Speak directly to the analyst to clarify any post sales queries you may have.

Parenteral nutrition is also called the intravenous administration of nutrition, which includes carbohydrates, proteins, fat, electrolytes, mineral, fat, vitamins, water, and other trace elements. Parenteral nutrition (PN) is used to deliver nutritional supply to patients who cannot tolerate enteral or oral nutrition delivery. There are two types of parenteral nutrition: total and partial parenteral. Depending on the patient's conditions and nutritional health status, the patient can receive total or partial parenteral nutrition in healthcare settings.

MARKET TRENDS & DRIVERS

Availability of Standardized and Commercial Parenteral Nutrition Solutions

- The increasing demand for personalized and commercial medicine in the healthcare industry is a growing trend addressed in recent years. The growing preference for standardized and commercial parenteral nutrition solutions gives a new shape to the parenteral nutrition market.

- Standardized parenteral nutrition products are convenient and flexible for healthcare services it can be given to patients without compounding in-house. Standardized and commercial parenteral nutrition products can be sourced as institution-specific standardized formulations, patient-specific customized, or commercially available products. The demand for standardized and commercial parenteral nutrition has been increasing in recent years due to beneficiaries associated with the products. These solutions offer several advantages to healthcare organizations, including stability & compatibility and minimal manipulation.

Increasing Targeted Patient Population

- Parenteral nutrition treats and manages various chronic conditions, malnourished patient populations, and emergency medical conditions. Worldwide, the increasing patient population drives the demand for nutritional support in healthcare services such as hospitals, clinics, and home care settings. Globally, the increasing prevalence of chronic conditions is one of the major factors that drive the significant demand for hospitalization where patients demand nutritional support due to the increasing illness or inability to meet the nutritional demand. On another side, the increasing poverty led to various medical conditions and demand for parenteral conditions.

- Cancer is one of the leading causes of death accounted for at the global level. In 2020, more than 18 million cancer cases were registered worldwide. Among cancer patients, malnutrition is a common condition that requires external nutrition support. Around 1.8 million people with cancer die just due to malnutrition. The higher prevalence of malnutrition among cancer patients drives the parenteral nutrition market growth.

INDUSTRY RESTRAINTS

Complications Associated with Parenteral Nutrition

Parenteral nutrition is a complex procedure to feed the external nutritional support for the patients. Most hospitalized patients receive parenteral nutrition due to the hospital's associated malnutrition and medical condition. Both factors are challenging for parenteral nutrition delivery. The most vital complication of parenteral nutrition support is the failure to achieve the desired goals due to inadequate monitoring. Due to the higher risk of complications associated with parenteral nutrition, it is given less prominence than enteral nutrition, which hampers the parenteral nutrition market growth. The primary and major concerns related to parenteral nutrition are infection of the bloodstream from the atrophy of the digestive tract when it isn’t being used and IV catheter.SEGMENTATION INSIGHTS

INSIGHTS BY NUTRIENTS

The global parenteral nutrition market is segmented into macronutrients, automated compounds, and micronutrients by the nutrient category. The macronutrients segment accounted for a 66.65% higher market share in the parenteral nutrition market and dominated the other segment in 2021. Macronutrients include lipids and amino acids. Lipids and amino acids are majorly used ingredients in parenteral nutrition solutions as energy-dese solutions and support body function and rapidly improve body physics. Lipids and amino acids are used in parenteral nutrition as per their characteristics in improving nutritional health through parenteral nutrition. Moreover, the maximum number of products available in the market by manufacturers and market players are based on macronutrients, which further accelerates the macronutrient segment growth.

- The global parenteral nutrition market by automated compounds was valued at USD 1.35 billion in 2021. The advancement in automated compounds in parenteral nutrition recently becomes more popular in pediatric parenteral nutrition. Parenteral nutrition compounding is automated using volumetric pump systems in major hospitals and healthcare settings. In most US hospitals and healthcare settings, more than 65% of hospitals use automated compounding devices.

Segmentation by Nutrients

- Macronutrients

- Automated Compounds

- Micronutrients

INSIGHTS BY PATIENT TYPE

The parenteral nutrition market is segmented into the pediatric and adult segment by patient type. The pediatric segment accounts for a 55.05% major market share and is expected to dominate the adult segment during the forecast period. The significant number of the targeted preterm patient population, rising low birth weight concern, and malnutrition fuel the demand for parenteral nutrition supply over the adults. In addition, the advancement in trace elements and new products for pediatric parenteral nutrition accelerates segmental growth.Segmentation by Patient Group

- Pediatric Patient Group

- Adult Patient Group

INSIGHTS BY INDICATION

- The global parenteral nutrition market is segmented into short-term and long-term segments by indication. The short-term segment dominates the market with a 55.41% higher share. Globally, the increasing prevalence of cancer, metabolic disorders, gut failure, and malnutrition significantly drive the demand for healthcare services and receiving parenteral nutrition.

- By long-term indication, the global parenteral nutrition market was valued at USD 3.20 billion in 2021. Long-term parenteral nutrition is a highly demanding medical nutrition therapy delivered through the intravenous route for a long time as per the patient’s requirement. With the increasing prevalence of gastrointestinal disorders, patients go through several medications and treatments that impact the digestive system's functional ability and demand for parenteral nutrition. The recovery from digestive system injury or surgery takes significant time to get normal health and drives the high demand for long-term parenteral nutrition supply.

Segmentation by Indication

- Short-Term

- Long-Term

INSIGHTS BY END USER

- The hospital segment accounted for a 47.57% share of the parenteral nutrition market in 2021 and dominated the end-user segment. The rising prevalence of malnutrition, diseases-related malnutrition, and hospital-associated malnutrition conditions significantly demand parenteral nutrition. Hospitals are a primary and well-established infrastructure for a longer stay if the patient suffers from any medical condition or procedure illness. Baxter, the leading industry player, stated that around 2 million approximated hospitals in the US involve in malnutrition prevalence.

- The global parenteral nutrition market by ambulatory care settings was valued at USD 3.13 billion in 2021. In the ambulatory care settings segment, clinics and external healthcare services are included. In developing countries or emerging markets, malnutrition poses a significant cost burden on patients. So patients looking to avoid long hospital stays opt for other healthcare settings. In such a scenario, clinics and ambulatory care settings play a vital role in parenteral nutrition deliveries. Clinical nutrition is a major part of healthcare services for patients suffering from chronic illness. Also, the high-cost burden in a hospital setting for parenteral nutrition deliveries and longer stays change the patient preference for care to ambulatory care settings.

Segmentation by End-users

- Hospitals

- Ambulatory Care Settings

- Others

GEOGRAPHICAL ANALYSIS

- North America dominates the global parenteral nutrition market accounting for an industry share of 41.05%. The factors that drive the industry growth in the region are the high research expenditure by the companies, government authorities, and private entities in the nutrition sector that give the region significant access to parenteral nutrition services. In addition, the high healthcare expenditure and acceptance of home parenteral and other nutrition therapies across the US anticipated higher parenteral nutrition market growth in the region.

- APAC's parenteral nutrition market was valued at USD 2.09 billion in 2021. The region is a growing parenteral nutrition market with an increasingly aging population, research and development in clinical nutrition, and regional healthcare infrastructure growth. The prevalence of chronic disorders such as cancer, diabetes, gastrointestinal disorders, kidney failure, and cardiovascular diseases showed that the region's highest patient population demands care services and drives the parenteral nutrition market.

Segmentation by Geography

- APAC

- China

- India

- Japan

- South Korea

- Australia

- Europe

- Germany

- Italy

- Spain

- France

- UK

- North America

- US

- Canada

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- Turkey

- South Africa

- South Arabia

VENDOR LANDSCAPE

Baxter, B. Braun Melsungen, Baxter, Fresenius Kabi, JW Pharmaceutical, and Kelun Pharmaceuticals are some of the leading players in the parenteral nutrition market. These companies account for the higher market share and show high industry penetration by offering advanced and quality solutions. On the other hand, emerging industry players and new start-ups are trying to achieve a solid customer base and market expansion. The presence of emerging industry players positively influences the competition in the global parenteral nutrition market. The primary competition among the industry players accounted due to new product launches, emerging, and gold standard formulations.Key Company Profiles

- Baxter

- B. Braun Melsungen

- Fresenius Kabi

- JW Pharmaceuticals

- Sichuan Kelun Pharmaceuticals

Other Prominent Vendors

- Aculife

- Albert David

- Amanta Healthcare

- American Reagent

- BML PARENTERAL DRUGS

- Caritas Healthcare

- Eurofarma

- EuroLife Healthcare Pvt. Ltd.

- Farmoterapica

- Grifol

- ICU Medical

- Otsuka Pharmaceutical

- Soleo Health

- REVIV

- Pfizer

- Vifor Pharma

KEY QUESTIONS ANSWERED

1. How big is the parenteral nutrition market?2. What is the growth rate of the global parenteral nutrition market?

3. Which region holds the most prominent global parenteral nutrition market share?

4. Who are the key players in the global parenteral nutrition market?

5. What are the key driving factors for the growth of the parenteral nutrition market?

Table of Contents

1 Research Methodology2 Research Objectives

3 Research Process

4 Scope & Coverage

4.1 Market Definition

4.1.1 Inclusions

4.1.2 Exclusions

4.1.3 Market Estimation Caveats

4.2 Base Year

4.3 Scope of the Study

4.3.1 Market by Nutrients

4.3.2 Market by Indication

4.3.3 Market by Patient Group

4.3.4 Market by End-Users

4.3.5 Market Segmentation by Geography

5 Report Assumptions & Caveats

5.1 Key Caveats

5.2 Currency Conversion

5.3 Market Derivation

6 Market at a Glance

7 Introduction

7.1 Overview

7.1.1 Economic Impact of Malnutrition & Growth of Parenteral Nutrition

8 Premium Insights

8.1 Overview

9 Market Opportunities & Trends

9.1 Advances in Trace Elements for Parenteral Nutrition

9.2 Availability of Standardized and Commercial Parenteral Nutrition Solutions

9.3 Growth in Preference for Home Parenteral Nutrition

10 Market Growth Enablers

10.1 Increasing Prevalence of Chronic Disorders

10.2 Increasing Prevalence of Malnutrition

10.3 Increasing Target Patient Population

11 Market Restraints

11.1 Parenteral Nutrition Challenges in Preterm Infants and Children

11.2 Availability of Alternative Nutrition Care Methods

11.3 Complications Associated with Parenteral Nutrition

12 Market Landscape

12.1 Market Overview

12.1.1 Nutrients Insights

12.1.2 Patient Group Insights

12.1.3 Indication Insights

12.1.4 End-Users Insights

12.1.5 Geography Insights

12.2 Market Size & Forecast

12.3 Five Forces Analysis

12.3.1 Threat of New Entrants

12.3.2 Bargaining Power of Suppliers

12.3.3 Bargaining Power of Buyers

12.3.4 Threat of Substitutes

12.3.5 Competitive Rivalry

13 Nutrients

13.1 Market Snapshot & Growth Engine

13.2 Market Overview

13.3 Macronutrients

13.3.1 Market Overview

13.3.2 Market Size & Forecast

13.3.3 Market by Geography

13.4 Automated Compounds

13.4.1 Market Overview

13.4.2 Market Size & Forecast

13.4.3 Market by Geography

13.5 Micronutrients

13.5.1 Market Overview

13.5.2 Market Size & Forecast

13.5.3 Market by Geography

14 Indication

14.1 Market Snapshot & Growth Engine

14.2 Market Overview

14.3 Short-Term

14.3.1 Market Overview

14.3.2 Market Size & Forecast

14.3.3 Market by Geography

14.4 Long-Term

14.4.1 Market Overview

14.4.2 Market Size & Forecast

14.4.3 Market by Geography

15 Patient Group

15.1 Market Snapshot & Growth Engine

15.2 Market Overview

15.1 Pediatric

15.1.1 Market Overview

15.1.2 Market Size & Forecast

15.1.3 Market by Geography

15.2 Adult

15.2.1 Market Overview

15.2.2 Market Size & Forecast

15.2.3 Market by Geography

16 End-Users

16.1 Market Snapshot & Growth Engine

16.2 Market Overview

16.3 Hospitals

16.3.1 Market Overview

16.3.2 Market Size & Forecast

16.3.3 Market by Geography

16.4 Ambulatory Care Settings

16.4.1 Market Overview

16.4.2 Market Size & Forecast

16.4.3 Market by Geography

16.5 Others

16.5.1 Market Overview

16.5.2 Market Size & Forecast

16.5.3 Market by Geography

17 Geography

17.1 Market Snapshot & Growth Engine

17.2 Geographic Overview

18 North America

18.1 Market Overview

18.2 Market Size & Forecast

18.3 Nutrients

18.3.1 Market Size & Forecast

18.4 Indication

18.4.1 Market Size & Forecast

18.5 Patient Group

18.5.1 Market Size & Forecast

18.6 End-Users

18.6.1 Market Size & Forecast

18.7 Key Countries

18.7.1 Us: Market Size & Forecast

18.7.2 Canada: Market Size & Forecast

19 APAC

19.1 Market Overview

19.2 Market Size & Forecast

19.3 Nutrients

19.3.1 Market Size & Forecast

19.4 Indication

19.4.1 Market Size & Forecast

19.5 Patient Group

19.5.1 Market Size & Forecast

19.6 End-Users

19.6.1 Market Size & Forecast

19.7 Key Countries

19.7.1 China: Market Size & Forecast

19.7.2 Japan: Market Size & Forecast

19.7.3 India: Market Size & Forecast

19.7.4 South Korea: Market Size & Forecast

19.7.5 Australia: Market Size & Forecast

20 Europe

20.1 Market Overview

20.2 Market Size & Forecast

20.3 Nutrients

20.3.1 Market Size & Forecast

20.4 Indication

20.4.1 Market Size & Forecast

20.5 Patient Group

20.5.1 Market Size & Forecast

20.6 End-Users

20.6.1 Market Size & Forecast

20.7 Key Countries

20.7.1 Germany: Market Size & Forecast

20.7.2 France: Market Size & Forecast

20.7.3 Uk: Market Size & Forecast

20.7.4 Italy: Market Size & Forecast

20.7.5 Spain: Market Size & Forecast

21 Latin America

21.1 Market Overview

21.2 Market Size & Forecast

21.3 Nutrients

21.3.1 Market Size & Forecast

21.4 Indication

21.4.1 Market Size & Forecast

21.5 Patient Group

21.5.1 Market Size & Forecast

21.6 End-Users

21.6.1 Market Size & Forecast

21.7 Key Countries

21.7.1 Brazil: Market Size & Forecast

21.7.2 Mexico: Market Size & Forecast

21.7.3 Argentina: Market Size & Forecast

22 Middle East & Africa

22.1 Market Overview

22.2 Market Size & Forecast

22.3 Nutrients

22.3.1 Market Size & Forecast

22.4 Indication

22.4.1 Market Size & Forecast

22.5 Patient Group

22.5.1 Market Size & Forecast

22.6 End-Users

22.6.1 Market Size & Forecast

22.7 Key Countries

22.7.1 Turkey: Market Size & Forecast

22.7.2 South Africa: Market Size & Forecast

22.7.3 Saudi Arabia: Market Size & Forecast

23 Competitive Landscape

23.1 Competition Overview

23.2 Market Share Analysis

23.2.1 Baxter

23.2.2 B. Braun Melsungen

23.2.3 Fresenius Kabi

23.2.4 Jw Pharmaceutical

23.2.5 Sichuan Kelun Pharmaceutical Co. Ltd.

24 Key Company Profiles

24.1 Baxter

24.1.1 Business Overview

24.1.2 Product Offerings

24.1.3 Key Strategies

24.1.4 Key Strengths

24.1.5 Key Opportunities

24.2 B. Braun Melsungen

24.2.1 Business Overview

24.2.2 Product Offerings

24.2.3 Key Strategies

24.2.4 Key Strengths

24.2.5 Key Opportunities

24.3 Fresenius Kabi

24.3.1 Business Overview

24.3.2 Product Offerings

24.3.3 Key Strategies

24.3.4 Key Strengths

24.3.5 Key Opportunities

24.4 Jw Pharmaceutical

24.4.1 Business Overview

24.4.2 Product Offerings

24.4.3 Key Strategies

24.4.4 Key Strengths

24.4.5 Key Opportunities

24.5 Sichuan Kelun Pharmaceutical Co. Ltd.

24.5.1 Business Overview

24.5.2 Product Offerings

24.5.3 Key Strategies

24.5.4 Key Strengths

24.5.5 Key Opportunities

25 Other Prominent Vendors

25.1 Aculife

25.1.1 Business Overview

25.1.2 Product Offerings

25.2 Albert David

25.2.1 Business Overview

25.2.2 Product Offerings

25.3 Amanta Healthcare

25.3.1 Business Overview

25.3.2 Product Offerings

25.4 American Reagent

25.4.1 Business Overview

25.4.2 Product Offerings

25.5 Bml Parenteral Drugs

25.5.1 Business Overview

25.5.2 Product Offerings

25.6 Caritas Healthcare

25.6.1 Business Overview

25.6.2 Product Offerings

25.7 Eurofarma

25.7.1 Business Overview

25.7.2 Product Offerings

25.8 Eurolife Healthcare

25.8.1 Business Overview

25.8.2 Product Offerings

25.9 Farmoterapica

25.9.1 Business Overview

25.9.2 Product Offerings

25.10 Grifols S.A.

25.10.1 Business Overview

25.10.2 Product Offerings

25.11 Icu Medical

25.11.1 Business Overview

25.11.2 Product Offerings

25.12 Otsuka Pharmaceutical

25.12.1 Business Overview

25.12.2 Product Offerings

25.13 Soleo Health

25.13.1 Business Overview

25.13.2 Product Offerings

25.14 Reviv

25.14.1 Business Overview

25.14.2 Product Offerings

25.15 Pfizer

25.15.1 Business Overview

25.15.2 Product Offerings

25.16 Vifor Pharma

25.16.1 Business Overview

25.16.2 Product Offerings

26 Report Summary

26.1 Key Takeaways

26.2 Strategic Recommendations

27 Quantitative Summary

27.1 Market by Geography

27.2 Market by Nutrients

27.3 Market by Indication

27.4 Market by Patient Group

27.5 Market by End-User

27.6 Nutrients: Market by Geography

27.6.1 Macronutrients: Market by Geography

27.6.2 Automated Compounds: Market by Geography

27.6.3 Micronutrients: Market by Geography

27.7 Indication: Market by Geography

27.7.1 Short-Term: Market by Geography

27.7.2 Long-Term: Market by Geography

27.8 Patient Group: Market by Geography

27.8.1 Pediatric: Market by Geography

27.8.2 Adult: Market by Geography

27.9 End-Users: Market by Geography

27.9.1 Hospitals: Market by Geography

27.9.2 Ambulatory Care Centers: Market by Geography

27.9.3 Others: Market by Geography

28 Appendix

28.1 Abbreviations

Companies Mentioned

- Baxter

- B. Braun Melsungen

- Fresenius Kabi

- JW Pharmaceuticals

- Sichuan Kelun Pharmaceuticals

- Aculife

- Albert David

- Amanta Healthcare

- American Reagent

- BML PARENTERAL DRUGS

- Caritas Healthcare

- Eurofarma

- EuroLife Healthcare Pvt. Ltd.

- Farmoterapica

- Grifol

- ICU Medical

- Otsuka Pharmaceutical

- Soleo Health

- REVIV

- Pfizer

- Vifor Pharma

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

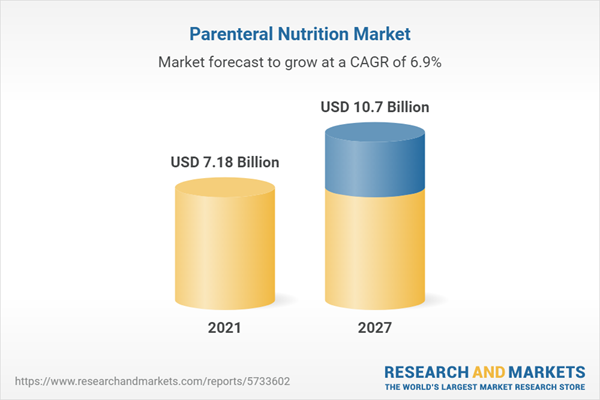

| Report Attribute | Details |

|---|---|

| No. of Pages | 289 |

| Published | February 2023 |

| Forecast Period | 2021 - 2027 |

| Estimated Market Value ( USD | $ 7.18 Billion |

| Forecasted Market Value ( USD | $ 10.7 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |