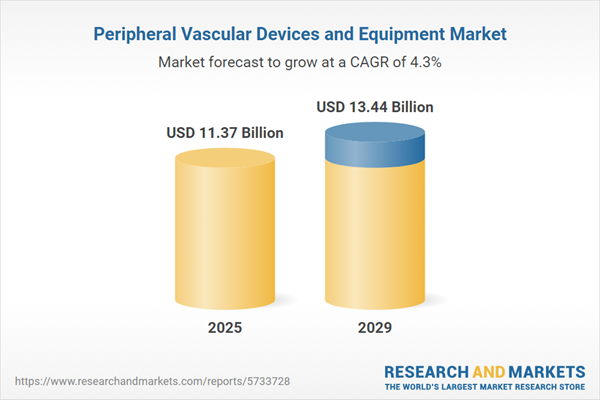

The peripheral vascular devices and equipment market size has grown strongly in recent years. It will grow from $10.62 billion in 2024 to $11.37 billion in 2025 at a compound annual growth rate (CAGR) of 7.1%. The growth in the historic period can be attributed to cardiovascular disease prevalence, aging population, chronic disease management, clinical guidelines and research.

The peripheral vascular devices and equipment market size is expected to see steady growth in the next few years. It will grow to $13.44 billion in 2029 at a compound annual growth rate (CAGR) of 4.3%. The growth in the forecast period can be attributed to minimally invasive procedures, telehealth integration, global access to healthcare, drug-coated devices. Major trends in the forecast period include artificial intelligence (ai) in vascular medicine, robot-assisted interventions, point-of-care testing, bioresorbable vascular scaffolds.

The peripheral vascular devices and equipment market is being primarily fueled by the increasing prevalence of peripheral artery diseases. These conditions occur when arteries become obstructed by plaque, including fats and cholesterol, leading to reduced blood flow to vital organs. Lower extremity peripheral artery disease (PAD) is impacting over 230 million adults globally, posing risks of adverse cardiovascular and leg-related outcomes. While younger populations may also be affected, the incidence rises significantly, with more than 20% of individuals over 80 years old experiencing PAD. In the United States, approximately 8.5 million people are currently affected by peripheral artery diseases, with 12-20% of them being over 60 years old, according to the Centers for Disease Control and Prevention (CDC).

The increasing healthcare expenditure is expected to propel the growth of the peripheral vascular devices and equipment market. Healthcare expenditure refers to the total spending on healthcare services, goods, and treatments, which includes investments in medical technologies. As healthcare systems allocate more resources to improving patient care, the demand for advanced medical equipment, such as peripheral vascular devices used in diagnosing and treating conditions like peripheral artery disease (PAD), rises. This expansion of healthcare budgets allows for the adoption of cutting-edge devices that enhance patient outcomes. For example, according to the American Medical Association, U.S. healthcare expenditures increased by 4.1% in 2022, reaching $4.5 trillion. This surge in spending indicates a growing demand for innovative medical technologies, including peripheral vascular devices, which are critical for improving diagnostic accuracy and treatment effectiveness in vascular conditions. Therefore, the rise in healthcare expenditure is a key factor driving the peripheral vascular devices and equipment market.

Major companies in the peripheral vascular devices and equipment market are focusing on developing innovative products to improve the treatment of peripheral artery diseases (PAD). One such advancement is the development of larger-diameter catheters, which are designed to enhance fluid administration or drainage in medical procedures, particularly in challenging vascular conditions. A notable example of this innovation is the Shockwave L6 Peripheral Intravascular Lithotripsy (IVL) catheter, launched in March 2023 by Shockwave Medical Inc. This catheter is specifically engineered to treat calcification in large peripheral vessels, such as the iliac and common femoral arteries. The Shockwave L6 catheter uses targeted lithotripsy technology to break down calcified plaque, which can impair blood flow and complicate PAD treatment. By addressing this issue, the catheter improves the procedural success rate and reduces complications compared to traditional endovascular techniques, demonstrating how advanced product development is enhancing the effectiveness of peripheral vascular treatments.

Major companies in the peripheral vascular devices and equipment market are also focused on innovative advancements, such as peripheral IVL catheters, which offer better treatment opportunities. Peripheral intravascular lithotripsy (IVL) catheters are instrumental in treating vascular disease, especially for managing calcified lesions within arteries. In March 2022, Shockwave Medical Inc. introduced the Shockwave M5+ peripheral IVL catheter, which aims to reduce IVL treatment time, expand access options, and extend IVL therapy to patients with larger vessel sizes. The Shockwave L6 Peripheral IVL Catheter optimizes IVL therapy for larger peripheral vessels, providing efficient and effective treatment for patients who were previously difficult to treat with IVL.

In September 2024, Boston Scientific Corporation, a leading US-based biotechnology company, acquired Silk Road Medical Inc. for $1.18 billion. This acquisition significantly strengthens Boston Scientific’s vascular technology portfolio, particularly by expanding access to Silk Road's innovative TransCarotid Artery Revascularization (TCAR) platform. The TCAR platform is designed to treat carotid artery disease, a major contributor to stroke risk. By integrating Silk Road's technology into its own, Boston Scientific aims to enhance the treatment options available to physicians and patients, ultimately improving outcomes for individuals with peripheral vascular conditions. The acquisition also allows Boston Scientific to leverage its broad commercial network to make these life-saving treatments more accessible. Silk Road Medical Inc. is recognized for its expertise in developing advanced peripheral vascular devices and equipment.

Peripheral vascular devices and equipment play a crucial role in the management of peripheral vascular diseases, which are characterized by the gradual and progressive impairment of blood circulation in blood vessels located outside the heart and brain, encompassing both arteries and veins. These conditions typically result from blockages, narrowing, or spasms within these vessels.

The primary categories of peripheral vascular devices and equipment include peripheral vascular stents, percutaneous transluminal angioplasty balloons, catheters, PTA guide wires, atherectomy devices, chronic total occlusion devices, aortic stents, synthetic surgical grafts, embolic protection devices, and inferior vena cava filters. Catheters, for instance, are tubular medical devices designed for insertion into canals, vessels, passageways, or body cavities to facilitate the injection or withdrawal of fluids or to maintain the patency of a passage. These devices find application in the treatment of damaged peripheral blood vessels and the management of blockages in peripheral blood vessels, ultimately enhancing blood circulation and supporting patient health. Various healthcare settings, including hospitals and clinics, utilize peripheral vascular devices and equipment to address these medical conditions.

The peripheral vascular devices and equipment market research report is one of a series of new reports that provides peripheral vascular devices and equipment market statistics, including peripheral vascular devices and equipment industry global market size, regional shares, competitors with a peripheral vascular devices and equipment market share, detailed peripheral vascular devices and equipment market segments, market trends and opportunities, and any further data you may need to thrive in the peripheral vascular devices and equipment industry. This peripheral vascular devices and equipment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Major companies operating in the peripheral vascular devices and equipment market include Medtronic plc, Boston Scientific Corporation, Abbott Laboratories, Cook Group, Angiomed GmbH & Co. Medizintechnik KG, Terumo Corporation, ENDOLOGIX Inc., Bolton Medical Inc., JOTEC GmbH, Clearstream Technologies, Aesculap AG, Curative Medical Devices, Lepu Medical Technology, MicroPort, Bioteque Corporation Co.Ltd., Cardinal Health, iVascular, B. Braun Group, Biosensors International Group, BIOTRONIK SE & Co., COVIDien, Volcano Corporation, AngioScore, Edwards Lifesciences Corporation, Cordis Corporation, Koninklijke Philips N.V., Nipro Corporation, Bluesail Medical Co. Ltd, Rex Medical, Teleflex Incorporated, Penumbra Inc., Lombard Medical Technologies PLC, W.L. Gore & Associates Inc., Merit Medical Systems Inc., Vascular Solutions Inc., LeMaitre Vascular Inc., Spectranetics Corporation.

North America was the largest region in global peripheral vascular devices and equipment market in 2024. Western Europe was the second-largest region in global peripheral vascular devices and equipment market. The regions covered in the peripheral vascular devices and equipment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa. The countries covered in the peripheral vascular devices and equipment market report are Australia, China, India, Indonesia, Japan, South Korea, Bangladesh, Thailand, Vietnam, Malaysia, Singapore, Philippines, Hong Kong, New Zealand, USA, Canada, Mexico, Brazil, Chile, Argentina, Colombia, Peru, France, Germany, UK, Austria, Belgium, Denmark, Finland, Ireland, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, Russia, Czech Republic, Poland, Romania, Ukraine, Saudi Arabia, Israel, Iran, Turkey, UAE, Egypt, Nigeria, South Africa.

The peripheral vascular devices and equipment market consist of sales of peripheral vascular stents, percutaneous transluminal angioplasty balloons, PTA drug-eluting balloons, embolic protection devices, inferior vena cava filters, Aortic stent-grafts, synthetic surgical drafts, and peripheral guide wires. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Executive Summary

Peripheral Vascular Devices and Equipment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on peripheral vascular devices and equipment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 50 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for peripheral vascular devices and equipment ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The peripheral vascular devices and equipment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Peripheral vascular stents; Percutaneous transluminal angioplasty balloons; Catheters; PTA guide wires; Atherectomy devices; Chronic total acclusion devices; Aortic stents; Synthetic surgical grafts; Embolic protection devices; Inferior vena cava filters2) By Application: Treatment of Peripheral Blood Vessels Damaged; Treatment of Peripheral Blood Vessels Blockage

3) By End User: Hospital applications; Clinic applications

Subsegments:

1) By Peripheral Vascular Stents: Balloon-expandable Stents; Self-expanding Stents2) By Percutaneous Transluminal Angioplasty Balloons: Drug-coated Balloons; Non-drug-Coated Balloons

3) By Catheters: Diagnostic Catheters; Therapeutic Catheters

4) By PTA Guide Wires: Hydrophilic Guide Wires; Non-hydrophilic Guide Wires

5) By Atherectomy Devices: Rotational Atherectomy Devices; Orbital Atherectomy Devices; Laser Atherectomy Devices; Directional Atherectomy Devices

6) By Chronic Total Occlusion Devices: CTO crossing devices; CTO re-entry devices

7) By Aortic Stents: Self-expanding Aortic Stents; Balloon-expandable Aortic Stents

8) By Synthetic Surgical Grafts: Polyester Grafts; Polytetrafluoroethylene (PTFE) Grafts; Dacron Grafts

9) By Embolic Protection Devices: Distal Protection Devices; Proximal Protection Devices

10) By Inferior Vena Cava Filters: Permanent Filters; Retrievable Filters

Key Companies Mentioned: Medtronic plc; Boston Scientific Corporation; Abbott Laboratories; Cook Group; Angiomed GmbH & Co. Medizintechnik KG

Countries: Australia; China; India; Indonesia; Japan; South Korea; Bangladesh; Thailand; Vietnam; Malaysia; Singapore; Philippines; Hong Kong; New Zealand; USA; Canada; Mexico; Brazil; Chile; Argentina; Colombia; Peru; France; Germany; UK; Austria; Belgium; Denmark; Finland; Ireland; Italy; Netherlands; Norway; Portugal; Spain; Sweden; Switzerland; Russia; Czech Republic; Poland; Romania; Ukraine; Saudi Arabia; Israel; Iran; Turkey; UAE; Egypt; Nigeria; South Africa

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Peripheral Vascular Devices and Equipment market report include:- Medtronic plc

- Boston Scientific Corporation

- Abbott Laboratories

- Cook Group

- Angiomed GmbH & Co. Medizintechnik KG

- Terumo Corporation

- ENDOLOGIX Inc.

- Bolton Medical Inc.

- JOTEC GmbH

- Clearstream Technologies

- Aesculap AG

- Curative Medical Devices

- Lepu Medical Technology

- MicroPort

- Bioteque Corporation Co.Ltd.

- Cardinal Health

- iVascular

- B. Braun Group

- Biosensors International Group

- BIOTRONIK SE & Co.

- COVIDien

- Volcano Corporation

- AngioScore

- Edwards Lifesciences Corporation

- Cordis Corporation

- Koninklijke Philips N.V.

- Nipro Corporation

- Bluesail Medical Co. Ltd

- Rex Medical

- Teleflex Incorporated

- Penumbra Inc.

- Lombard Medical Technologies PLC

- W.L. Gore & Associates Inc.

- Merit Medical Systems Inc.

- Vascular Solutions Inc.

- LeMaitre Vascular Inc.

- Spectranetics Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 11.37 Billion |

| Forecasted Market Value ( USD | $ 13.44 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 37 |