The benzene market consists of the sales of benzene used as an intermediary chemical in the production of plastics, resins, dyes, detergents, drugs, pesticides, nylons, and synthetic fibers. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

Benzene refers to an aromatic hydrocarbon produced from cracked gasoline. It is highly flammable and has a sweet odor. Benzene is manufactured naturally by volcanoes and forest fires.

The Asia Pacific was the largest region in the benzene market in 2022. North America was the second-largest region in the benzene market. The regions covered in the benzene market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa.

The main manufacturing processes of benzene are pyrolysis steam cracking of naphtha, catalytic reforming of naphtha, toluene hydrodealkylation, toluene disproportionation, and biomass. toluene disproportionation to benzene from less valuable toluene. These are derived from ethylbenzene, cumene, alkylbenzene, aniline, chlorobenzene, cyclohexane, maleic anhydride, and other derivatives. Benzene is applied in plastics, resins, synthetic fibers, and rubber lubricants.

The increased use of styrene to drive the benzene market The benzene derivative ethylbenzene is majorly used in the manufacturing of styrene. Styrene is used in the production of various products, such as styrene-acrylonitrile (SAN), acrylonitrile-butadiene-styrene (ABS), polystyrene, styrene-butadiene elastomers, latexes, unsaturated polyester resins, among others. There is an increased demand for styrene-based polymers and copolymers in the automotive industry due to their lightweight nature. For instance, according to the American Chemistry Council (ACC), the fuel economy of a vehicle can improve by 6-8% by reducing the weight of a vehicle by 10%. Usage of plastics like styrene can reduce the weight of vehicles, thereby improving fuel economy. The use of styrene has also benefited manufacturers by reducing vehicle assembly time and costs. These advantages of the usage of styrene-based polymers and copolymers, especially in the automotive industry, are expected to contribute to the growth of the benzene market.

Stringent safety regulations associated with the manufacture and transportation of benzene were a significant market restraint. Benzene is highly inflammable, toxic, and hazardous when exposed to extreme temperatures and pressures. Companies in this market should invest in equipment, technologies, and processes to limit the toxic levels and chemical concentrations as they may harm the environment and population. Humans, when exposed to benzene in the air for a certain amount of time, lose their lives. In order to provide a safe environment, government agencies limit the amount of benzene that can be released into the environment. For instance, the EPA (Environmental Protection Agency) has set the maximum permissible level of benzene in drinking water at 5 ppb (per billion parts of air). These regulations have increased the operating costs of companies in this industry, thus restricting their growth.

Many companies in the benzene market are focusing on research and developmental activities to discover new technologies and processes for the production of benzene. The technologies developed are expected to help curb environmental issues. For instance, Reliance Industries Limited entered into a joint venture with the Indian Institute of Petroleum (IIP), Dehradun, to develop a technology that restricts benzene content in the gasoline pool to address health and environmental concerns. The increase in such technological advances to reduce emissions will gain traction and contribute to the growth of the market.

in June 2020, Ineos, a UK-based chemicals company acquired chemical unit (aromatics and acetyls business) of BP plc for $5 billion along with its BP's Cooper River petrochemical plant in South Carolina among other facilities. This will enhance the production capacity of aromatics to cater to the market demand and enables operations synergies. BP plc is a UK-based oil and gas company.

The countries covered in the benzene market are Brazil, China, France, Germany, India, Indonesia, Japan, South Korea, Russia, the UK, the USA, and Australia.

The market value is defined as the revenues that enterprises gain from goods and/or services sold within the specified market and geography through sales, grants, or donations in terms of currency (in USD ($) unless otherwise specified).

The revenues for a specified geography are consumption values - that is, they are revenues generated by organizations in the specified geography within the specified market, irrespective of where they are produced. It does not include revenues from resales either further along the supply chain or as part of other products.

The benzene market research report is one of a series of new reports that provides benzene market statistics, including benzene industry global market size, regional shares, competitors with a benzene market share, detailed benzene market segments, market trends and opportunities, and any further data you may need to thrive in the benzene industry. This benzene market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Major players in the benzene market are Ameriya Oil Ref. Co., Angarsk Petrochemical, Alexandria National Refining, and Petrochemicals Company (ANRPC), Arsol Aromatics GmbH & Co. KG, Atyrau Oil & Gas, Azerkhimija, BASF SE, Borealis AG, Bp Plc, and Braskem.

This product will be delivered within 3-5 business days.

Table of Contents

1. Executive Summary2. Benzene Market Characteristics

3. Benzene Market - Macro Economic Scenario

3.1 COVID-19 Impact On Benzene Market

3.2 Ukraine-Russia War Impact On Benzene Market

3.3 Impact Of High Inflation On Benzene Market

4. Benzene Market Size And Growth

4.1. Global Benzene Historic Market, 2017 - 2022, $ Billion

4.1.1. Drivers Of The Market

4.1.2. Restraints On The Market

4.2. Global Benzene Forecast Market, 2022- 2027F, 2032F, $ Billion

4.2.1. Drivers Of The Market

4.2.2. Restraints On the Market

5. Benzene Market Segmentation

5.1. Global Benzene Market, Segmentation By Manufacturing Process, Historic and Forecast, 2017-2022, 2027F, 2032F, $ Billion

- Pyrolysis Steam Cracking of Naphtha

- Catalytic Reforming of Naphtha

- Toluene Hydrodealkylation

- Toluene Disproportionation

- From Biomass

- Ethylbenzene

- Cumene

- Alkylbenzene

- Aniline

- Chlorobenzene

- Cyclohexane

- Maleic Anhydride

- Other Derivatives

- Plastics

- Resins

- Synthetic Fibers

- Rubber Lubricants

6.1. Global Benzene Market, Split By Region, Historic and Forecast, 2017-2022, 2027F, 2032F, $ Billion

6.2. Global Benzene Market, Split By Country, Historic and Forecast, 2017-2022, 2027F, 2032F, $ Billion

7. Asia-Pacific Benzene Market

7.1. Asia-Pacific Benzene Market Overview

7.2. Asia-Pacific Benzene Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2027F, 2032F, $ Billion

8. China Benzene Market

8.1. China Benzene Market Overview

8.2. China Benzene Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2027F, 2032F,$ Billion

9. India Benzene Market

9.1. India Benzene Market Overview

9.2. India Benzene Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2027F, 2032F, $ Billion

10. Japan Benzene Market

10.1. Japan Benzene Market Overview

10.2. Japan Benzene Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2027F, 2032F, $ Billion

11. Australia Benzene Market

11.1. Australia Benzene Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2027F, 2032F, $ Billion

12. Indonesia Benzene Market

12.1. Indonesia Benzene Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2027F, 2032F, $ Billion

13. South Korea Benzene Market

13.1. South Korea Benzene Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2027F, 2032F, $ Billion

14. Western Europe Benzene Market

14.1. Western Europe Benzene Market Overview

14.2. Western Europe Benzene Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2027F, 2032F, $ Billion

15. UK Benzene Market

15.1. UK Benzene Market Overview

15.2. UK Benzene Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2027F, 2032F, $ Billion

16. Germany Benzene Market

16.1. Germany Benzene Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2027F, 2032F, $ Billion

17. France Benzene Market

17.3. France Benzene Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2027F, 2032F, $ Billion

18. Eastern Europe Benzene Market

18.1. Eastern Europe Benzene Market Overview

18.2. Eastern Europe Benzene Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2027F, 2032F, $ Billion

19. Russia Benzene Market

19.1. Russia Benzene Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2027F, 2032F, $ Billion

20. North America Benzene Market

20.1. North America Benzene Market Overview

20.2. North America Benzene Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2027F, 2032F, $ Billion

21. USA Benzene Market

21.1. USA Benzene Market Overview

21.2. USA Benzene Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2027F, 2032F, $ Billion

22. South America Benzene Market

22.1. South America Benzene Market Overview

22.2. South America Benzene Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2027F, 2032F, $ Billion

23. Brazil Benzene Market

23.1. Brazil Benzene Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2027F, 2032F, $ Billion

24. Middle East Benzene Market

24.1. Middle East Benzene Market Overview

24.2. Middle East Benzene Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2027F, 2032F, $ Billion

25. Africa Benzene Market

25.1. Africa Benzene Market Overview

25.2. Africa Benzene Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2027F, 2032F, $ Billion

26. Benzene Market Competitive Landscape And Company Profiles

26.1. Benzene Market Competitive Landscape

26.2. Benzene Market Company Profiles

26.2.1. Ameriya Oil Ref. Co.

26.2.1.1. Overview

26.2.1.2. Products and Services

26.2.1.3. Strategy

26.2.1.4. Financial Performance

26.2.2. Angarsk Petrochemical

26.2.2.1. Overview

26.2.2.2. Products and Services

26.2.2.3. Strategy

26.2.2.4. Financial Performance

26.2.3. Alexandria National Refining and Petrochemicals Company (ANRPC)

26.2.3.1. Overview

26.2.3.2. Products and Services

26.2.3.3. Strategy

26.2.3.4. Financial Performance

26.2.4. Arsol Aromatics GmbH & Co. KG

26.2.4.1. Overview

26.2.4.2. Products and Services

26.2.4.3. Strategy

26.2.4.4. Financial Performance

26.2.5. Atyrau Oil & Gas

26.2.5.1. Overview

26.2.5.2. Products and Services

26.2.5.3. Strategy

26.2.5.4. Financial Performance

27. Key Mergers And Acquisitions In The Benzene Market

28. Benzene Market Trends And Strategies

29. Benzene Market Future Outlook and Potential Analysis

30. Appendix

30.1. Abbreviations

30.2. Currencies

30.3. Historic And Forecast Inflation Rates

30.4. Research Inquiries

30.5. About the Publisher

30.6. Copyright And Disclaimer

Executive Summary

Benzene Global Market Report 2023 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on benzene market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase

- Gain a truly global perspective with the most comprehensive report available on this market covering 50+ geographies.

- Understand how the market has been affected by the coronavirus and how it is responding as the impact of the virus abates.

- Assess the Russia - Ukraine war’s impact on agriculture, energy and mineral commodity supply and its direct and indirect impact on the market.

- Measure the impact of high global inflation on market growth.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

Scope

Markets Covered

1) By Manufacturing Process: Pyrolysis Steam Cracking of Naphtha; Catalytic Reforming of Naphtha; Toluene Hydrodealkylation; Toluene Disproportionation; From Biomass2) By Derivative: Ethylbenzene; Cumene; Alkylbenzene; Aniline; Chlorobenzene; Cyclohexane; Maleic Anhydride; Other Derivatives

3) By Application: Plastics; Resins; Synthetic Fibers; Rubber Lubricants

Companies Mentioned: Ameriya Oil Ref. Co.; Angarsk Petrochemical; Alexandria National Refining and Petrochemicals Company (ANRPC); Arsol Aromatics GmbH & Co. KG; Atyrau Oil & Gas

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita,

Data segmentations: country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Ameriya Oil Ref. Co.

- Angarsk Petrochemical

- Alexandria National Refining and Petrochemicals Company (ANRPC)

- Arsol Aromatics GmbH & Co. KG

- Atyrau Oil & Gas

- Azerkhimija

- BASF SE

- Borealis AG

- Bp Plc

- Braskem

- Chevron Phillips Chemical Company

- China National Petroleum Corporation

- China Petrochemical Corporation

- China Petroleum & Chemical Corporation (Sinopec)

- CPC Corporation Limited

- Deza, A. S

- Eastman Chemical Company

- Egyptian Petrochemicals Holding Company (ECHEM)

- Exxon Mobil Corporation

- Flint Hills Resources

- Gadiv Petrochemical Industries

- Gazprom Neft PJSC

- GS Caltex Corporation

- IBN Rushd

- INEOS

- JSC Mozyr Oil Refinery

- JX Holdings

- JXTG Nippon Oil & Energy Corporation

- Kian Petrochemical Company

- Kuwait Aromatics Co. (Karo)

- LG Chem

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | February 2023 |

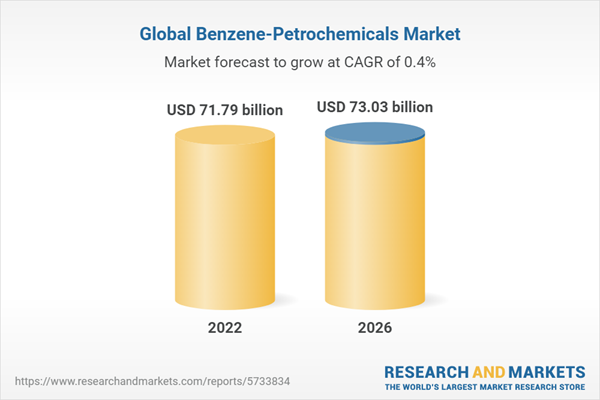

| Forecast Period | 2022 - 2026 |

| Estimated Market Value ( USD | $ 71.79 billion |

| Forecasted Market Value ( USD | $ 73.03 billion |

| Compound Annual Growth Rate | 0.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |