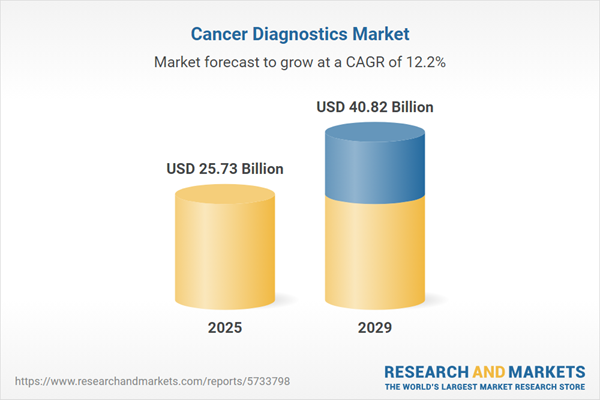

The cancer diagnostics market size has grown rapidly in recent years. It will grow from $23.24 billion in 2024 to $25.73 billion in 2025 at a compound annual growth rate (CAGR) of 10.7%. The growth in the historic period can be attributed to increasing cancer incidence, cancer screening programs, personalized medicine, public awareness.

The cancer diagnostics market size is expected to see rapid growth in the next few years. It will grow to $40.82 billion in 2029 at a compound annual growth rate (CAGR) of 12.2%. The growth in the forecast period can be attributed to emerging markets growth, regulatory support, artificial intelligence (ai) and machine learning, early detection and intervention. Major trends in the forecast period include liquid biopsies, multi-omics approaches, point-of-care testing, screening and early intervention campaigns.

The significant driver behind the cancer diagnostics market is the high prevalence of various cancer types, compelling a larger number of individuals to seek diagnosis and treatment. These escalating cancer incidents have led to cancer becoming the second most common cause of death globally, as per the World Health Organization (WHO). Projections by the National Cancer Institute (NCI) estimate new annual cancer cases to increase to 23.6 million by the year 2030.

The growth of the cancer diagnostic device market is anticipated to be significantly propelled by the rising incidence of lung cancer. Lung cancer, characterized by the uncontrolled growth of abnormal cells in lung tissues, is a prevalent and deadly form of cancer. Cancer diagnostic devices play a crucial role in detecting, diagnosing, and monitoring lung cancer, aiding healthcare professionals in identifying its presence, determining its type and stage, and guiding treatment strategies. For example, as of March 2023, Cancer.Net, an online resource affiliated with the American Society of Clinical Oncology (ASCO), has estimated that the United States will witness around 238,340 new cases of lung cancer in 2023, an increase from the 236,000 cases diagnosed in 2022. This escalating incidence of lung cancer is a key driver for the growth of the cancer diagnostic device market.

The emerging trend within the cancer diagnostics market is the utilization of AI-based systems for cancer detection. AI plays a pivotal role in enhancing the precision of image detection in diagnostic procedures related to breast and lung cancer. Its capabilities aid in identifying cancers during their early stages, thereby contributing to improved detection accuracy. In lung cancer screening, AI's involvement results in a reduction in false-positive occurrences, ultimately enhancing accuracy in cancer detection. Notably, researchers at the Naval Medical Center San Diego and Google AI research division developed an AI-driven solution for autonomous evaluation of lymph node biopsies, significantly enhancing metastatic breast cancer detection accuracy to 99%.

Prominent companies within the cancer diagnostic device market are directing their efforts toward technological advancements involving artificial intelligence (AI), as seen with QAi Prostate, to establish a competitive advantage in the industry. QAi Prostate is a cutting-edge cancer diagnostic tool specifically designed for prostate cancer detection. Notably, in March 2023, Qritive, a Singapore-based enterprise specializing in AI-powered diagnostic solutions for pathologists, introduced QAi Prostate. This innovative AI-driven tool employs machine learning algorithms to precisely recognize and categorize malignant and benign regions within prostate tissue samples. It serves as a valuable resource for pathologists, aiding in the accurate detection of prostate cancer while distinguishing between malignant and benign areas in the analyzed tissue samples.

The cancer diagnostics market is overseen by the FDA, which applies stringent regulations to cancer diagnostic devices like MRI and NMR. These devices fall under the Class II category due to their moderate associated risk. This classification subjects them to specific regulatory mandates encompassing performance standards, premarket data requirements, post-market surveillance, and necessary labelling conditions. Notably, device labelling must include details like contraindications, adverse reactions, precautions, warnings, and usage instructions. Such regulatory measures serve as a checkpoint for manufacturers producing cancer diagnostic devices.

Cancer diagnostics involves the processes, tests, and technologies used to detect the presence of cancer in individuals. This area includes various methods aimed at identifying, staging, and characterizing cancer, enabling timely and effective treatment.

The primary offerings within the cancer diagnostics sector include companion diagnostics and molecular diagnostics. Molecular diagnostics involve laboratory procedures to detect particular proteins, genes, or molecules indicating the presence of cancer. Diagnostic methods in cancer assessments encompass biopsies, endoscopies, tumor biomarker tests, and imaging. These diagnostic tools cater to various applications, including cervical cancer, breast cancer, liver cancer, blood cancer, kidney cancer, colorectal cancer, pancreatic cancer, ovarian cancer, melanoma, and others. They are utilized by diverse end-users like cancer research institutes, diagnostic laboratories, hospitals, and related entities.

The cancer diagnostics market research report is one of a series of new reports that provides cancer diagnostics market statistics, including cancer diagnostics industry global market size, regional shares, competitors with a cancer diagnostics market share, detailed cancer diagnostics market segments, market trends and opportunities, and any further data you may need to thrive in the cancer diagnostics industry. This cancer diagnostics market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Major companies operating in the cancer diagnostics market include Abbott Laboratories, Becton Dickinson and Company, Hologic, GE Healthcare Ltd., Thermo Fisher Scientific, Siemens Healthcare GmbH, Accuray, Elekta AB, C.R. BardInc., Biogenex Laboratories, Eckert & Ziegler BEBIG, Veracyte, PathAI, Bio-Rad Laboratories, Biochain, DiagnoCure, Illumina, Myriad Genetics, CompanionDx, Epic Sciences, Eli Lilly and Co, Genomic Health, Affymetrix, Agilent Technologies, Adaptive Biotechnologies, Biocartis, Biocept, Cancer Genetics Inc., Caris Life Sciences, Cepheid, Epigenomics AG, Exact Sciences, Foundation Medicine, GenMark Diagnostics, Guardant Health, HalioDX, IBA group, Invitae Corporation, Medtronic PLC, NanoString Technologies, Natera, NeoGenomics, Oncura Inc., PerkinElmer, Personal Genome Diagnostics, Qiagen, Roche Diagnostics, Theragenics Corporation, Varian Medical SystemsInc.

North America was the largest region in the cancer diagnostics market in 2024. Asia-Pacific was the second-largest region in the global cancer diagnostics market. The regions covered in the cancer diagnostics market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa. The countries covered in the cancer diagnostics market report are Australia, China, India, Indonesia, Japan, South Korea, Bangladesh, Thailand, Vietnam, Malaysia, Singapore, Philippines, Hong Kong, New Zealand, USA, Canada, Mexico, Brazil, Chile, Argentina, Colombia, Peru, France, Germany, UK, Austria, Belgium, Denmark, Finland, Ireland, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, Russia, Czech Republic, Poland, Romania, Ukraine, Saudi Arabia, Israel, Iran, Turkey, UAE, Egypt, Nigeria, South Africa.

The cancer diagnostics market consists of sales of pathology-based instruments (slide staining systems, tissue processing systems, cell processors, PCR instruments, NGS instruments, and other pathology-based instruments), imaging Instruments (CT systems, ultrasound systems, MRI systems, mammography systems, and nuclear imaging systems) and biopsy instruments that are used for the diagnosis of cancer. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Cancer Diagnostics Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on cancer diagnostics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 50 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for cancer diagnostics ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The cancer diagnostics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Products: Companion Diagnostics; Molecular Diagnostics2) By Method: Biopsy; Endoscopy; Tumor Biomarker Tests; Imaging

3) By Application: Cervical Cancer; Breast Cancer; Liver Cancer; Blood Cancer; Kidney Cancer; Colorectal Cancer; Pancreatic Cancer; Ovarian Cancer; Melanoma; Other Applications

4) By End-User: Cancer Research Institutes; Diagnostic Laboratories; Hospitals; Other End Users

Subsegments:

1) By Companion Diagnostics: Biomarker-Based Companion Diagnostics; Genetic Testing-Based Companion Diagnostics; Immunohistochemistry-Based Companion Diagnostics; PCR-Based Companion Diagnostics; Other Companion Diagnostics;2) By Molecular Diagnostics: Polymerase Chain Reaction (PCR) Diagnostics; Next-Generation Sequencing (NGS) Diagnostics; in Situ Hybridization Diagnostics; Microarray-Based Diagnostics; DNA or RNA Extraction Kits; Other Molecular Diagnostics

Key Companies Mentioned: Abbott Laboratories; Becton Dickinson and Company; Hologic; GE Healthcare Ltd.; Thermo Fisher Scientific

Countries: Australia; China; India; Indonesia; Japan; South Korea; Bangladesh; Thailand; Vietnam; Malaysia; Singapore; Philippines; Hong Kong; New Zealand; USA; Canada; Mexico; Brazil; Chile; Argentina; Colombia; Peru; France; Germany; UK; Austria; Belgium; Denmark; Finland; Ireland; Italy; Netherlands; Norway; Portugal; Spain; Sweden; Switzerland; Russia; Czech Republic; Poland; Romania; Ukraine; Saudi Arabia; Israel; Iran; Turkey; UAE; Egypt; Nigeria; South Africa

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Cancer Diagnostics market report include:- Abbott Laboratories

- Becton Dickinson and Company

- Hologic

- GE Healthcare Ltd.

- Thermo Fisher Scientific

- Siemens Healthcare GmbH

- Accuray

- Elekta AB

- C.R. BardInc.

- Biogenex Laboratories

- Eckert & Ziegler BEBIG

- Veracyte

- PathAI

- Bio-Rad Laboratories

- Biochain

- DiagnoCure

- Illumina

- Myriad Genetics

- CompanionDx

- Epic Sciences

- Eli Lilly and Co

- Genomic Health

- Affymetrix

- Agilent Technologies

- Adaptive Biotechnologies

- Biocartis

- Biocept

- Cancer Genetics Inc.

- Caris Life Sciences

- Cepheid

- Epigenomics AG

- Exact Sciences

- Foundation Medicine

- GenMark Diagnostics

- Guardant Health

- HalioDX

- IBA group

- Invitae Corporation

- Medtronic plc

- NanoString Technologies

- Natera

- NeoGenomics

- Oncura Inc.

- PerkinElmer

- Personal Genome Diagnostics

- Qiagen

- Roche Diagnostics

- Theragenics Corporation

- Varian Medical SystemsInc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 25.73 Billion |

| Forecasted Market Value ( USD | $ 40.82 Billion |

| Compound Annual Growth Rate | 12.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 50 |