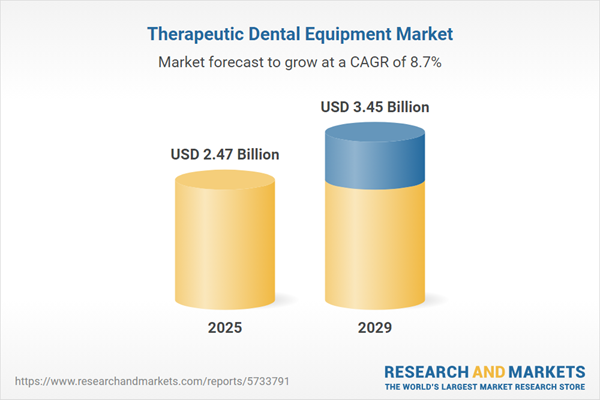

The therapeutic dental equipment market size has grown strongly in recent years. It will grow from $2.27 billion in 2024 to $2.47 billion in 2025 at a compound annual growth rate (CAGR) of 9.1%. The growth in the historic period can be attributed to dental healthcare, oral disease management, aging population, dental education and training.

The therapeutic dental equipment market size is expected to see strong growth in the next few years. It will grow to $3.45 billion in 2029 at a compound annual growth rate (CAGR) of 8.7%. The growth in the forecast period can be attributed to preventive dentistry, patient-centered care, regulatory compliance, oral health awareness. Major trends in the forecast period include technological advancements, technological integration, minimally invasive dentistry, digital dentistry.

The growing prevalence of oral diseases due to changing lifestyles and unhealthy habits has led to an increased demand for dental and oral care. Key lifestyle changes contributing to periodontal diseases include smoking, inadequate oral hygiene, and a lack of awareness about dental health. Diabetes is also a significant factor in the development of oral diseases. With the diabetic population projected to increase by 154% (reaching 642 million by 2040), the need for periodontal care is expected to surge. These lifestyle shifts, coupled with the rising diabetes prevalence, are set to drive higher demand for dental care and related procedures, consequently fueling the growth of the therapeutic dental equipment market.

The anticipated growth in healthcare expenditure is poised to propel the expansion of the therapeutic dental equipment market. Healthcare expenditure encompasses the total spending on healthcare-related goods and services within a healthcare system or economy. It plays a pivotal role in supporting the development, accessibility, and utilization of therapeutic dental equipment. For instance, in November 2022, healthcare expenditure in the United States increased by 0.8%, reaching $331 billion in 2022, following a 7.6% rise in 2021, as reported by the Canadian Institute for Health Information. Thus, the upward trend in healthcare spending is a driving force behind the therapeutic dental equipment market's growth.

Continuous technological advancements in dental lasers are having a positive impact on the dental laser industry's growth. For example, in January 2023, the Austria-based company W&H, known for manufacturing technological products, launched the new Lexa Plus Class B sterilizer and an advanced Assistina One maintenance device. The Assistina One is designed to streamline the maintenance process, enhancing efficiency for users in dental practices.

Major companies in the therapeutic dental equipment sector are introducing innovative products featuring digital light processing (DLP) technology to boost their market revenues. DLP technology is a form of 3D printing that utilizes a digital micromirror device to create high-resolution 3D prints. For instance, in May 2022, Desktop Health, a U.S.-based company specializing in medical technology products, introduced the Einstein Series, a new family of dental 3D printers that employ DLP technology to produce high-resolution 3D prints.

In the United States, manufacturers of medical laser devices must adhere to Title 21 Code of Federal Regulations (CFR). Compliance with these regulations includes providing the laser product's performance standard, specific purpose, and details about calibration records furnished to customers. For instance, Daheng Group Inc. recalled its Diode Laser Therapy System and Dental Laser Therapy System for non-compliance with 21 CFR 1040.11 and a lack of calibration procedures provided to purchasers.

Therapeutic dental equipment includes tools and devices used by dentists to diagnose and treat various oral health problems, with an emphasis on improving patient comfort and treatment effectiveness. Its primary goal is to provide effective interventions for conditions such as gum disease, cavities, and oral infections. By enhancing treatment precision and boosting the overall patient experience, this equipment plays a crucial role in modern dentistry.

The primary products in the therapeutic dental equipment market include soft tissue lasers and all-tissue lasers. Soft tissue dental equipment is utilized in various dental treatments. Soft tissue lasers are employed for tasks like removing aphthous ulcers, crown lengthening, incisions in soft tissue, and the removal of soft tissue lesions. They find applications in therapeutic areas such as restorative dentistry, orthodontics, endodontics, and others. These devices are commonly used in hospitals, clinics, and dental laboratories.

The therapeutic dental equipment market research report is one of a series of new reports that provides therapeutic dental equipment market statistics, including therapeutic dental equipment industry global market size, regional shares, competitors with a therapeutic dental equipment market share, detailed therapeutic dental equipment market segments, market trends and opportunities, and any further data you may need to thrive in the therapeutic dental equipment industry. This therapeutic dental equipment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Major companies operating in the therapeutic dental equipment market include CAO Group, BIOLASE Technology, Danaher Corporation, Dentsply Sirona, Planmeca Group, A-dec, 3M Company, Midmark Corporation, A.R.C. Laser, Carestream Health Inc., The Yoshida Dental Mfg. Co., Ivoclar Vivadent Aktiengesellschaft, Convergent Dental, Den-Mat Holdings, IPG Photonics, Gnatus International Ltda., Integra LifeSciences, Takara Belmont Corporation, NSK Nakanishi, Zimmer Biomet Holdings, Young Innovations, Prime Dental Products Pvt. Ltd., AMD LASERS LLC, Convergent Dental, GC Corporation, Henry Schein Inc., Septodont, Coltène Whaledent, Kavo Kerr, KaVo Dental, Hu-Friedy Mfg. Co. LLC, BEGO, Ultradent Products Inc., DENTALEZ, StarDental, Aseptico Inc., Parkell Inc.

Asia-Pacific was the largest region in the global therapeutic dental equipment market in 2024. Western Europe was the second-largest region in the therapeutic dental equipment market report. The regions covered in the therapeutic dental equipment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa. The countries covered in the therapeutic dental equipment market report are Australia, China, India, Indonesia, Japan, South Korea, Bangladesh, Thailand, Vietnam, Malaysia, Singapore, Philippines, Hong Kong, New Zealand, USA, Canada, Mexico, Brazil, Chile, Argentina, Colombia, Peru, France, Germany, UK, Austria, Belgium, Denmark, Finland, Ireland, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, Russia, Czech Republic, Poland, Romania, Ukraine, Saudi Arabia, Israel, Iran, Turkey, UAE, Egypt, Nigeria, South Africa.

The therapeutic dental equipment market consists of sales of dental lasers, soft-tissue laser systems, diode laser systems, CO2 laser systems, YAG laser systems, and all-tissue (hard/soft) laser systems that are used for dental therapies. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Executive Summary

Therapeutic Dental Equipment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on therapeutic dental equipment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 50 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for therapeutic dental equipment ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The therapeutic dental equipment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Soft Tissue Lasers; All Tissue Lasers2) By End User: Hospitals; Clinics; Dental laboratories

3) By Therapeutic Area: Restorative Dentistry; Orthodontics; Endodontics; Other Therapeutic Areas

Subsegments:

1) By Soft Tissue Lasers: Diode Lasers; CO2 Lasers2) By All Tissue Lasers: Er:YAG Lasers; Nd:YAG Lasers

Key Companies Mentioned: CAO Group; BIOLASE Technology; Danaher Corporation; Dentsply Sirona; Planmeca Group

Countries: Australia; China; India; Indonesia; Japan; South Korea; Bangladesh; Thailand; Vietnam; Malaysia; Singapore; Philippines; Hong Kong; New Zealand; USA; Canada; Mexico; Brazil; Chile; Argentina; Colombia; Peru; France; Germany; UK; Austria; Belgium; Denmark; Finland; Ireland; Italy; Netherlands; Norway; Portugal; Spain; Sweden; Switzerland; Russia; Czech Republic; Poland; Romania; Ukraine; Saudi Arabia; Israel; Iran; Turkey; UAE; Egypt; Nigeria; South Africa

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Therapeutic Dental Equipment market report include:- CAO Group

- BIOLASE Technology

- Danaher Corporation

- Dentsply Sirona

- Planmeca Group

- A-dec

- 3M Company

- Midmark Corporation

- A.R.C. Laser

- Carestream Health Inc.

- The Yoshida Dental Mfg. Co.

- Ivoclar Vivadent Aktiengesellschaft

- Convergent Dental

- Den-Mat Holdings

- IPG Photonics

- Gnatus International Ltda.

- Integra LifeSciences

- Takara Belmont Corporation

- NSK Nakanishi

- Zimmer Biomet Holdings

- Young Innovations

- Prime Dental Products Pvt. Ltd

- AMD LASERS LLC

- Convergent Dental

- GC Corporation

- Henry Schein Inc.

- Septodont

- Coltène Whaledent

- Kavo Kerr

- KaVo Dental

- Hu-Friedy Mfg. Co. LLC

- BEGO

- Ultradent Products Inc.

- DENTALEZ

- StarDental

- Aseptico Inc.

- Parkell Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.47 Billion |

| Forecasted Market Value ( USD | $ 3.45 Billion |

| Compound Annual Growth Rate | 8.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 38 |