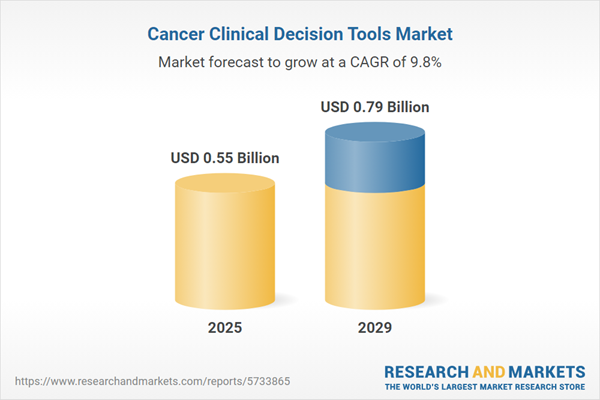

The cancer clinical decision tools market size has grown strongly in recent years. It will grow from $0.5 billion in 2024 to $0.55 billion in 2025 at a compound annual growth rate (CAGR) of 9.5%. The growth in the historic period can be attributed to the growing prevalence of cancer, increasing complexity of cancer treatment, rising demand for personalized medicine, growing adoption of value-based healthcare, increasing availability of cancer data, and government support for cancer research and development.

The cancer clinical decision tools market size is expected to see strong growth in the next few years. It will grow to $0.79 billion in 2029 at a compound annual growth rate (CAGR) of 9.8%. The growth in the forecast period can be attributed to global aging population, patient engagement and shared decision-making, patient-centric care, clinical research and evidence-based medicine. Major trends in the forecast period include advancements in medical imaging, AI-driven clinical decision support, telemedicine and remote consultations, predictive analytics, interoperability and data standards, and ethical and regulatory considerations.

The ascending global cancer cases are poised to fuel growth in the cancer clinical decision tools market. As highlighted by the American Cancer Society in January 2022, the US alone is estimated to witness 1.9 million new cancer diagnoses and approximately 609,360 cancer-related deaths, translating to roughly 1,670 fatalities daily. Lung, prostate, bowel, and female breast cancers collectively account for 43% of all new cancer cases worldwide. This surge in cancer incidents globally is projected to intensify the demand for cancer clinical decision tools, expediting treatment decisions and thereby bolstering the market for these tools.

The proliferation of healthcare IT adoption is anticipated to be a driving force behind the cancer clinical decision tools market. Healthcare IT adoption denotes the assimilation and usage of information technology solutions within the healthcare domain. Health institutions strategically invest in information technology, encompassing electronic health records (EHRs) and clinical decision support systems (CDSS), aiming to optimize patient care. These systems integrate real-time patient data, treatment guidelines, and alert mechanisms for potential issues, ultimately enhancing cancer treatment outcomes. For example, a report published by the Healthcare Information and Management Systems Society (HIMSS) in January 2022 indicated that a significant 80% of healthcare providers planned to augment their technology investments over the next five years. This trend in healthcare IT adoption is expected to propel the cancer clinical decision tools market's growth trajectory.

Key industry players in the cancer clinical decision tools market are exploring innovative offerings like the BenchMark Ultra Plus tissue staining system to gain a competitive edge. This advanced system streamlines tissue staining, enabling quicker and more accurate pathology outcomes. Launched by F. Hoffmann-La Roche AG in June 2022, the BenchMark Ultra Plus system showcases enhanced workflow efficiency, testing processes, and sustainability attributes. This innovation empowers pathologists to deliver high-quality, time-sensitive results to medical professionals and patients alike. The BenchMark Ultra Plus system marks a significant advancement in the BenchMark series, automating erstwhile manual slide-by-slide processes and revolutionizing cancer diagnostics.

In October 2022, Beckman Coulter Inc., a medical diagnostics company based in the United States, acquired StoCastic, LLC for an undisclosed amount. This acquisition is intended to enhance Beckman Coulter's capabilities in cancer diagnostics by incorporating advanced data analytics and clinical decision support tools developed by StoCastic, LLC. StoCastic, LLC is a U.S.-based biotechnology firm that focuses on creating advanced data analytics and clinical decision tools specifically for cancer diagnostics and treatment.

Major companies operating in the cancer clinical decision tools market include McKesson Corporation, Medical Information Technology Inc., Philips Healthcare, Siemens Healthineers AG, Elsevier B.V., Macmillan Publishers Limited, National Decision Support Company, Cerner Corporation, GE Healthcare, Allscripts Healthcare Solutions Inc., Epic Systems Corporation, RaySearch Laboratories AB, Elekta AB, Varian Medical Systems Inc., Accuray Incorporated, F. Hoffmann-La Roche Ltd., Flatiron Health Inc., Tempus Labs Inc., NantHealth Inc., Syapse Inc., Inspirata Inc., Oncora Medical Inc., Prognos Health Inc., Deep 6 AI Inc., PathAI Inc., Enlitic Inc., Ibex Medical Analytics Ltd., Zebra Medical Vision Ltd., Aidoc Medical Ltd.

Cancer clinical decision tools are instrumental aids designed to support medical practitioners in identifying potential signs and symptoms of cancer, enabling more effective patient treatment. These tools play a crucial role in clinical decision-making by assisting General Practitioners (GPs) in determining whether further diagnostic testing or referrals are necessary for patients suspected of having cancer.

Among the primary types of cancer clinical decision tools are risk assessment tools (RAT) and Qcancer. Risk assessment tools evaluate a combination of risk factors, encompassing genetic, environmental, and behavioral elements, to translate these factors into estimations of an individual's likelihood of developing specific types of cancer. These tools serve to streamline risk models and facilitate assessments of an individual's cancer risk profile. These cancer clinical decision tools find application across various healthcare settings, including hospitals and clinics, supporting healthcare professionals in making informed decisions regarding patient care and potential referrals for further diagnostic assessments.

The cancer clinical decision tools market research report is one of a series of new reports that provides cancer clinical decision tools market statistics, including cancer clinical decision tools industry global market size, regional shares, competitors with a cancer clinical decision tools market share, detailed cancer clinical decision tools market segments, market trends and opportunities, and any further data you may need to thrive in the cancer clinical decision tools industry. This cancer clinical decision tools market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

North America was the largest region in the cancer clinical decision tools market in 2024. The regions covered in the cancer clinical decision tools market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa. The countries covered in the cancer clinical decision tools market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

The market for cancer clinical decision tools consists of sales of risk assessment tools, Q-Cancer tools, and MacMillan’s cancer decision tool. Values in this market are ‘factory gate values,’ that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Cancer Clinical Decision Tools Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on cancer clinical decision tools market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for cancer clinical decision tools ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The cancer clinical decision tools market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Risk Assessment Tool(RAT); Qcancer2) By End-User: Hospital; Clinics

Subsegments:

1) By Risk Assessment Tool (RAT): Family History Assessment; Genetic Testing and Counseling; Lifestyle and Environmental Risk Factors Evaluation2) By Qcancer: Symptom Checker; Risk Calculator; Guideline-Based Recommendations

Key Companies Mentioned: McKesson Corporation; Medical Information Technology Inc.; Philips Healthcare; Siemens Healthineers AG; Elsevier B.V.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Cancer Clinical Decision Tools market report include:- McKesson Corporation

- Medical Information Technology Inc.

- Philips Healthcare

- Siemens Healthineers AG

- Elsevier B.V.

- Macmillan Publishers Limited

- National Decision Support Company

- Cerner Corporation

- GE Healthcare

- Allscripts Healthcare Solutions Inc.

- Epic Systems Corporation

- RaySearch Laboratories AB

- Elekta AB

- Varian Medical Systems Inc.

- Accuray Incorporated

- F. Hoffmann-La Roche Ltd.

- Flatiron Health Inc.

- Tempus Labs Inc.

- NantHealth Inc.

- Syapse Inc.

- Inspirata Inc.

- Oncora Medical Inc.

- Prognos Health Inc.

- Deep 6 AI Inc.

- PathAI Inc.

- Enlitic Inc.

- Ibex Medical Analytics Ltd.

- Zebra Medical Vision Ltd.

- Aidoc Medical Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 0.55 Billion |

| Forecasted Market Value ( USD | $ 0.79 Billion |

| Compound Annual Growth Rate | 9.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |