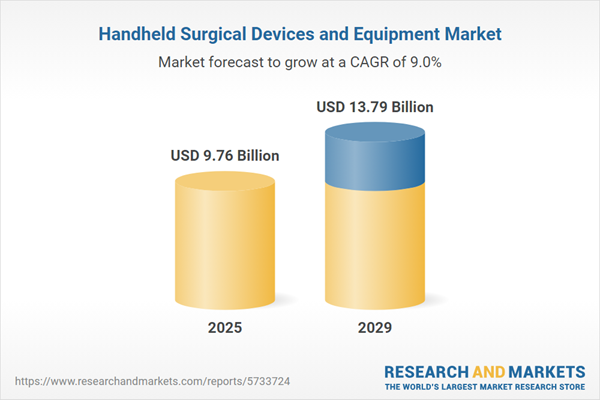

The handheld surgical devices and equipment market size has grown rapidly in recent years. It will grow from $8.76 billion in 2024 to $9.76 billion in 2025 at a compound annual growth rate (CAGR) of 11.4%. The growth in the historic period can be attributed to aging population, minimally invasive surgery (mis), healthcare infrastructure, regulatory compliance.

The handheld surgical devices and equipment market size is expected to see strong growth in the next few years. It will grow to $13.79 billion in 2029 at a compound annual growth rate (CAGR) of 9%. The growth in the forecast period can be attributed to telemedicine and remote surgery, emerging markets growth, robotics and automation, personalized medicine. Major trends in the forecast period include miniaturization and portability, smart and connected devices, sustainable and eco-friendly materials, augmented reality (ar) and virtual reality (vr).

The growing demand for aesthetic surgeries is a key driver for the handheld surgical devices and equipment market. This demand is primarily linked to an increase in per capita disposable income. According to the 2022 data from the American Society of Plastic Surgeons (ASPS), approximately 1.5 million cosmetic procedures were performed in 2022 alone. Notably, liposuction ranked as the leading cosmetic surgery in 2022, with a remarkable 325,669 surgeries performed.

The increasing prevalence of chronic disorders is expected to boost the handheld surgical devices market. Chronic diseases, also known as non-communicable diseases (NCDs), encompass long-term medical conditions that typically advance slowly and persist over an extended duration. The rising incidence of chronic diseases has led to a growing demand for handheld surgical devices tailored for minimally invasive procedures. These devices empower healthcare professionals to execute surgeries with enhanced precision and minimal invasiveness, contributing to improved patient outcomes. For instance, as of September 2022, the World Health Organization reported that chronic diseases, or NCDs, accounted for approximately 74% of global annual deaths, totaling 41 million deaths. These chronic diseases include 17.9 million deaths from cardiovascular diseases, 9.3 million deaths from cancer, 4.1 million deaths from chronic respiratory diseases, and 2 million deaths from diabetes. Hence, the increasing prevalence of chronic diseases is a driving force behind the growth of the handheld surgical devices market.

In the United States, the Food and Drug Administration (FDA) classifies medical devices into Class I, Class II, and Class III based on their associated risks and the regulatory controls required to ensure safety and effectiveness. Hand-held surgical devices, including instruments such as scalpels, forceps, and retractors, fall within Class I medical devices. Class I devices typically present the lowest risk to both patients and users and are exempt from premarket notification procedures (510(k)).

Major companies in the handheld surgical devices market are innovating with technologies like UIMG image technology and 2D decoder chips to enhance precision and accuracy during surgical procedures. UIMG image technology is a standardized format designed for efficient, cross-platform image handling with adaptive compression and resolution. For example, in November 2023, a Netherlands-based company specializing in data capture technology launched the IVD Product Line at MEDICA. In response to this market development, Newland EMEA introduced a range of high-performance and user-friendly barcode scanners. These scanners are designed for easy integration into IVD instruments, offering ultrafast scanning performance that improves the speed and quality of diagnoses, detection, prevention, and care.

In October 2022, Aspen Surgical Products, a portfolio company of Audax Private Equity based in the United States, acquired Symmetry Surgical for an undisclosed sum. This acquisition enhances Aspen's product portfolio with additional brands, diversifying its offerings. Symmetry Surgical is a U.S.-based manufacturer of surgical instrumentation.

Hand-held surgical devices and equipment are essential non-powered, hand-held, or manually manipulated tools used in a variety of general surgical procedures to aid in precision and control.

The primary product categories within hand-held surgical devices include scalpels, forceps, retractors, dilators, graspers, and other related instruments. Forceps, for example, are handheld tools designed for grasping and holding objects during surgical procedures. These devices find applications in a range of surgical specialties, including neurosurgery, cardiovascular surgery, orthopedic surgery, plastic and reconstructive surgery, obstetrics and gynecology, and other medical fields. These hand-held surgical devices are used by a diverse set of healthcare facilities and end-users, including hospitals, specialized clinics, long-term care centers, ambulatory surgery centers, and others, to support a wide array of surgical procedures.

The handheld surgical devices market research report is one of a series of new reports that provides handheld surgical devices market statistics, including handheld surgical devices industry global market size, regional shares, competitors with a handheld surgical devices market share, detailed handheld surgical devices market segments, market trends and opportunities, and any further data you may need to thrive in the handheld surgical devices industry. This handheld surgical devices market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Major companies operating in the handheld surgical devices and equipment market include B. Braun Melsungen AG, Medtronic PLC, Smith & Nephew, Johnson & Johnson Services Inc., Integra LifeSciences Corporation, Zimmer Biomet, CooperSurgical Inc., Becton Dickinson and Company, Moria, Pelion Surgical, Elite Medical, Millennium Surgical, Gsource LLC, Medicon eG, Sklar Corporation, Ethicon US LLC., Erbe Elektromedizin GmbH, CONMED Corporation, Synergetics USA Inc., Stryker Corporation, Karl Storz SE & Co. KG, KLS Martin, Grena Ltd., Maxer Endoscopy GmbH, GPC Medical Ltd., Teleflex Incorporated, Cook Medical LLC, Richard Wolf GmbH, Microline Surgical Inc., Applied Medical Resources Corporation, Olympus Corporation, Boston Scientific Corporation, Wexler Surgical Inc., Surgmed Group.

North America was the largest region in the global handheld surgical devices market in 2024. Western Europe was the second-largest region in the global handheld surgical devices market. The regions covered in the handheld surgical devices and equipment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa. The countries covered in the handheld surgical devices and equipment market report are Australia, China, India, Indonesia, Japan, South Korea, Bangladesh, Thailand, Vietnam, Malaysia, Singapore, Philippines, Hong Kong, New Zealand, USA, Canada, Mexico, Brazil, Chile, Argentina, Colombia, Peru, France, Germany, UK, Austria, Belgium, Denmark, Finland, Ireland, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, Russia, Czech Republic, Poland, Romania, Ukraine, Saudi Arabia, Israel, Iran, Turkey, UAE, Egypt, Nigeria, South Africa.

The handheld surgical devices and equipment market consists of sales of spatulas, dilators, graspers, auxiliary instruments, cutter instruments, and others. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Executive Summary

Handheld Surgical Devices and Equipment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on handheld surgical devices and equipment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 50 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for handheld surgical devices and equipment ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The handheld surgical devices and equipment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Scalpels; Forceps; Retractor; Dilators; Graspers; Other Products2) By Application; Neurosurgery; Cardiovascular; Orthopedic; Plastic and Reconstructive Surgery; Obstetrics and Gynecology; Other Applications

3) By End-User: Hospitals; Specialized Clinics; Long-Term Care Centers; Ambulatory Surgery Centers; Other End Users

Subsegments:

1) By Scalpels: Disposable Scalpels; Reusable Scalpels2) By Forceps: Hemostatic Forceps; Tissue Forceps; Surgical Forceps

3) By Retractors: Handheld Retractors; Self-Retaining Retractors

4) By Dilators: Urethral Dilators; Cervical Dilators; Esophageal Dilators

5) By Graspers: Laparoscopic Graspers; Endoscopic Graspers

6) By Other Products: Surgical Hooks; Scissors; Clamps; Spatulas; Needle Holders

Key Companies Mentioned: B. Braun Melsungen AG; Medtronic plc; Smith & Nephew; Johnson & Johnson Services Inc.; Integra LifeSciences Corporation

Countries: Australia; China; India; Indonesia; Japan; South Korea; Bangladesh; Thailand; Vietnam; Malaysia; Singapore; Philippines; Hong Kong; New Zealand; USA; Canada; Mexico; Brazil; Chile; Argentina; Colombia; Peru; France; Germany; UK; Austria; Belgium; Denmark; Finland; Ireland; Italy; Netherlands; Norway; Portugal; Spain; Sweden; Switzerland; Russia; Czech Republic; Poland; Romania; Ukraine; Saudi Arabia; Israel; Iran; Turkey; UAE; Egypt; Nigeria; South Africa

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Handheld Surgical Devices and Equipment market report include:- B. Braun Melsungen AG

- Medtronic plc

- Smith & Nephew

- Johnson & Johnson Services Inc.

- Integra LifeSciences Corporation

- Zimmer Biomet

- CooperSurgical Inc.

- Becton Dickinson and Company

- Moria

- Pelion Surgical

- Elite Medical

- Millennium Surgical

- Gsource LLC

- Medicon eG

- Sklar Corporation

- Ethicon US LLC.

- Erbe Elektromedizin GmbH

- CONMED Corporation

- Synergetics USA Inc.

- Stryker Corporation

- Karl Storz SE & Co. KG

- KLS Martin

- Grena Ltd.

- Maxer Endoscopy GmbH

- GPC Medical Ltd.

- Teleflex Incorporated

- Cook Medical LLC

- Richard Wolf GmbH

- Microline Surgical Inc.

- Applied Medical Resources Corporation

- Olympus Corporation

- Boston Scientific Corporation

- Wexler Surgical Inc.

- Surgmed Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 9.76 Billion |

| Forecasted Market Value ( USD | $ 13.79 Billion |

| Compound Annual Growth Rate | 9.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 35 |