figure 28. MEA Others: Embolization Coils Market- Revenue and Forecast to 2028 (US$ Million)

Figure 29. Middle East & Africa Embolization Coil Market Revenue Overview, by Country, 2022 (US$ Million)

Figure 30. Saudi Arabia: Embolization Coil Market- Revenue and Forecast to 2028 (US$ Million)

Figure 31. South Africa: Embolization Coil Market- Revenue and Forecast to 2028 (US$ Million)

Figure 32. UAE: Embolization Coil Market- Revenue and Forecast to 2028 (US$ Million)

Figure 33. Rest of Middle East and Africa: Embolization Coil Market- Revenue and Forecast to 2028 (US$ Million)

Figure 34. Growth Strategies Done by the Companies in the Market, 2021(%)

Companies Mentioned

- Terumo Corporation

- Medtronic

- Boston Scientific Corporation

- Stryker

- KANEKA CORPORATION

- MicroPort Scientific Corporation

- Penumbra, Inc.

- Cook Medical LLC,

- Johnson & Johnson Services, Inc.

- Shape Memory Medical INC.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 143 |

| Published | January 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 44.11 Million |

| Forecasted Market Value ( USD | $ 52.36 Million |

| Compound Annual Growth Rate | 2.9% |

| Regions Covered | Africa, Middle East |

| No. of Companies Mentioned | 10 |