A field programmable gate array (FPGA) is a type of integrated circuit (IC) that can be programmed and configured by the user or designer after manufacturing. It comprises programmable logic blocks (PLBs) and programmable interconnects that can be configured to create custom digital circuits, wherein PLBs contain look-up tables (LUTs), flip-flops, and other logic elements that can be interconnected to perform various logical operations. It also involves specifying the desired circuit design using a hardware description language (HDL), such as VHDL or Verilog. As it allows users to define and implement their own digital circuits and logic functions, the demand for FPGA is rising around the world.

At present, the growing demand for FPGAs, as they can provide high-performance computing capabilities and can handle complex algorithms and computations efficiently, is offering a favorable market outlook. Besides this, FPGAs offer parallel processing and can execute multiple tasks simultaneously, which makes them suitable for demanding applications like artificial intelligence (AI), data centers, and high-performance computing. This, along with the rising utilization of FPGAs to customize and reprogram the hardware functionality after fabrication, is propelling the growth of the market.

In addition, the increasing adoption of FPGAs in the telecommunications, aerospace, automotive, and defense industries for rapid prototyping, design modifications, and iterative development cycles is strengthening the growth of the market. Moreover, the growing demand for FPGAs, as they offer a faster time-to-market compared to traditional application-specific integrated circuits (ASICs), is positively influencing the market.

Field Programmable Gate Array (FPGA) Market Trends/Drivers:

Growing demand for artificial intelligence (AI) and machine learning (ML)A rise in the use of artificial intelligence (AI) and machine learning (ML) applications is catalyzing the demand for high-performance computing platforms. Moreover, these technologies process a large amount of data and perform complex calculations simultaneously. FPGAs, with their parallel processing capabilities, can accelerate AI and ML workloads and offer a viable alternative to graphics processing units (GPUs) or application-specific accelerators. They can be programmed and optimized for specific algorithms and tasks, thereby allowing efficient parallel processing and accelerated performance. In addition, developers can design and implement custom hardware accelerators with FPGAs, which can significantly enhance the performance and efficiency of AI and ML tasks.

Increasing complexity of electronics systems

The complexity of electronic systems is continuously growing across various industries. FPGAs provide a versatile platform for integrating multiple functions and interfaces into a single device, reducing the need for multiple components, and simplifying system design. They offer both parallel processing capabilities and the ability to implement custom logic, which allows designers to optimize performance for specific applications.As system complexity increases, FPGAs also assist in implementing complex algorithms and processing large amounts of data in real time. In addition, electronic systems are no longer standalone entities but are increasingly connected and integrated into larger systems or networks. As a result, FPGAs offer built-in features, such as high-speed transceivers, memory interfaces, and peripheral interfaces, which makes them suitable for system-level integration.

Rising demand for energy efficient and cost saving solutions

FPGAs can be power-efficient compared to general-purpose processors or ASICs. They can be optimized for specific tasks and reduce power consumption and overall system costs. This makes them useful for applications wherein power efficiency is critical, such as edge computing, the Internet of Things (IoT), and embedded systems. In addition, FPGAs are designed to perform parallel computations, allowing multiple operations to be executed simultaneously.This parallelism can lead to energy savings, as the same task can be accomplished with fewer clock cycles as compared to a sequential processor, which reduces overall power consumption. Moreover, FPGAs are more cost-effective, as they can be reprogrammed and reconfigured multiple times during the development process, eliminating the need for expensive and time-consuming fabrication processes.

Field Programmable Gate Array (FPGA) Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global field programmable gate array (FPGA) market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on architecture, configuration, and end use industry.Breakup by Architecture:

- SRAM-Based FPGA

- Anti-Fuse Based FPGA

- Flash-Based FPGA

SRAM-based FPGA dominate the market

The report has provided a detailed breakup and analysis of the market based on the architecture. This includes SRAM-based FPGA, anti-fuse based FPGA, and flash-based FPGA. According to the report, SRAM-based FPGA represented the largest segment as it is highly flexible and allows designers to configure the device according to their specific requirements.Moreover, SRAM-based FPGAs offer high-performance capabilities, as they use static random-access memory (SRAM) cells for configuration storage. SRAM cells can be quickly and easily reprogrammed, which allows for the efficient implementation of complex logic functions, memory structures, and high-speed interfaces. They also provide the ability to reprogram the device on the fly and enables designers to perform design iterations and debugging at the hardware level. The flexibility of SRAM-based FPGAs also allows for faster time-to-market. With SRAM-based FPGAs, designers can implement and validate their designs without the need for custom ASIC development or lengthy fabrication processes.

Breakup by Configuration:

- Low-range FPGA

- Mid-range FPGA

- High-range FPGA

Low-range FPGA holds the biggest market share

A detailed breakup and analysis of the market based on the configuration has also been provided in the report. This includes low-range FPGA, mid-range FPGA, and high-range FPGA. According to the report, low-range FPGA accounted for the largest market share as it is more cost-effective compared to its higher-end counterparts. It is often more affordable and can offer a balance between price and functionality, which makes it suitable for cost-sensitive applications.It consumes less power as compared to high-end FPGA. This lower power consumption can be advantageous in applications wherein power efficiency is critical, such as battery-powered devices or embedded systems. Moreover, it has simpler architecture and fewer features compared to high-end FPGAs, which can make it easier to understand, program, and integrate into designs, especially for beginners or projects with less complex requirements. It is also available in smaller form factors and makes them suitable for space-constrained applications.

Breakup by End Use Industry:

- IT and Telecommunication

- Consumer Electronics

- Automotive

- Industrial

- Military and Aerospace

- Others

IT and telecommunication accounts for the majority of the market share

A detailed breakup and analysis of the market based on the end use industry has also been provided in the report. This includes IT and telecommunication, consumer electronics, automotive, industrial, military and aerospace, and others. According to the report, IT and telecommunication accounted for the largest market share.FPGAs offer a high degree of flexibility in hardware design and functionality. They can be reprogrammed or reconfigured after manufacturing, allowing for quick prototyping, iterative design changes, and customization to meet specific application requirements. This flexibility is particularly valuable in the IT and telecommunication industry that experiences rapid technological advancements and evolving standards.

FPGAs also provide parallel processing capabilities that can be tailored to match the requirements of specific applications, making them suitable for demanding tasks, such as signal processing, data analytics, cryptography, and high-speed networking. Moreover, in telecommunications, they can be used in network switches, routers, and base stations to handle data packet routing and processing with minimal delay.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest field programmable gate array (FPGA) market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa.Asia Pacific held the biggest market share as it is a major manufacturing hub for electronic devices and components. As FPGAs are crucial components in various electronic systems, the demand for FPGAs is increasing in parallel with the growth of the semiconductor industry. Moreover, the growing adoption of advanced technologies and automation in industries, such as telecommunications, automotive, consumer electronics, and healthcare, is catalyzing the demand for FPGAs in the region, as they offer flexible and customizable solutions for these industries, which enables them to implement complex functionalities, enhance performance, and reduce time-to-market for their products.

Competitive Landscape:

The level of competition in the market is moderate with a moderate threat of new entrants. Established players have a long history of developing and refining FPGA technologies, which provides them with a competitive advantage. As for the threat of new entrants, it can be somewhat challenging for new companies to enter the FPGA market, as developing FPGA technology requires significant research and development (R&D) investments, as well as expertise in semiconductor design and manufacturing.The established players in the market have made substantial investments in these areas over many years, giving them a strong technological advantage. However, numerous advancements in technology and evolving market dynamics can create opportunities for new entrants, such as hybrid FPGAs, machine learning (ML) accelerators, and high-performance computing solutions.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Achronix Semiconductor

- Cypress Semiconductor Corporation (Infineon Technologies AG)

- Efinix Inc.

- EnSilica Limited

- Flex Logix Technologies Inc.

- Gidel Inc.

- Intel Corporation

- Lattice Semiconductor Corporation

- Microsemi Corporation (Microchip Technology Inc.)

- Quicklogic Corporation

- Taiwan Semiconductor Manufacturing Company

- Xilinx Inc.

Key Questions Answered in This Report:

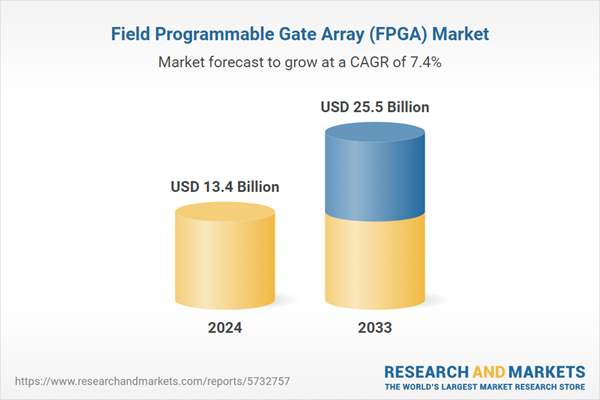

- What was the size of the global field programmable gate array (FPGA) market in 2024?

- What is the expected growth rate of the global field programmable gate array (FPGA) market during 2025-2033?

- What are the key factors driving the global field programmable gate array (FPGA) market?

- What has been the impact of COVID-19 on the global field programmable gate array (FPGA) market?

- What is the breakup of the global field programmable gate array (FPGA) market based on the architecture?

- What is the breakup of the global field programmable gate array (FPGA) market based on the configuration?

- What is the breakup of the global field programmable gate array (FPGA) market based on the end use industry?

- What are the key regions in the global field programmable gate array (FPGA) market?

- Who are the key players/companies in the global field programmable gate array (FPGA) market?

Table of Contents

Companies Mentioned

- Achronix Semiconductor

- Cypress Semiconductor Corporation (Infineon Technologies AG)

- Efinix Inc.

- EnSilica Limited

- Flex Logix Technologies Inc.

- Gidel Inc.

- Intel Corporation

- Lattice Semiconductor Corporation

- Microsemi Corporation (Microchip Technology Inc.)

- Quicklogic Corporation

- Taiwan Semiconductor Manufacturing Company

- Xilinx Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 146 |

| Published | April 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 13.4 Billion |

| Forecasted Market Value ( USD | $ 25.5 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |