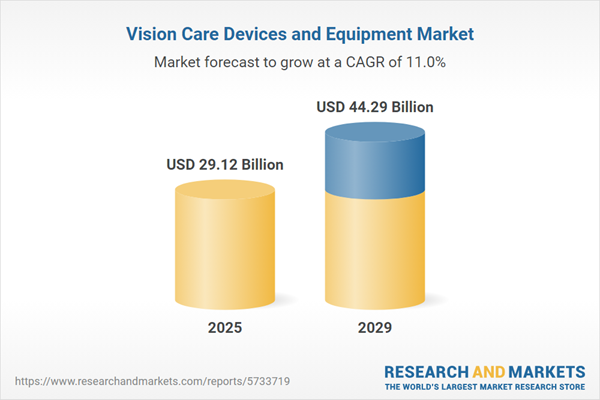

The vision care devices and equipment market size has grown rapidly in recent years. It will grow from $25.5 billion in 2024 to $29.12 billion in 2025 at a compound annual growth rate (CAGR) of 14.2%. The growth in the historic period can be attributed to eye health awareness, aging population, fashion and aesthetics, increased screen time.

The vision care devices and equipment market size is expected to see rapid growth in the next few years. It will grow to $44.29 billion in 2029 at a compound annual growth rate (CAGR) of 11%. The growth in the forecast period can be attributed to digital eye strain, aging demographics, myopia management, sustainable and eco-friendly products. Major trends in the forecast period include smart eyewear, customized and 3d-printed eyewear, ai-powered eye examinations, teleophthalmology.

The increasing usage of electronic devices remains a consistent driver for the growth of the vision care devices and equipment market. The widespread use of laptops, mobile phones, personal computers, and other electronic devices in daily life has contributed significantly to the prevalence of eye-related issues. As per a survey conducted by Deloitte, Americans collectively check their phones more than 8 billion times each day. On average, individuals spend approximately five hours daily browsing the internet and using various applications on electronic devices.

The rising prevalence of eye disorders is expected to be a significant driver for the growth of the vision care devices and equipment market in the future. Eye disorders, also known as ocular disorders or eye conditions, encompass various medical conditions or abnormalities that impact the structure and function of the eye, often resulting in visual impairment or discomfort. With an increasing number of individuals affected by eye disorders, there is a growing demand for vision care products and services, including eyeglasses, contact lenses, and surgical interventions. This heightened demand is propelling the market for vision care devices and equipment. For example, as of August 2023, a report from the World Health Organization (WHO), an intergovernmental organization based in Sweden, revealed that at least 2.2 billion people worldwide are affected by near- or distance vision impairment. Among these, nearly half, approximately 1 billion individuals, experience vision loss that could have been prevented or is still present. The leading causes of distance vision impairment or blindness in this group include conditions like cataracts (94 million cases), refractive errors (88.4 million cases), age-related macular degeneration (8 million cases), glaucoma (7.7 million cases), and diabetic retinopathy (3.9 million cases). Presbyopia, affecting 826 million people, is the primary condition leading to issues with close-up vision. Thus, the increasing prevalence of eye disorders is a key driver behind the growth of the vision care devices and equipment market.

Recent technological advancements in vision care devices have brought about significant transformations in eye care. These innovations represent substantial breakthroughs in the field, and they are quickly reshaping the prospects for individuals dealing with chronic eye conditions. Some of the innovations encompass the development of DriveSafe lenses with anti-glare coatings designed to improve vision during challenging driving conditions, the creation of photochromic contact lenses that provide protection against harmful UV rays from the sun, and the introduction of blue light blocking glasses, among other notable advancements. Leading companies, including Johnson & Johnson Vision, have made investments in adaptive lenses, further driving progress in this area.

Prominent companies in the vision care devices and equipment market are actively innovating by introducing new products like myopia management lenses. These lenses are specifically designed to address a larger customer base, boost sales, and increase overall revenue. Myopia management lenses are specialized corrective eyeglasses or contact lenses that aim to slow down the progression of myopia (nearsightedness), primarily in children and adolescents. For instance, in April 2023, HOYA Vision Care, a manufacturer of eyeglass lenses based in Thailand, launched MiYOSMART Sun Spectacle Lenses, which combine myopia control with protection against strong sunlight. These non-invasive MiYOSMART clear spectacle lenses incorporate unique technology that has been shown to reduce myopia progression in children aged 8 to 13 by 60%. Additionally, they have introduced photochromic and polarized spectacle lenses, MiYOSMART Chameleon and MiYOSMART Sunbird, both designed to slow down the progression of myopia in youngsters by utilizing Defocus Incorporated Multiple Segments (DIMS). This product innovation is contributing to the growth and evolution of the vision care market.

In the United States, the FDA regulates eyeglass frames and prescription lenses, categorizing them as class 1 medical devices. These devices are considered low risk and are exempt from the requirement of filing a premarket notification application or obtaining FDA clearance before being marketed. As a result, prescription eyeglasses sold online are still subject to FDA regulation in the United States. Within the European Union (EU), medical devices, including contact lenses, fall under the regulatory purview of the European Commission (EC). The EC collaborates closely with the health authorities of individual EU Member States to harmonize national requirements into a single law applicable across the EU. In 2020, the EU introduced new medical device regulations (MDR), which encompass contact lenses. These updated regulations emphasize the importance of prioritizing safety and efficacy when seeking marketing approval and enhancing the transparency of device-related information. The implementation of these new EU regulations will have implications for the approval process of contact lenses in Europe.

Vision care devices and equipment encompass a range of tools used to address various eye vision issues. These devices and equipment are categorized into several key types, including intraocular lenses, ophthalmic lasers, glaucoma drainage devices, contact lenses, and others.

Vision care devices and equipment encompass various categories, including intraocular lenses, ophthalmic lasers, glaucoma drainage devices, contact lenses, and other related tools. Intraocular lenses are artificial replacements for the eye's natural lens. These devices find applications in vision care, diagnostic procedures, and surgeries, serving a range of end-users like hospitals, ambulatory surgery centers, optical centers, and other relevant facilities.

The vision care devices and equipment research report is one of a series of new reports that provides vision care devices and equipment statistics, including vision care devices and equipment industry global market size, regional shares, competitors with vision care devices and equipment share, detailed vision care devices and equipment segments, market trends and opportunities, and any further data you may need to thrive in the vision care devices and equipment industry. This vision care devices and equipment research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Major companies operating in the vision care devices and equipment market include Essilor International, Johnson & Johnson, Carl Zeiss AG, The Cooper Companies, Novartis AG, Bausch & Lomb, Nidek Co.Ltd., Valeant Pharmaceuticals International Inc., Luxottica Group SpA, Escalon Services, Tomey Corporation, CIBA Vision Corporation, Visionix Ltd., Potec, LuxVisions Innovation Limited, Heine Optotechnik, Luneau Technology Operations SAS, Heidelberg Engineering Inc., Huvitz Technologies, STAAR Surgical Company, Swiss Advanced Vision, Visioneering Technologies Inc., Rayner Intraocular Lenses Limited, Jiangsu Hongchen Optical Co. Ltd., Alcon, Hoya Corporation, Topcon Corporation, Carl Zeiss Meditec AG, Lumenis Ltd., Ellex Medical Pty Ltd., Abbott Medical Optics, Canon Medical Systems, Haag-Streit AG, Optovue Inc., Quantel Medical SAS, VisionCare Devices LLC, Med-Logics Inc., Advanced Vision Science Inc., Eyenovia Inc., HumanOptics Holding AG, Clearside Biomedical Inc.

North America was the largest region in global vision care devices and equipment market in 2024. Asia-Pacific was the second-largest region in the vision care devices and equipment market share. The regions covered in the vision care devices and equipment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa. The countries covered in the vision care devices and equipment market report are Australia, China, India, Indonesia, Japan, South Korea, Bangladesh, Thailand, Vietnam, Malaysia, Singapore, Philippines, Hong Kong, New Zealand, USA, Canada, Mexico, Brazil, Chile, Argentina, Colombia, Peru, France, Germany, UK, Austria, Belgium, Denmark, Finland, Ireland, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, Russia, Czech Republic, Poland, Romania, Ukraine, Saudi Arabia, Israel, Iran, Turkey, UAE, Egypt, Nigeria, South Africa.

The vision care devices and equipment market consist of sales of equipment such as vitrector, Phoropter, VT 1 vision screener, contact lenses and spectacles and others that are used for proper diagnosis and treating vision of an eye. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Executive Summary

Vision Care Devices and Equipment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on vision care devices and equipment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 50 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for vision care devices and equipment ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The vision care devices and equipment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Intraocular Lens; Ophthalmic Lasers; Glaucoma Drainage Devices; Contact Lenses; Other Types2) By Aplication: Vision Care; Diagnosis; Surgery

3) By End User: Hospitals; Ambulatory Surgery Centers; Optical Centers; Other End Users

Subsegments:

1) By Intraocular Lens (IOL): Monofocal IOLs; Multifocal IOLs; Toric IOLs; Accommodating IOLs; Phakic IOLs2) By Ophthalmic Lasers: Excimer Lasers; Femtosecond Lasers; YAG Lasers; Diode Lasers; Argon Lasers

3) By Glaucoma Drainage Devices: Shunt Implants; Tube Drainage Implants; Cyclodestructive Procedures; Valved Drainage Devices

4) By Contact Lenses: Soft Contact Lenses; Rigid Gas Permeable Lenses; Toric Lenses; Scleral Lenses; Hybrid Contact Lenses

5) By Other Types: Retinal Implant Devices; Corneal Implants; Vision Correction Devices; Eye Examination Equipment

Key Companies Mentioned: Essilor International; Johnson & Johnson; Carl Zeiss AG; the Cooper Companies; Novartis AG

Countries: Australia; China; India; Indonesia; Japan; South Korea; Bangladesh; Thailand; Vietnam; Malaysia; Singapore; Philippines; Hong Kong; New Zealand; USA; Canada; Mexico; Brazil; Chile; Argentina; Colombia; Peru; France; Germany; UK; Austria; Belgium; Denmark; Finland; Ireland; Italy; Netherlands; Norway; Portugal; Spain; Sweden; Switzerland; Russia; Czech Republic; Poland; Romania; Ukraine; Saudi Arabia; Israel; Iran; Turkey; UAE; Egypt; Nigeria; South Africa

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Vision Care Devices and Equipment market report include:- Essilor International

- Johnson & Johnson

- Carl Zeiss AG

- The Cooper Companies

- Novartis AG

- Bausch & Lomb

- Nidek Co.Ltd.

- Valeant Pharmaceuticals International Inc.

- Luxottica Group SpA

- Escalon Services

- Tomey Corporation

- CIBA Vision Corporation

- Visionix Ltd.

- Potec

- LuxVisions Innovation Limited

- Heine Optotechnik

- Luneau Technology Operations SAS

- Heidelberg Engineering Inc.

- Huvitz Technologies

- STAAR Surgical Company

- Swiss Advanced Vision

- Visioneering Technologies Inc.

- Rayner Intraocular Lenses Limited

- Jiangsu Hongchen Optical Co. Ltd.

- Alcon

- Hoya Corporation

- Topcon Corporation

- Carl Zeiss Meditec AG

- Lumenis Ltd.

- Ellex Medical Pty Ltd.

- Abbott Medical Optics

- Canon Medical Systems

- Haag-Streit AG

- Optovue Inc.

- Quantel Medical SAS

- VisionCare Devices LLC

- Med-Logics Inc.

- Advanced Vision Science Inc.

- Eyenovia Inc.

- HumanOptics Holding AG

- Clearside Biomedical Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 29.12 Billion |

| Forecasted Market Value ( USD | $ 44.29 Billion |

| Compound Annual Growth Rate | 11.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 42 |