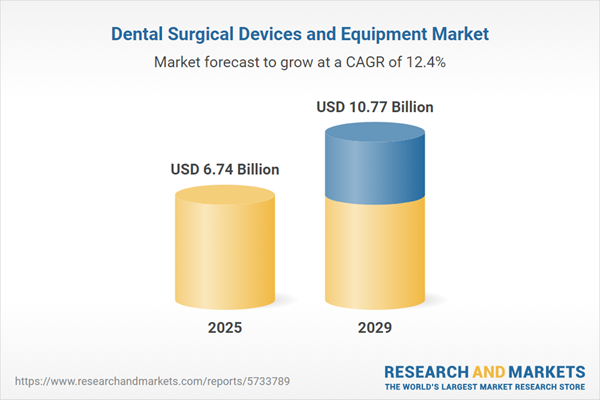

The dental surgical devices and equipment market size has grown rapidly in recent years. It will grow from $5.96 billion in 2024 to $6.74 billion in 2025 at a compound annual growth rate (CAGR) of 13.1%. The growth in the historic period can be attributed to oral healthcare, clinical diagnostics, dental education and training, aging population.

The dental surgical devices and equipment market size is expected to see rapid growth in the next few years. It will grow to $10.77 billion in 2029 at a compound annual growth rate (CAGR) of 12.4%. The growth in the forecast period can be attributed to digital dentistry integration, patient-centered care, preventive dentistry, sustainable dentistry. Major trends in the forecast period include minimally invasive dentistry, robot-assisted surgery, artificial intelligence (ai) in surgery, eco-friendly surgical practices.

Growing demand for orthodontic treatments is expected to drive the expansion of the dental surgical devices and equipment market in the future. Orthodontic treatments involve the use of devices like braces and plates to correct teeth and jaw alignment. These devices are fundamental for diagnosing, planning, delivering, and maintaining orthodontic treatments. They assist orthodontists in providing effective treatments that improve dental alignment and overall oral health. For example, the 2022 Orthodontic Practice Performance Survey, published by Orthodontic Products, a US-based magazine, revealed that the majority of orthodontic practices saw stable or increased production in 2022, with 8 out of 10 practices reporting a rise in production in 2021. This trend highlights the growing demand for orthodontic treatments, which is contributing to the expansion of the dental surgical devices and equipment market.

The increase in dental diseases is expected to drive the growth of the dental surgical devices and equipment market in the coming years. Dental diseases encompass conditions that affect the teeth, gums, and other oral structures, including cavities, gum disease, and oral infections. The rise in dental diseases is mainly due to poor oral hygiene, unhealthy diets, and inadequate dental care. Dental surgical devices and equipment play a crucial role in managing dental diseases by enabling accurate diagnosis, treatment, and surgery, thus improving patient outcomes and enhancing the effectiveness of dental procedures. For example, in November 2024, the World Health Organization, a US-based intergovernmental organization, reported that in 2022, nearly 3.5 billion people worldwide were affected by oral diseases, with around 75% of them residing in middle-income countries. As a result, the increase in dental diseases is driving the growth of the dental surgical devices and equipment market.

Major companies within the dental surgical devices and equipment market are incorporating innovative approaches involving artificial intelligence (AI) to enhance patient care. AI holds the potential to improve patient outcomes, streamline work processes, and boost the effectiveness of dental procedures. For example, in June 2023, Incisive Technologies, a US-based software company, received FDA 510(k) approval for BlueCheck Caries Detection and Monitoring. This innovation aids dentists in identifying caries at an earlier stage with higher accuracy. Utilizing colored agents applied to tooth surfaces after a dental examination, the device highlights areas of decay. Powered by artificial intelligence, the tool analyzes images to identify caries in a more precise manner.

Several companies are increasingly investing in 3D printing technology within the dental surgical devices and equipment market. This technology involves the creation of intricate 3D structures by sequentially depositing thin layers of raw materials. In this market, 3D printing is applied for various purposes, including the production of drill guides for dental implants, the generation of physical models for prosthodontics, orthodontics, and surgery, and the manufacturing of dental, craniomaxillofacial, and orthopedic implants. It's also utilized in creating copings and frameworks for dental restorations. Leading market players are utilizing 3D printing technology to fabricate items like 3D printed braces, dental crowns, and implants. For instance, ArchForm, a teeth-aligner software startup, enables orthodontists to independently design, create, and 3D print aligners in their offices. The company's data suggests that approximately 75% of orthodontists already possess 3D printers equipped with suitable software for this purpose.

In August 2023, NSK Ltd., a Japan-based machinery manufacturing company, acquired DCI International, LLC, for an undisclosed amount. This acquisition enables NSK to enhance its position in the U.S. dental market by leveraging DCI's expertise in dental chairs and units. The move is aimed at expanding product offerings, creating synergies to improve customer service, and increasing market reach, all while maintaining a shared commitment to innovation and customer satisfaction. DCI International, LLC is a U.S.-based manufacturer of dental equipment and parts.

Dental surgical devices and equipment are employed in addressing a spectrum of dental issues such as cavities, tooth decay, periodontitis, and various oral diseases and injuries.

Primary dental surgical devices and equipment include handheld instruments, handpieces, lasers, electrosurgical systems, and ultrasonic instruments. Hand-held dental surgical instruments are portable tools that offer convenience and flexibility in dental surgical procedures. These devices find applications in treating bone abnormalities, reconstructive post-mortem dental profiling, cysts, comparative dental identification, fractures, and various dental clinical settings like hospitals, dental clinics, and diagnostic centers.

The dental surgical devices and equipment market research report is one of a series of new reports that provides dental surgical devices and equipment market statistics, including dental surgical devices and equipment industry global market size, regional shares, competitors with a dental surgical devices and equipment market share, detailed dental surgical devices and equipment market segments, market trends and opportunities, and any further data you may need to thrive in the dental surgical devices and equipment industry. This dental surgical devices and equipment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Major companies operating in the dental surgical devices and equipment market include Sirona Dental Systems, Planmeca, DentalEZ Inc., KaVo Group, LM Dental, A-dec Inc., Danaher Corporation, Midmark Corporation, Yoshida Dental Mfg. Co., Ltd., Morita Group, Belmont Dental Equipment Company, Integra LifeScience, BTI Biotechnology, Helmut Zepf Medizintechnik GmbH, 3M Company, Hu-Friedy Mfg. Co. LLC, J. Morita Mfg. Corp., Takara Belmont Corporation, Fimet Oy, Join Champ, Shinhung Co. Ltd., TREE, CFPM Industries, Prima Dental, Aseptico Inc., Bien-Air Medical Technologies, Biolase Inc., Brasseler USA, Carestream Dental, Nobel Biocare Services AG, GC Corporation, Henry Schein Inc., Ivoclar Vivadent AG, NSK America Corporation, Osstem Implant Co. Ltd., Patterson Dental, Premier Dental Products Company, Septodont Holding, Straumann Holding AG, Sybron Dental Specialties Inc., The Yoshida Dental Mfg. Co. Ltd., Ultradent Products Inc.

Asia-Pacific was the largest region in the global dental surgical devices and equipment market in 2024. Western Europe was the second-largest region in dental surgical devices and equipment market. The regions covered in the dental surgical devices and equipment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa. The countries covered in the dental surgical devices and equipment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

The dental surgical devices and equipment market consists of sales of instrument delivery systems, extraoral radiology equipment, and intra oral radiology equipment, dental probes, and others) that are used for dental surgeries. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Executive Summary

Dental Surgical Devices and Equipment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on dental surgical devices and equipment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 50 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for dental surgical devices and equipment ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The dental surgical devices and equipment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Handheld Instruments; Handpieces; Lasers; Electrosurgical Systems; Ultrasonic Instruments2) By Application: Bone Abnormalities; Reconstructive Post-Mortem Dental Profiling; Cysts; Comparative Dental Identification; Fractures

3) By End User: Hospitals; Dental Clinic; Diagnostic Centres; Other End Users

Subsegments:

1) By Handheld Instruments: Scalpels; Forceps; Scissors; Elevators; Curettes; Other Handheld Instruments2) By Handpieces: Air-Driven Handpieces; Electric Handpieces; Surgical Handpieces; Low-Speed Handpieces; High-Speed Handpieces

3) By Lasers: Diode Lasers; CO2 Lasers; Erbium Lasers; Nd:YAG Lasers; Other Dental Lasers

4) By Electrosurgical Systems: Electrosurgical Generators; Electrosurgical Electrodes; Other Electrosurgical Devices

5) By Ultrasonic Instruments: Ultrasonic Scalers; Ultrasonic Surgical Instruments; Ultrasonic Cleaners; Other Ultrasonic Instruments

Key Companies Mentioned: Sirona Dental Systems; Planmeca; DentalEZ Inc.; KaVo Group; LM Dental

Countries: Australia; China; India; Indonesia; Japan; South Korea; Bangladesh; Thailand; Vietnam; Malaysia; Singapore; Philippines; Hong Kong; New Zealand; USA; Canada; Mexico; Brazil; Chile; Argentina; Colombia; Peru; France; Germany; UK; Austria; Belgium; Denmark; Finland; Ireland; Italy; Netherlands; Norway; Portugal; Spain; Sweden; Switzerland; Russia; Czech Republic; Poland; Romania; Ukraine; Saudi Arabia; Israel; Iran; Turkey; UAE; Egypt; Nigeria; South Africa

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Dental Surgical Devices and Equipment market report include:- Sirona Dental Systems

- Planmeca

- DentalEZ Inc.

- KaVo Group

- LM Dental

- A-dec Inc.

- Danaher Corporation

- Midmark Corporation

- Yoshida Dental Mfg. Co. Ltd.

- Morita Group

- Belmont Dental Equipment Company

- Integra LifeScience

- BTI Biotechnology

- Helmut Zepf Medizintechnik GmbH

- 3M Company

- Hu-Friedy Mfg. Co. LLC

- J. Morita Mfg. Corp.

- Takara Belmont Corporation

- Fimet Oy

- Join Champ

- Shinhung Co. Ltd.

- TREE

- CFPM Industries

- Prima Dental

- Aseptico Inc.

- Bien-Air Medical Technologies

- Biolase Inc.

- Brasseler USA

- Carestream Dental

- Nobel Biocare Services AG

- GC Corporation

- Henry Schein Inc.

- Ivoclar Vivadent AG

- NSK America Corporation

- Osstem Implant Co. Ltd.

- Patterson Dental

- Premier Dental Products Company

- Septodont Holding

- Straumann Holding AG

- Sybron Dental Specialties Inc.

- The Yoshida Dental Mfg. Co. Ltd.

- Ultradent Products Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 6.74 Billion |

| Forecasted Market Value ( USD | $ 10.77 Billion |

| Compound Annual Growth Rate | 12.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 43 |