Increasing IoT and Communication Applications is Driving the Europe Small Satellite Market

Internet access, machine-to-machine communication (M2M), and the Internet of Things (IoT) are among the most important applications of a small satellite. Space has become an ideal solution to improve the efficiency of current terrestrial communication networks. According to Alén Space, by 2025, more than 25.2 billion IoT connections are predicted to exist in the region, and the IoT market will reach US$ 1,072.08 billion (€ 950 billion). Also, small satellite constellations can play an important role in various environmental conditions, especially in remote or hard-to-reach places, where real-time data is received from all types of sensors and linked devices for IoT-based business models. Thus, a small satellite helps receive, store, and transmit real-time information to any point. The small satellite can also be effective for remote management. Sensors can help to control all devices, receive real-time information, and send commands for configurations remotely across the Europe. Satellite communications support land-based communications in Amazon basin, Antarctica, offshore platforms, critical infrastructure like nuclear power plants, and other hard-to-reach areas. Also, small satellites guarantee communication in any circumstances in virtually uncommunicated areas such as large rural areas, desert territories, frozen areas, jungle areas, and high seas. For high internet access, several projects are being launched in various developed and developing regions where small satellites play a major role. The growing internet access in Europe will propel the demand for small satellites during the forecast period. Thus, the rising demand for small satellites to provide internet access, M2M communication, and IoT will create a lucrative opportunity for market growth in the forecasted period.Europe Small Satellite Market Overview

Based on country, the small satellite market in Europe is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. Over the years, satellite research & development programs and production facilities have increased in Europe. The region is also highly dependent on space services for applications such as earth observation, and communication and navigation. According to European Parliamentary Research Service (EPRS), 10% of Europe’s GDP is supported by satellite navigation signals. For instance, according to EPRS, in 2021, the global navigation satellite systems (GNSS) recorded a total revenue of US$ 174.27 billion, in which Europe accounted for 25% of the total revenue. Thus, the growing demand for nano and micro satellites for communication and navigation applications across the country is constantly increasing across the region.Europe Small Satellite Market Segmentation

The Europe small satellite market is segmented based on type, payload, application, vertical, and country.- Based on type, the Europe small satellite market is bifurcated into nanosatellite (1 to 10 Kg) and microsatellite (10 to 150 Kg). The microsatellite (10 to 150 Kg) segment held a larger market share in 2022.

- Based on payload, the Europe small satellite market is segmented into automatic identification system (AIS), transmitter, imaging devices, and others. The automatic identification system (AIS) segment held the largest market share in 2022.

- Based on application, the Europe small satellite market is segmented into earth observation, communication and navigation, and scientific research. The earth observation segment held the largest market share in 2022.

- Based on vertical, the Europe small satellite market is segmented into government, military, and commercial. The commercial segment held the largest market share in 2022.

- Based on country, the Europe small satellite market is segmented into Germany, the UK, France, Italy, Russia, and the Rest of Europe. France dominated the market share in 2022.

Table of Contents

1. Introduction1.1 Study Scope

1.2 Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Europe Small Satellite Market Landscape

4.1 Market Overview

4.2 Porter’s Five Forces Analysis

4.2.1 Bargaining Power of Buyers

4.2.2 Bargaining Power of Suppliers

4.2.3 Threat to New Entrants

4.2.4 Threat to Substitutes

4.2.5 Competitive Rivalry

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. Europe Small Satellite Market - Key Market Dynamics

5.1 Market Drivers

5.1.1 Mounting Support for Development of Small Satellite

5.1.2 Growing Number of Partnerships and Contracts

5.2 Key Market Restraints

5.2.1 Absence of Small Satellite Manufacturers Across Emerging Regions

5.3 Key Market Opportunities

5.3.1 Increasing IoT and Communication Applications

5.3.2 Expanding Production of Smallest’s for Beyond LEO Orbit Launches

5.4 Future Trends

5.4.1 Growing Adoption of Small Satellites for Military Applications

5.5 Impact Analysis of Drivers and Restraints

6. Small Satellite Market - Europe Market Analysis

6.1 Small Satellite Market Europe Overview

6.2 Europe Small Satellite Market Forecast and Analysis

7. Europe Small Satellite Market Analysis - By Type

7.1 Overview

7.2 Small Satellite Market, By Type (2021 and 2028)

7.3 Nanosatellite (Upto 10 Kg)

7.3.1 Overview

7.3.2 Nanosatellite (Upto 10 Kg): Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

7.4 Microsatellite (10-150 Kg)

7.4.1 Overview

7.4.2 Microsatellite (10-150 Kg): Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

8. Europe Small Satellite Market Analysis - By Payload

8.1 Overview

8.2 Small Satellite Market, By Payload (2021 and 2028)

8.3 Automatic Identification System (AIS)

8.3.1 Overview

8.3.2 Automatic Identification System: Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

8.4 Transmitter

8.4.1 Overview

8.4.2 Transmitter: Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

8.5 Imaging Devices

8.5.1 Overview

8.5.2 Imaging Devices: Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

8.6 Others

8.6.1 Overview

8.6.2 Others: Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

9. Europe Small Satellite Market Analysis - By Application

9.1 Overview

9.2 Small Satellite Market Breakdown, by Application, (2021 and 2028)

9.3 Earth Observation

9.3.1 Overview

9.3.2 Earth Observation: Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

9.4 Communication and Navigation

9.4.1 Overview

9.4.2 Communication and Navigation: Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

9.5 Scientific Research

9.5.1 Overview

9.5.2 Scientific Research: Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

10. Europe Small Satellite Market Analysis - By Vertical

10.1 Overview

10.2 Small Satellite Market Breakdown, by Vertical, (2021 and 2028)

10.3 Government

10.3.1 Overview

10.3.2 Government: Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

10.4 Military

10.4.1 Overview

10.4.2 Military: Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

10.5 Commercial

10.5.1 Overview

10.5.2 Commercial: Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

11. Europe Small Satellite Market - by Country Analysis

11.1 Europe: Small Satellite Market

11.1.1 Europe: Small Satellite Market, by Key Country

11.1.1.1 Germany: Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

11.1.1.1.1 Germany: Small Satellite Market, By Type

11.1.1.1.2 Germany: Small Satellite Market, by Application

11.1.1.1.3 Germany: Small Satellite Market, by Payload

11.1.1.1.4 Germany: Small Satellite Market, by Vertical

11.1.1.2 France: Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

11.1.1.2.1 France: Small Satellite Market, By Type

11.1.1.2.2 France: Small Satellite Market, by Application

11.1.1.2.3 France: Small Satellite Market, by Payload

11.1.1.2.4 France: Small Satellite Market, by Vertical

11.1.1.3 Italy: Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

11.1.1.3.1 Italy: Small Satellite Market, By Type

11.1.1.3.2 Italy: Small Satellite Market, by Application

11.1.1.3.3 Italy: Small Satellite Market, by Payload

11.1.1.3.4 Italy: Small Satellite Market, by Vertical

11.1.1.4 UK: Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

11.1.1.4.1 UK: Small Satellite Market, By Type

11.1.1.4.2 UK: Small Satellite Market, by Application

11.1.1.4.3 UK: Small Satellite Market, by Payload

11.1.1.4.4 UK: Small Satellite Market, by Vertical

11.1.1.5 Russia: Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

11.1.1.5.1 Russia: Small Satellite Market, By Type

11.1.1.5.2 Russia: Small Satellite Market, by Application

11.1.1.5.3 Russia: Small Satellite Market, by Payload

11.1.1.5.4 Russia: Small Satellite Market, by Vertical

11.1.1.6 Rest of Europe: Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

11.1.1.6.1 Rest of Europe: Small Satellite Market, By Type

11.1.1.6.2 Rest of Europe: Small Satellite Market, by Application

11.1.1.6.3 Rest of Europe: Small Satellite Market, by Payload

11.1.1.6.4 Rest of Europe: Small Satellite Market, by Vertical

12. Industry Landscape

12.1 Overview

12.2 Market Initiative

12.3 New Product Development

12.4 Merger and Acquisition

13. Company Profiles

13.1 Dauria Aerospace

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 GomSpace Group AB

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Lockheed Martin Corp

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Northrop Grumman Corp

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Raytheon Technologies Corp

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Sierra Nevada Corp

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Surrey Satellite Technology Ltd

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Thales SA

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

13.9 Tyvak international SRL

13.9.1 Key Facts

13.9.2 Business Description

13.9.3 Products and Services

13.9.4 Financial Overview

13.9.5 SWOT Analysis

13.9.6 Key Developments

14. Appendix

14.1 About the Publisher

14.2 Word Index

Table 1. Europe Small Satellite Market, Revenue and Forecast, 2020-2028 (US$ Million)

Table 2. Germany: Small Satellite Market, By Type- Revenue and Forecast to 2028 (US$ Million)

Table 3. Germany: Small Satellite Market, by Application - Revenue and Forecast to 2028 (US$ Million)

Table 4. Germany: Small Satellite Market, by Payload - Revenue and Forecast to 2028 (US$ Million)

Table 5. Germany: Small Satellite Market, by Vertical - Revenue and Forecast to 2028 (US$ Million)

Table 6. France: Small Satellite Market, By Type- Revenue and Forecast to 2028 (US$ Million)

Table 7. France: Small Satellite Market, by Application - Revenue and Forecast to 2028 (US$ Million)

Table 8. France: Small Satellite Market, by Payload - Revenue and Forecast to 2028 (US$ Million)

Table 9. France: Small Satellite Market, by Vertical - Revenue and Forecast to 2028 (US$ Million)

Table 10. Italy: Small Satellite Market, By Type- Revenue and Forecast to 2028 (US$ Million)

Table 11. Italy: Small Satellite Market, by Application - Revenue and Forecast to 2028 (US$ Million)

Table 12. Italy: Small Satellite Market, by Payload - Revenue and Forecast to 2028 (US$ Million)

Table 13. Italy: Small Satellite Market, by Vertical - Revenue and Forecast to 2028 (US$ Million)

Table 14. UK: Small Satellite Market, By Type- Revenue and Forecast to 2028 (US$ Million)

Table 15. UK: Small Satellite Market, by Application - Revenue and Forecast to 2028 (US$ Million)

Table 16. UK: Small Satellite Market, by Payload - Revenue and Forecast to 2028 (US$ Million)

Table 17. UK: Small Satellite Market, by Vertical - Revenue and Forecast to 2028 (US$ Million)

Table 18. Russia: Small Satellite Market, By Type- Revenue and Forecast to 2028 (US$ Million)

Table 19. Russia: Small Satellite Market, by Application - Revenue and Forecast to 2028 (US$ Million)

Table 20. Russia: Small Satellite Market, by Payload - Revenue and Forecast to 2028 (US$ Million)

Table 21. Russia: Small Satellite Market, by Vertical - Revenue and Forecast to 2028 (US$ Million)

Table 22. Rest of Europe: Small Satellite Market, By Type- Revenue and Forecast to 2028 (US$ Million)

Table 23. Rest of Europe: Small Satellite Market, by Application - Revenue and Forecast to 2028 (US$ Million)

Table 24. Rest of Europe: Small Satellite Market, by Payload - Revenue and Forecast to 2028 (US$ Million)

Table 25. Rest of Europe: Small Satellite Market, by Vertical - Revenue and Forecast to 2028 (US$ Million)

Table 26. List of Abbreviation

Figure 1. Europe Small Satellite Market Segmentation

Figure 2. Europe Small Satellite Market Segmentation - by Country

Figure 3. Europe Small Satellite Market Overview

Figure 4. Europe Small Satellite Market, By Type

Figure 5. Europe Small Satellite Market, By Application

Figure 6. Europe Small Satellite Market, By Payload

Figure 7. Europe Small Satellite Market, By Vertical

Figure 8. Europe Small Satellite Market, By Country

Figure 9. Europe Porter’s Five Forces Analysis

Figure 10. Europe Small Satellite Market: Ecosystem Analysis

Figure 11. Europe Expert Opinion

Figure 12. Europe Small Satellite Market: Impact Analysis of Drivers and Restraints

Figure 13. Europe Small Satellite Market, Forecast and Analysis (US$ Million)

Figure 14. Europe Small Satellite Market Revenue Share, by Type (2021 and 2028)

Figure 15. Nanosatellite (Upto 10 Kg): Europe Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

Figure 16. Microsatellite (10-150 Kg): Europe Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

Figure 17. Europe Small Satellite Market Revenue Share, by Payload (2021 and 2028)

Figure 18. Automatic Identification System: Europe Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

Figure 19. Transmitter: Europe Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

Figure 20. Imaging Devices: Europe Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

Figure 21. Others: Europe Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

Figure 22. Europe Satellite Market Breakdown, by Application (2021 and 2028)

Figure 23. Earth Observation: Europe Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

Figure 24. Communication and Navigation: Europe Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

Figure 25. Scientific Research: Europe Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

Figure 26. Europe Small Satellite Market Breakdown, by Vertical (2021 and 2028)

Figure 27. Government: Europe Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

Figure 28. Military: Europe Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

Figure 29. Commercial: Europe Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

Figure 30. Europe: Small Satellite Market, by Country - Revenue (2021) (US$ Million)

Figure 31. Europe: Small Satellite Market Revenue Share, by Key Country (2021 & 2028)

Figure 32. Germany: Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

Figure 33. France: Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

Figure 34. Italy: Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

Figure 35. UK: Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

Figure 36. Russia: Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

Figure 37. Rest of Europe: Small Satellite Market - Revenue and Forecast to 2028 (US$ Million)

Companies Mentioned

- Dauria Aerospace

- GomSpace Group AB

- Lockheed Martin Corp

- Northrop Grumman Corp

- Raytheon Technologies Corp

- Sierra Nevada Corp

- Surrey Satellite Technology Ltd

- Thales SA

- Tyvak international SRL

Table Information

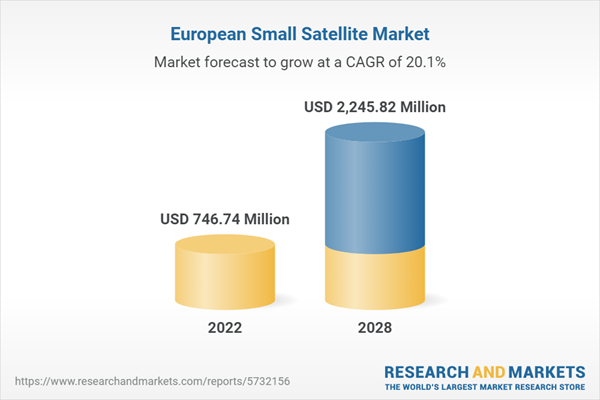

| Report Attribute | Details |

|---|---|

| No. of Pages | 141 |

| Published | January 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 746.74 Million |

| Forecasted Market Value ( USD | $ 2245.82 Million |

| Compound Annual Growth Rate | 20.1% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 9 |

![Satellite Payload Market by Payload Type [Communication (Laser/Optical, RF), Navigation (PNT, GNSS, Tracking, Augmentation), EO (Laser/Optical Cameras, Radar, Hyper & Multispectral Imaging)], Technology, Frequency, Satellite - Global Forecast to 2030 - Product Image](http://www.researchandmarkets.com/product_images/11415/11415688_60px_jpg/satellite_payload_market.jpg)

![LEO Satellite Market by Subsystem [Satellite Bus (Command & Data Handling, Electric Power System), Payload (Optical, Infrared, Radar), Solar Panel, Satellite Antenna], Satellite Mass, Application, End Use, Frequency, and Region - Global Forecast to 2030 - Product Image](http://www.researchandmarkets.com/product_images/12240/12240064_60px_jpg/leo_satellite_market.jpg)