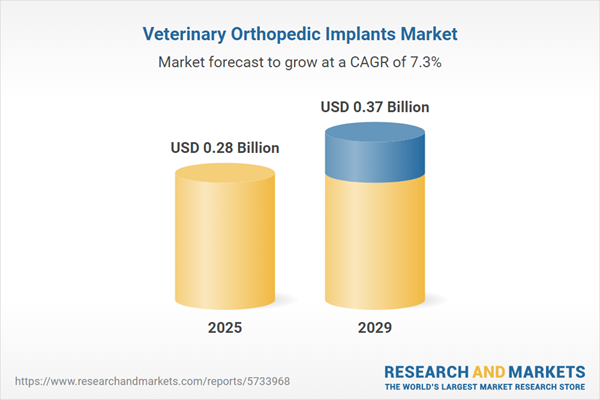

The veterinary orthopedic implants market size has grown strongly in recent years. It will grow from $0.26 billion in 2024 to $0.28 billion in 2025 at a compound annual growth rate (CAGR) of 7%. The growth in the historic period can be attributed to rising pet ownership rate, growing awareness of the benefits of veterinary orthopedic surgery, companion animal humanization, aging pet population, veterinary referral centers.

The veterinary orthopedic implants market size is expected to see strong growth in the next few years. It will grow to $0.37 billion in 2029 at a compound annual growth rate (CAGR) of 7.3%. The growth in the forecast period can be attributed to aging pet population, increasing pet insurance, pet obesity and joint health, rising awareness of the benefits of preventive veterinary care, custom implants, minimally invasive surgery. Major trends in the forecast period include advancements in veterinary medicine, customized implants, regenerative medicine, digital health and telemedicine, orthopedic device connectivity, 3d printing technology, biocompatible materials, rehabilitation and physical therapy.

The rising incidence of obesity and arthritis among pets is driving demand in the veterinary orthopedic implants market. Obesity is a condition in which a pet’s excessive weight negatively impacts its health, often weakening bones, while arthritis causes a loss of bone strength in pets. Both obesity and arthritis can lead to fractures and other bone and joint issues, which adversely affect the pet’s overall health and may reduce its lifespan. For example, in March 2023, the World Heart Foundation, a Switzerland-based global cardiovascular community, reported that approximately 2.3 billion adults and children worldwide are obese or overweight. This number is projected to reach 2.7 billion by 2025 if current trends continue. Consequently, the prevalence of bone-impacting health conditions like obesity and arthritis is fueling growth in the veterinary orthopedic implants market.

The rise in pet ownership is anticipated to drive growth in the veterinary orthopedic implants market. Pet ownership involves caring for a domesticated animal and meeting its needs for food, water, shelter, healthcare, and companionship. Orthopedic implants are widely used in veterinary surgeries, helping veterinarians enhance pets' quality of life and improve their mobility. These procedures are particularly valuable for maintaining the comfort and well-being of pets as they age or recover from injuries. For example, according to the UK Pet Food Organization, there were 13.5 million dogs and 12.5 million cats in the UK in 2024, reflecting an increase of 1.5 million for each species. This increase in pet ownership is contributing to the growth of the veterinary orthopedic implants market.

Companies in the veterinary orthopedic implants sector are heavily investing in 3D printing technology to innovate their products. This technology enables the creation of bone models, surgical guides, and titanium implants, streamlining surgical procedures by reducing time and costs. Langford Veterinary Services, in collaboration with CBM, has successfully treated dogs with bone deformities by utilizing 3D printing for titanium implants. CBM, a UK-based entity specializing in research and manufacturing, employs advanced 3D printing techniques, creating models using the Arcam EBM Q10plus machine from MRI or CT scans sent by Langford Veterinary Services. This adoption of 3D printing represents a significant trend in the veterinary orthopedic implants market, fostering its growth.

Major players in the veterinary orthopedic implants arena are optimizing operations by expanding their distribution centers to bolster revenues. This expansion involves increasing logistics facilities to store finished goods, ensuring efficient order fulfillment. For instance, in January 2022, Movora, a prominent provider of veterinary orthopedic implants, established a new US distribution center, aiming to streamline operations and enhance customer experience. The move promises simpler purchasing processes, comprehensive educational options, and an extensive range of orthopedic products, from accessories to advanced joint replacement systems, contributing to their market dominance.

In August 2022, Vimian Group, a Sweden-based animal health company, acquired New Generation Devices’ assets. The acquisition, Vimian will get access to a new customer base, which they can tap to increase their revenues. New Generation Devices is a veterinary orthopedic implant manufacturer based in the United States that was founded in 2002.

Veterinary orthopedic implants serve as surgical instruments employed to repair and restore the functionality of fractured bone structures in animals. These implants are typically constructed from various metals like pure commercial titanium (Ti), titanium alloys, stainless steel, and cobalt-chromium (Co-Cr) alloys. Veterinary surgeons utilize these implants for bone fixation procedures, treating fractures, and providing structural support during the healing process and reconstructive surgeries in animals.

Key product types within the veterinary orthopedic implants market include advanced locking plate systems, tibial plateau levelling osteotomy implants, tibial tuberosity advancement implants, total elbow replacement, total hip replacement, total knee replacement, and trauma fixations. For instance, tibial plateau levelling osteotomy implants are specifically used to address cranial cruciate ligament ruptures in dogs. These implants cater to various animals such as dogs and cats and are utilized by end-users such as veterinary hospitals, clinics, and surgical centers to provide advanced orthopedic care for animals.

The veterinary orthopedic implants market research report is one of a series of new reports that provides veterinary orthopedic implants market statistics, including veterinary orthopedic implants industry global market size, regional shares, competitors with a veterinary orthopedic implants market share, detailed veterinary orthopedic implants market segments, market trends and opportunities, and any further data you may need to thrive in the veterinary orthopedic implants industry. The veterinary orthopedic implants market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

Major companies operating in the veterinary orthopedic implants market include KYON Pharma Inc., Veterinary Orthopedic Implants Inc., BioMedtrix LLC, IMEX Veterinary Inc., Orthomed Ltd., Securos Surgical, B.Braun Vet Care, BlueSAO, MWI Veterinary Supply Co., New Generation Devices, Scil Animal Care Company, SophiaTech, Johnson & Johnson, Fusion Implants, GPC Medical Ltd., Narang Medical Limited, D4 Surgicals (India) Pvt. Ltd., Uteshiya Medicare Private Limited., Bonetech Medisys Pvt. Ltd., Integra LifeSciences Corporation, GerMedUSA Inc., Everost Inc., Arthrex Vet Systems, Ortho Max Mfg. Co. Pvt. Ltd., Auxein Medical, Vimian Group, Innoplant Medizintechnik GmbH.

North America was the largest region in the veterinary orthopedic implants market in 2024. Western Europe was the second-largest region in the global veterinary orthopedic implants market share. The regions covered in the veterinary orthopedic implants market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa. The countries covered in the veterinary orthopedic implants market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

The veterinary orthopedic implant market consists of sales screws, plates, pins, and wires. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Veterinary Orthopedic Implants Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on veterinary orthopedic implants market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for veterinary orthopedic implants ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The veterinary orthopedic implants market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Type: Advanced Locking Plate System; Tibial Plateau Leveling Osteotomy Implants; Tibial Tuberosity Advancement Implants; Total Elbow Replacement; Total Hip Replacement; Total Knee Replacement; Trauma Fixations2) By Animal: Dog; Cat; Other Animals

3) By End-User: Veterinary Hospitals; Veterinary Clinics; Veterinary Surgical Centers

Subsegments:

1) By Advanced Locking Plate System: Locking Compression Plates (LCP); Locking Distal Plates2) By Tibial Plateau Leveling Osteotomy (TPLO) Implants: TPLO Plates; TPLO Jigs and Instruments

3) By Tibial Tuberosity Advancement (TTA) Implants: TTA Plates; TTA Screws

4) By Total Elbow Replacement: Elbow Prostheses; Surgical Instruments for Elbow Replacement

5) By Total Hip Replacement: Hip Prostheses; Surgical Instruments for Hip Replacement

6) By Total Knee Replacement: Knee Prostheses; Surgical Instruments for Knee Replacement

7) By Trauma Fixations: Intramedullary Pins; Bone Screws; External Fixators

Key Companies Mentioned: KYON Pharma Inc.; Veterinary Orthopedic Implants Inc.; BioMedtrix LLC; IMEX Veterinary Inc.; Orthomed Ltd.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Veterinary Orthopedic Implants market report include:- KYON Pharma Inc.

- Veterinary Orthopedic Implants Inc.

- BioMedtrix LLC

- IMEX Veterinary Inc.

- Orthomed Ltd.

- Securos Surgical

- B.Braun Vet Care

- BlueSAO

- MWI Veterinary Supply Co.

- New Generation Devices

- Scil Animal Care Company

- SophiaTech

- Johnson & Johnson

- Fusion Implants

- GPC Medical Ltd.

- Narang Medical Limited

- D4 Surgicals (India) Pvt. Ltd.

- Uteshiya Medicare Private Limited.

- Bonetech Medisys Pvt. Ltd.

- Integra LifeSciences Corporation

- GerMedUSA Inc.

- Everost Inc.

- Arthrex Vet Systems

- Ortho Max Mfg. Co. Pvt. Ltd.

- Auxein Medical

- Vimian Group

- Innoplant Medizintechnik GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 0.28 Billion |

| Forecasted Market Value ( USD | $ 0.37 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |