Growth in the historic period resulted from increased healthcare access, the coronavirus outbreak, continuous protection towards infectious diseases and increased awareness of immunization.

Going forward, increasing cases of invasive cervical cancer, strong late-stage pipeline and new vaccine approvals, increasing prevalence of infectious diseases among children, emergence of zoonotic diseases and vaccine resistant mutations will drive the growth. Factors that could hinder the growth of the vaccines market in the future include skilled workforce shortages and high cost of vaccines.

The vaccines market is segmented by type into anti-infective vaccines, anti-cancer vaccines, and other types. The anti-infective vaccines market was the largest segment of the vaccines market segmented by type, accounting for 85.9% of the total in 2021. Going forward, the anti-cancer vaccines market is expected to be the fastest growing segment in the vaccines market segmented by type, at a CAGR of 10.7% during 2021-2026.

The vaccines market is segmented by technology into conjugate vaccines, inactivated and subunit vaccines, live attenuated vaccines, recombinant vaccines, toxoid vaccines, and other technologies. The conjugate vaccines market was the largest segment of the vaccines market segmented by technology accounting for 43.9% of the total in 2021. Going forward, the other technologies market is expected to be the fastest growing segment in the vaccines market segmented by technology, at a CAGR of 17.7% during 2021-2026.

The vaccines market is segmented by route of administration into intramuscular (IM), subcutaneous (SC), oral, and other route of administration. The intramuscular (IM) market was the largest segment of the vaccines market segmented by route of administration, accounting for 47.5% of the total in 2021. Going forward, the intramuscular (IM) market is expected to be the fastest growing segment in the vaccines market segmented by route of administration, at a CAGR of 11.0% during 2021-2026.

The vaccines market is segmented by valance into monovalent, and multivalent. The multivalent market was the largest segment of the vaccines market segmented by valance, accounting for 61.5% of the total in 2021. Going forward, the multivalent market is expected to be the fastest growing segment in the vaccines market segmented by valance, at a CAGR of 10.8% during 2021-2026.

The vaccines market is segmented by distribution channel into hospital pharmacies, retail pharmacies, and institutional sales. The hospital pharmacies market was the largest segment of the vaccines market segmented by distribution channel, accounting for 30.5% of the total in 2021. Going forward, the institutional sales market is expected to be the fastest growing segment in the vaccines market segmented by distribution channel, at a CAGR of 12.7% during 2021-2026.

North America was the largest region in the vaccines market, accounting for 53.7% of the total in 2021. It was followed by Asia Pacific, and then the other regions. Going forward, the fastest-growing regions in the vaccines market will be Middle East, and, South America where growth will be at CAGRs of 14.6% and 13.0% respectively. These will be followed by Asia Pacific, and, Africa where the markets are expected to grow at CAGRs of 11.6% and 10.9% respectively.

The vaccines market is highly consolidated with a small number of global players dominating the market. The key players in the market are focusing on expanding their operational and business presence in the vaccine market through development of advanced technologies, strategic collaborations and establishments of new production plants to meet the global demand. The top ten competitors in the market made up to 82.34% of the total market in 2021. Pfizer Inc. was the largest competitor with 46.03% share of the market, followed by Merck & Co., Inc. with 10.46%, GlaxoSmithKline plc with 9.77%, Sanofi S.A. with 8.06%, AstraZeneca with 4.57%, CSL Limited with 1.92%, Serum Institute of India Pvt. Ltd. with 0.54%, Emergent BioSolutions Inc. with 0.50%, Daiichi Sankyo Company, Limited with 0.37%, and Bavarian Nordic with 0.11%.

The top opportunities in the vaccines market segmented by type will arise in the anti-infective vaccines segment, which will gain $49,866.9 million of global annual sales by 2026. The top opportunities in segment by technology will arise in the conjugate vaccines segment, which will gain $26,610.1 million of global annual sales by 2026. The top opportunities in segment by route of administration will arise in the intramuscular (IM) segment, which will gain $30,201.7 million of global annual sales by 2026. The top opportunities in segment by valence will arise in the multivalent segment, which will gain $38,172.2 million of global annual sales by 2026. The top opportunities in segment by distribution channel will arise in the hospital pharmacies segment, which will gain $37,872.6 million of global annual sales by 2026. The vaccines market size will gain the most in the USA at $27,549.2 million.

Market-trend-based strategies for the vaccines market include focusing on synthetic biology to aid in drug discovery processes to help understand the molecular mechanisms of target diseases, developing combination vaccines for protection against multiple diseases, focusing on robust research and development to continuously strive to make breakthroughs, leveraging artificial intelligence for vaccine development, focusing on development of conjugate vaccines for the prevention of bacterial infections and focusing on partnerships and acquisitions for expanding market presence and reach.

Player-adopted strategies in the vaccines market include strengthening portfolio of products, expanding market presence through collaborations and partnerships, enhancing geographic presence through strategic acquisitions and focusing on new product launches.

To take advantage of the opportunities, the publisher recommends the companies in the vaccines market to focus on development of combination vaccines, focus on research and development, focus on artificial intelligence, expand in emerging markets, continue to focus on developed markets, focus on partnerships and collaborations, provide competitively priced offerings, participate in trade shows and events, continue to use business-to-business (B2B) promotions and continue to target fast-growing end-users.

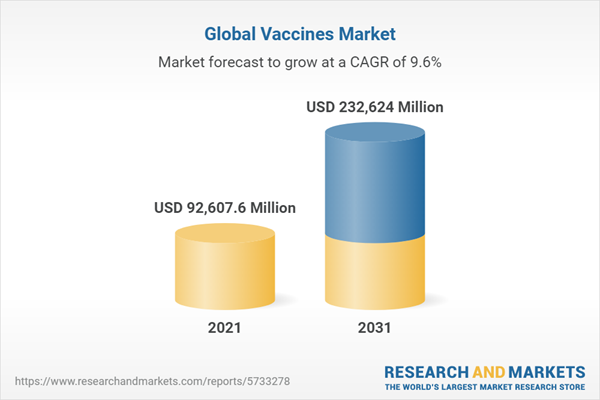

This report describes and explains the vaccines market and covers 2016 to 2021, termed the historic period, and 2021 to 2026 termed the forecast period, along with further forecasts for the period 2026-2031. The report evaluates the market across each region and for the major economies within each region.

Table of Contents

1. Executive Summary2. Table Of Contents

3. List Of Figures

4. List Of Tables

5. Report Structure

6. Introduction And Market Characteristics

6.1. General Market Definition

6.2. Summary

6.3. Vaccines Market Definition And Segmentations

6.4. Market Segmentation By Type

6.4.1. Anti-Infective Vaccines

6.4.2. Anti-Cancer Vaccines

6.4.3. Other Types

6.5. Market Segmentation By Technology

6.5.1. Conjugate Vaccines

6.5.2. Inactivated And Subunit Vaccines

6.5.3. Live Attenuated Vaccines

6.5.4. Recombinant Vaccines

6.5.5. Toxoid Vaccines

6.5.6. Other Technologies

6.6. Market Segmentation By Route Of Administration

6.6.1. Intramuscular (IM)

6.6.2. Subcutaneous (SC)

6.6.3. Oral

6.6.4. Other Route of Administration

6.7. Market Segmentation By Valance

6.7.1. Monovalent

6.7.2. Multivalent

6.8. Market Segmentation By Distribution Channel

6.8.1. Hospital Pharmacies

6.8.2. Retail Pharmacies

6.8.3. Institutional Sales

7. Major Market Trends

7.1. Synthetic Biology In Vaccine Development

7.2. Development Of Combination Vaccines

7.3. Robust Research And Development

7.4. Increasing Demand For Conjugate Vaccines

7.5. Artificial Intelligence In Vaccine Development

7.6. mRNA Vaccines

7.7. Cancer Vaccines

7.8. Increasing Acquisitions And Partnerships

8. Global Market Size And Growth

8.1. Market Size

8.2. Historic Market Growth, 2016 - 2021, Value ($ Million)

8.2.1. Market Drivers 2016 - 2021

8.2.2. Market Restraints 2016 - 2021

8.3. Forecast Market Growth, 2021 - 2026, 2031F Value ($ Million)

8.3.1. Market Drivers 2021 - 2026

8.3.2. Market Restraints 2021 - 2026

9. Global Vaccines Market Segmentation

9.1. Global Vaccines Market, Segmentation By Type, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

9.2. Global Vaccines Market, Segmentation By Technology, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

9.3. Global Vaccines Market, Segmentation By Route Of Administration, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

9.4. Global Vaccines Market, Segmentation By Valence, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

9.5. Global Vaccines Market, Segmentation By Distribution Channel, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

10. Vaccines Market, Regional and Country Analysis

10.1. Global Vaccines Market, By Region, Historic and Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

10.2. Global Vaccines Market, By Country, Historic and Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

11. Asia-Pacific Market

11.1. Summary

11.2. Market Overview

11.2.1. Region Information

11.2.2. Market Information

11.2.3. Background Information

11.2.4. Government Initiatives

11.2.5. Regulations

11.2.6. Regulatory Bodies

11.2.7. Major Associations

11.2.8. Taxes Levied

11.2.9. Corporate Tax Structure

11.2.10. Investments

11.2.11. Major Companies

11.3. Asia-Pacific Vaccines Market, Historic Market Growth, 2016 - 2021, Value ($ Million)

11.4. Asia-Pacific Vaccines Market, Forecast Market Growth, 2021 - 2026, 2031F Value ($ Million)

11.5. Asia-Pacific Vaccines Market, Segmentation By Type, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

11.6. Asia-Pacific Vaccines Market, Segmentation By Technology, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

11.7. Asia-Pacific Vaccines Market, Segmentation By Distribution Channel, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

11.8. Asia-Pacific Vaccines Market: Country Analysis

11.9. China Market

11.10. Summary

11.11. Market Overview

11.11.1. Country Information

11.11.2. Market Information

11.11.3. Background Information

11.11.4. Government Initiatives

11.11.5. Regulations

11.11.6. Regulatory Bodies

11.11.7. Major Associations

11.11.8. Taxes Levied

11.11.9. Corporate Tax Structure

11.11.10. Investments

11.11.11. Major Companies

11.12. China Vaccines Market, Historic Market Growth, 2016 - 2021, Value ($ Million)

11.13. China Vaccines Market, Forecast Market Growth, 2021 - 2026, 2031F Value ($ Million)

11.14. China Vaccines Market, Segmentation By Type, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

11.15. China Vaccines Market, Segmentation By Technology, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

11.16. China Vaccines Market, Segmentation By Distribution Channel, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

11.17. India Market

11.18. India Vaccines Market, Historic Market Growth, 2016 - 2021, Value ($ Million)

11.19. India Vaccines Market, Forecast Market Growth, 2021 - 2026, 2031F Value ($ Million)

11.20. India Vaccines Market, Segmentation By Type, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

11.21. India Vaccines Market, Segmentation By Technology, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

11.22. India Vaccines Market, Segmentation By Distribution Channel, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

11.23. Japan Market

11.24. Japan Vaccines Market, Historic Market Growth, 2016 - 2021, Value ($ Million)

11.25. Japan Vaccines Market, Forecast Market Growth, 2021 - 2026, 2031F Value ($ Million)

11.26. Japan Vaccines Market, Segmentation By Type, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

11.27. Japan Vaccines Market, Segmentation By Technology, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

11.28. Japan Vaccines Market, Segmentation By Distribution Channel, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

11.29. Australia Market

11.30. Australia Vaccines Market, Historic Market Growth, 2016 - 2021, Value ($ Million)

11.31. Australia Vaccines Market, Forecast Market Growth, 2021 - 2026, 2031F Value ($ Million)

11.32. Australia Vaccines Market, Segmentation By Type, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

11.33. Australia Vaccines Market, Segmentation By Technology, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

11.34. Australia Vaccines Market, Segmentation By Distribution Channel, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

11.35. Indonesia Market

11.36. Indonesia Vaccines Market, Historic Market Growth, 2016 - 2021, Value ($ Million)

11.37. Indonesia Vaccines Market, Forecast Market Growth, 2021 - 2026, 2031F Value ($ Million)

11.38. Indonesia Vaccines Market, Segmentation By Type, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

11.39. Indonesia Vaccines Market, Segmentation By Technology, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

11.40. Indonesia Vaccines Market, Segmentation By Distribution Channel, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

11.41. South Korea Market

11.42. South Korea Vaccines Market, Historic Market Growth, 2016 - 2021, Value ($ Million)

11.43. South Korea Vaccines Market, Forecast Market Growth, 2021 - 2026, 2031F Value ($ Million)

11.44. South Korea Vaccines Market, Segmentation By Type, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

11.45. South Korea Vaccines Market, Segmentation By Technology, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

11.46. South Korea Vaccines Market, Segmentation By Distribution Channel, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

12. Western Europe Market

12.1. Summary

12.2. Market Overview

12.2.1. Region Information

12.2.2. Market Information

12.2.3. Background Information

12.2.4. Government Initiatives

12.2.5. Regulations

12.2.6. Regulatory Bodies

12.2.7. Major Associations

12.2.8. Taxes Levied

12.2.9. Corporate Tax Structure

12.2.10. Investments

12.2.11. Major Companies

12.3. Western Europe Vaccines Market, Historic Market Growth, 2016 - 2021, Value ($ Million)

12.4. Western Europe Vaccines Market, Forecast Market Growth, 2021 - 2026, 2031F Value ($ Million)

12.5. Western Europe Vaccines Market, Segmentation By Type, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

12.6. Western Europe Vaccines Market, Segmentation By Technology, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

12.7. Western Europe Vaccines Market, Segmentation By Distribution Channel, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

12.8. Western Europe Vaccines Market: Country Analysis

12.9. UK Market

12.10. UK Market, Historic Market Growth, 2016 - 2021, Value ($ Million)

12.11. UK Vaccines Market, Forecast Market Growth, 2021 - 2026, 2031F Value ($ Million)

12.12. UK Vaccines Market, Segmentation By Type, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

12.13. UK Vaccines Market, Segmentation By Technology, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

12.14. UK Vaccines Market, Segmentation By Distribution Channel, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

12.15. Germany Market

12.16. Germany Vaccines Market, Historic Market Growth, 2016 - 2021, Value ($ Million)

12.17. Germany Vaccines Market, Forecast Market Growth, 2021 - 2026, 2031F Value ($ Million)

12.18. Germany Vaccines Market, Segmentation By Type, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

12.19. Germany Vaccines Market, Segmentation By Technology, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

12.20. Germany Vaccines Market, Segmentation By Distribution Channel, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

12.21. France Market

12.22. France Vaccines Market, Historic Market Growth, 2016 - 2021, Value ($ Million)

12.23. France Vaccines Market, Forecast Market Growth, 2021 - 2026, 2031F Value ($ Million)

12.24. France Vaccines Market, Segmentation By Type, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

12.25. France Vaccines Market, Segmentation By Technology, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

12.26. France Vaccines Market, Segmentation By Distribution Channel, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

13. Eastern Europe Market

13.1. Summary

13.2. Market Overview

13.2.1. Region Information

13.2.2. Market Information

13.2.3. Background Information

13.2.4. Government Initiatives

13.2.5. Regulations

13.2.6. Regulatory Bodies

13.2.7. Major Associations

13.2.8. Taxes Levied

13.2.9. Corporate Tax Structure

13.2.10. Investments

13.2.11. Major Companies

13.3. Eastern Europe Vaccines Market, Historic Market Growth, 2016 - 2021, Value ($ Million)

13.4. Eastern Europe Vaccines Market, Forecast Market Growth, 2021 - 2026, 2031F Value ($ Million)

13.5. Eastern Europe Vaccines Market, Segmentation By Type, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

13.6. Eastern Europe Vaccines Market, Segmentation By Technology, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

13.7. Eastern Europe Vaccines Market, Segmentation By Distribution Channel, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

13.8. Eastern Europe Vaccines Market: Country Analysis

13.9. Russia Market

13.10. Russia Vaccines Market, Historic Market Growth, 2016 - 2021, Value ($ Million)

13.11. Russia Vaccines Market, Forecast Market Growth, 2021 - 2026, 2031F Value ($ Million)

13.12. Russia Vaccines Market, Segmentation By Type, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

13.13. Russia Vaccines Market, Segmentation By Technology, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

13.14. Russia Vaccines Market, Segmentation By Distribution Channel, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

14. North America Market

14.1. Summary

14.2. Market Overview

14.2.1. Region Information

14.2.2. Market Information

14.2.3. Background Information

14.2.4. Government Initiatives

14.2.5. Regulations

14.2.6. Regulatory Bodies

14.2.7. Major Associations

14.2.8. Taxes Levied

14.2.9. Corporate Tax Structure

14.2.10. Investments

14.2.11. Major Companies

14.3. North America Vaccines Market, Historic Market Growth, 2016 - 2021, Value ($ Million)

14.4. North America Vaccines Market, Forecast Market Growth, 2021 - 2026, 2031F Value ($ Million)

14.5. North America Vaccines Market, Segmentation By Type, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

14.6. North America Vaccines Market, Segmentation By Technology, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

14.7. North America Vaccines Market, Segmentation By Distribution Channel, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

14.8. North America Vaccines Market: Country Analysis

14.9. USA Market

14.10. Summary

14.11. Market Overview

14.11.1. Country Information

14.11.2. Market Information

14.11.3. Background Information

14.11.4. Government Initiatives

14.11.5. Regulations

14.11.6. Regulatory Bodies

14.11.7. Major Associations

14.11.8. Taxes Levied

14.11.9. Corporate Tax Structure

14.11.10. Investments

14.11.11. Major Companies

14.12. USA Vaccines Market, Historic Market Growth, 2016 - 2021, Value ($ Million)

14.13. USA Vaccines Market, Forecast Market Growth, 2021 - 2026, 2031F Value ($ Million)

14.14. USA Vaccines Market, Segmentation By Type, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

14.15. USA Vaccines Market, Segmentation By Technology, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

14.16. USA Vaccines Market, Segmentation By Distribution Channel, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

15. South America Market

15.1. Summary

15.2. Market Overview

15.2.1. Region Information

15.2.2. Market Information

15.2.3. Background Information

15.2.4. Government Initiatives

15.2.5. Regulations

15.2.6. Regulatory Bodies

15.2.7. Major Associations

15.2.8. Taxes Levied

15.2.9. Corporate Tax Structure

15.2.10. Investments

15.2.11. Major Companies

15.3. South America Vaccines Market, Historic Market Growth, 2016 - 2021, Value ($ Million)

15.4. South America Vaccines Market, Forecast Market Growth, 2021 - 2026, 2031F Value ($ Million)

15.5. South America Vaccines Market, Segmentation By Type, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

15.6. South America Vaccines Market, Segmentation By Technology, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

15.7. South America Vaccines Market, Segmentation By Distribution Channel, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

15.8. South America Vaccines Market: Country Analysis

15.9. Brazil Market

15.10. Brazil Vaccines Market, Historic Market Growth, 2016 - 2021, Value ($ Million)

15.11. Brazil Vaccines Market, Forecast Market Growth, 2021 - 2026, 2031F Value ($ Million)

15.12. Brazil Vaccines Market, Segmentation By Type, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

15.13. Brazil Vaccines Market, Segmentation By Technology, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

15.14. Brazil Vaccines Market, Segmentation By Distribution Channel, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

16. Middle East Market

16.1. Summary

16.2. Market Overview

16.2.1. Region Information

16.2.2. Market Information

16.2.3. Background Information

16.2.4. Government Initiatives

16.2.5. Regulations

16.2.6. Regulatory Bodies

16.2.7. Major Associations

16.2.8. Taxes Levied

16.2.9. Corporate Tax Structure

16.2.10. Investments

16.2.11. Major Companies

16.3. Middle East Vaccines Market, Historic Market Growth, 2016 - 2021, Value ($ Million)

16.4. Middle East Vaccines Market, Forecast Market Growth, 2021 - 2026, 2031F Value ($ Million)

16.5. Middle East Vaccines Market, Segmentation By Type, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

16.6. Middle East Vaccines Market, Segmentation By Technology, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

16.7. Middle East Vaccines Market, Segmentation By Distribution Channel, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

17. Africa Market

17.1. Summary

17.2. Market Overview

17.2.1. Region Information

17.2.2. Market Information

17.2.3. Background Information

17.2.4. Government Initiatives

17.2.5. Regulations

17.2.6. Regulatory Bodies

17.2.7. Major Associations

17.2.8. Taxes Levied

17.2.9. Corporate Tax Structure

17.2.10. Investments

17.2.11. Major Companies

17.3. Africa Vaccines Market, Historic Market Growth, 2016 - 2021, Value ($ Million)

17.4. Africa Vaccines Market, Forecast Market Growth, 2021 - 2026, 2031F Value ($ Million)

17.5. Africa Vaccines Market, Segmentation By Type, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

17.6. Africa Vaccines Market, Segmentation By Technology, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

17.7. Africa Vaccines Market, Segmentation By Distribution Channel, Historic And Forecast, 2016 - 2021, 2026F, 2031F, Value ($ Million)

18. Competitive Landscape and Company Profiles

19. Company Profiles

19.1. Pfizer Inc

19.1.1. Company Overview

19.1.2. Products And Services

19.1.3. Business Strategy

19.1.4. Financial Overview

19.2. Merck & Co., Inc

19.2.1. Company Overview

19.2.2. Products And Services

19.2.3. Business Strategy

19.2.4. Financial Overview

19.3. GlaxoSmithKline plc

19.3.1. Company Overview

19.3.2. Products And Services

19.3.3. Business Strategy

19.3.4. Financial Overview

19.4. Sanofi S. A

19.4.1. Company Overview

19.4.2. Products And Services

19.4.3. Business Strategy

19.4.4. Financial Overview

19.5. AstraZeneca plc

19.5.1. Company Overview

19.5.2. Products And Services

19.5.3. Business Strategy

19.5.4. Financial Overview

20. Pipeline Analysis

21. Key Mergers And Acquisitions

21.1. GSK plc Acquired Affinivax Inc

21.2. Ceva Santé Animale Acquired Artemis Technologies Inc.

21.3. Pfizer Inc. Acquired ReViral Ltd.

21.4. NEC OncoImmunity AS Acquired Vaximm AG’s Neoantigen Vaccine Development Assets.

21.5. Sanofi S. A. To Acquire Origimm Biotechnology GmbH

21.6. Vaccitech plc Acquired Avidea Technologies, Inc.

21.7. Shanghai Fosun Pharmaceutical Co., Ltd. Acquired Chengdu Antejin Biotech Co. Ltd.

21.8. Sanofi S. A. Acquired Translate Bio, Inc.

21.9. Thermo Fisher Scientific Inc. Acquired Viral Vector Manufacturing Business from Novasep SAS

21.10. Merck KGaA’s Life Sciences Company MilliporeSigma Acquired AmpTec

21.11. Sanofi S. A. Acquired Kymab Ltd

21.12. BioNTech SE Acquired GMP Certified Manufacturing Site of Novartis AG

21.13. GlaxoSmithKline plc Acquired 10% Stake In CureVac For $163.67 million

21.14. Merck & Co., Inc. Acquired Themis Bioscience GmbH

21.15. Novavax, Inc. Acquired Praha Vaccines For $167 million

21.16. Bavarian Nordic A/S Acquired Global Rights for Two Vaccines from GSK For $940.07 Million

21.17. Bharat Biotech International Limited Acquired Chiron Behring Vaccines from GlaxoSmithKline

22. Global Vaccines Market Opportunities And Strategies

22.1. Global Vaccines Market In 2026 - Countries Offering Most New Opportunities

22.2. Global Vaccines Market In 2026 - Segments Offering Most New Opportunities

22.3. Global Vaccines Market In 2026 - Growth Strategies

22.3.1. Market Trend Based Strategies

22.3.2. Competitor Strategies

23. Vaccines Market, Conclusions And Recommendations

23.1. Conclusions

23.2. Recommendations

23.2.1. Product

23.2.2. Place

23.2.3. Price

23.2.4. Promotion

23.2.5. People

24. Appendix

24.1. Market Data Sources

24.2. Research Methodology

24.3. Currencies

24.4. About the Publisher

24.5. Copyright and Disclaimer

Executive Summary

Vaccines Global Market Opportunities And Strategies To 2031 provides the strategists; marketers and senior management with the critical information they need to assess the global vaccines market as it emerges from the COVID-19 shut down.Reasons to Purchase

- Gain a truly global perspective with the most comprehensive report available on this market covering 12 geographies.

- Understand how the market is being affected by the coronavirus and how it is likely to emerge and grow as the impact of the virus abates.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market research findings.

- Benchmark performance against key competitors.

- Utilize the relationships between key data sets for superior strategizing.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis

The report covers market characteristics; size and growth; segmentation; regional and country breakdowns; competitive landscape; market shares; trends and strategies for this market. It traces the market’s history and forecasts market growth by geography. It places the market within the context of the wider vaccines market; and compares it with other markets.

The report covers the following chapters:

- Introduction and Market Characteristics: Brief introduction to the segmentations covered in the market, definitions and explanations about vaccines market.

- Key Trends: Highlights the major trends shaping the global vaccines market. This section also highlights likely future developments in the market.

- Global Market Size and Growth: Global historic (2016-2021) and forecast (2021-2026), and (2026-2031) market values, and drivers and restraints that support and control the growth of the market in the historic and forecast periods.

- Regional Analysis: Historic (2016-2021) and forecast (2021-2026), and (2026-2031) market values and growth and market share comparison by region.

- Market Segmentation: Contains the market values (2016-2031) and analysis for for segment by type, segmentation by technology, segmentation by route of administration, segmentation by valance and segmentation by distribution channel in the market.

- Regional Market Size and Growth: Regional market size (2021), historic (2016-2021) and forecast (2021-2026), and (2026-2031) market values, and growth and market share comparison of countries within the region. This report includes information on all the regions Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa and major countries within each region.

- Competitive Landscape: Details on the competitive landscape of the market, estimated market shares and company profiles of the leading players.

- Pipeline Analysis: Briefs on the pipeline analysis of vaccines from the major players in the market.

- Key Mergers and Acquisitions: Information on recent mergers and acquisitions in the market covered in the report. This section gives key financial details of mergers and acquisitions, which have shaped the market in recent years.

- Market Opportunities And Strategies - Describes market opportunities and strategies based on findings of the research, with information on growth opportunities across countries, segments and strategies to be followed in those markets.

- Conclusions And Recommendations - This section Includes recommendations for vaccines providers in terms of product/service offerings, geographic expansion, marketing strategies and target groups.

- Appendix: This section includes details on the NAICS codes covered, abbreviations and currencies codes used in this report.

Scope

Markets Covered

1) By Type: Anti-Infective Vaccines; Anti-Cancer Vaccines; Other Types2) By Technology: Conjugate Vaccines; Inactivated And Subunit Vaccines; Live Attenuated Vaccines; Recombinant Vaccines; Toxoid Vaccines; Other Technologies

3) By Route Of Administration: Intramuscular (IM); Subcutaneous (SC); Oral; Other Route of Administration

4) By Valance: Monovalent; Multivalent

5) By Distribution Channel: Hospital Pharmacies; Retail Pharmacies; Institutional Sales

Companies Mentioned: Pfizer Inc.; Merck & Co., Inc.; GlaxoSmithKline plc; Sanofi S.A.; AstraZeneca

Countries: China; Australia; India; Indonesia; Japan; South Korea; USA; Brazil; France; Germany; UK; Russia

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time-series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets; GDP proportions; expenditure per capita; vaccines indicators comparison.

Data segmentations: country and regional historic and forecast data; market share of competitors; vaccines market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Companies Mentioned

- Pfizer Inc.

- Merck & Co., Inc.

- GlaxoSmithKline plc

- Sanofi S.A.

- AstraZeneca

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 343 |

| Published | January 2023 |

| Forecast Period | 2021 - 2031 |

| Estimated Market Value ( USD | $ 92607.6 Million |

| Forecasted Market Value ( USD | $ 232624 Million |

| Compound Annual Growth Rate | 9.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 5 |