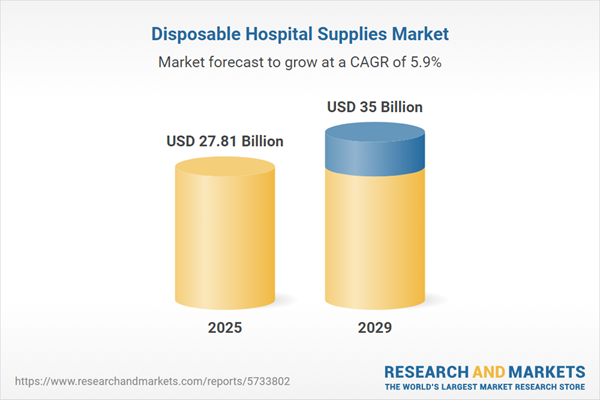

The disposable hospital supplies market size is expected to see strong growth in the next few years. It will grow to $35 billion in 2029 at a compound annual growth rate (CAGR) of 5.9%. The growth in the forecast period can be attributed to rising healthcare investments, prevalence of chronic diseases, global pandemic preparedness, evolving regulatory landscape, environmental sustainability initiatives. Major trends in the forecast period include technological innovations, telehealth expansion, advancements in medical technology, increased emphasis on cost efficiency, rising adoption of single-use devices.

The rising number of COVID-19 cases worldwide is expected to increase the demand for disposable hospital supplies. The rapid rise in COVID-19 cases is creating significant demand for personal protective equipment (PPE) and other disposable items to safeguard healthcare workers from infections during their daily operations. For example, in January 2024, the World Health Organization, a Switzerland-based international organization, reported a 4% increase in new COVID-19 cases during the 28-day period from December 11, 2023, to January 7, 2024, compared to the previous 28 days, with over 1.1 million new cases. Consequently, the rising number of COVID-19 cases is driving the growth of the disposable hospital supplies market.

Key players in the disposable hospital supplies market are concentrating on forming strategic partnerships to gain a competitive advantage. These collaborations are essential for expanding product portfolios, improving distribution networks, fostering innovation, and increasing market reach. For instance, in February 2024, Argosy Healthcare, a US-based equity firm focused solely on healthcare investments, partnered with Command Medical Products, a US-based manufacturing service dedicated exclusively to medical devices. This strategic initiative aims to enhance Command's capabilities in contract manufacturing for single-use disposable medical devices, serving global original equipment manufacturers (OEMs) and life sciences clients.

Prominent companies in the disposable hospital supplies market are actively innovating their product offerings, exemplified by the introduction of ClearMask Transparent Surgical Mask Plus, to address evolving customer requirements. The ClearMask Transparent Surgical Mask represents a groundbreaking advancement as the first fully transparent, FDA-cleared, and CE-marked mask designed for optimal clarity and comfort. For example, in May 2022, ClearMask LLC, a US-based medical supply company, launched the ClearMask Transparent Surgical Mask, aiming to enhance human connections and facilitate clearer communication, particularly for individuals who rely on lip-reading or facial expressions. The mask, crafted from lightweight materials, incorporates an anti-fogging design to ensure maximum clarity. The introduction of the ClearMask Transparent Surgical Mask Plus underscores the continuous innovation in the disposable mask market, prioritizing improvements in comfort, communication, and protection.

Key players in the disposable hospital supplies market are actively spearheading the development of innovative products such as PROSENSO biodegradable nitrile gloves, aimed at mitigating environmental pollution caused by traditional disposable gloves. The PROSENSO biodegradable nitrile gloves represent a groundbreaking and transformative solution, designed to undergo microbial degradation in both aerobic and anaerobic environments within landfills. For instance, in June 2022, Eastwest Medico Aps, a Denmark-based company, introduced the PROSENSO biodegradable nitrile gloves, marking the inception of the first biodegradable disposable gloves in the market. These gloves undergo thorough testing and certification processes, ensuring compliance with or surpassing industry benchmarks for performance and reliability. The introduction of such eco-friendly alternatives reflects a commitment to waste reduction initiatives and the promotion of sustainable practices within the disposable hospital supplies industry. By embracing these innovative solutions, manufacturers contribute to environmental conservation efforts and advocate for a more sustainable future.

In September 2024, Kimberly-Clark Corporation, a US-based consumer goods company, completed the acquisition of Ballard Medical Products for $774 million. This acquisition is intended to enhance Kimberly-Clark's portfolio within the healthcare sector, specifically in disposable medical products. By incorporating Ballard Medical's offerings, Kimberly-Clark aims to solidify its presence in the expanding disposable medical device market, which is becoming increasingly essential for healthcare providers. Ballard Medical is a US-based manufacturer specializing in disposable medical devices.

Major companies operating in the disposable hospital supplies market include Cardinal Health Inc., Johnson & Johnson Services Inc., Abbott Laboratories, 3M Company, Covidien Limited, Medtronic plc, Medline Industries Inc., Kimberly-Clark Corporation, Becton, Dickinson and Company, Baxter International Inc., Owens & Minor Inc., B Braun Melsungen AG, Terumo Corporation, Steris Corporation, Nipro Corporation, Getinge AB, Molnlycke Health Care AB, Ansell Healthcare LLC, Avanos Medical Inc., Semperit AG Holding, Advanced Sterilization Products Services Inc.

North America was the largest region in the disposable hospital supplies market in 2024. Western Europe was the second largest region in the global disposable hospital supplies market. The regions covered in the disposable hospital supplies market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the disposable hospital supplies market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Disposable hospital supplies, classified as medical devices for single-use, play a vital role in healthcare facilities, notably in hospitals, by streamlining processes, saving time, and reducing healthcare expenses.

These supplies encompass a range of items including gloves, drapes, gowns, needles, syringes, procedure kits and trays, bandages, and masks. Drapes serve the purpose of being covered or adorned with cloth folds. They encompass diagnostic supplies, dialysis consumables, radiology consumables, infusion products, incubation and ventilation supplies, hypodermic products, sterilization consumables, non-woven medical supplies, wound care consumables, and other related items. These supplies cater to diverse end-users such as hospitals, clinics/physician offices, assisted living centers, nursing homes, ambulatory surgery centers, and research institutes.

The disposable hospital supplies market research report is one of a series of new reports that provides disposable hospital supplies market statistics, including disposable hospital supplies industry global market size, regional shares, competitors with a disposable hospital supplies market share, detailed disposable hospital supplies market segments, market trends and opportunities, and any further data you may need to thrive in the disposable hospital supplies industry. This disposable hospital supplies market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The disposable hospital supplies market consists of sales of procedure kits and trays, conventional syringes and needles, facemasks, prefilled syringes, isolation gowns, and medical gloves that are used in dental hospitals. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Disposable Hospital Supplies Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on disposable hospital supplies market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for disposable hospital supplies? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The disposable hospital supplies market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Gloves; Drapes; Gowns; Needles; Syringes; Procedure Kits and Trays; Bandages; Masks2) By Product: Diagnostic Supplies; Dialysis Consumables; Radiology Consumables; Infusion Products; Incubation and Ventilation Supplies; Hypodermic Products; Sterilization Consumables; Non-Woven Medical Supplies; Wound Care Consumables; Other Products

3) By End-Users: Hospitals; Clinics or Physician Offices; Assisted Living Centers and Nursing Homes; Ambulatory Surgery Centers; Research Institutes

Subsegments:

1) By Gloves: Latex Gloves; Nitrile Gloves; Vinyl Gloves2) By Drapes: Surgical Drapes; Non-Surgical Drapes

3) By Gowns: Surgical Gowns; Isolation Gowns; Patient Gowns

4) By Needles: Hypodermic Needles; IV Needles; Specialty Needles

5) By Syringes: Standard Syringes; Safety Syringes; Insulin Syringes

6) By Procedure Kits and Trays: Surgical Procedure Kits; Diagnostic Procedure Kits

7) By Bandages: Adhesive Bandages; Sterile Dressings; Compression Bandages

8) By Masks: Surgical Masks; N95 Respirators; Face Shields

Key Companies Mentioned: Cardinal Health Inc.; Johnson & Johnson Services Inc.; Abbott Laboratories; 3M Company; Covidien Limited

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Cardinal Health Inc.

- Johnson & Johnson Services Inc.

- Abbott Laboratories

- 3M Company

- Covidien Limited

- Medtronic plc

- Medline Industries Inc.

- Kimberly-Clark Corporation

- Becton

- Dickinson and Company

- Baxter International Inc.

- Owens & Minor Inc.

- B Braun Melsungen AG

- Terumo Corporation

- Steris Corporation

- Nipro Corporation

- Getinge AB

- Molnlycke Health Care AB

- Ansell Healthcare LLC

- Avanos Medical Inc.

- Semperit AG Holding

- Advanced Sterilization Products Services Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 27.81 Billion |

| Forecasted Market Value ( USD | $ 35 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |